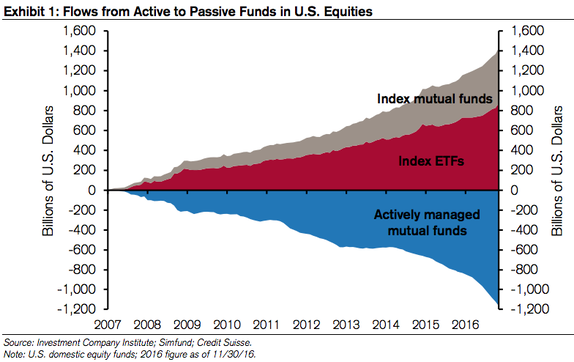

The Asset Management industry is facing a transition period following the longest bullish stock market the US have ever seen. It has been driven by a strong cost reduction and an increased transparency in actively-managed investment funds, due to the rise of passive investment funds (Exhibit 1) that has made customers far more cost-conscious. Furthermore, the enhanced disruptive force of artificial intelligence and other innovative portfolio management strategies will be the key to deliver performances and to survive to an incredibly competitive environment.

Exhibit 1

The return of market volatility and of a normal interest rate regime in the US could become vital for active asset managers to have a comeback with respect to passively-managed funds, which have been the beneficiaries of the era of quantitative easing. This thesis is supported by the corporate debt boom in recent years and a slowing worldwide economy that will probably hit the US when the fiscal stimulus effects will fade. As the cycle turns, in fact, portfolio managers will try to differentiate firms between winners and losers of the new economic conditions, finally trying to post a significative overperformance with respect to the falling stock and bond indexes.

In this inevitable comeback of active-managed funds, there are many forces that could erode the operational efficiency and, as a result, the profitability of the industry.

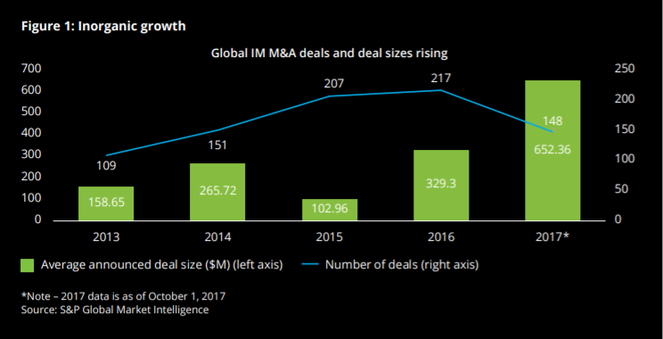

First, the always higher pressure on active funds fees. The long decline of fees has, in fact, prompted a consolidation wave in the asset management industry, where the economy of scale effect is relevant to amortize costs to manage the fund. In 2017, we can notice the beginning of fewer but larger deals with an exponential increase in cross-border activity. This confirms the common strategy of mid-tier players that are better positioning themselves for the new competitive landscape (Exhibit 2).

In this inevitable comeback of active-managed funds, there are many forces that could erode the operational efficiency and, as a result, the profitability of the industry.

First, the always higher pressure on active funds fees. The long decline of fees has, in fact, prompted a consolidation wave in the asset management industry, where the economy of scale effect is relevant to amortize costs to manage the fund. In 2017, we can notice the beginning of fewer but larger deals with an exponential increase in cross-border activity. This confirms the common strategy of mid-tier players that are better positioning themselves for the new competitive landscape (Exhibit 2).

Exhibit 2

The second main aspect is highlighted by rising costs due to a more onerous regulation and the requested amount of investments in new technology to keep up with competitors. On one hand, these are the consequence of the stricter regulation requested by institutional investors and the increasing required transparency as the asset management industry has a major role in market stability. On the other hand, we have the urge by asset management firms to invest more on technological enhancements for organic growth. Between some of the innovation, we have the use of artificial intelligence in the investment decision process and the increasing alternative data sources that can provide new investment insight, such as satellite imagery, social media sentiment, online review, geolocation and web-crawled data.

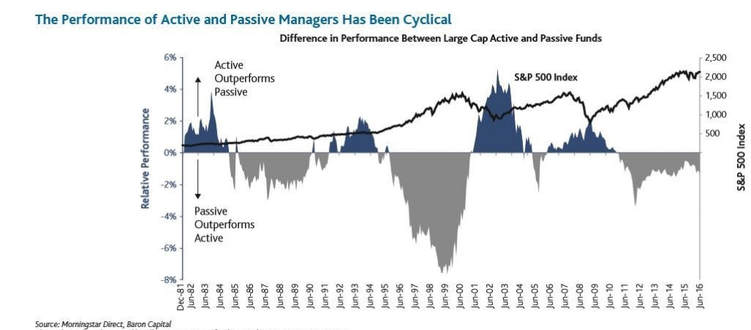

Exhibit 3

Even though the industry remains healthy and with double-digit growth prospects, the financial market turbulence and the radical change from a bullish to a bearish environment will emphasize some of the problem discussed above. At the same time, this could be a maturity test for actively managed strategies to outperform the respective indexes and to reverse the long-lasting net outflow (Exhibit 3).

Riccardo Nocita

Riccardo Nocita