The Chinese slowdown of 2018 has had consequences on many aspects of the Country’s economy. The signs that we are facing a serious phase in the economy of the Asian Giant are evident and even more if we consider the impact of an industry that has been characterised by considerable growth in the past three years: the steel industry. China in fact represents the supplier of more than a half of the world’s crude steel.

The slowdown is pervading the whole economic tissue and both experts and market players do not believe that this time the government will be able to provide the needed stimulus in order to keep the economic growth on a straight line. This is the biggest worry in the steel industry, which has in the past benefited from the strongly supportive approach of the government. This time there seems to be a different, more cautious tune.

The biggest players in the demand for steel are the Real Estate and the Infrastructure industries, accounting for 28% and 24% of the demand. With regards to Real Estate, the sector is suffering from a decreased demand and lack of support from the government in terms of incentives and friendlier restrictions on housing purchases. The same is true also for the Automotive industry, which has registered a drop in sales of nearly 3% during the last fiscal year together with the government’s denial of a tax cut in order to stimulate the demand for cars. Also the Infrastructure sector is at risk, considering that the lack of funds in order to complete the scheduled projects does not seem currently so unlikely.

It goes without saying that the US-China tensions are considerably affecting first the industries behind the demand for steel and, consequently, the steel industry itself: reaching an agreement would mean a more positive view in terms of sales forecasts and, therefore, more commitment of the firms in ordering and buying the commodity.

For now, the industry is lacking of the aforementioned commitment: it is evident that expectations of a price decrease in the near future drive current prices down and determine a stagnation in the industry.

The slowdown is pervading the whole economic tissue and both experts and market players do not believe that this time the government will be able to provide the needed stimulus in order to keep the economic growth on a straight line. This is the biggest worry in the steel industry, which has in the past benefited from the strongly supportive approach of the government. This time there seems to be a different, more cautious tune.

The biggest players in the demand for steel are the Real Estate and the Infrastructure industries, accounting for 28% and 24% of the demand. With regards to Real Estate, the sector is suffering from a decreased demand and lack of support from the government in terms of incentives and friendlier restrictions on housing purchases. The same is true also for the Automotive industry, which has registered a drop in sales of nearly 3% during the last fiscal year together with the government’s denial of a tax cut in order to stimulate the demand for cars. Also the Infrastructure sector is at risk, considering that the lack of funds in order to complete the scheduled projects does not seem currently so unlikely.

It goes without saying that the US-China tensions are considerably affecting first the industries behind the demand for steel and, consequently, the steel industry itself: reaching an agreement would mean a more positive view in terms of sales forecasts and, therefore, more commitment of the firms in ordering and buying the commodity.

For now, the industry is lacking of the aforementioned commitment: it is evident that expectations of a price decrease in the near future drive current prices down and determine a stagnation in the industry.

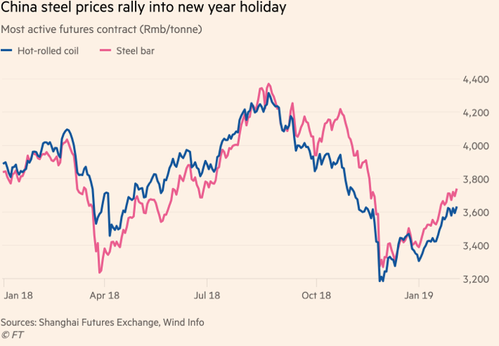

The steel market has already undergone a dark phase between October and November 2018, reaching a low of 3,200 RMB/tonne and bringing the margins to a 18-month low, due to levels of production from the supply side that did not match the level of economic growth. However, prices have recovered from it, but not in a sustainable and stable way: the drive has not been a reassuring rebound in the demand for the seasonal inventory, but instead a much more unreliable bet coming from the speculators’ side on the broadening of the premium of spot over future contracts.

Overall, it seems that the industry is going to face a tough time after having been spoiled by the accommodative government reforms and stimulus. If the demand will keep falling, there will not be as much room as before for all the players in the field and, as everywhere nowadays, the ones that will keep standing will be those that have already started to innovate and prepare for the period to come.

Adriana Messina