The economic outlook

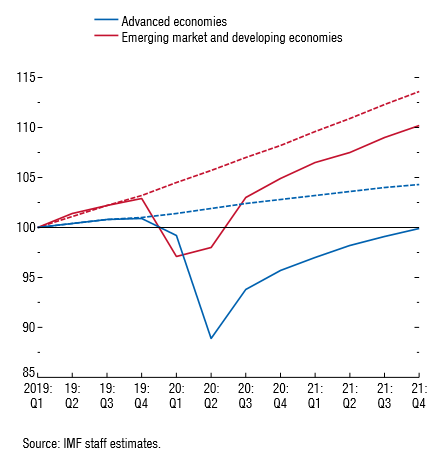

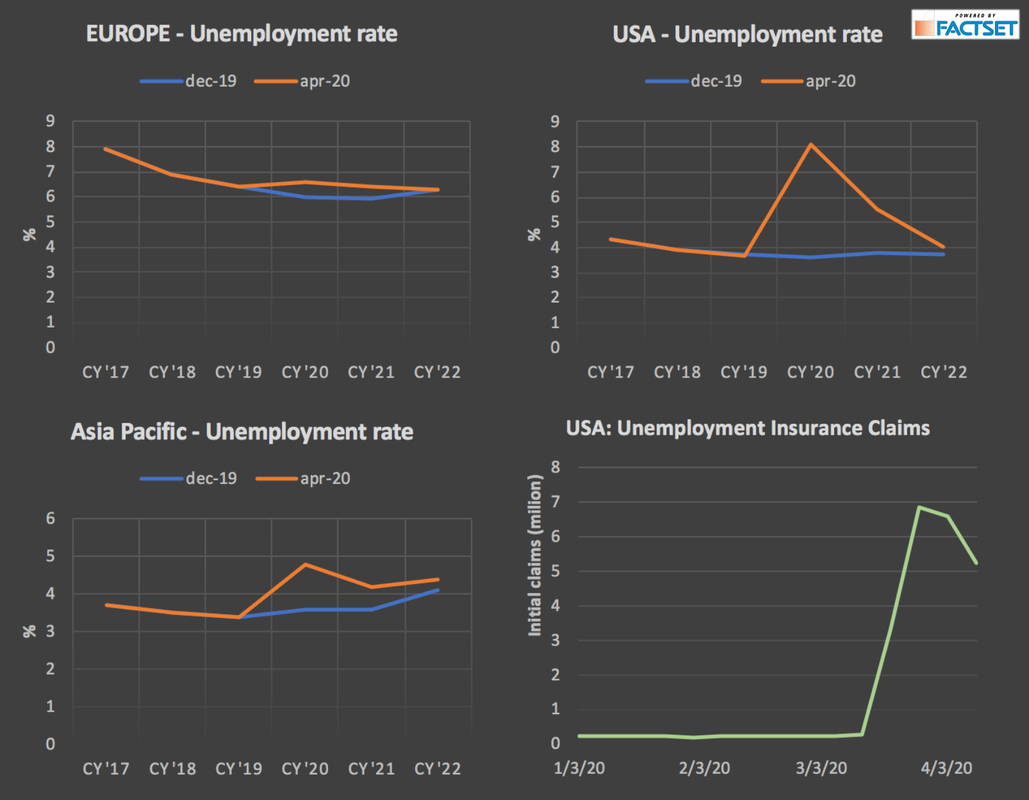

The IMF stated that we are entering the worst global economic crisis since the Great Depression. In fact, there are a few peculiar aspects characterizing this crisis. First, the governments’ policies implemented to slow down the spread of the virus (and alleviate pressure from the NHS) froze the entire economy. Most of the companies witnessed a dramatic fall in revenues. Since some costs remain fixed, companies experienced a liquidity shortfall which may lead to bankruptcy. This situation is particularly tough for those small and midsize enterprises (SMEs) that don’t have cash reserves. Second, this is a global crisis: the sudden stop of economic activity regards all the countries around the world. So, the recovery may be tougher because exports may not pick up as it happened after the great recession of 2009.

The IMF stated that we are entering the worst global economic crisis since the Great Depression. In fact, there are a few peculiar aspects characterizing this crisis. First, the governments’ policies implemented to slow down the spread of the virus (and alleviate pressure from the NHS) froze the entire economy. Most of the companies witnessed a dramatic fall in revenues. Since some costs remain fixed, companies experienced a liquidity shortfall which may lead to bankruptcy. This situation is particularly tough for those small and midsize enterprises (SMEs) that don’t have cash reserves. Second, this is a global crisis: the sudden stop of economic activity regards all the countries around the world. So, the recovery may be tougher because exports may not pick up as it happened after the great recession of 2009.

A comparison between world GDP growth in 2009 and the expected one in 2020. Source: IMF.

Many governments tried to use the banking system to cushion the economic effect of the pandemic. For instance, banks’ capital requirements have been relaxed in Europe and many governments have provided State guarantee to SME loans.

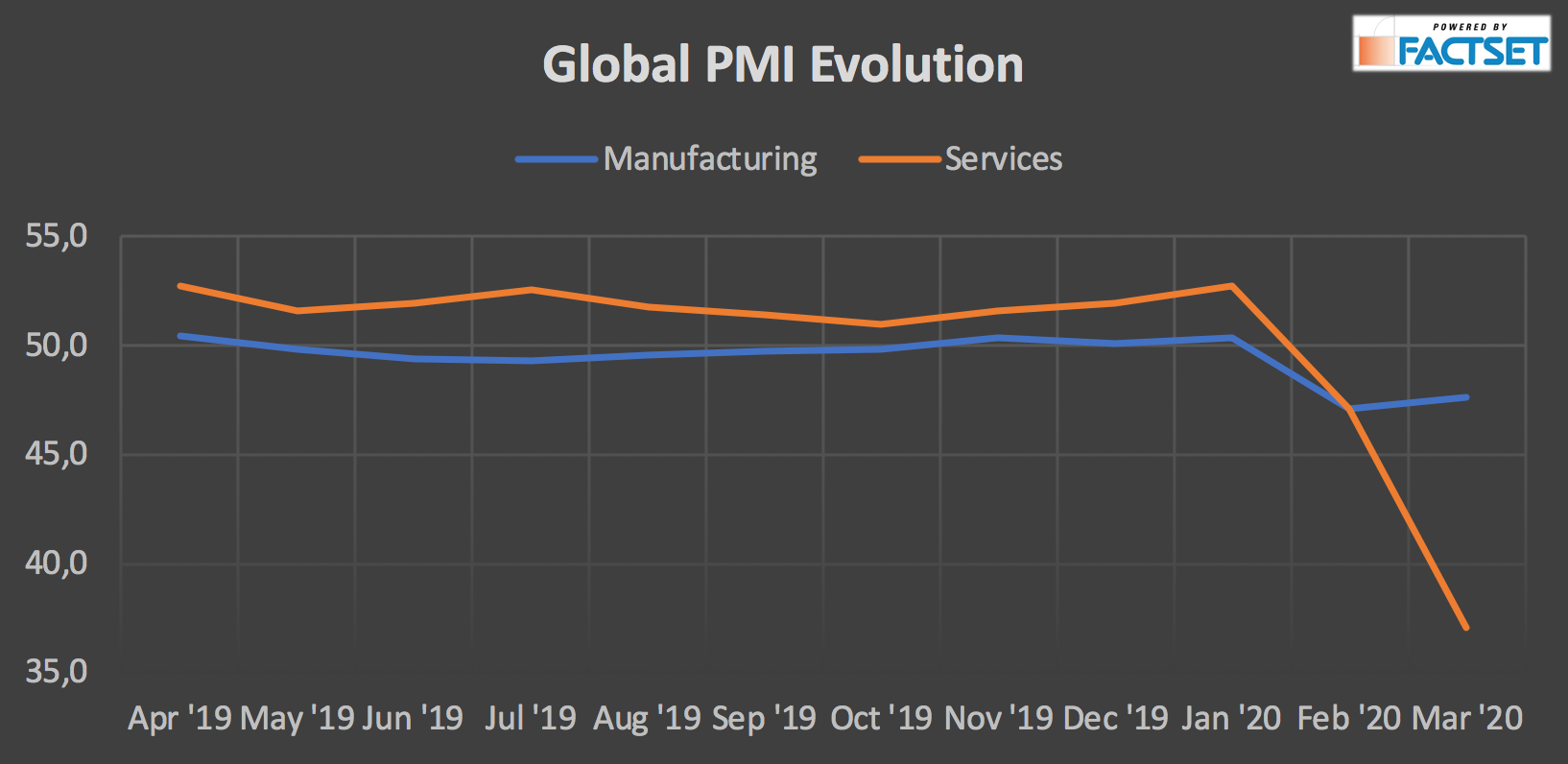

China was the first country to be hit by this pandemic. China’s first quarter GDP fell 6.8% YoY as a result of the Covi19 outbreak. This was the first time since 1976 that China experienced a year-on-year contraction. In particular, retail sales of consumer goods decreased by 16% in March. The manufacturing sector was hit particularly bad, with the PMI index falling to a record low of 35.7 in February.

China was the first country to be hit by this pandemic. China’s first quarter GDP fell 6.8% YoY as a result of the Covi19 outbreak. This was the first time since 1976 that China experienced a year-on-year contraction. In particular, retail sales of consumer goods decreased by 16% in March. The manufacturing sector was hit particularly bad, with the PMI index falling to a record low of 35.7 in February.

China GDP growth turned negative for the first time since 1976. Source: Financial Times.

The Chinese banking system

China relied heavily on its banking system to support the economy. People’s Bank of China stated it would inject RMB100bn ($14.2bn) into the financial system. In addition, the central bank cut the one-year medium-term lending (MLF) rate by 0.2 percentage points to 2.95%, a new record low. This is a key interest rate because it represents the cost of funding for commercial banks borrowing from the central bank. The goal is to incentivize banks to provide cheap credit to local businesses.

However, the banking system was not in perfect shape before the outbreak of the virus. Indeed, the 2019 stress test carried about by the People’s Bank of China on the top 30 largest banks of the country (RBM800 bn in assets, 80% of the total), suggested that some banks were particularly vulnerable to idiosyncratic risk. The stress test’s most severe scenario assumed the Chinese GDP growing at 4.15%, a 37% decline with respect to 6.6% growth rate in 2018: nowadays the Chinese economy is shrinking at a rate of 6.8%. According to the stress test, five banks failed to meet the 5% CET1 requirement and seven did not meet the 6% Tier-1 capital ratio requirement. In addition, a third of the banks involved failed the liquidity test under the severe stress case. The banks which failed the test were not individually identified for fear of adverse market reactions. Moreover, the 2019 stress test confirmed that China’s NPLs are very sensitive to GDP growth.

The Chinese banking system has been under stress since May 2019, when the central bank took control of Baoshang Bank citing “severe credit risk”. The central bank stated that those creditors with exposure above RMB50 million would have entered negotiations to determine the recovery amount. Although only a bunch of creditors would not have received 100% of the lent amount, the news was enough to create tension in the Chinese interbank market, with a sharp increase in the interbank lending rate. Consequently, corporates witnessed tighter financing conditions. This event proved how the failure of a single regional lender could create shock waves through the national banking system and the real economy.

Now, China has entered the second phase of the pandemic. As already explained, the Chinese government has widely relied on the banking system to stimulate the economy. This has been done in two ways: first, by encouraging banks to lend to SMEs; second, by offering forbearance to debtors. For instance, for some creditworthy borrowers, banks were allowed to extend loan repayments until the end of June. That is a payment extension of more than 90 days, which would technically classify the loan as an NPL. So, since these loans are not going to be classified as NPLs, reported NPLs/Gross Loan ratio is expected to increase only to 2.2% from 1.74% (December 2019). However, including also forborne loans, NPL ratios could become 8-9 times the level of 2019.

Regional banks in the Hubei province will be more affected

When considering the epidemic’s effects on the Chinese banking system, a first key consideration is that the increase in NPLs would be more relevant for those regional banks located in the Hubei province. Indeed, Hubei, the seventh Chinese province in terms of GDP, was the epicenter of the pandemic, with Wuhan experiencing a two-month lockdown. The total banks’ aggregate loan exposure to Hubei was only 3.5% in September 2019. Most of the largest national banks have an exposure to the area below 5%. However, the top three local banks in Hubei have more than 90% of their loan books concentrated in this region. It is worth noting (especially after the Baoshang Bank’s case) that contagion risk remains high and a local crisis could potentially escalate into a national banking crisis.

Exposure to consumer-driven industries will play a role

Because of the nature of this crisis, consumer-driven industries have been hit the most by the outbreak of Covid19. First, the outbreak started during the Lunar New Year, so it was particularly bad for consumption given the fall in spending on travel, entertainment, and gifts. Standard and Poor’s estimates that wholesale and retail account for 8% of Chinese banks’ loans, the logistic sector for 6% and manufacturing for about 11%. All these sectors were particularly hampered by the epidemic. Banks will be forced to account credit loss provisions to comply with the International Financial Reporting Standards. This will severely impact their profitability as it has happened to the major American banks. Chinese largest banks can rely on high levels of capital and easy access to new financing to absorb losses. In addition, China’s mega banks’ (China’s 6 largest banks) exposure to the wholesale and retail sector is only 5%. Smaller banks will suffer more, both because they don’t have the same access to new financing and they are less capitalized.

SMEs likely to suffer the most

The lockdown has been particularly tough for smaller companies, which don’t have many resources to survive a sudden two-month stop of the economy. Secondly, they have been slower to reopen because of cash shortages. According to a study by Tsinghua University, out of the 995 SMEs surveyed, one-third expect revenues to halved with respect to the previous year. At the beginning of 2020, the Chinese banking system had a RMB36.9 trillion exposure to SMEs, up 10.1% from the previous year. This was the result of a central government’s policy which encouraged banks to lend to so-called inclusive SMEs. At the end of 2019, loans to inclusive SMEs were RMB11.7 trillion, 9% of China’s total bank loans. The NPL ratio for this kind of loan stood at 3.22%: this figure is likely to rise over the year. To alleviate the credit crunch, policymakers have encouraged banks to keep lending to SMEs, they cut cost of funding and offered forbearance to creditors. It is worth noting that different banks have very different exposures to SMEs: for instance, SME loans are 13% of Postal Savings Bank of China’s total loan, 4 percentage points higher than the industry average. However, the bank seems to have a good loss-absorption capacity given a 48.7% loan-to-asset ratio and a 0.86% NPL ratio.

China relied heavily on its banking system to support the economy. People’s Bank of China stated it would inject RMB100bn ($14.2bn) into the financial system. In addition, the central bank cut the one-year medium-term lending (MLF) rate by 0.2 percentage points to 2.95%, a new record low. This is a key interest rate because it represents the cost of funding for commercial banks borrowing from the central bank. The goal is to incentivize banks to provide cheap credit to local businesses.

However, the banking system was not in perfect shape before the outbreak of the virus. Indeed, the 2019 stress test carried about by the People’s Bank of China on the top 30 largest banks of the country (RBM800 bn in assets, 80% of the total), suggested that some banks were particularly vulnerable to idiosyncratic risk. The stress test’s most severe scenario assumed the Chinese GDP growing at 4.15%, a 37% decline with respect to 6.6% growth rate in 2018: nowadays the Chinese economy is shrinking at a rate of 6.8%. According to the stress test, five banks failed to meet the 5% CET1 requirement and seven did not meet the 6% Tier-1 capital ratio requirement. In addition, a third of the banks involved failed the liquidity test under the severe stress case. The banks which failed the test were not individually identified for fear of adverse market reactions. Moreover, the 2019 stress test confirmed that China’s NPLs are very sensitive to GDP growth.

The Chinese banking system has been under stress since May 2019, when the central bank took control of Baoshang Bank citing “severe credit risk”. The central bank stated that those creditors with exposure above RMB50 million would have entered negotiations to determine the recovery amount. Although only a bunch of creditors would not have received 100% of the lent amount, the news was enough to create tension in the Chinese interbank market, with a sharp increase in the interbank lending rate. Consequently, corporates witnessed tighter financing conditions. This event proved how the failure of a single regional lender could create shock waves through the national banking system and the real economy.

Now, China has entered the second phase of the pandemic. As already explained, the Chinese government has widely relied on the banking system to stimulate the economy. This has been done in two ways: first, by encouraging banks to lend to SMEs; second, by offering forbearance to debtors. For instance, for some creditworthy borrowers, banks were allowed to extend loan repayments until the end of June. That is a payment extension of more than 90 days, which would technically classify the loan as an NPL. So, since these loans are not going to be classified as NPLs, reported NPLs/Gross Loan ratio is expected to increase only to 2.2% from 1.74% (December 2019). However, including also forborne loans, NPL ratios could become 8-9 times the level of 2019.

Regional banks in the Hubei province will be more affected

When considering the epidemic’s effects on the Chinese banking system, a first key consideration is that the increase in NPLs would be more relevant for those regional banks located in the Hubei province. Indeed, Hubei, the seventh Chinese province in terms of GDP, was the epicenter of the pandemic, with Wuhan experiencing a two-month lockdown. The total banks’ aggregate loan exposure to Hubei was only 3.5% in September 2019. Most of the largest national banks have an exposure to the area below 5%. However, the top three local banks in Hubei have more than 90% of their loan books concentrated in this region. It is worth noting (especially after the Baoshang Bank’s case) that contagion risk remains high and a local crisis could potentially escalate into a national banking crisis.

Exposure to consumer-driven industries will play a role

Because of the nature of this crisis, consumer-driven industries have been hit the most by the outbreak of Covid19. First, the outbreak started during the Lunar New Year, so it was particularly bad for consumption given the fall in spending on travel, entertainment, and gifts. Standard and Poor’s estimates that wholesale and retail account for 8% of Chinese banks’ loans, the logistic sector for 6% and manufacturing for about 11%. All these sectors were particularly hampered by the epidemic. Banks will be forced to account credit loss provisions to comply with the International Financial Reporting Standards. This will severely impact their profitability as it has happened to the major American banks. Chinese largest banks can rely on high levels of capital and easy access to new financing to absorb losses. In addition, China’s mega banks’ (China’s 6 largest banks) exposure to the wholesale and retail sector is only 5%. Smaller banks will suffer more, both because they don’t have the same access to new financing and they are less capitalized.

SMEs likely to suffer the most

The lockdown has been particularly tough for smaller companies, which don’t have many resources to survive a sudden two-month stop of the economy. Secondly, they have been slower to reopen because of cash shortages. According to a study by Tsinghua University, out of the 995 SMEs surveyed, one-third expect revenues to halved with respect to the previous year. At the beginning of 2020, the Chinese banking system had a RMB36.9 trillion exposure to SMEs, up 10.1% from the previous year. This was the result of a central government’s policy which encouraged banks to lend to so-called inclusive SMEs. At the end of 2019, loans to inclusive SMEs were RMB11.7 trillion, 9% of China’s total bank loans. The NPL ratio for this kind of loan stood at 3.22%: this figure is likely to rise over the year. To alleviate the credit crunch, policymakers have encouraged banks to keep lending to SMEs, they cut cost of funding and offered forbearance to creditors. It is worth noting that different banks have very different exposures to SMEs: for instance, SME loans are 13% of Postal Savings Bank of China’s total loan, 4 percentage points higher than the industry average. However, the bank seems to have a good loss-absorption capacity given a 48.7% loan-to-asset ratio and a 0.86% NPL ratio.

The exposure of China's largest banks to inclusive SMEs. Source: Standard and Poor's Global ratings.

Conclusions

To sum up, the outbreak of Covid19 will cause a global recession. Policymakers have used the banking system to mitigate the slowdown of the economy. China is not an exception. The stock of NPLs will rise all over the country. Smaller regional banks exposed to SMEs and to the wholesale and retail sector are the institutions more at risk. Nevertheless, contagion risk remains high.

Marco Calamandrei

Want to keep up with our most recent articles? Subscribe to our weekly newsletter here

To sum up, the outbreak of Covid19 will cause a global recession. Policymakers have used the banking system to mitigate the slowdown of the economy. China is not an exception. The stock of NPLs will rise all over the country. Smaller regional banks exposed to SMEs and to the wholesale and retail sector are the institutions more at risk. Nevertheless, contagion risk remains high.

Marco Calamandrei

Want to keep up with our most recent articles? Subscribe to our weekly newsletter here