The electric vehicle (EV) industry in China has experienced impressive growth, driven by government incentives and technological advancements. China is now the world's leading exporter of electric cars, with projections indicating a further 35% growth in global sales by 2030. This article explores trends and perspectives for China's electric vehicle market, highlighting the crucial role the country will play in shaping sustainable mobility worldwide.

The origin of China’s Electric Vehicle industry

The emergence of electrical automobiles (EVs) in China is an interesting trip of technology, policymaking and market development that has propelled China into becoming worldwide leader in the market. EVs story in China starts in the late 20th century when ecological worries plus oil shortages began to pressure automobile innovations in the direction of even more lasting options. China's venture right into electrical cars can be generally classified right into numerous stages each noted by considerable growth, difficulties and innovations.

In the onset throughout the late 1990s and very early 2000s, China's electrical car sector was advancing, with initiatives mainly restricted to R&D. These very early years were identified by speculative jobs plus small production mainly concentrating on buses plus various other industrial cars. The federal government's function throughout this period was mainly supporting R&D, with considerable financial investments in modern battery technology, electrical motors and associated facilities. Nevertheless, the marketplace for EVs was practically missing due to high expenses, restricted efficiency and low-quality building facilities.

The catalyst for EVs in China came in the mid-2000s when the Chinese federal government started to carry out a collection of policies as well as rewards to push the development of electric cars. This was driven by several aspects of increasing concerns regarding air contamination, power protection and the wish to gain market share in a high-growth sector. Plans like aids for EV purchasers, financial investment in building facilities and requirements for federal government fleets to use electric cars began to develop a more positive atmosphere for EV development.

By the 2010s, China's EV market started to blossom. This period saw an amazing rise in EV manufacturing and sales, sustained by proceeded federal government assistance, innovation developments and customer approval. Domestic suppliers like BYD, NIO and XPeng became crucial players together with international titans looking to take advantage of the expanding Chinese market. Throughout this period, the federal government's involvement developed culminating with the introduction of the " New Energy Vehicle" (NEV) plan. Its mission is not just to improve EV sales, but also cultivate the advancement of a thorough EV ecological community consisting of battery manufacturing, recycling and second-hand car buying applications.

The facilities for EVs increased considerably with China developing among the globe's biggest networks of building terminals. This development was key to propelling the electrification of its transport industry. Additionally, China's concentration on advanced battery technology as well as manufacturing capability have transformed it into a worldwide leader for battery production, providing not just the residential market but also the global one.

Getting in the 2020s China's EV market has entered a brand-new stage of development, defined by increased competition, technical advancement and worldwide growth. The focus has shifted from raising production of EVs to boosting their quality, driving variety as well as technical functions such as independent driving capacities. In addition, the Chinese federal government has started to slowly decrease aids for private companies, allowing them to navigate the market difficulties by their own means. This change has motivated car manufacturers to increase spending in R&D and to look for brand-new affordable technologies.

China's ventures in the electrical cars industry are a statement proving the power of efficient critical planning, developing and market positioning. From a slow start at the beginning of the millennium to becoming one of the globe's biggest EV markets, China's EV developments are an essential milestone in the international pursuit of sustainable transportation. As the nation tries to navigate the difficulties of this sector, its resilience or fragility will decide the future of this sector and its developments.

Manufacturers and characteristics of the EVs

The electric vehicle (EV) industry in China is experiencing a transformative shift, fueled by a convergence of factors including government backing, technological advancements, and a growing emphasis on eco-friendly transportation solutions. As the world's largest market for new energy vehicles, China is witnessing the rise of several prominent EV brands that are reshaping the future of mobility.

One such trailblazer is BYD, which has been at the forefront of China's EV sector since its establishment in 1995. Renowned for its innovative technologies such as blade batteries and Cell-to-Body (CTB) design, BYD offers a diverse range of electric and hybrid vehicles. For example, the BYD SEAL, equipped with an 82.5 kWh battery and offering a range of 650 km, strikes a balance between efficiency and affordability with a price tag of €44,990.

Another standout player is NIO, known for its luxury and forward-thinking design ethos. Established in 2014, NIO has captured the hearts of consumers with flagship models like the ES8, ES6, and ET7. The NIO ET5, featuring a 100kWh battery and a range of 650 km, embodies premium driving experience with a price of €68,500, blending style and sustainability seamlessly.

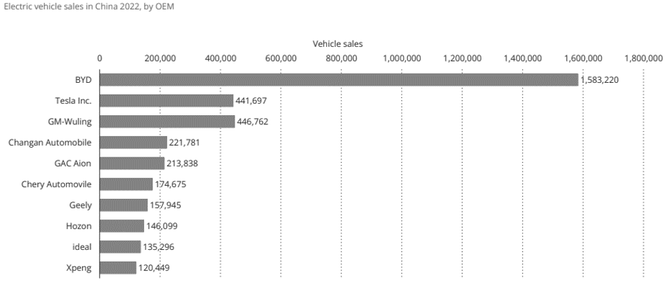

Source(s): Statista

Xpeng is pioneering future mobility solutions with its focus on advanced research and development in automatic assisted driving technology. Models such as the G3, G6, P5, and P7 offer cutting-edge features at competitive price points. For instance, the XPENG P7 RWD Long Range, priced at €51,188, boasts an impressive range of 706 km, showcasing Xpeng's commitment to efficiency and performance.

Zeekr, a premium brand under Geely Holding, is redefining mobility through its intelligent evolutionary architecture. Models like the Zeekr 001 and Zeekr 009 offer a travel ecosystem, integrating innovation with sustainability. An example is represented by the Zeekr 001 Long Range, with a range of 525 km and a starting price of €60,970.

AITO, a collaboration between Cyrus and Huawei, stands out for its integration of hardware excellence with advanced features like automatic driving systems and Hongmeng smart cockpits. Its flagship vehicle, the AITO M5, has a range of 620 km and it is priced at €35,850, exemplifies the company’s commitment to innovation and affordability.

AVATR, developed by Changan, Huawei, and CATL, embodies sophistication and innovation in smart electric vehicles. Models like the AVATR 12 prioritize high-end design and cutting-edge technology. For example, the AVATR 12, with a range of 650 km and priced at €41,510, offers luxury and performance for discerning consumers.

Aion, owned by Guangzhou Automobile Group, distinguishes itself with core technologies such as magazine battery systems and dual-motor electric drives. A recent innovative model is the GAC A Aion Y, priced at €22,000 and offering an outstanding range of 600 km.

Zeekr, a premium brand under Geely Holding, is redefining mobility through its intelligent evolutionary architecture. Models like the Zeekr 001 and Zeekr 009 offer a travel ecosystem, integrating innovation with sustainability. An example is represented by the Zeekr 001 Long Range, with a range of 525 km and a starting price of €60,970.

AITO, a collaboration between Cyrus and Huawei, stands out for its integration of hardware excellence with advanced features like automatic driving systems and Hongmeng smart cockpits. Its flagship vehicle, the AITO M5, has a range of 620 km and it is priced at €35,850, exemplifies the company’s commitment to innovation and affordability.

AVATR, developed by Changan, Huawei, and CATL, embodies sophistication and innovation in smart electric vehicles. Models like the AVATR 12 prioritize high-end design and cutting-edge technology. For example, the AVATR 12, with a range of 650 km and priced at €41,510, offers luxury and performance for discerning consumers.

Aion, owned by Guangzhou Automobile Group, distinguishes itself with core technologies such as magazine battery systems and dual-motor electric drives. A recent innovative model is the GAC A Aion Y, priced at €22,000 and offering an outstanding range of 600 km.

Profitability

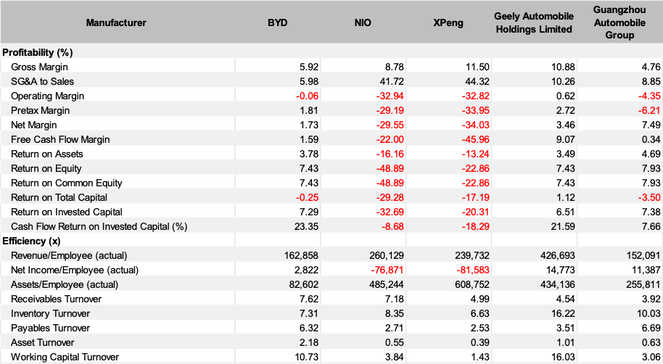

The profitability analysis of prominent Chinese EV brands provides valuable insights into their financial performance and market positioning. While manufacturers like BYD demonstrate robust profitability, characterized by positive margins and efficient resource utilization, others such as NIO and XPeng face challenges with persistent losses and lower efficiency metrics.

Source(s): Facset

BYD, whose products includes only electric vehicles, demonstrates decent profitability across various metrics, with positive net margins and return on equity. The company also shows strong efficiency in terms of revenue per employee and inventory turnover, showing a solid financial performance with relatively healthy margins and efficient use of resources.

Since its foundation, NIO has always been unprofitable, with increasing net losses during the years, from €-478.6 million in 2016 to -2,760.8 million in 2023, thus resulting in negative operating and net margins. Additionally, NIO's efficiency metrics, such as revenue per employee and asset turnover, are comparatively lower than its peers, suggesting inefficiencies in resource utilization.

Similarly, XPeng experienced increasing net losses from €-179.2 million in 2018 to -1,354.6 million in 2023, despite sales doubling each year. The company's efficiency metrics are also less favorable, indicating potential areas for improvement in resource management and operational efficiency.

Geely Automobile Holdings Limited is the most profitable manufacturer. Unlike NIO and XPeng which rely completely on electric vehicles, the company owns also brands such as Lotus, Volvo and Lynk & Co, producing internal combustion engines cars, thus diversifying its offer across various markets.

An analogous situation characterizes Guangzhou Automobile Group, which produces and sells vehicles under its own branding, such as Trumpchi, Aion, Hycan as well as under foreign-branded joint ventures such as GAC Toyota, GAC Honda, and GAC Mitsubishi. Guangzhou Automobile Group (GAC) shows mixed profitability, with positive net margins but negative returns on equity. Efficiency metrics like inventory turnover are strong, but revenue per employee is lower compared to peers.

Since its foundation, NIO has always been unprofitable, with increasing net losses during the years, from €-478.6 million in 2016 to -2,760.8 million in 2023, thus resulting in negative operating and net margins. Additionally, NIO's efficiency metrics, such as revenue per employee and asset turnover, are comparatively lower than its peers, suggesting inefficiencies in resource utilization.

Similarly, XPeng experienced increasing net losses from €-179.2 million in 2018 to -1,354.6 million in 2023, despite sales doubling each year. The company's efficiency metrics are also less favorable, indicating potential areas for improvement in resource management and operational efficiency.

Geely Automobile Holdings Limited is the most profitable manufacturer. Unlike NIO and XPeng which rely completely on electric vehicles, the company owns also brands such as Lotus, Volvo and Lynk & Co, producing internal combustion engines cars, thus diversifying its offer across various markets.

An analogous situation characterizes Guangzhou Automobile Group, which produces and sells vehicles under its own branding, such as Trumpchi, Aion, Hycan as well as under foreign-branded joint ventures such as GAC Toyota, GAC Honda, and GAC Mitsubishi. Guangzhou Automobile Group (GAC) shows mixed profitability, with positive net margins but negative returns on equity. Efficiency metrics like inventory turnover are strong, but revenue per employee is lower compared to peers.

Market Share Evolution in China

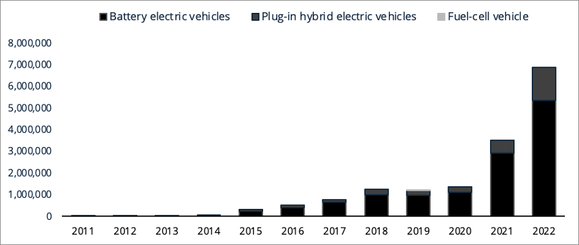

China's electric vehicle (EV) industry has demonstrated exceptional growth, leveraging government incentives, local manufacturing prowess, and consumer demand. In 2022, the country solidified its position as the leading EV market (followed in the podium by EU and US), accounting for around 60% of global electric car sales, with overall sales of 5.4 million battery-electric vehicles (BEVs) and 1.5 million plug-in hybrid electric vehicles (PHEVs). This massive surge represents an increase, respectively for BEVs and PHEVs global sales, of 83.95% and 151.91%, compared to 2021(Source 1). Considering that the total spending on electric cars reached USD 425 billion in 2022, with the share of government support in total spending around 10%, China still plays a major role in the development of the EV market.

Figure 3: Annual sales volume of new energy vehicles in China from 2011 to 2022, by propulsion type

Source(s): CAAM; Statista

Export Dynamics and Global Market Influence

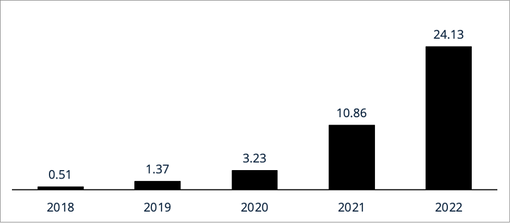

China's influence extends beyond its borders through its significant presence in the global export market for electric passenger vehicles. In 2022, China exports for electric passenger vehicles are valued at around $24.13 billion (Source 2), increasing +122% with respect to the previous year, thus illustrating the country's growing export capabilities in the EV domain. This export strength, coupled with China's leading production capacity, underscores its pivotal role in shaping the global electric mobility field. In fact, electrification is already widespread among two-/three-wheelers: sales of electric buses are picking up, as trucks pose to be the next frontier for electrification. To this extent, China accounts for the vast majority of them, with 54 000 bus sales and 52 000 medium- and heavy-duty truck sales in 2022.

By the other hand, notwithstanding its export-intensive policy, China also maintains a balanced import strategy for new energy vehicles. As a matter of fact, in 2021, China imported around 139,800 new energy vehicles, showing a 7% increase over the previous year. This import activity highlights China's commitment not only to dominate the global EV market through exports but also enrich its domestic market with diverse international offerings, thus driving and fostering a competitive EV ecosystem within the country.

Figure 4: China’s export value in USD billions of electric vehicles for passengers from 2018 to 2022

Source(s): China Customs

Comparison with Europe and the United States

Europe, as the second largest EV market, has seen significant growth, with electric car sales increasing by over 15% in 2022. This growth translates to more than one in every five cars sold in Europe being electric, a clear indication of the continent's accelerating transition towards electric mobility. The European market benefits from stringent emissions regulations, a robust charging infrastructure, and substantial government incentives, which collectively facilitate the adoption of EVs across the region, thus making the Euro market a coveted target for EV producers globally, and particularly from China, as overall EU tariff and trade policies remain more favorable and less volatile than US ones, leaving room for long-term market penetration strategies.

On the other hand, in the US, the EV market experienced a 55% increase in sales in 2022, with electric cars accounting for an 8% share of total sales. This growth, while substantial, indicates a slower adoption rate compared to China, highlighting the varied pace of EV adoption across major markets. The U.S. market is influenced by federal and state policies, technological innovations, and consumer preferences, with an increasing number of American consumers showing interest in electric mobility. Since Tesla and BYD dominate global electric car markets, together accounting for over 30% of sales, other major incumbents are racing to capture global market share: however, as a matter of fact, between 2019 and 2022, the share of traded EV went from quarter to just a sixth of global sales, and since 2021, China seems to have become the largest exporter of electric vehicles, overtaking the US.

Government Investment and Incentives

Government policies have arguably played a part in the rising global electric vehicle demand. In China, a main electric vehicle incentive package worth $72 billion is currently in place. This includes battery electric vehicles and plug-in hybrids being exempt from 30,000 yuan ($4000) worth of sales tax until 2025 with the figure transitioning to 15,000 yuan ($2000) from 2026 to 2027. Previously, the government directed its incentives at producers, handing out 200 billion yuan ($29 billion) in incentives and subsidies between 2009 and 2022. This shows intent on the government’s side to boost electric vehicle demand but also highlights a desire to allow the market to grow more organically as uptake increases.

Europe also has government policies playing a role in its electric vehicle markets. This includes a mixture of tax incentives and subsidies with twenty EU member states offering the latter. Among these, France and Germany notably offer significant €5000 and €4500 subsidies respectively on the purchase price of electric vehicles. Additionally, countries that do not offer subsidies nevertheless incentivise electric vehicle uptake in the form of tax reductions or exceptions. This also shows fiscal intent across the continent with the aim of incentivising electric vehicles.

In comparison to China, US federal electric vehicle tax breaks seem much more generous, reaching $7500 with state incentives still to come into play. Though further incentives can vary on a state by state basis, some such as Colorado and Maine even add in a further $7500 in subsidies on electric vehicles. This emphasises a major effort to increase electric vehicle use. However, the average electric vehicle price in the US is much higher too, reaching $52,000, more than double the Chinese average. Therefore, higher vehicle prices could offset the advantage that US incentives put in place relative to those in China.

Future Outlook

On a forward-looking perspective the global EV market is poised for continued growth, with projections indicating an increase to 35% by 2030 of the share of electric car global sales (compared to a 14% share in 2022). China is expected to maintain its market dominance, driven by robust domestic demand, extensive production capabilities, and aggressive export strategies. Nowadays, electric cars account for more than 20% of total sales both in China and in more than 10 European countries (compared to a 8% share in the US), but these stakes are expected to climb much higher by 2030, in line with the current and future expected net-zero policies, which are also set to avoid over 5 mb/d of oil consumption in that same year.

Also, battery manufacturing capacity is expected to grow two- to fourfold by 2030, and policies must ensure that investments are channeled effectively through all the steps of the supply chain, facing all the major problematics concerning the increasing costs of battery production and critical minerals high demand.

In summary, China's rapid ascension in the EV market is marked by significant sales growth, technological leadership, extensive production and export capabilities. Europe and the U.S., while growing at a different pace, are also evolving their EV markets, influenced by regulatory environments, market dynamics, and technological innovations. As the global shift towards electric mobility continues, the strategies, advancements, and market dynamics of these 3 macro markets will play a crucial role in shaping the future landscape of the EV industry.

By Andrea Cavenago, Lodovico Del Re, Ettore Marku, Neil Pinto

SOURCES

- Statista

- Factset

- Forbes

- IEA

- Acea

- CNET

- MIT Technology Review

- CNN