Introduction

A new rise in Covid cases and subsequent restrictions imposed by the Chinese government have led many Chinese cities to come to a standstill. Apart from the social and humanitarian consequences of ongoing lockdowns, Chinese businesses and the Chinese economy are also majorly impacted by the measures. The present article takes a deep dive into the current situation in China: First, the Chinese zero-Covid policy is explained. Furthermore, the article explains the impacts of such policy on both businesses and the Chinese GDP. We observe that the already stressed supply chains may be further disrupted, and that the Chinese GPD forecasts are heavily dependent on the length of the lockdowns.

The Chinese zero-Covid policy

The Zero-Covid strategy was introduced by the Chinese government early in the pandemic with the goal of zero new infections through a “control and maximum suppression” strategy. It aims to prevent transmission by utilizing large-scale lockdowns, mass testing and international travel bans and can be considered the opposite approach when compared to the Living with Covid Strategy. China has remained one of the strictest in its approach to Covid even as others have eased restrictions within the past year up until the last few days. Countries like Australia and New Zealand who have maintained the Zero-Covid strategy in the past, have adapted instead to focusing on vaccination rates and lessening general restrictions with the rise of the Omnicron Variant.

Recently, Covid cases in Shanghai have reached levels not seen since Wuhan in 2020. However, the Zero-Covid approach this time around is being disputed among the Chinese population.

With over 51% of over-80-year-olds remaining unvaccinated and Intensive Care Unit capacities far below comparative countries, there is a definite reason political figures remain sided with continuing the strict approach. However, public sentiment has begun to express opposition with stories surfacing of trouble accessing regular medical care and even food due to the lockdown measures during the worst outbreak seen in 2 years.

While China is sticking to the Zero-Covid strategy, most other countries have shifted in their response to the pandemic to the Living with Covid strategy. For example, the US government’s approach to Covid in the short term has been the Test to Treat model which will allows people to test for Covid-19 and receive antiviral medication in “one step” at pharmacies. Long term plans support investments into Covid treatment centers with an approach different from the Living with Covid strategy.

Within Europe, restrictions and approaches have differed from country to country. In Italy, COVID-19 preventive measures regarding the use of masks and the Green Pass certification are gradually being relaxed but wearing masks on public transit and indoors is still the general precedent. Switzerland announced the lifting of all remaining restrictions as of April 1st. In England, COVID restrictions were lifted as of February 24th. And in Portugal, on April 21st, the mask mandate was lifted, but continues to be enforced on public transportation.

Recently, Covid cases in Shanghai have reached levels not seen since Wuhan in 2020. However, the Zero-Covid approach this time around is being disputed among the Chinese population.

With over 51% of over-80-year-olds remaining unvaccinated and Intensive Care Unit capacities far below comparative countries, there is a definite reason political figures remain sided with continuing the strict approach. However, public sentiment has begun to express opposition with stories surfacing of trouble accessing regular medical care and even food due to the lockdown measures during the worst outbreak seen in 2 years.

While China is sticking to the Zero-Covid strategy, most other countries have shifted in their response to the pandemic to the Living with Covid strategy. For example, the US government’s approach to Covid in the short term has been the Test to Treat model which will allows people to test for Covid-19 and receive antiviral medication in “one step” at pharmacies. Long term plans support investments into Covid treatment centers with an approach different from the Living with Covid strategy.

Within Europe, restrictions and approaches have differed from country to country. In Italy, COVID-19 preventive measures regarding the use of masks and the Green Pass certification are gradually being relaxed but wearing masks on public transit and indoors is still the general precedent. Switzerland announced the lifting of all remaining restrictions as of April 1st. In England, COVID restrictions were lifted as of February 24th. And in Portugal, on April 21st, the mask mandate was lifted, but continues to be enforced on public transportation.

Implications on Chinese businesses

The zero covid policy and the lower efficacy of Chinese vaccines have remarkable implications on supply chains and the situation of Chinese workers. Even more, as discussed below, repercussions do not affect just China but the entire world as China is “the World’s Factory”

Because of favorable economic conditions, such as low-cost workers, efficient business ecosystem and lower compliance levels, the Chinese economy is a manufacturing powerhouse and is commonly recognized as the World’s Factory. According to the International Standard Industrial Classification, Chinese Manufacturing output was $3,853.81bn in 2020. UN data shows that China is the world’s leading manufacturer, as shown in the graph below.

Because of favorable economic conditions, such as low-cost workers, efficient business ecosystem and lower compliance levels, the Chinese economy is a manufacturing powerhouse and is commonly recognized as the World’s Factory. According to the International Standard Industrial Classification, Chinese Manufacturing output was $3,853.81bn in 2020. UN data shows that China is the world’s leading manufacturer, as shown in the graph below.

However, the imposed zero Covid policy has had major impacts on businesses´ supply chains, which have experienced disruption since 2020. Economists fear that the combination of Chinese supply chain disruptions and the conflict between Russia and Ukraine could cause what was defined by HSBC as the “mother of all supply chain shocks”.

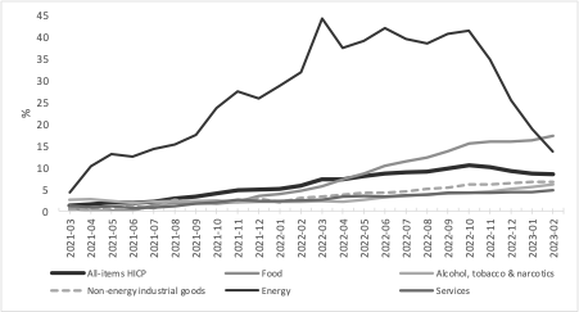

Indeed, the zero Covid policy has reimposed strict lockdowns in major Chinese cities such as Shanghai. This means that business activity and production are disrupted, as workers struggle to reach their workplaces. As reported by The Guardian, Richard Yu Chengdong, a top Huawei executive declared that “If Shanghai cannot resume production by May, all of the tech and industrial players who have supply chains in the area will come to a complete halt, especially the automotive industry”. What is concerning companies and economists is the ongoing lockdown in Shanghai as it is causing huge losses in terms of GDP for China as a whole and for worldwide supply chains. In response, many companies are trying to diversify risk through new suppliers. “We are starting to see companies mitigating risk, seeing where they can increase capabilities for production of different products in different factories so they can shift that around,” said Krishnan from IDC in Singapore. However, the situation is alarming for the country as last month Chinese Covid-related restrictions cost approximately £35bn a month, according to Chinese University of Hong Kong. Another consequence of the supply chain disruption could be a further rise in inflation. As supply slows down and the demand is still relatively high, prices could rise further. Niels Rasmussen from BIMCO said that “a slowdown in Chinese exports will exacerbate supply chain delays and reduce inventories held by businesses, which could drive further price increases."

Apart from the implications on businesses, restrictions also impact Chinese workers, who are confined at home, have no income and face increasing costs of living. While normal life shuts down, some businesses have been allowed to continue factory work if workers remain in the workplace overnight. In these cases, workers must remain inside a plant, eating and sleeping there for days or weeks. The outlined situation may further increase social tensions.

Indeed, the zero Covid policy has reimposed strict lockdowns in major Chinese cities such as Shanghai. This means that business activity and production are disrupted, as workers struggle to reach their workplaces. As reported by The Guardian, Richard Yu Chengdong, a top Huawei executive declared that “If Shanghai cannot resume production by May, all of the tech and industrial players who have supply chains in the area will come to a complete halt, especially the automotive industry”. What is concerning companies and economists is the ongoing lockdown in Shanghai as it is causing huge losses in terms of GDP for China as a whole and for worldwide supply chains. In response, many companies are trying to diversify risk through new suppliers. “We are starting to see companies mitigating risk, seeing where they can increase capabilities for production of different products in different factories so they can shift that around,” said Krishnan from IDC in Singapore. However, the situation is alarming for the country as last month Chinese Covid-related restrictions cost approximately £35bn a month, according to Chinese University of Hong Kong. Another consequence of the supply chain disruption could be a further rise in inflation. As supply slows down and the demand is still relatively high, prices could rise further. Niels Rasmussen from BIMCO said that “a slowdown in Chinese exports will exacerbate supply chain delays and reduce inventories held by businesses, which could drive further price increases."

Apart from the implications on businesses, restrictions also impact Chinese workers, who are confined at home, have no income and face increasing costs of living. While normal life shuts down, some businesses have been allowed to continue factory work if workers remain in the workplace overnight. In these cases, workers must remain inside a plant, eating and sleeping there for days or weeks. The outlined situation may further increase social tensions.

Implications on the Chinese economy

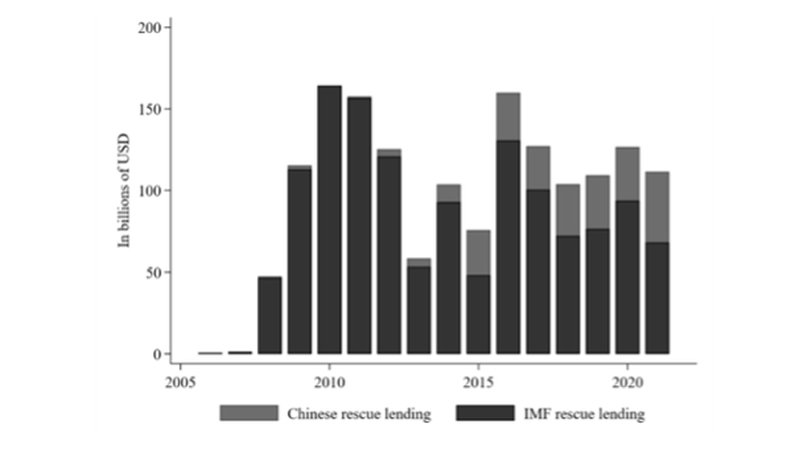

Chinese GDP growth has averaged almost 10% a year, with meaningful improvements in access to health, education, and other services. China relied mainly on resource-intensive manufacturing, exports, and low-paid labor to achieve its rapid growth, but these traditional growth drivers reached their limits (declining returns to public investment and rapid ageing) and led to economic, social, and environmental imbalances.

Over the past few years, China has encountered various challenges such as the Covid-19 pandemic but maintained moderate growth rates, as can be seen in the graph below. Due to structural developments, the Chinese economy now faces the challenge of finding new growth drivers. Moreover, the renewed growth strategy must address the social and environmental legacies of China’s previous development path. Indeed, growing faster than domestic institutions created some regulatory gaps that China needs to address to guarantee sustainable growth. Different requirements are necessary to develop new drivers of growth, such as a more efficient allocation of resources, a reduction in environmental impacts and a continuous boost in productivity. Equally important are government reforms, such as the strengthening of the regulatory system and the rule of law to support the market system.

Over the past few years, China has encountered various challenges such as the Covid-19 pandemic but maintained moderate growth rates, as can be seen in the graph below. Due to structural developments, the Chinese economy now faces the challenge of finding new growth drivers. Moreover, the renewed growth strategy must address the social and environmental legacies of China’s previous development path. Indeed, growing faster than domestic institutions created some regulatory gaps that China needs to address to guarantee sustainable growth. Different requirements are necessary to develop new drivers of growth, such as a more efficient allocation of resources, a reduction in environmental impacts and a continuous boost in productivity. Equally important are government reforms, such as the strengthening of the regulatory system and the rule of law to support the market system.

Real GDP grew by 8.1% in 2021, but growth is projected to slow to 5.0 per cent in 2022. The forecast reflects rising obstacles: domestic demand is lower, and the global economic environment has worsened significantly with the war in Ukraine. Indeed, the World Bank has cut this year’s global growth rate forecast to 3.2% from 4.1%. Nevertheless, China beat expectations in the Q1 of 2022, but consumer activity slowed down due to newly induced Covid-19 lockdowns. Indeed, COVID incursions have become more frequent and widespread. Although the zero-covid policy has performed well during 2020, many analysts forecast that being stuck to the policy could further slow the growth of the Chinese economy. According to Allianz analysts, who already cut the forecast of the GDP growth rate to 4.6%, in case the Shanghai lockdown lasts for 2 months, the growth rate will plumb to 3.8%. In the worst-case scenario, in which the Q1 2020 shock is repeated, China would experience growth of just 1.3%.

The first signs of a slowdown can be seen in the private consumption segment, where retail sales fell by 3.5% in March (when compared to 2021) due to new anti-virus controls. Breaking down the contribution to China's GDP growth, the influence of private consumption decreased, together with the real estate sector, due to a debt crisis in the sector and loss of momentum. A higher contribution comes from public spending and net exports.

The first signs of a slowdown can be seen in the private consumption segment, where retail sales fell by 3.5% in March (when compared to 2021) due to new anti-virus controls. Breaking down the contribution to China's GDP growth, the influence of private consumption decreased, together with the real estate sector, due to a debt crisis in the sector and loss of momentum. A higher contribution comes from public spending and net exports.

Although global trade volume is expected to grow by 4% (against the forecasted 6% before the invasion of Ukraine), in Q2 2022 global trade volume is likely to contract due to the slower Chinese economy. Indeed, by looking at the demand channel, lower Chinese consumption will create an export shortfall of $140bn for the rest of the world but could deteriorate to $345bn in the worst-case scenario. Furthermore, China has an extremely important position in global value chains, as it is estimated that $1.3trn worth of Chinese inputs are used in the rest of the world. Reports from companies in the Chinese provinces affected by lockdowns underline the electronics and automotive sectors to be the most affected.

Conclusion

As discussed, Chinese businesses are suffering from the imposed restrictions: Due to lockdowns, workers struggle to make their way into offices and factories, thus disrupting supply chains. Chinese GDP forecasts have been lowered by analysts, reflecting the unusually hard measures as compared to other countries.

Authors: Alessandro Chen, Emanuele Lamberti, Jensen Marie Getzweller

Authors: Alessandro Chen, Emanuele Lamberti, Jensen Marie Getzweller