Introduction

Over the past year, the Federal Reserve has been implementing harsh interest rate increases with a magnitude that has not been experienced in the last decade. The implications of these increases can be felt in all fields of the economy and are especially apparent in the credit market. High interest rates have started driving investors out of the market, which raised the cost of debt and interest rates for companies taking out loans and issuing bonds.

The leveraged buyout industry and private equity firms, which use high levels of debt for acquisitions are especially affected by this macroeconomic phenomenon. Because of high interest rates, LBOs are getting more and more expensive and debt underwriters are less inclined to buy debt instruments from these funds, doing so only with larger discounts. This article explores the effects of the macroeconomic environment on the debt market and buyout companies by examining the buyout of Citrix and explores the potential future implications for the industry.

Overview of the Debt Market

The bond market or debt market is composed of trades and issues of debt securities. Bonds are issued on both the primary market, also known as the new issues market, and the secondary market, where investors buy debt via financial institutions

Bonds can be classified into three main groups based on their issuer. Government bonds are national-issued and are generally considered attractive and least risky since the authorities can tax their citizens or print money to cover the payments. In the U.S., government bonds are known as Treasuries. They are distinguished, depending on the maturity, in T-bills, T-notes, and T-bonds, and they belong to the most active and liquid debt market. Municipal bonds are locally issued by government-owned entities to fund a sundry of projects. Finally, corporate bonds are issued by companies and firms to finance investments.

The bond rating is a process that alerts investors of the quality and stability of the financial tool, indicating its credit quality. Ratings are provided by credit rating agencies, such as S&P, Moody’s, and Fitch. Bond ratings are expressed as letters ranging from AAA, which is the highest grade, to D, which is the lowest one. Higher-rated bonds are seen as safer and more stable investments, while non-investment grade bonds or junk bonds (below BBB) are perceived as very risky, since they have a higher probability of default, and so they have higher yields.

The main economic factors that affect yields are interest rates, inflation, and economic growth. Bonds are deeply affected by monetary policies; in fact, falling interest rates cause the rise in bond prices and so bond yields fall. Conversely, rising interest rates determine a decline in bond prices, and bond yields increase. Indeed, when the demand for bonds decreases, issuers of new bonds must offer a better yield to attract investors and thus reduce the value of lower-yield bonds that were already on the market.

U.S. Macroeconomic Environment

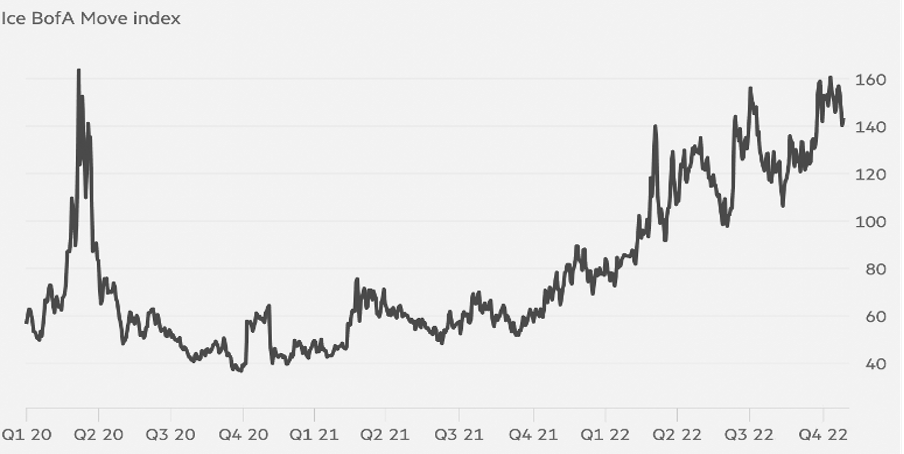

Since the Federal Reserve started fighting inflation by rising interest rates, both the stock and the bond markets have reacted. The policies adopted by the Fed and the overall global uncertainty are causing unfamiliar volatility to bond prices, resembling them to stocks. As a consequence, in a market that used to be liquid, nowadays it is harder and more expensive for investors to buy or sell Treasury bonds.

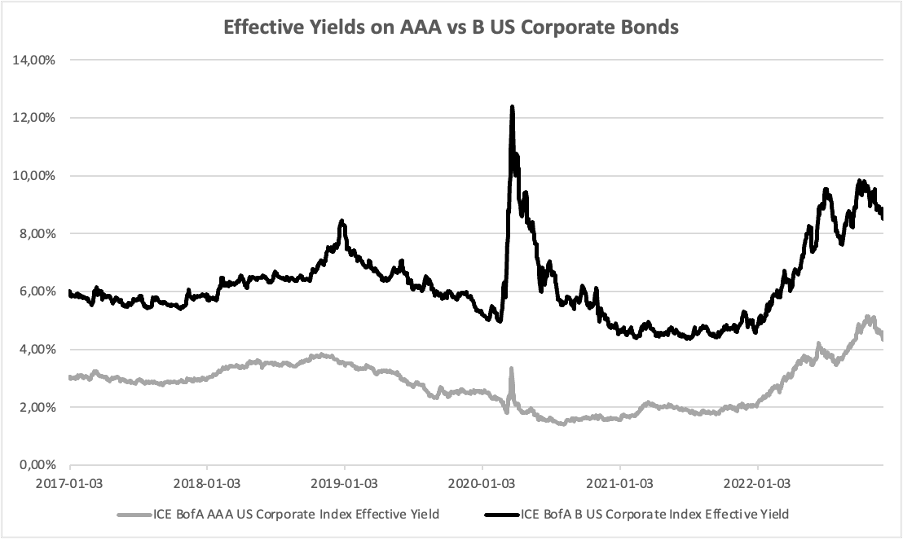

When interest rates rise, the prices of fixed-rate corporate bonds decline, and the yield tends to increase. To analyze this, we consider the ICE BofA US Corporate Index, which includes medium-to-long-term American corporate bonds. Concerning investment-grade bonds, the yield surpassed a level last seen in 2009, reaching 5% in June 2022. Since then, they partially recovered, but their yield is still above 4.5%. As for junk bonds, their yields have risen to 8.8% from 4.4% at the beginning of 2022, as the graph below shows.

This has caused outflows from US bond funds in the measure of $2.1 bn from funds investing in investment-grade bonds and $6.6 bn from funds buying high-yield bonds. Indeed, several bond deals have failed or have been postponed. This is not only a US phenomenon but rather a global trend. For instance, the number of deals pulled in EMEA has tripled from May to June 2022, reaching the record of cancellations in the last three years.

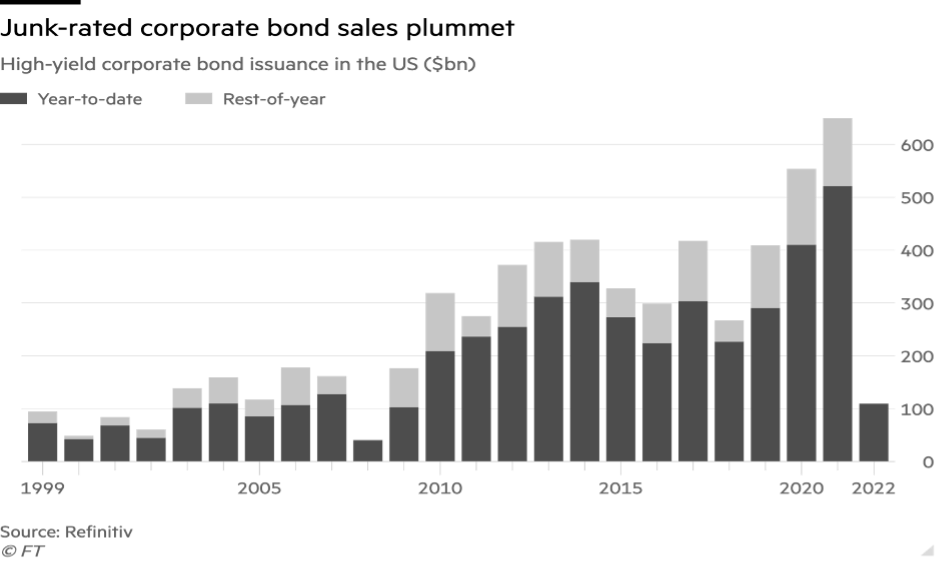

According to data from Refinitiv, the value of newly-issued corporate bonds fell by 17% whereas high-yield issuance fell by 78%, reaching a bottom last seen during the crisis of 2009.

Bond Market Activity in the US

In 2022, investors had to adapt to a new situation regarding the bond market, facing a new scenario characterized by the high yield of the 10-year Treasury Note, which registered a significant increase compared to the last year. It currently yields approximately 4%, a level that was last hit in April 2010, compared to a 1.5% rate at the end of 2021

Bond market participants try to anticipate in advance the decisions that the Fed will take. Considering the constant fears related to the next interest rate hikes, the record rise in yields, and the decrease in the value of bonds, it can be understood why bonds are perceived to be a less attractive investment opportunity.

Throughout history, fixed income has been considered the safest investment, having a much lower degree of risk and volatility compared to the stock market - thus with a lower probability of huge losses. However, this year, due to uncertainty, investing a significant amount of money in a bond with a long maturity date is not the best solution. Using the Bloomberg US Aggregate Index as a benchmark, we can see that bonds have lost their value only five times since 1977, with the biggest decline being -2.9% in 1994. 2022 represents a negative record in this sense, with a -11% YTD performance.

Another less common aspect that can be noted in 2022 relates to the interest rate of bonds with different maturities. Under normal circumstances, bonds with longer maturities offer a higher yield (investors are rewarded for the uncertainty of borrowing money over a longer period). However, due to the actions of the Fed, we can note that some bonds with a much shorter maturity period offer a higher rate than some bonds with a longer maturity, so the riskier investment in these long-term bonds becomes even less attractive.

Credit market activity has been severely hit by the rising cost of debt. The yield on bonds issued by solid businesses is now about 6%, almost twice as much as it was a year ago, with rates being even higher for smaller businesses (considered riskier by investors). Although corporate bankruptcies and defaults remain low by historical standards, an increasing number of companies are beginning to suffer from a financial point of view due to the high cost that they have to pay for debt, which creates significant uncertainty for investors in corporate bonds, and therefore lower demand.

Because of this situation, investment banks had to use approximately $30 bn of their own funds to finance loans that they could not offload to investors. This issue regards more than 15 transactions. This number may double in the next few months, considering that more deals are scheduled to close. Some examples of deals in which banks struggled to sell bonds they had underwritten include Musk’s acquisition of Twitter, as well as Brightspeed, Nielsen, Tenneco, and Citrix LBOs. The latter will be presented in more detail in the following paragraph.

The Citrix Deal: a Nightmare for Underwriters

Evidence for the substantial slowdown experienced in the credit market, thus on LBOs, is certainly to be easily found in the Citrix deal, where banks such as Credit Suisse, Bank of America, and Goldman Sachs closed the debt chapter with $600 mn losses, for now.

Citrix is a corporation whose main service offered is a software that allows employees to safely work remotely from any of their devices, which has profited from increased demand during the coronavirus outbreak. The Florida-based corporation earned $307 mn in profit in 2021, up from $504 mn in 2020, according to figures announced on the annual report of the company.

In January 2022, the company reached an agreement to be taken private for $16.5 bn, representing the most leveraged acquisition in months and the first to be worth more than $10 bn in 2022 in the wake of a decline in publicly traded technology stocks. The acquirers were Elliott Management and Vista Equity for $104 per share. They intended to merge the firm with Tibco software, one of the businesses in Vista's portfolio that aids in the integration of company management.

Investment banks, and specifically the above-mentioned BofA, Goldman Sachs, and Credit Suisse, agreed to finance the deal in the first place, but are now facing a hard time offloading the debt related to Citrix from their balance sheets. In September, a portion of $8.55 bn was offered to investors in the biggest corporate junk bonds sale of the year, which concluded with unsatisfactory results as lenders were compelled to give low-cost bonds and loans to support Citrix's leveraged takeover. Bankers ended up issuing $4 bn in secured Citrix bonds at a discount of around 83.6 cents on the dollar, yielding 10%. An additional $4.55 bn in loans was offered for 91 cents on the dollar, yielding 10%. The banks which agreed to lend to Citrix's purchasers before the Fed had begun tapering have suffered massive losses, around $600 mn.

The interest for the bond sale was so scarce that, according to people briefed on the situation, investor orders barely covered the loan package on offer, with several large money managers and hedge funds refusing to lend to the company. Moreover, Elliott Management resulted incredibly among the main buyers of the bonds.

Losses, however, are expected to go beyond the ones experienced in September, since banks are still holding roughly $6.45 bn of Citrix debt on their balance sheets, including some of the riskiest bonds that resulted impossible to sell.

According to recent news, a group of banks among the underwriters sold an additional $750 mn worth of loans by Dec. 6th, taking advantage of the credit market rebound in November. The portion of debt sold is a Term Loan A, meaning that it is among the loans with the highest seniority. The terms of the agreement have not been disclosed yet.

Considering the example just outlined, it can be observed that the lack of investor interest in Citrix debt mirrors the shaky situation of the US credit markets, the lifeblood of the buyout sector. Companies with low debt ratings have and are now struggling to get financing as the global economy slows down and central banks hike interest rates to combat inflation, rising borrowing costs. Regarding this, in the next paragraph we focus on what will be the future trends for LBOs and the credit market in general.

Outlooks on the LBO Market

The future of leveraged buyout deals will partially depend on inflation and the Fed’s response. If inflation persists, the Fed will be forced to raise interest rates again further raising the yield-to-maturity of bonds and lowering their prices. As a result, heavily leveraged, debt-backed buyouts are going to be more costly, forcing private equity firms to either be pickier about their investments or reduce leverage, lowering returns in both cases.

While inflation seems to be moderately cooling down, experts, including Jerome Powell warn that in the future even starker interest rate raises might be more necessary than previously believed. The Fed chair announced at a press conference in November that the interest rate is likely to rise above 4.6% and that it will have to remain at a high level for an extended period in order to cool down the economy and bring back inflation to the target rate of 2%.

Although increasing inflation is not a problem of the past, most recent reports seem to suggest that the pace at which prices are increasing is gradually slowing down. The Federal Reserve reacted to this slowdown by hinting at a lower raising of interest rates, only 50 basis points instead of the 75 bps that they have moved the interest rate by four times in a row in the past year. As a result, banks have now started to unload some of the debt they have piled up on their balance sheets, and existing LBO debt has become more attractive in the eyes of debt investors. Triple-A corporate bonds for example are offering the highest rates in the last decade, which is enticing to some as interest rate levels might have reached their tipping point. That being said, LBO dealmaking is still largely on hold as debt is still relatively expensive, and outlooks are uncertain for private equity companies to make large bets.

Conclusion

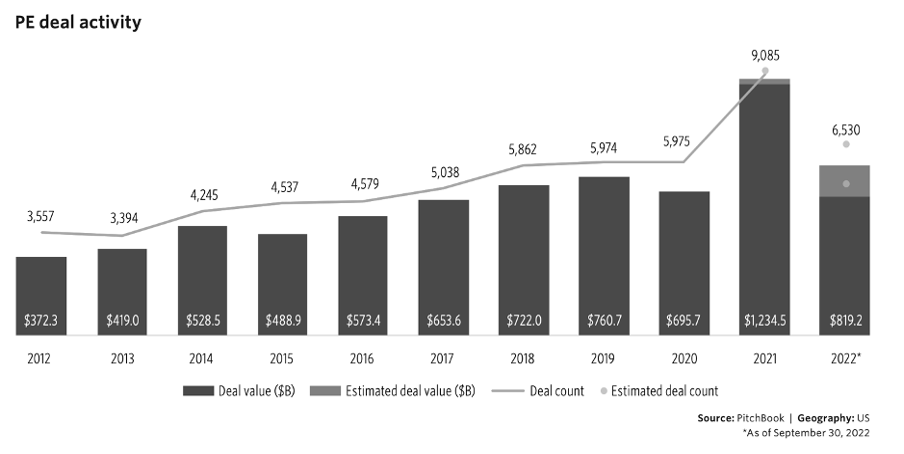

Even though most LBO deals have been put on hold, the outlooks on the market are still positive, as ongoing private equity ventures are outperforming public market investments. The raises in interest rates and macroeconomic circumstances had a profound negative effect on the stock market, but as private equity funds are illiquid and might not be liquidated for years, they are relatively unscathed. Additionally, although there has been a stark reduction in deal count and size this year compared to last year, projections show that this year is still the second most successful year for US private equity in the last decade both in terms of deal value and count.

By Francesca Dini, Mate Mangoff, Matteo Panizza, and Laurian David Pop

Sources

- Bloomberg

- Financial Times

- Forbes

- FRED

- New York Times

- Pitchbook

- Reuters

- Wall Street Journal