During the last year, the threat of the Covid-19 pandemic has contributed to the unfolding of an investment world characterized by extraordinary measures implemented by the Fed and the US government in terms of monetary and fiscal policies, respectively, leading to an ultra-low interest rates environment. In this regard, the latest Biden administration stimulus program amounting to $1.9 trillion and the $120bn-plus of monthly asset purchases completed by the Fed can give a sense of the exceptionality of the actions necessary to try to sustain the economy in such a period of economic distress.

One of the many economic consequences of these unprecedented actions on financial markets has been the effect on the level and trends of US government bond yields. In particular, the level of interest rates fixed by the Fed in terms of lower bound is currently equal to zero. While this phenomenon has certainly benefited companies in terms of borrowing costs and easiness in access to capital to finance their operations, investors need to enlarge their perspectives of investments to accomplish their objectives in terms of returns. As a consequence, situations in which the risk-return tradeoff seems not always to be a necessary rule of the game started emerging, in particular when looking at one specific asset class: US Corporate Junk Bonds.

In this regard, when looking at the latest issuances of high yield bonds in the US market, it is notably impressing to see how, this year, for example, Centene Corporation has been able to issue a 10-year corporate bond classified as high yield with a coupon equal to 2.5%. When looking back at two years ago, this level of return is even below what an equivalent maturity US government bond could guarantee back then. This example is important to understand how the appetite for yields has led to a rush to find other sources of investments that few years ago would have not even been taken into consideration for many portfolios because considered “too risky”. In the current framework, financial markets are characterized by an incredible optimism for the distribution of vaccines and reopening of the US economy that implies strongly positive expectations for corporate growth, even for the most distressed and low rated companies. Consequently, when the entire spectrum of credit rating evaluations for corporate investments is taken into account, the need for higher returns has led to rely on a broader range of opportunities, comprising, in certain cases, triple C rated bonds. In particular, the latter have seen a record low of yields going below the unprecedented threshold of 7.5% (Figure 2), which gives a sense of the divergence of investors from prudence and risk-aversion, more than compensated by the so-called “appetite for yields”.

One of the many economic consequences of these unprecedented actions on financial markets has been the effect on the level and trends of US government bond yields. In particular, the level of interest rates fixed by the Fed in terms of lower bound is currently equal to zero. While this phenomenon has certainly benefited companies in terms of borrowing costs and easiness in access to capital to finance their operations, investors need to enlarge their perspectives of investments to accomplish their objectives in terms of returns. As a consequence, situations in which the risk-return tradeoff seems not always to be a necessary rule of the game started emerging, in particular when looking at one specific asset class: US Corporate Junk Bonds.

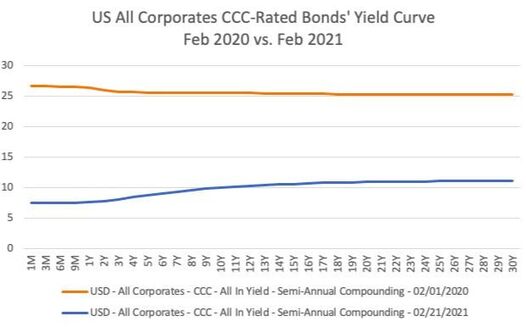

In this regard, when looking at the latest issuances of high yield bonds in the US market, it is notably impressing to see how, this year, for example, Centene Corporation has been able to issue a 10-year corporate bond classified as high yield with a coupon equal to 2.5%. When looking back at two years ago, this level of return is even below what an equivalent maturity US government bond could guarantee back then. This example is important to understand how the appetite for yields has led to a rush to find other sources of investments that few years ago would have not even been taken into consideration for many portfolios because considered “too risky”. In the current framework, financial markets are characterized by an incredible optimism for the distribution of vaccines and reopening of the US economy that implies strongly positive expectations for corporate growth, even for the most distressed and low rated companies. Consequently, when the entire spectrum of credit rating evaluations for corporate investments is taken into account, the need for higher returns has led to rely on a broader range of opportunities, comprising, in certain cases, triple C rated bonds. In particular, the latter have seen a record low of yields going below the unprecedented threshold of 7.5% (Figure 2), which gives a sense of the divergence of investors from prudence and risk-aversion, more than compensated by the so-called “appetite for yields”.

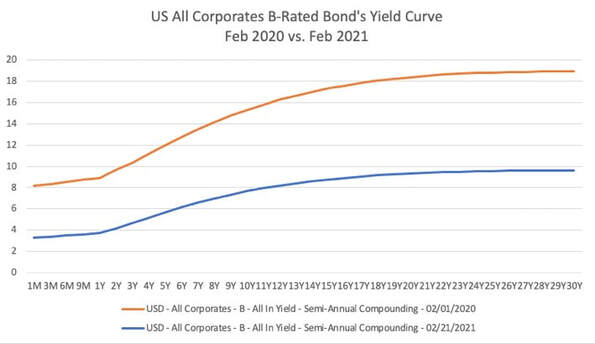

Figure 1. US B-rated corporate bonds yield curve (Feb 2020-Feb 2021). Source: Factset

Figure 2. US-CCC Rated Corporate Bonds yield curve (Feb 2020-Feb 2021). Source: Factset

At the same time, it is not only the preference towards increasingly risky assets justified by the investors’ search for yields that represents a new response to a challenging environment, but also the attitude of some companies in terms of access to capital seems to be atypical. In fact, in periods of distress, many companies usually try to organize more efficiently the resources at their disposal, by, for example, getting rid of less relevant assets to the core business and focusing on most profitable and relevant activities. On the contrary, in 2020 there has been a tendency for corporates to keep their assets and try to leverage them as much as possible to raise more cash through the reliance on tangible collaterals. In particular, airlines and cruise companies have benefited from this practice accessing capital quite easily despite the strong push down that the travelling sector faced in the last months. For these kinds of transactions, it is of particular importance that the recovery in 2021 will be substantial, so that debt will be started to be paid down or to be refinanced cheaply by companies with also an effort to prolong even more the maturities of these obligations. If this will not happen, threats to sustainability of debt and corporate financing could seriously emerge, severely impacting volatility in bonds’ markets and requiring other possible interventions from the relevant authorities to stabilize them.

After having delineated a new and interesting trend emerging in financial markets, which can be relevant in the near future for their stability and functioning, it is quite straightforward to ask ourselves whether this situation is sustainable or not and what could be its real effects on credit markets in the medium-long term.

Unfortunately, the answer is not as simple as it appears considering that the unprecedented intervention of the Fed has given to investors several reasons to feel protected, with the consequence that they are now even more willing to take risks. If the reopening of the US economy will not be as fast as hoped, then serious problems can come for what concerns the concrete ability of corporations to pay it down through earnings. This will be reflected in a strong decrease on the price of these bonds and, if further interventions would not be put in place, the risk of downturns of returns and liquidity in the markets can become a relevant problem. On the other side, if the economy improves as expected, then at some point the Fed will raise interest rates, which would put pressure on fixed rate bonds, even though improving creditworthiness would hopefully counteract this negative effect. On the contrary, this would not happen on low coupon bonds. In this regard, it has to be mentioned that the Fed has made clear that the accommodative policy will be in act for as much as necessary, but some inflationary forces are already priced in markets today...

In the end, being too much optimistic in taking excessive risks with the aim of finding higher returns can pose several threats on the stability of the corporate bond market, despite the firepower the Fed demonstrated in March. Whether the trend will be sustainable or not will depend on the actual development of the US economic recovery in 2021 and the ability of low rated firms to boost earnings to repay their debt. In this sense, it is very important to remember that sustainability of debt issuances does not only come from low interest rates, but it is also and mainly a function of growth. The possible stop of the booming market of corporate bonds could be particularly detrimental, but, until that moment, it seems that the show will probably go on.

Orazio Gianmarco Olivieri

BSCM would like to thank Factset for giving us access to their platform and providing charts and data

Want to keep up with our most recent articles? Subscribe to our weekly newsletter here.

After having delineated a new and interesting trend emerging in financial markets, which can be relevant in the near future for their stability and functioning, it is quite straightforward to ask ourselves whether this situation is sustainable or not and what could be its real effects on credit markets in the medium-long term.

Unfortunately, the answer is not as simple as it appears considering that the unprecedented intervention of the Fed has given to investors several reasons to feel protected, with the consequence that they are now even more willing to take risks. If the reopening of the US economy will not be as fast as hoped, then serious problems can come for what concerns the concrete ability of corporations to pay it down through earnings. This will be reflected in a strong decrease on the price of these bonds and, if further interventions would not be put in place, the risk of downturns of returns and liquidity in the markets can become a relevant problem. On the other side, if the economy improves as expected, then at some point the Fed will raise interest rates, which would put pressure on fixed rate bonds, even though improving creditworthiness would hopefully counteract this negative effect. On the contrary, this would not happen on low coupon bonds. In this regard, it has to be mentioned that the Fed has made clear that the accommodative policy will be in act for as much as necessary, but some inflationary forces are already priced in markets today...

In the end, being too much optimistic in taking excessive risks with the aim of finding higher returns can pose several threats on the stability of the corporate bond market, despite the firepower the Fed demonstrated in March. Whether the trend will be sustainable or not will depend on the actual development of the US economic recovery in 2021 and the ability of low rated firms to boost earnings to repay their debt. In this sense, it is very important to remember that sustainability of debt issuances does not only come from low interest rates, but it is also and mainly a function of growth. The possible stop of the booming market of corporate bonds could be particularly detrimental, but, until that moment, it seems that the show will probably go on.

Orazio Gianmarco Olivieri

BSCM would like to thank Factset for giving us access to their platform and providing charts and data

Want to keep up with our most recent articles? Subscribe to our weekly newsletter here.