BSCM would like to thank FactSet for providing charts and data. The FactSet platform has been extremely useful in all the stages of the draft of this analysis.

On July the 26th 2019, the Board of directors of Inwit and Vodafone approved the merger between the two companies, which was executed later in December 2019 and approved by the European commission in March 2020. The result of this transaction is the creation of the largest tower operator of the Italian market, second in Europe, with a network of more than 22 thousand towers. Let’s break down the transaction and see why this deal was so important for both companies.

Business Model

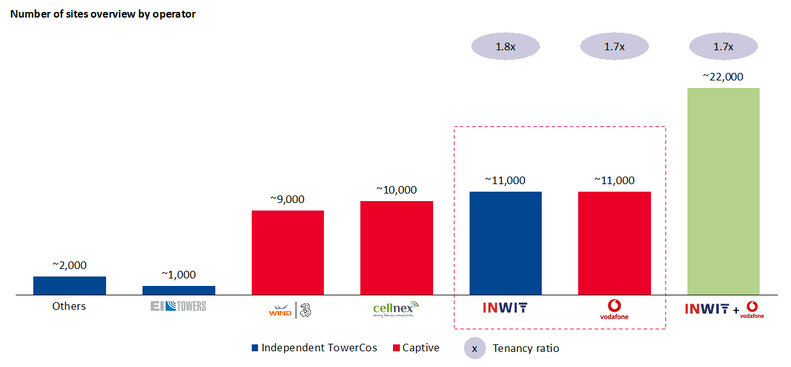

The business is based on the rent of every tower to different tenants, which are mainly Mobile Network Operators. A key tenant is established, called ‘Anchor Tenant’, and its relationship with the tower company is regulated by the MSA, a safety company that overviews installation and maintenance. The major costs are the management of the towers and the leaves that must be paid to the owner of the ground on which the tower was installed. One of the key indicators of the turnover of each company is indeed the so called “co-tenancy ratio”, which is the ratio between the total amount of tenants and the overall number of towers.

Sector overview and evolution

The telecommunication sector has features that create opportunities for M&A activity among the different players towards a more aggregate and densified sector, rather than fragmented. First, the implementation of 5G technology requires a significant increase in network density that can be only provided by big operators. Second, the overall business is restricted by capital constraints, which push main Mobile Network Operators to share more assets, thus providing a chance for industry to enlarge participation in the mobile access network value chain. Lastly, the Italian tower market is characterized by a substantial overlap, which results in inefficiencies that represent a significant potential for synergies to be extracted.

Due to this kind of structure, the sector is made up of mainly big players: WindTre, Cellnex, Inwit and Vodafone, which all together control almost 93% of the market.

On July the 26th 2019, the Board of directors of Inwit and Vodafone approved the merger between the two companies, which was executed later in December 2019 and approved by the European commission in March 2020. The result of this transaction is the creation of the largest tower operator of the Italian market, second in Europe, with a network of more than 22 thousand towers. Let’s break down the transaction and see why this deal was so important for both companies.

Business Model

The business is based on the rent of every tower to different tenants, which are mainly Mobile Network Operators. A key tenant is established, called ‘Anchor Tenant’, and its relationship with the tower company is regulated by the MSA, a safety company that overviews installation and maintenance. The major costs are the management of the towers and the leaves that must be paid to the owner of the ground on which the tower was installed. One of the key indicators of the turnover of each company is indeed the so called “co-tenancy ratio”, which is the ratio between the total amount of tenants and the overall number of towers.

Sector overview and evolution

The telecommunication sector has features that create opportunities for M&A activity among the different players towards a more aggregate and densified sector, rather than fragmented. First, the implementation of 5G technology requires a significant increase in network density that can be only provided by big operators. Second, the overall business is restricted by capital constraints, which push main Mobile Network Operators to share more assets, thus providing a chance for industry to enlarge participation in the mobile access network value chain. Lastly, the Italian tower market is characterized by a substantial overlap, which results in inefficiencies that represent a significant potential for synergies to be extracted.

Due to this kind of structure, the sector is made up of mainly big players: WindTre, Cellnex, Inwit and Vodafone, which all together control almost 93% of the market.

About Inwit and Vodafone Towers

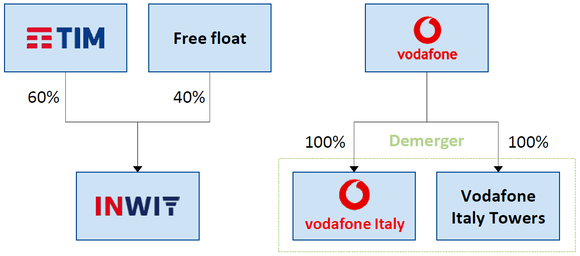

Inwit (‘Infrastrutture Wireless Italiane’), was the biggest tower operator in Italy, with a network of over 11 thousand units and over 20 thousand tenants. It was born in 2015, as a spin-off of the branch ‘Towers’ of Telecom Italia. The majority shareholder was ‘Telecom Italia’ with a 60% stake, while the rest was made up of free float. The company went through a period of stable growth over the recent years, thanks to established relationships with the main radio-mobile operators and a significant generation of cash flow, guaranteed by long-term contracts that are renewable upon expiration.

Vodafone Italy Towers s.r.l. was created in 2019, as a Newco, in which Vodafone transferred its properties of almost 11 thousand towers and other assets reaching a net income of €221m, in order to prepare the merger with Inwit.

Transaction effects

The transaction has a strong industrial rationale for all parties involved. In terms of business profile, it represents a remarkable opportunity of diversification and expansion of costumer base. It can generate more than €200m additional EBITDA run rate from synergies commitments and new potential opportunities. Moreover, in terms of network sharing, it leads to a wider coverage, therefore the company can benefit from a faster 5G implementation, a protect network and CapEx and OpEx optimization. Finally, significant industrial savings from network sharing partnership can deliver cumulative cash flow benefits of more than €800m over the next 10 years.

Timeline

The intentions of the two parties were announced on February 22, 2019 through the publication of the Memorandum of Understanding. The deal with all the details was later announced to the public on July 26, 2019. After all the parties had communicated to the market the intention of undertaking active network sharing and merging the TowerCos, three main steps were thoroughly followed. Starting in March 2019 with the background work of preparation of the Due Diligence and carve-out documentation, the transaction structure began to shape through data extraction and financial analysis.

After this, financial, technical and legal assessment took place throughout the months of April and May, giving birth to the Companies’ business plans. Finally, they finalized the deal in July, after a month of negotiation on the terms of the merger. The latter would then be approved with the “whitewash” procedure in December. A whitewash solution happens where the target company's directors agree to pledge that the company should be able to pay its debts for a fixed duration of 12 months. Perhaps an auditor would then have to assess the solvency of the company. Just when this occurs will a target company offer some form of financial assistance to the purchasing company.

On March 6, 2020, it was announced that Inwit and Vodafone secured conditional antitrust approval from European Commission. The transaction would be effective from March 31, 2020.

Actors in the M&A process

In order for such an elaborate M&A transaction to be carried out, a group of experts gathered to set out the transaction process. As a matter of fact, coordination and alignment between financial advisors (Mediobanca and Equita for INWIT; Banca IMI, Goldman Sachs and Bank of America Merrill Lynch for TIM and UBS on Vodafone’s side) from due diligence to negotiations steered the dialogue of the parties towards a successful path. The integration of major legal advisors (Pedersoli, Allen & Overy for INWIT; Gianni, Origoni, Grippo, Capelli Partners for TIM and Nctm for Vodafone), accounting and tax advisors (Deloitte for both INWIT and TIM and KPMG for Vodafone) and industrial advisors (Analysys Mason on INWIT and TIM’s side and McKinsey & Company for Vodafone) was key as they laid down the solid foundations upon which the process was thereby conducted.

Transaction Structure

The transaction was structured into two main stages: the set-up of Vodafone Italy Towers and the INWIT acquisition of a stake in Vodafone Italy Towers and subsequent merger.

As far as the former is concerned, Vodafone carried out a corporate restructuring of its “tower business” in Italy: as a necessary step before the merger, Vodafone split off its business units into Vodafone Italy and Vodafone Italy Towers through a demerger, keeping its 100% ownership in both.

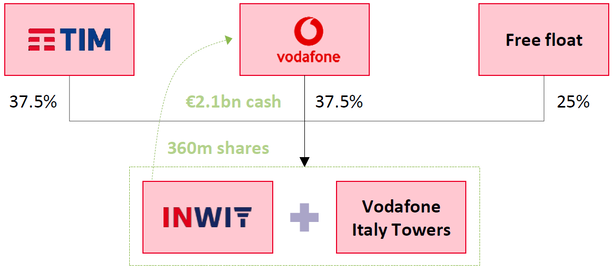

The other side of the deal featured INWIT, whose ownership is separated between TIM, holding 60% of the company, and the free-float market share of 40%. After the demerger, INWIT could boast a major common ground with the target company, Vodafone Italy Towers, in terms of similar valuation. Spurred by the intentions of Vodafone, TIM and INWIT itself to extend their passive network sharing agreement towards an active one, INWIT agreed to purchase a 43% stake in Vodafone Italy Towers through a payment of cash consideration of €2.1bn, so as to level out TIM and Vodafone post-merger equity shares.

As a result, following the buyout, not only were the acquired shares cancelled in order for the merger to be officially executed but the stakes between the two parent companies were also balanced – both Vodafone and TIM now respectively hold 37.5% of the newly formed company, adding up to a total of 75% of the overall ownership, whereas the remaining 25% is marketable free float. In this connection, the transaction dictated for Vodafone to receive 360m newly issued INWIT shares.

Finally, another seminal element of the process to be pointed out is the payment of an extraordinary dividend of €570m which led to reaching a 6.0x Net Debt/EBITDA, consistent with the objective of achieving a minimum BB+ credit rating.

Valuation

The financial advisors have used three different valuation methods, namely:

- Trading multiples, which are derived applying multiples of similar listed companies to the target key metrics. In this regard, not only is Inwit almost identical to Vodafone Italy Towers but also a chosen list of U.S. tower corporations, which share major common grounds with both Inwit and Vodafone Italy Towers, was integrated.

- Discounted Cash Flow (DCF): the business model of tower businesses (contractualized long-term sales and fixed-cost base) contributes to a high visibility of cash flow, which renders tower companies ideal for DCF-based analyses.

- Broker valuation: Inwit has an extensive analysts' coverage.

In addition, there has to be pointed out that at the time of the merger Vodafone Italy Towers had an enterprise value of more than €5bn, which included a cash consideration of €2.1bn, plus the 360m Inwit’s new shares that had a value of ~€3bn.

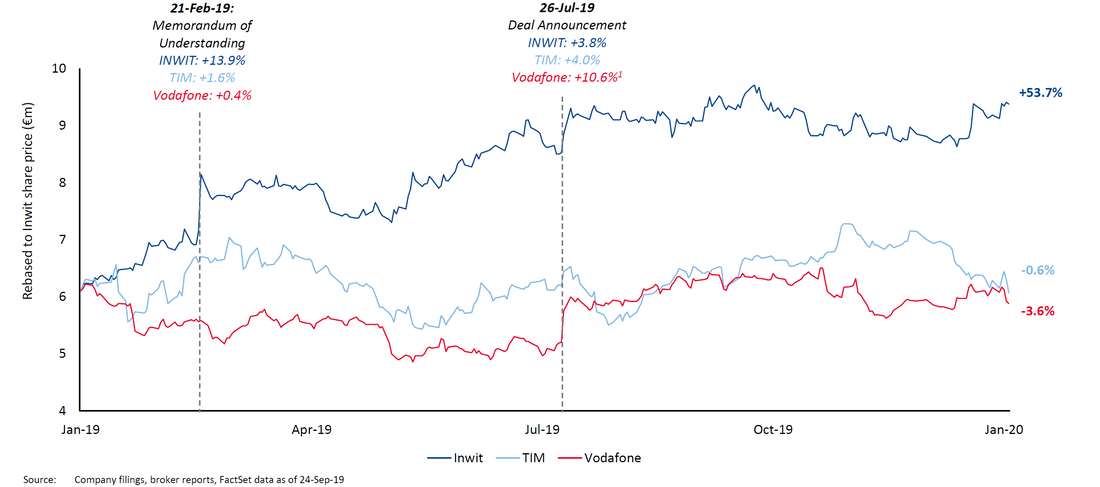

Public perception

The transaction was welcomed by the finance community. Consequent to the signing of the Memorandum of Understanding on February 21st, 2019, the market mainly benefited Inwit, which boasted a +13.9% stock price performance that day. On the other hand, on the deal announcement day, TIM and Vodafone experienced extremely positive performances of +4.0% and +10.6% respectively.

As a matter of fact, it is worth quoting some of the main brokers’ comments in order to better understand what the overall market sentiment about the deal was. For instance, after the MoU, Intesa Sanpaolo wrote: “We see multiple value drivers from this deal: for INWIT, the industrial synergies from both the active sharing and the decommissioning from the additional co-siting.[…] The Vodafone TIM-INWIT agreement seems to be a win-win deal, in our opinion. The possible releveraging on INWIT from the acquisition of Vodafone’s towers would represent a potential upside.” Last but not least, these are Credit Suisse’s comments after the deal had been announced last July: “We see potential upside from continued OPEX efficiencies (mainly land leases), upsell of third parties on small cells and new macro sites and tax efficiencies, and for now we reiterate our Outperform and €10.4 target price.”

Camilla Calzolari

Matteo Girello

Filippo Rosaschino

Want to keep up with our most recent articles? Subscribe to our weekly newsletter here.