In the past decade, the EV industry and China have both developed to become salient factors in today’s global economy. Fueled by a decade of extensive government support, China is the world leader in EV usage and production by a large margin. However, as of late, politics and excess supply in markets have been hurting China’s prospects in the EV industry. In light of these recent challenges, China’s EV industry is set for a wave of consolidation, reducing the hundreds of current players to a mere handful. Furthermore, Chinese EV incursion into international markets has elicited varying reactions across the globe, with further consequences on the table.

Introduction

As the world transitions towards a sustainable and environmentally-conscious future, the global Electric Vehicles (EV) market has taken a tremendous leap forward in the past decade and is expected to continue fostering innovation and driving growth in one of the crucial sectors of the global economy: the automobile industry. Over 18 million Electric Vehicles are in use worldwide in 2023 - and this figure is expected to continue growing for many years to come. This shift towards EVs has coincided with and been fueled by China’s rise as an electric vehicles and components manufacturing hub, as well as the rapid growth of Chinese companies in this sector.

The EV industry at a glance and reasons behind China’s dominance

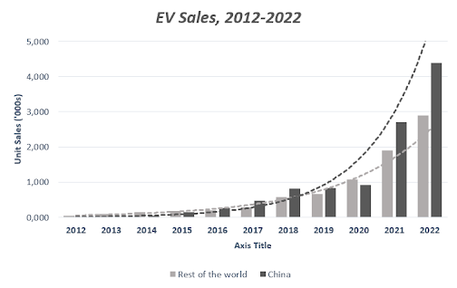

The year 2022 came on strong, with the EV industry breaking record after record. According to the International Energy Agency, the number of EVs sold exceeded 10 million, and the share of electric vehicles rose to 14% of all new automobiles. This highlights the jump made by the industry, considering the same metric reached only 9% in 2021 and less than 5% in 2020. This resulted in more than 26 million electric cars roaming global roads in 2022, representing a 60% uptake from 2021.

China occupies the first position among the players in the EV industry. In 2022, 22% of passenger vehicles sold in China were all-electric, which translates to 4.4 million vehicles sold, figure which surpassed the 3 million EVs sold in the rest of the world combined and is over 4 times bigger than the second largest producer - the United States. More than half EVs on roads worldwide are now in China and the country has already exceeded its 2025 target for new energy vehicle cars.

Source: Statista

Globally, China holds a dominant position in the EV supply chain, with over three quarters of the world’s battery production capacity. The battery is among the most important components of an EV and accounts for 40% of the vehicles’ total price. Moreover, China houses more than half of the world’s processing and refining capacity for lithium, cobalt, and graphite, which are essential materials for making EV batteries. Specifically, China boasts 70% of the global production capacity for cathodes (that is, the batteries’ positive electrode) and 85% for anodes (that is, the batteries’ negative electrode).

These capabilities possessed by China create its inherent supply chain advantages, lowering costs in logistics, labor, and land management. Moreover, the large EV market enables the emergence of economies of scale. According to the founder of Chinese EV maker Nio, William Li, his firm and other peers producing EVs in China have as much as a 20% cost advantage over rivals due to China's grip over the supply chain and raw materials.

These capabilities possessed by China create its inherent supply chain advantages, lowering costs in logistics, labor, and land management. Moreover, the large EV market enables the emergence of economies of scale. According to the founder of Chinese EV maker Nio, William Li, his firm and other peers producing EVs in China have as much as a 20% cost advantage over rivals due to China's grip over the supply chain and raw materials.

What does the EV industry supply chain look like and how does it work?

The EV supply chain can be divided into three main stages of production activity: upstream, midstream, and downstream.

The upstream industry involves the supply of raw materials and components for vehicle manufacturing. It encompasses extraction of minerals, namely lithium and cobalt, and manufacturing of major parts, including the power battery, drive motor, and electronic control system. Most of the required minerals are concentrated in a few countries, including the Democratic Republic of Congo, Argentina, Chile, and Australia. The dispersion and concentration of these key materials make the global supply chain vulnerable and susceptible to disruptions caused by developments linked to geopolitics, shifts in trade alliances, and corporate consolidation.

China currently holds a prominent position in this stage, accounting for 75% of global lithium-ion battery production and 70% of cathode capacity. It stands as the leading refiner of battery metals globally and currently hosts a significant share of battery cell manufacturing capacity, anode, and electrolyte production as well as battery component manufacturing.

The midstream industry covers the vehicle manufacturing process. China is a major player in this industry stage, with a robust manufacturing ecosystem in place for electric cars, commercial vehicles, and special-purpose vehicles. Supportive government policies and investments have contributed to the rapid growth of the automotive manufacturing industry, making China a leading force in the global EV market.

The downstream segment of the EV supply chain comprises charging services and after-market services. This includes charging equipment infrastructure, automobile finance, insurance, trading, automobile repair and maintenance, and automobile dismantling and recycling. In recent years, the number of EV charging piles in China has been steadily increasing. Private charging piles are growing at an even faster rate compared to public charging piles. However, there is still a significant gap between the current number of charging piles and the market demand, leaving ample room for further development in the charging infrastructure.

Recent performance of key commodities in the EV industry

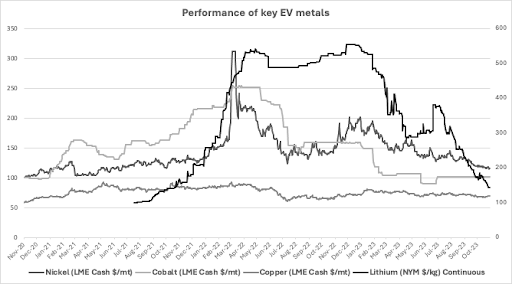

Over the past few years, the globally-spread EV frenzy, mostly driven by the strong policy effort to decarbonize the transportation sector, translated into a spike in global demand for a set of commodities that are critical to multiple stages of the EV supply chain, including lithium, cobalt, graphite and many others.

The vast majority of these key materials’ prices surged to all-time highs between 2016-2022 due to supplies falling short of stronger-than-expected demand for EVs. Clearly, this was accompanied with continuously rising prices charged by EV manufacturers worldwide as suppliers faced increasing costs of raw materials.

This changed drastically starting from the second half of 2022. In China, prices of battery-critical commodities were negatively affected by the slowdown in EV sales during H1 2023 relative to the previous year. Needless to say, the direction that the Chinese and global EV industry will take strongly depends on whether the declining trend of these key metals will persist or revert in the upcoming years.

Source: Trading Economics

Lithium prices are down 70% year-to-date, a downfall that was mostly due to demand for this commodity being strongly correlated to demand for electric vehicles. Lithium is the lightest and highest energy-dense metal, which is why lithium-ion batteries are favored relative to other materials for EV engines as they allow more energy to be stored in less space, arguably making lithium the most important element in the EV supply chain.

The slowdown of demand for EVs in China, which also came with a downturn of the broader Chinese economy, put downward pressure on lithium as well as other critical commodities in the EV supply chain. After a small upward correction in June, lithium prices dropped further and are now back to pre-frenzy levels. This additional fall was even more pronounced as it was driven by the ongoing destocking of lithium inventory by battery manufacturers. Following the decline in demand, players in the industry were forced to use accumulated inventory to make new batteries rather than purchasing new raw material, which contributed to demand for lithium falling further below supply.

The downfall was even worse for cobalt, which gave back roughly 60% in the 12 months between March 2022 and 2023. Cobalt prices fell the most among critical materials for electric vehicles. China controls the production of approximately 50% of global cobalt output, of which 75% is mined in the Democratic Republic of Congo where China owns most production processes. The initial downward trend in cobalt prices resulted from the strong increase in supply due to stronger-than-expected production in DRC as well as the emergence of Indonesia which is set to become the world’s second largest cobalt producer, as the country quintupled its output over the past 2 years.

The fall in cobalt prices was amplified by the dispute between China and the Democratic Republic of Congo related to the chinese-owned Tenke Fungurume Mine located in DRC. In July 2022, CMOC Group, China’s largest producer of copper and cobalt and the second biggest worldwide, was banned from exporting copper and cobalt extracted from the mine for 10 months until April this year. Clearly, this created a huge stockpile of cobalt leading to additional oversupply, and a further price drop.

Graphite, another key component of lithium-ion EV batteries, has been at the core of the most recent geopolitical tensions between China and the West concerning EVs. As of today, China is the largest graphite producer and provides roughly 70% of global supplies of natural graphite, according to the USGS. Additionally, China also refines approximately 90% of the world's natural graphite which is ultimately used in virtually all EV battery anodes.

On October 20th 2023, Beijing imposed export controls on the commodity in response to the recently-implemented measures restricting China’s ability to import AI chips from the US. These were merely the latest stages of the ongoing war between Washington and Beijing over key minerals for tech applications. In July 2023, China imposed export bans on Gallium and Germanium, two key semiconductor materials increasingly used in electric vehicle chargers. Just like for these two metals, China also dominates the global supply of graphite for EV batteries, with the US being the largest importer. Prices of natural and synthetic graphite have fallen roughly 30% YTD, and while a restrictive supply-side shock like Beijing’s export ban could potentially set this commodity on an upward trend, the outlook remains bearish. This is because new technological advancements such as using silicon or lithium as anodes offer better performance and have greater energy capacity compared to graphite, which will most likely drive this metal’s price further down in the upcoming years.

The slowdown of demand for EVs in China, which also came with a downturn of the broader Chinese economy, put downward pressure on lithium as well as other critical commodities in the EV supply chain. After a small upward correction in June, lithium prices dropped further and are now back to pre-frenzy levels. This additional fall was even more pronounced as it was driven by the ongoing destocking of lithium inventory by battery manufacturers. Following the decline in demand, players in the industry were forced to use accumulated inventory to make new batteries rather than purchasing new raw material, which contributed to demand for lithium falling further below supply.

The downfall was even worse for cobalt, which gave back roughly 60% in the 12 months between March 2022 and 2023. Cobalt prices fell the most among critical materials for electric vehicles. China controls the production of approximately 50% of global cobalt output, of which 75% is mined in the Democratic Republic of Congo where China owns most production processes. The initial downward trend in cobalt prices resulted from the strong increase in supply due to stronger-than-expected production in DRC as well as the emergence of Indonesia which is set to become the world’s second largest cobalt producer, as the country quintupled its output over the past 2 years.

The fall in cobalt prices was amplified by the dispute between China and the Democratic Republic of Congo related to the chinese-owned Tenke Fungurume Mine located in DRC. In July 2022, CMOC Group, China’s largest producer of copper and cobalt and the second biggest worldwide, was banned from exporting copper and cobalt extracted from the mine for 10 months until April this year. Clearly, this created a huge stockpile of cobalt leading to additional oversupply, and a further price drop.

Graphite, another key component of lithium-ion EV batteries, has been at the core of the most recent geopolitical tensions between China and the West concerning EVs. As of today, China is the largest graphite producer and provides roughly 70% of global supplies of natural graphite, according to the USGS. Additionally, China also refines approximately 90% of the world's natural graphite which is ultimately used in virtually all EV battery anodes.

On October 20th 2023, Beijing imposed export controls on the commodity in response to the recently-implemented measures restricting China’s ability to import AI chips from the US. These were merely the latest stages of the ongoing war between Washington and Beijing over key minerals for tech applications. In July 2023, China imposed export bans on Gallium and Germanium, two key semiconductor materials increasingly used in electric vehicle chargers. Just like for these two metals, China also dominates the global supply of graphite for EV batteries, with the US being the largest importer. Prices of natural and synthetic graphite have fallen roughly 30% YTD, and while a restrictive supply-side shock like Beijing’s export ban could potentially set this commodity on an upward trend, the outlook remains bearish. This is because new technological advancements such as using silicon or lithium as anodes offer better performance and have greater energy capacity compared to graphite, which will most likely drive this metal’s price further down in the upcoming years.

Can commodity prices and technological disruptions end China’s dominance?

Commodity prices have been falling for over a year now, the Chinese economy is slowing and the increased tensions between Beijing and Washington are repeatedly causing supply shocks. Naturally, it did not take long for competitive markets to price these downward movements in commodities and demand-supply dynamics into electric vehicles prices, which translated into increased competition as well as an actual price war among car manufacturers in China’s EV market.

Whether or not this trend will persist is highly dependent on various macroeconomic factors.

Which price movements should we expect from these commodities? The general sentiment currently prevailing in the market is mostly bearish, as at least for the next few years, the major battery metals are expected to be oversupplied. While this holds true for commodities such as cobalt, graphite and nickel, the outlook for lithium is slightly more optimistic as the increased reliance on this metal of newly-developed batteries might potentially lead to a shortage of lithium and subsequent price increase in the upcoming years.

How are price movements in EV-related commodities going to affect the industry? Again, due to the strong importance of materials such as lithium, cobalt and graphite, prices of these metals will most likely comove with supply and demand dynamics in the EV market. In this iterative setting, changes in demand for EVs directly impact the prices of these commodities, which in turn affects equilibrium supply and demand. Clearly, due to the contract-based nature of the business carried out between suppliers of battery-critical commodities and battery manufacturers, this often occurs with a time lag. In the short-term, EV batteries are expected to be cheaper as new contracts will allow EV battery manufacturers to lock in the current lower prices of key metals from suppliers, which in turn will put downward pressure on electric vehicle prices, potentially boosting the ongoing price war in the short term. Once the EV discount war in China passes and demand starts to recover, then prices should increase as battery manufacturers start buying materials to restock inventories.

One last aspect to touch upon is whether China will be able to maintain its dominance over battery technology and manufacturing. The country’s quasi-monopolistic market share over key commodities, paired with the strong depreciation of the yuan against the dollar in 2023 which further strengthened China’s export competitiveness, makes it very hard for other countries to close the gap with Beijing’s leadership in the industry, unless some disruptive change in market conditions occurs. Recently, Toyota, the world’s largest automaker, announced significant progress in manufacturing the first solid-state battery, which would be a major innovation in the EV industry. These batteries would feature a major increase in energy density, allowing a full recharge of an electric vehicle in essentially half the time relative to standard lithium-ion batteries. News of further advancements in the manufacturing of this innovative technology would be a catalyst for two important developments in the industry. First, demand for lithium would increase at the expense of graphite. This is because solid-state batteries’ major change entails the use of lithium anodes instead of graphite or silicon, as replacing the graphite currently used in anodes would help double the battery’s range and make it lighter. Clearly, this development would increase demand for lithium, at the extreme leading to a shortage of this metal, since new batteries would consume even more lithium than current ones. Second, the introduction of solid-state batteries could reshape the global EV industry in terms of country dominance, as this could be one of the very few ways to challenge Beijing’s leadership over the EV battery space. Besides Toyota, other Japanese and South Korean carmakers and battery manufacturers have been investing in solid and semi-solid state technology and aim to scale the production process up in the next few years. As this will not be easy to achieve in such a short time frame, a more realistic scenario entails the gradual integration of semi-solid technologies into the current lithium-ion batteries over the short-run. In this setting, it will be interesting to see whether battery makers like CATL and BYD will be able to defend China’s dominance in the global battery industry from the threats of new foreign players.

Another layer of concern: how EV consolidation in China can threaten smaller EV companies

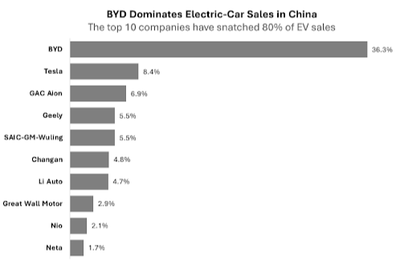

While certain Chinese automakers have achieved household recognition, such as the Warren Buffett-backed BYD, many others that mushroomed during a decade-long investment boom now find themselves at a crossroads with an uncertain future.

The Chinese electric vehicle (EV) market is currently undergoing a phase of consolidation, where the top 10 EV manufacturers are set to capture roughly 80% of this year's total EV sales. This scenario poses formidable challenges for smaller EV companies. As Jing Yang, Director of China Corporate Research at Fitch Ratings, highlights, "If we look at these EV companies with minimal sales from a credit perspective, their main problems are a very high execution risk in strategy, sustained negative free cash flow and liquidity risk”. For those automakers, it’s “very hard to access the bond markets. Their refinancing risk becomes elevated if equity investors and banks walk away”.

These challenges are multifaceted. Firstly, there's a high execution risk in strategy because smaller EV firms often lack the experience and expertise of their larger counterparts, making it more challenging for them to implement their plans. Secondly, sustained negative free cash flow is a common issue since many EV companies are still in their early stages of growth and haven't yet reached profitability. This necessitates their reliance on external funding to sustain operations. Lastly, there's the looming threat of liquidity risk; if smaller EV companies can't secure new funding, they might run out of cash and face the prospect of closure.

These difficulties are particularly acute in the current landscape, where the sales growth of new-energy vehicles in China is decelerating, and exports are on the rise. While all EV companies are feeling the squeeze on their profit margins, the smaller players are particularly vulnerable.

Data from the China Automotive Technology and Research Centre (CATARC) indicates that among the approximately 91 active electric car manufacturers, nearly a third are reporting sales of fewer than 500 vehicles per quarter. By way of comparison, Tesla dispatched approximately 74,000 vehicles from its Shanghai factory just last month.

Brands like Aiways, Zotye, and Haima, once known for robust sales, have seen their new-energy vehicle registrations plummet to no more than 20 vehicles in the second quarter of this year, according to CATARC's data. The Herfindahl-Hirschman Index, used to gauge market competition and concentration, suggests that the sector is teetering on the edge of transitioning from overcrowded to moderately concentrated.

Nonetheless, select investors continue to back the most promising up-and-comers. For instance, Xpeng Inc secured a substantial $700 million investment from Volkswagen AG, with the German automaker acquiring a 4.99% stake in the Chinese company and securing an observer board seat.

Nio Inc, despite not having turned a profit yet, is striving to double its EV sales to 250,000 units this year. It has already sold a 7% stake to an entity controlled by Abu Dhabi for approximately $740 million and is contemplating raising an additional $3 billion from investors, according to sources familiar with the matter.

Source: Bloomberg

Furthermore, there are still companies determined to enter the competitive EV market, including Xiaomi Corp. The Chinese smartphone manufacturer is engaged in discussions with established automakers about potential production partnerships as it awaits Beijing's approval for an EV manufacturing license. However, given the slowing growth in new-energy vehicle sales in China and the surge in exports, even these sizable corporations find it increasingly challenging to maintain their foothold in the industry. Should they falter, it could send shockwaves through numerous other companies that are barely staying afloat in this cutthroat market.

China’s attempts of expansion into other EV markets

In all of that, the Chinese EV industry is making a bold push into new territories, underlining the pivotal role their vehicles play in global clean energy initiatives. They are not just staying within their homeland but are expanding their manufacturing reach into various foreign regions, including Europe, Southeast Asia (with a particular focus on Thailand), and Brazil.

The decision to establish production facilities beyond China is closely intertwined with the growing wave of international sales. By producing vehicles and batteries locally in foreign countries, these companies can sidestep tariffs and trim hefty transportation costs. Additionally, they can tap into enticing government incentives in their host nations and mitigate potential political opposition.

Several countries are actively vying for these investments. For instance in Thailand, the third largest recipient of Chinese EV exports by absolute quantity in 2022, the government has introduced incentives such as temporary corporate tax breaks for EV manufacturers. This led to substantial investments, primarily driven by Chinese companies, which reached a noteworthy $2.2 billion in 2023. Multiple Chinese firms have now set up factories or have imminent plans to do so in Thailand over the next few years. In H1 2023, EVs made up 6% of all cars sold in Thailand, up from 1% in 2022. Other Southeast Asian nations, like Malaysia, are also keen on attracting more Chinese investments. As much as 75% of EVs sold in Southeast Asia are imported from China, facilitated by exemptions from import duties under the ASEAN trade agreement.

In Brazil, the government is openly endorsing arrangements where Chinese companies take over existing manufacturing facilities, as exemplified by BYD's acquisition of a former Ford plant. Both in Thailand and Brazil, Chinese manufacturing facilities can potentially serve the wider region, capitalizing on existing manufacturing infrastructure and trade networks.

In Europe, where the EU aims to phase out traditional gasoline cars by 2035, the influx of Chinese electric vehicles (EVs) presents both an opportunity and a challenge. Chinese brands are in a unique position to offer affordable EVs to the masses, something Europe's renowned automakers have yet to match.

We see, in fact, foreign direct investment in the battery sector is on the rise, with numerous battery companies either already investing or planning to invest in various European countries. For instance, a key player like BYD, has witnessed rapid expansion to meet surging demand. In 2022, the expansion of battery companies played a pivotal role in driving greenfield investments from China into Europe.

However, in September of 2023, Ursula von der Leyen announced that the European Commission was launching an anti-subsidy investigation into EVs coming from China, following last year’s reversal of the car trade surplus Europe had with the country. The investigation comes after the perceived threat and allegations of unfair competition from Chinese companies, who benefit from huge Chinese state subsidies, Ursula von der Leyen emphasising that "cheaper Chinese electric cars" are flooding the global market. Currently, European import duties on Chinese EVs are set at only 10%, the same level as other imports, which could be subject to change if the investigation finds that Chinese companies have an unfair advantage. Just over a decade ago, a 47% import duty was almost imposed on Chinese solar panels for similar reasons.

The investigation could lead to two explicit outcomes: (1) Chinese EV investment targeting Europe pulling out and instead redirecting to the smaller markets of Southeast Asia, South Africa and the Middle East, or (2) Chinese companies setting up shop in the EU to avoid any new tariffs. However, the ability of Chinese firms to maintain their competitive pricing would be less certain, considering Europe’s higher energy/labour costs and regulation.

Retaliation from China is also on the table, as seen with commodities. However, this would be a bloodier battle, considering the vast number of strategic partnerships and JVs in manufacturing between European and Chinese companies, one example being Volkswagen and Xpeng. In H1 2023, 9.5% of China’s EV exports stemmed from European-Chinese JVs, while 39.2% were American Teslas. Attitudes vary across the bloc, German brands have been increasing their investment in and reliance on China, while Peugeuot (owned by Stellantis) has been pulling away from China.

Conclusion

China holds dominating positions in the materials, manufacturing and distribution of EVs, giving the country the grandest economies of scale among any competitors in the sector, which is only set to grow thanks to regulatory tailwinds and global decarbonisation. The frenzy in corresponding commodity prices between 2016 and 2022 has recently resided, following excess supply of EVs and destocking of inventories by battery manufacturers. With low costs, excess supply and overarching presence in the sector, the consolidation of the Chinese EV industry will champion the few top profit-turning players, putting an end to many smaller and innovative but unprofitable brands propped up by government support. Internationally, the inbound flood of relatively cheaper Chinese EVs and sector FDI has already drawn eyes and incited action, differing attitudes across regions will further contribute to trade wars and political conflict.

By Ginevra Ferraioli, Jacopo Landi, Vittoria Palmieri, Pietro Vascotto Vidal

Sources

- Bloomberg

- Center for Strategic and International Studies

- CNBC

- Financial Times

- Just Auto

- MIT Technology Review

- Nikkei

- Reuters

- Statista