The Bank of Thailand announced earlier this month that Thailand’s benchmark interest rate would be cut to a record low of 1.25%. It is the second time in three months that the Monetary Policy Committee (MPC) has agreed to a rate cut after the Southeast Asian country has seen the weakest growth in five years and is need of both monetary and fiscal stimulus to ramp up the economic outlook.

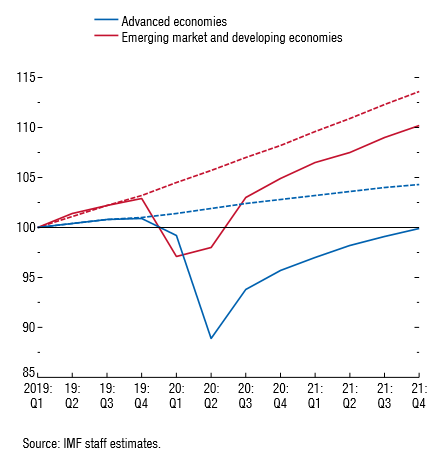

The Secretary of the MPC, Titanun Mallikamas, outlines that “the Thai economy would expand at a lower rate than previously assessed and further below its potential due to a decline in exports”. This decline in exports and overall decrease in growth rate can be partly attributed to the appreciation of the country’s currency (see diagram), the Baht, which has emerged as one of Asia’s strongest and most stable currencies in recent times. It has gained 8% against the US Dollar this year alone. As a result, exports, which make up more than half of the nation’s output, have significantly suffered and the tourism sector has also been hit. With inflation being well below target, the rate cut intends to boost both domestic output, bring inflation slightly up and, more importantly, will attempt to slow the appreciation of the Baht. Directly after the announcement of the central bank, the Baht had fallen as much as 0.63%, but is still expected to continue its bullish run, at least in the foreseeable future.

The Secretary of the MPC, Titanun Mallikamas, outlines that “the Thai economy would expand at a lower rate than previously assessed and further below its potential due to a decline in exports”. This decline in exports and overall decrease in growth rate can be partly attributed to the appreciation of the country’s currency (see diagram), the Baht, which has emerged as one of Asia’s strongest and most stable currencies in recent times. It has gained 8% against the US Dollar this year alone. As a result, exports, which make up more than half of the nation’s output, have significantly suffered and the tourism sector has also been hit. With inflation being well below target, the rate cut intends to boost both domestic output, bring inflation slightly up and, more importantly, will attempt to slow the appreciation of the Baht. Directly after the announcement of the central bank, the Baht had fallen as much as 0.63%, but is still expected to continue its bullish run, at least in the foreseeable future.

US Dollar to Thai Baht exchange rate (Source: Bloomberg)

The lacklustre economic growth, although being fuelled by a strong currency, is however also the result of more fundamental and underlying issues that the Thai economy is facing. As a result, looking at these in the remainder of this article will help establish the scope and broadness of the situation.

When looking at Thailand from a macroeconomic perspective, it is evident that although the country is obviously comparably less well off than its European counterparts, it is by far one of the more developed Southeast Asian countries, especially when compared to its direct neighbours. This also means that its wages are comparably higher and, as a result of this, it has lost out in manufacturing and agriculture, which has increasingly moved to low-wage neighbouring states, such as Myanmar and Cambodia. Together with increasing automation, which puts close to half of the industrial workforce at risk, the loss of competitive advantage in manufacturing has caused a shift towards new technologies and an even larger reliance on tourism. At the same time, Thailand is also increasingly relying on foreign workers, which, on one hand, are a source of cheaper labour, but have also become a necessity, given the demographic changes towards an ageing population. It is this ageing population that is also putting a strain on a broad cross-section of the economy and society.

More recently, the agricultural sector has been suffering from severe drought, which was followed by heavy rainfalls, essentially destroying much of the harvest. Along with an increasingly worrying amount of household debt, the appreciation of the Baht and fallout from the US-China trade war, this has caused a slump in Thailand’s growth rate.

To an extent, Thailand is facing problems similar to those of Japan or Germany, where an ageing population and several economic factors have contributed to decreased growth rates in recent times. In the case of Thailand, this is however even more surprising (and worrying) as it is still a developing nation. Now, without doubt, a growth rate of 2.5% is still up to the mark, but significantly behind the above 5% growth rates that its neighbouring countries are seeing. Therefore, the monetary stimulus provided by the Bank of Thailand is an important step to boost confidence and bring the Baht under control, but it will require even more initiatives, especially fiscally, in order to bring the economy back to where it could and should be.

Maximilian Lessing

(Cover image by Sasin Tipchai-Pixabay)