In recent years, the Italian government has been taking steps towards digitalization in various sectors, including finance and business. One significant development towards this goal is the dematerialization of S.r.l. shares, which will bring greater transparency, efficiency and accountability to the management of limited liability companies in Italy. The new legal regulations governing the dematerialization process were proposed in May 2020 and are expected to be fully implemented by the end of this year. This article examines the challenges faced by Italian SMEs in accessing financing and how the overdependence on bank debt can be addressed, providing, furthermore, an overview of the new regulations and their implications for Italian SMEs, which are the backbone of the country's economy.

Italian SMEs - sources of financing

Small and medium-sized enterprises are the backbone of Italy's economy and contribute for nearly 47% to the country's GDP. These companies, which are usually family-owned, operate in various sectors, including manufacturing, services, agriculture, and construction. Italian SMEs face significant challenges, such as limited access to capitals, regulatory constraints, and the difficulty of doing business in a highly bureaucratic system.

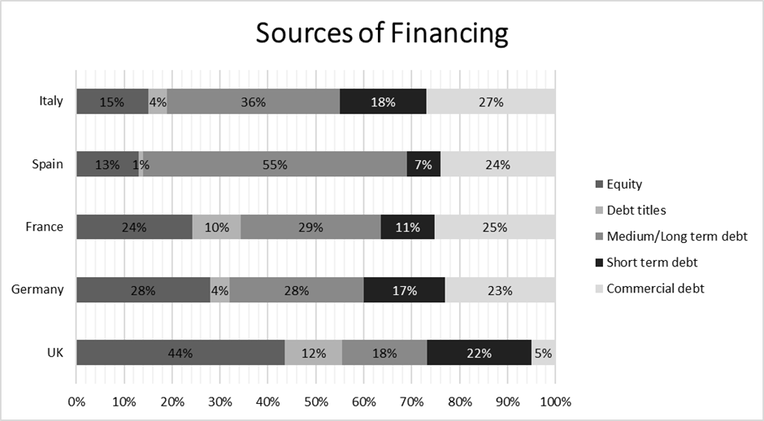

Bank debt has traditionally been the primary source of financing for Italian SMEs. According to data from the Bank of Italy, bank loans account for over 80% of the total financing of Italian businesses. Unlike in other countries, where businesses can access several sources of funding, including equity, bonds, and venture capital, Italian SMEs too often rely on loan issuance to maintain their operations. This overdependence on bank debt exposes Italian SMEs to several risks, including credit rationing and high-interest rates. On the other hand, Italy’s bank performances depend heavily on its enterprises.

Italian SMEs - sources of financing

Small and medium-sized enterprises are the backbone of Italy's economy and contribute for nearly 47% to the country's GDP. These companies, which are usually family-owned, operate in various sectors, including manufacturing, services, agriculture, and construction. Italian SMEs face significant challenges, such as limited access to capitals, regulatory constraints, and the difficulty of doing business in a highly bureaucratic system.

Bank debt has traditionally been the primary source of financing for Italian SMEs. According to data from the Bank of Italy, bank loans account for over 80% of the total financing of Italian businesses. Unlike in other countries, where businesses can access several sources of funding, including equity, bonds, and venture capital, Italian SMEs too often rely on loan issuance to maintain their operations. This overdependence on bank debt exposes Italian SMEs to several risks, including credit rationing and high-interest rates. On the other hand, Italy’s bank performances depend heavily on its enterprises.

Source: SDA Bocconi

One major reason of Italian SMEs over-reliance on bank debt is that those financial institutions possess significant influence over the country's economic policies. Italian banks are the primary buyers of government bonds in the domestic market, which gives them significant leverage over the government's economic policies.

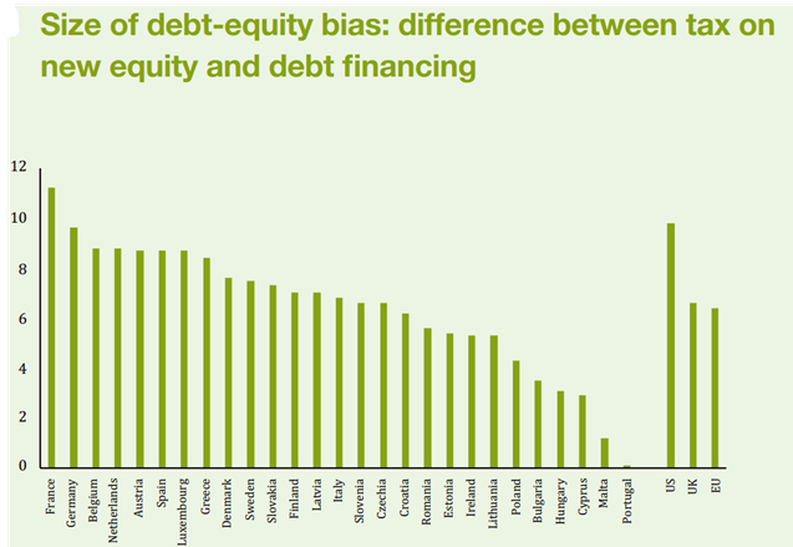

Another factor that contributes to the over-reliance on bank debt is the country's tax policy, which in the past twenty years has favored corporate debt over equity. As a matter of fact, Italy's tax system favors businesses that issue debt over those that issue equity and, as a result, SMEs prefer to borrow from banks rather than issue shares, which are more expensive due to the high tax burden associated with equity financing. As we will analyze in this article, this situation is going through positive changes, in favor of less rule-bound procedures.

Another factor that contributes to the over-reliance on bank debt is the country's tax policy, which in the past twenty years has favored corporate debt over equity. As a matter of fact, Italy's tax system favors businesses that issue debt over those that issue equity and, as a result, SMEs prefer to borrow from banks rather than issue shares, which are more expensive due to the high tax burden associated with equity financing. As we will analyze in this article, this situation is going through positive changes, in favor of less rule-bound procedures.

Source: ZEW and PwC

Last but not least, as evidenced by SDA Bocconi research laboratory, companies in this country are mainly family-owned enterprises, with a lack of proper governance education. First of all, this reflects itself in the absence of a proper distinction between ownership and management. Secondly, it is possible to observe the skepticism of many entrepreneurs when taking decisions about extraordinary financial operation or alternative ways of capital opening.

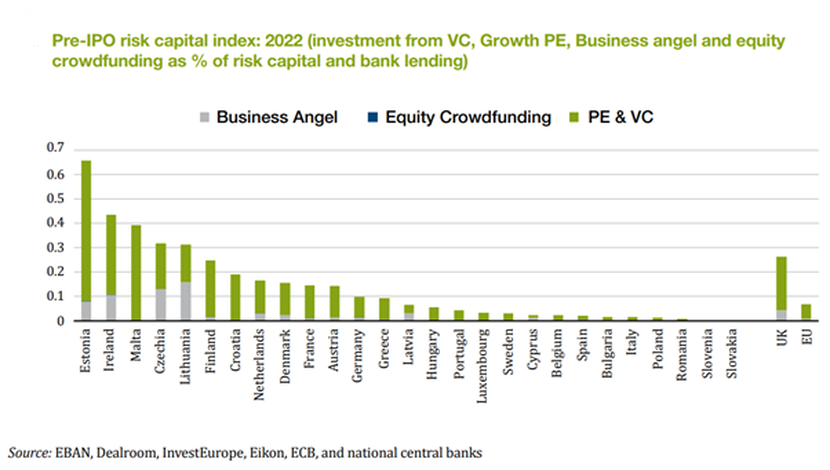

Despite the great possibilities given by alternative sources of financing in this highly fragmented economic scenario, in which SMEs are characterized by low capitalization and an excessive family dependence, Italy, the fourth largest EU economy, is last in Europe for investment in risk capital pre-IPOs.

Despite the great possibilities given by alternative sources of financing in this highly fragmented economic scenario, in which SMEs are characterized by low capitalization and an excessive family dependence, Italy, the fourth largest EU economy, is last in Europe for investment in risk capital pre-IPOs.

Source: EBAN, Dealroom, InvestEurope, ECB, and national central banks

This over-reliance on bank debt has led to SMEs being exposed to interest rate risk, credit rationing, and a lack of financing options. By diversifying the sources of financing available to SMEs, the Italian economy can achieve sustained growth, reduced loan costs, and lower interest rates that better position businesses to compete effectively at the global level.

However, the situation is changing, and this is testified by the presence of many ongoing projects towards the growth and the internationalization of small-mid cap Italian enterprises, in addition to promoting a market-based debt system. The main drivers of it are Euronext, with the creation of Euronext Growth (previously known as AIM) and Access markets and the Elite project focused on training and tutoring of SM companies that want to undertake a path of organizational and managerial development. Furthermore, it is possible to observe consistent cooperation with the legislature between experts of the sector and the government. The most important changes can be observed in the VC and Crowdfunding scenarios, two fast-growing financing alternatives in the country.

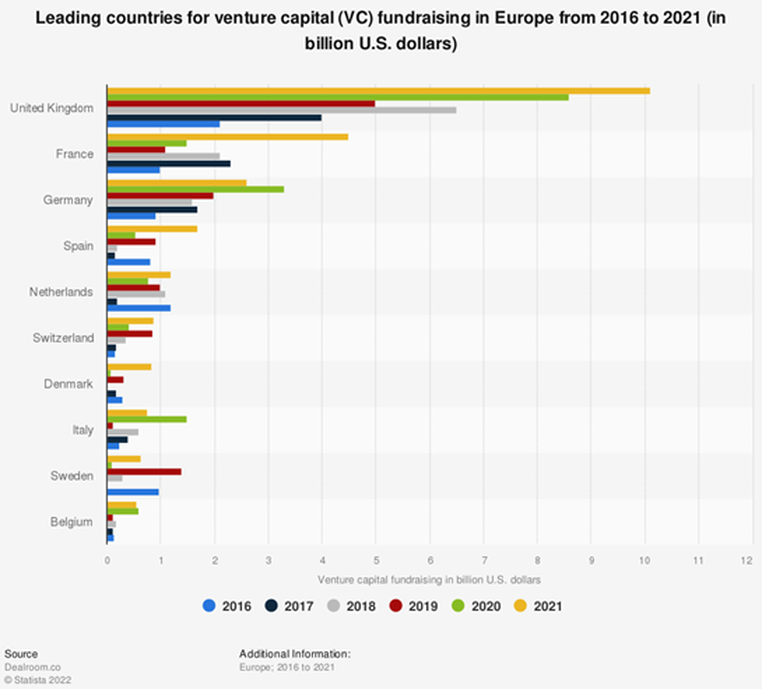

Despite Italy still has a long way to go to even get close to the European VC industry, the venture capital industry has grown significantly in recent years, with Italian startups attracting $850 million in 2019, compared to just €140 million in 2017, jumping to over €1.1 billion invested in startups in 2021 alone. In spite of this growth, Italy still lags behind other European countries in terms of VC funding, especially compared to northern European countries.

However, the situation is changing, and this is testified by the presence of many ongoing projects towards the growth and the internationalization of small-mid cap Italian enterprises, in addition to promoting a market-based debt system. The main drivers of it are Euronext, with the creation of Euronext Growth (previously known as AIM) and Access markets and the Elite project focused on training and tutoring of SM companies that want to undertake a path of organizational and managerial development. Furthermore, it is possible to observe consistent cooperation with the legislature between experts of the sector and the government. The most important changes can be observed in the VC and Crowdfunding scenarios, two fast-growing financing alternatives in the country.

Despite Italy still has a long way to go to even get close to the European VC industry, the venture capital industry has grown significantly in recent years, with Italian startups attracting $850 million in 2019, compared to just €140 million in 2017, jumping to over €1.1 billion invested in startups in 2021 alone. In spite of this growth, Italy still lags behind other European countries in terms of VC funding, especially compared to northern European countries.

Source: Dealroom

The Italian government is trying to address this problem with new investment initiatives: it has sponsored a €1 billion investment program and The Italian Startup Act to provide incentives for the Italian tech industry and for all those companies that aim for the innovation.

While the pandemic caused a contraction in margins and a decrease in funding before, funds have carefully focused on investments in defensive sectors, and the market is now showing signs of growth. With more investment and government support, the future outlook for the venture capital industry in Italy looks promising and, as previously stated, with lots of potential for new funds. Last but not least, it is important to point out that the most active quarter for VC funding in Italy was Q3 2022 (Q1 2023 N/A), and it was extremely tech-oriented with fintech, health & biotech and foodtech being the most attractive sectors for investment.

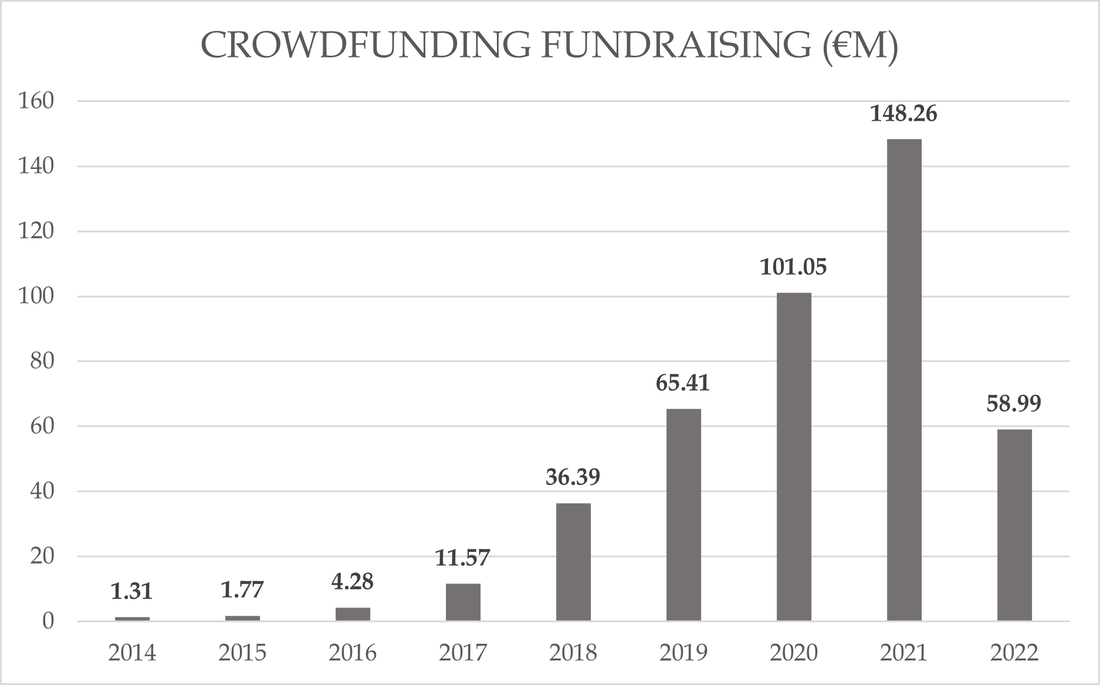

Even though per capita funding is still quite low, and Italy is not yet attracting top European and international VCs, the equity crowdfunding industry is gaining popularity among the individuals: platforms such as MamaCrowd or CrowdFundMe are offering italians alternative ways to invest small amounts of capital (usually savings). CrowdFundMe, for example, raised almost half a billion euros only in Italy in the past 9 years and it doesn’t seem to stop growing anytime soon.

This whole situation points out that Italy – a country with over €1 trillion sitting in the bank accounts – with the right investment campaigns and more financial awareness, could be full of funding opportunities through equity. Surely Italy ought to have more faith in crowdfunding and alternative investments in order to develop its early-stage companies at faster rate.

While the pandemic caused a contraction in margins and a decrease in funding before, funds have carefully focused on investments in defensive sectors, and the market is now showing signs of growth. With more investment and government support, the future outlook for the venture capital industry in Italy looks promising and, as previously stated, with lots of potential for new funds. Last but not least, it is important to point out that the most active quarter for VC funding in Italy was Q3 2022 (Q1 2023 N/A), and it was extremely tech-oriented with fintech, health & biotech and foodtech being the most attractive sectors for investment.

Even though per capita funding is still quite low, and Italy is not yet attracting top European and international VCs, the equity crowdfunding industry is gaining popularity among the individuals: platforms such as MamaCrowd or CrowdFundMe are offering italians alternative ways to invest small amounts of capital (usually savings). CrowdFundMe, for example, raised almost half a billion euros only in Italy in the past 9 years and it doesn’t seem to stop growing anytime soon.

This whole situation points out that Italy – a country with over €1 trillion sitting in the bank accounts – with the right investment campaigns and more financial awareness, could be full of funding opportunities through equity. Surely Italy ought to have more faith in crowdfunding and alternative investments in order to develop its early-stage companies at faster rate.

Source: CrowdFundMe

European Landscape

In the past few years, the venture capital industry witnessed a quick growth and expansion. According to the Adams Street Partners’ report, Europe's share of global venture investment has almost doubled in the last five years (2018-2023) and now accounts for over 18% (which leaves lots of room to expand even more).

In 2020, European startups raised over €46 billions in funding, which is more than double the €19 billions of total capital raised in 2016 and over 10x the €4 billions raised in 2010, which underlines the exponential growth that the European market is witnessing. Early-stage rounds accounted for 34.5% of overall deal value with several substantial rounds closing in Q1 2023. Additionally, venture debt is likely to become more prevalent in larger rounds as per Pitchbook's Q1 2023 European Venture Report. All these data made us understand how the VC industry is becoming increasingly fundamental for financing early-stage startups in Europe and, also, how much potential is yet to be exploited, especially if compared to the VC market in the APAC area.

Looking ahead, the Venture Capital Outlook 2023 by Russell Investments states that private markets, such as VC, are likely to be affected by public markets volatility and macroeconomic uncertainty (brought by a mixture of banking crisis, inflation, and higher interest rates). However, the report also suggested that the VC market will remain favorable for investors keen on seeking alpha and for companies looking for funding. Overall, while European VC activity slowed down in 2022, the market remains an attractive destination for venture capitalists, with significant investment opportunities for startups. On the other side, we are currently witnessing ongoing changes in the Italian regulatory and legal framework that will increase market efficiency and will ensure an easier capital access to the Italian market for both domestic and international investors.

The Italian government has indeed approved the DDL Capitali, which includes a number of innovations with the aim of increasing financial markets efficiency and transparency, among them there’s the dematerialization of the S.r.l. shares, introduced with the scope of boosting both the equity crowdfunding and the venture capital activity.

Legal framework for the dematerialization of S.r.l. shares

An Italian S.r.l. (Società a responsabilità limitata) is a type of limited liability company in Italy, similar to an LLC in the United States. However, there are some differences between the two. For example, an S.r.l. has a minimum capital requirement of €10.000, while an LLC does not have a minimum capital requirement. Finally, an S.r.l. is subject to different tax laws than an LLC.

The Italian government's recent implementation of new legal regulations for the dematerialization of S.r.l. shares is a significant development towards achieving greater transparency, efficiency, and accountability in the management of such companies. Notably these regulations are aimed at S.r.l with a larger pool of partners, a number that we can assess to be around a minimum of 20. This is to note that the dematerialization of shares is voluntary, meaning new regulations do not burden S.r.l with additional requirements, whilst promoting efficiency. This action is in line with the global trend towards digitalization, and the government's aim is to promote efficient and effective management practices.

The previous regulations in Italy for the dematerialization of shares were primarily governed by the Testo Unico della Finanza (Unified Financial Act) and "Consob Regulation 11971/99". These regulations established the legal framework for the issuance and transfer of securities, including the use of physical certificates to represent shares. However, these regulations were considered outdated and did not keep pace with the rapid technological advancements in the financial industry.

The new legal regulations were proposed in the recovery bill of the 19th of May 2020, number 34 and by article 3 of the DDL of 11th of April 2023. These regulations will set out the possibility for all S.r.l. to dematerialize their shares, and the process involves the conversion of physical certificates into electronic records, which will be stored in a centralized depository managed by the Italian Stock Exchange.

This initiative aims to promote transparency and accountability in the management of these companies and is a significant step towards greater digitalization and transparency in the management of companies. This change is expected to simplify the process of buying and selling shares, reduce the risk of fraud and errors, and enhance the overall security of the system. The availability of electronic records will make it easier for investors to track their investments and manage their portfolios, which will encourage greater participation from both domestic and international investors.

When it comes to qualifying as transferable securities, financial products have to meet specific requirements, including standardization and negotiability. Standardization refers to the characteristic of a financial product belonging to a homogeneous set of financial products with equal value and rights. This means that for a financial product to qualify as transferable securities, it must be capable of being standardized. That is thus necessary to ensure that they are easily identifiable and comparable to those of other listed companies.

Negotiability, on the other hand, refers to the ability of a financial product to be subject to transferable transactions of the property. This is essential to ensure a liquid market and an easy exit for investors. Free transferability means that a financial product should be tradable on the capital market with the consequent transfer of ownership and the right to exercise the rights embodied in that instrument. It is worth noting that negotiability is necessary for a financial product to qualify as transferable, but it is not necessary that it be freely transferable. Financial products that are not freely transferable but are negotiable may exist, even outside of regulated markets. This means that financial products may have limitations or constraints imposed upon them, which may limit their transferability. However, this does not necessarily disqualify them from being transferable securities.

The dematerialization of S.r.l. shares will offer small and medium-sized enterprises a simpler alternative to exiting the company compared to transforming into a joint stock company. Dematerialized shares will allow S.r.l. to be listed on regulated markets, offering greater access to capital and liquidity. This will allow small and medium-sized enterprises to access a greater number of investors and expand more quickly.

Market Infrastructure

There are several benefits of dematerialization for S.r.l. shares in Italy. First, dematerialization increases transparency and reduces the risk of fraud. Electronic shares cannot be lost, stolen, or forged, which reduces the risk of fraudulent activity. Second, dematerialization streamlines the process of buying and selling shares. Electronic shares can be transferred quickly and easily, without the need for physical certificates. This reduces the time and cost of share transactions. Finally, dematerialization reduces the administrative burden on companies. Electronic shares are easier to manage and maintain than physical certificates.

There are of course costs and fees associated with dematerialization of S.r.l. shares. Companies must pay a fee to the central depository for each share deposited. The fee varies depending on the depository and the number of shares deposited. In addition, companies must pay a fee to their financial intermediary for the dematerialization process. This fee varies depending on the intermediary and the services provided. However, the cost of dematerialization is generally lower than the cost of maintaining physical share certificates.

In the past few years, the venture capital industry witnessed a quick growth and expansion. According to the Adams Street Partners’ report, Europe's share of global venture investment has almost doubled in the last five years (2018-2023) and now accounts for over 18% (which leaves lots of room to expand even more).

In 2020, European startups raised over €46 billions in funding, which is more than double the €19 billions of total capital raised in 2016 and over 10x the €4 billions raised in 2010, which underlines the exponential growth that the European market is witnessing. Early-stage rounds accounted for 34.5% of overall deal value with several substantial rounds closing in Q1 2023. Additionally, venture debt is likely to become more prevalent in larger rounds as per Pitchbook's Q1 2023 European Venture Report. All these data made us understand how the VC industry is becoming increasingly fundamental for financing early-stage startups in Europe and, also, how much potential is yet to be exploited, especially if compared to the VC market in the APAC area.

Looking ahead, the Venture Capital Outlook 2023 by Russell Investments states that private markets, such as VC, are likely to be affected by public markets volatility and macroeconomic uncertainty (brought by a mixture of banking crisis, inflation, and higher interest rates). However, the report also suggested that the VC market will remain favorable for investors keen on seeking alpha and for companies looking for funding. Overall, while European VC activity slowed down in 2022, the market remains an attractive destination for venture capitalists, with significant investment opportunities for startups. On the other side, we are currently witnessing ongoing changes in the Italian regulatory and legal framework that will increase market efficiency and will ensure an easier capital access to the Italian market for both domestic and international investors.

The Italian government has indeed approved the DDL Capitali, which includes a number of innovations with the aim of increasing financial markets efficiency and transparency, among them there’s the dematerialization of the S.r.l. shares, introduced with the scope of boosting both the equity crowdfunding and the venture capital activity.

Legal framework for the dematerialization of S.r.l. shares

An Italian S.r.l. (Società a responsabilità limitata) is a type of limited liability company in Italy, similar to an LLC in the United States. However, there are some differences between the two. For example, an S.r.l. has a minimum capital requirement of €10.000, while an LLC does not have a minimum capital requirement. Finally, an S.r.l. is subject to different tax laws than an LLC.

The Italian government's recent implementation of new legal regulations for the dematerialization of S.r.l. shares is a significant development towards achieving greater transparency, efficiency, and accountability in the management of such companies. Notably these regulations are aimed at S.r.l with a larger pool of partners, a number that we can assess to be around a minimum of 20. This is to note that the dematerialization of shares is voluntary, meaning new regulations do not burden S.r.l with additional requirements, whilst promoting efficiency. This action is in line with the global trend towards digitalization, and the government's aim is to promote efficient and effective management practices.

The previous regulations in Italy for the dematerialization of shares were primarily governed by the Testo Unico della Finanza (Unified Financial Act) and "Consob Regulation 11971/99". These regulations established the legal framework for the issuance and transfer of securities, including the use of physical certificates to represent shares. However, these regulations were considered outdated and did not keep pace with the rapid technological advancements in the financial industry.

The new legal regulations were proposed in the recovery bill of the 19th of May 2020, number 34 and by article 3 of the DDL of 11th of April 2023. These regulations will set out the possibility for all S.r.l. to dematerialize their shares, and the process involves the conversion of physical certificates into electronic records, which will be stored in a centralized depository managed by the Italian Stock Exchange.

This initiative aims to promote transparency and accountability in the management of these companies and is a significant step towards greater digitalization and transparency in the management of companies. This change is expected to simplify the process of buying and selling shares, reduce the risk of fraud and errors, and enhance the overall security of the system. The availability of electronic records will make it easier for investors to track their investments and manage their portfolios, which will encourage greater participation from both domestic and international investors.

When it comes to qualifying as transferable securities, financial products have to meet specific requirements, including standardization and negotiability. Standardization refers to the characteristic of a financial product belonging to a homogeneous set of financial products with equal value and rights. This means that for a financial product to qualify as transferable securities, it must be capable of being standardized. That is thus necessary to ensure that they are easily identifiable and comparable to those of other listed companies.

Negotiability, on the other hand, refers to the ability of a financial product to be subject to transferable transactions of the property. This is essential to ensure a liquid market and an easy exit for investors. Free transferability means that a financial product should be tradable on the capital market with the consequent transfer of ownership and the right to exercise the rights embodied in that instrument. It is worth noting that negotiability is necessary for a financial product to qualify as transferable, but it is not necessary that it be freely transferable. Financial products that are not freely transferable but are negotiable may exist, even outside of regulated markets. This means that financial products may have limitations or constraints imposed upon them, which may limit their transferability. However, this does not necessarily disqualify them from being transferable securities.

The dematerialization of S.r.l. shares will offer small and medium-sized enterprises a simpler alternative to exiting the company compared to transforming into a joint stock company. Dematerialized shares will allow S.r.l. to be listed on regulated markets, offering greater access to capital and liquidity. This will allow small and medium-sized enterprises to access a greater number of investors and expand more quickly.

Market Infrastructure

There are several benefits of dematerialization for S.r.l. shares in Italy. First, dematerialization increases transparency and reduces the risk of fraud. Electronic shares cannot be lost, stolen, or forged, which reduces the risk of fraudulent activity. Second, dematerialization streamlines the process of buying and selling shares. Electronic shares can be transferred quickly and easily, without the need for physical certificates. This reduces the time and cost of share transactions. Finally, dematerialization reduces the administrative burden on companies. Electronic shares are easier to manage and maintain than physical certificates.

There are of course costs and fees associated with dematerialization of S.r.l. shares. Companies must pay a fee to the central depository for each share deposited. The fee varies depending on the depository and the number of shares deposited. In addition, companies must pay a fee to their financial intermediary for the dematerialization process. This fee varies depending on the intermediary and the services provided. However, the cost of dematerialization is generally lower than the cost of maintaining physical share certificates.

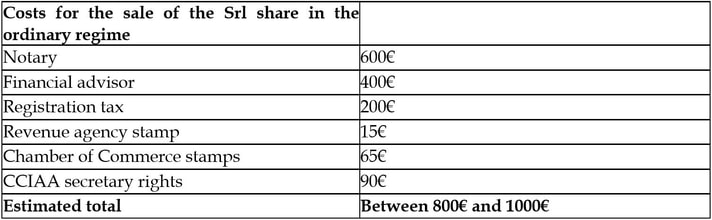

Source: Borsa Italiana

With dematerialization, these costs would drop to €20/25 per transaction.

Dematerialized S.r.l. shares in Italy are fully negotiable and transferable. Electronic shares can be transferred quickly and easily, without the need for physical certificates. The transfer process is facilitated by the central depository, which maintains the electronic register of shareholders. The depository records all transfers of electronic shares and updates the register accordingly.

The share exchange time and process for dematerialized S.r.l. shares in Italy are generally faster and more efficient than the process for physical certificates. Electronic shares can be transferred quickly and easily, without the need for physical certificates.

In terms of market infrastructure, Monte Titoli, the Operations Division of Borsa Italiana, as Central Depository will manage the transactions and the custody of the new dematerialized S.rl. shares by play an intermediation role between the issuers, which are the companies, and the investors, who will be both be associated to a specific identification code, same as the ISIN code for listed companies, connected to the respective banking account.

Conclusion

In conclusion, by understanding the regulations and requirements for dematerialization of S.r.l. shares in Italy, companies can benefit from increased transparency, reduced fraud, and streamlined share transactions. With the right approach, the dematerialization of the S.r.l. shares can be a valuable tool for companies seeking to optimize their shareholder structure in order to reach financial scalability in a more efficient way. This regulatory and legislative innovation represents another step forward in the creation of solid financial ecosystem, able to support startups and underdeveloped companies to future IPOs and liquidation events, thus boosting not only the liquidity of the financial markets, but the overall Italian economy.

SOURCES

By Pietro Casnigo, Andrea Cavenago, Pietro Golzio, Emanuele Tartaglini

Dematerialized S.r.l. shares in Italy are fully negotiable and transferable. Electronic shares can be transferred quickly and easily, without the need for physical certificates. The transfer process is facilitated by the central depository, which maintains the electronic register of shareholders. The depository records all transfers of electronic shares and updates the register accordingly.

The share exchange time and process for dematerialized S.r.l. shares in Italy are generally faster and more efficient than the process for physical certificates. Electronic shares can be transferred quickly and easily, without the need for physical certificates.

In terms of market infrastructure, Monte Titoli, the Operations Division of Borsa Italiana, as Central Depository will manage the transactions and the custody of the new dematerialized S.rl. shares by play an intermediation role between the issuers, which are the companies, and the investors, who will be both be associated to a specific identification code, same as the ISIN code for listed companies, connected to the respective banking account.

Conclusion

In conclusion, by understanding the regulations and requirements for dematerialization of S.r.l. shares in Italy, companies can benefit from increased transparency, reduced fraud, and streamlined share transactions. With the right approach, the dematerialization of the S.r.l. shares can be a valuable tool for companies seeking to optimize their shareholder structure in order to reach financial scalability in a more efficient way. This regulatory and legislative innovation represents another step forward in the creation of solid financial ecosystem, able to support startups and underdeveloped companies to future IPOs and liquidation events, thus boosting not only the liquidity of the financial markets, but the overall Italian economy.

SOURCES

- Borsa Italiana

- Euronext

- SDA Bocconi Research Center

- Kpmg

By Pietro Casnigo, Andrea Cavenago, Pietro Golzio, Emanuele Tartaglini