Overview of the EdTech industry

During last year, lockdowns all over the world forced schools to shut down and lectures to move online. Teachers often found themselves in need of reinventing from scratch their teaching techniques, to match with a new learning environment, as an online classroom, without losing the interest of their students.

EdTech, more thoroughly “education technology," can be defined as enhanced learning thanks to the mix of IT tools and educational practices.

Recently, there has been a disrupting change in the education sector from conventional learning to personalized and interactive techniques. Digitization has increasingly shaped education thanks to creative techniques enforced with new technologies and learning has now become a lifelong process. Analysts foresee a thrive of the Edtech sector across the geographical regions and socio-economic backgrounds.

In the age of digitization and artificial intelligence (AI), the use of technology in the education sector allows institutions to provide innovative solutions, such as e-books, immersive content via Augmented Reality (AR)/Virtual Reality (VR), and online courses. Several firms, ranging from start-ups to renowned players, are considering Edtech as a huge business opportunity.

Regarding the power and efficacy of EdTech, there are numerous and quite different point of views. Some detractors regard as irreplaceable the teacher-student relationship as well as the “old-style learning” based on long study hours, books and tests. Others, more in favour of new disrupting innovations, consider EdTech as a huge improvement, especially for students from unprivileged backgrounds or underdeveloped countries that may reach world-class renowned teachers from their laptop.

EdTech is in truth one of the best examples of the democratization of knowledge brought by Internet in our world: everyone, in every part of the world, if in possession of a laptop and Wi-fi connection, can know everything. And that is one of the most important innovations the tech-revolution gave us.

Ed-Tech tools are changing classrooms in many ways.

For students, the possibilities offered by technology developments in education imply:

As for teachers, they can strengthen efficient learning techniques and economise time in the classroom using:

EdTech will surely be a trend to stay for the foreseeable future, as we can appreciate from an in-depth analysis of its market. The industry is primarily driven by the increasing availability of smart devices and awareness about the advantages of technology integrated in education.

Analysts foresee the growing adoption of EdTech tools as a positive drive for market growth, and a crucial factor for the creation of new job opportunities for future generations.

This sector is highly fragmented with the concurrent presence of several local and international firms. Numerous start-ups within the marketplace are receiving funding from investors owing to the lucrative outcomes. The market players are providing users with gamification elements, such as timers, points, and level-enhancement badges, in video lessons in an attempt to boost student engagement and enhance knowledge acquisition. Some of the notable players in the Edtech sector include BYJU’S, VIPKid, iTutorGroup and Udacity.

Consolidation trends in the EdTech industry

COVID-19 has profoundly modified the way of doing business in almost every industry. However, there are some specific sectors that were affected more than others, and, in some cases, experienced strong growth triggered by the pandemic. One of those is, without any doubt, the EdTech industry.

Even before the pandemic, the EdTech segment was expected to grow at extremely high rates, but the outbreak of COVID-19 has boosted expectations even more, as it led, on one side, to the closure of schools and education institutes, and, on the other, it generated a higher demand for digital products, also sustained by a greater access to the Internet across the globe.

In fact, in April, the virus caused “nationwide school closures in 190 countries, impacting 90% of total enrolled learners, or almost 1.6 billion people globally”. Thus, the pandemic is challenging both education institutions and students to re-think the entire education process in order to find ways to provide successful education programs with remote learning. Furthermore, at a more general level, Coronavirus has intensified the demand for digital education products, as testified by a 90% increase in educational app downloads during March 2020, with respect to the weekly average for Q4 2019.

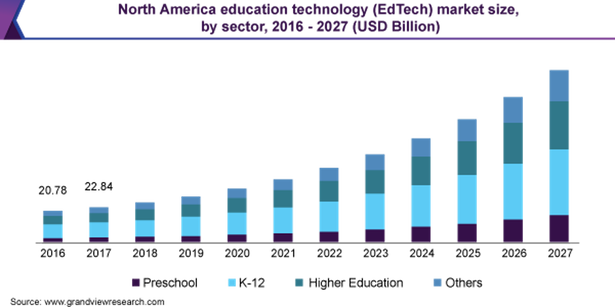

In 2019 the global Education Technology industry value amounted up to $76.4 billion. Now, it is expected to grow at a compounded annual growth rate (CAGR) of 18.1% until 2027. According to other estimates, the EdTech market is expected to be worth $350 billion by 2025.

During last year, lockdowns all over the world forced schools to shut down and lectures to move online. Teachers often found themselves in need of reinventing from scratch their teaching techniques, to match with a new learning environment, as an online classroom, without losing the interest of their students.

EdTech, more thoroughly “education technology," can be defined as enhanced learning thanks to the mix of IT tools and educational practices.

Recently, there has been a disrupting change in the education sector from conventional learning to personalized and interactive techniques. Digitization has increasingly shaped education thanks to creative techniques enforced with new technologies and learning has now become a lifelong process. Analysts foresee a thrive of the Edtech sector across the geographical regions and socio-economic backgrounds.

In the age of digitization and artificial intelligence (AI), the use of technology in the education sector allows institutions to provide innovative solutions, such as e-books, immersive content via Augmented Reality (AR)/Virtual Reality (VR), and online courses. Several firms, ranging from start-ups to renowned players, are considering Edtech as a huge business opportunity.

Regarding the power and efficacy of EdTech, there are numerous and quite different point of views. Some detractors regard as irreplaceable the teacher-student relationship as well as the “old-style learning” based on long study hours, books and tests. Others, more in favour of new disrupting innovations, consider EdTech as a huge improvement, especially for students from unprivileged backgrounds or underdeveloped countries that may reach world-class renowned teachers from their laptop.

EdTech is in truth one of the best examples of the democratization of knowledge brought by Internet in our world: everyone, in every part of the world, if in possession of a laptop and Wi-fi connection, can know everything. And that is one of the most important innovations the tech-revolution gave us.

Ed-Tech tools are changing classrooms in many ways.

For students, the possibilities offered by technology developments in education imply:

- Increased Collaboration: cloud-based apps enable students to upload their homework, chat with one another and ask for any help they may need;

- 24/7 Access to Learning: whether they are at school, on the bus or at home, students can complete work at their own pace;

- "Flipping” the Classroom: thanks to video lectures, class time can be used to collaboratively work on projects as a group, encouraging self-learning, creativity and collaboration among students;

- Personalized Educational Experiences, namely learning plans crafted for each student;

- Attention-Grabbing Lessons, possible thanks to classroom interactions via video and even gamifying problem-solving.

As for teachers, they can strengthen efficient learning techniques and economise time in the classroom using:

- Automated Grading: artificially intelligent tools use machine learning to assess answers based on the assignment requests;

- Classroom Management Tools as apps to send parents and students reminders of projects, assignments, or tools to self-monitor classroom noise levels;

- Eliminating Guesswork: there is a wide range of tools, data platforms and apps on the market that constantly assess students’ skills and needs, and convey data to the teacher.

EdTech will surely be a trend to stay for the foreseeable future, as we can appreciate from an in-depth analysis of its market. The industry is primarily driven by the increasing availability of smart devices and awareness about the advantages of technology integrated in education.

Analysts foresee the growing adoption of EdTech tools as a positive drive for market growth, and a crucial factor for the creation of new job opportunities for future generations.

This sector is highly fragmented with the concurrent presence of several local and international firms. Numerous start-ups within the marketplace are receiving funding from investors owing to the lucrative outcomes. The market players are providing users with gamification elements, such as timers, points, and level-enhancement badges, in video lessons in an attempt to boost student engagement and enhance knowledge acquisition. Some of the notable players in the Edtech sector include BYJU’S, VIPKid, iTutorGroup and Udacity.

Consolidation trends in the EdTech industry

COVID-19 has profoundly modified the way of doing business in almost every industry. However, there are some specific sectors that were affected more than others, and, in some cases, experienced strong growth triggered by the pandemic. One of those is, without any doubt, the EdTech industry.

Even before the pandemic, the EdTech segment was expected to grow at extremely high rates, but the outbreak of COVID-19 has boosted expectations even more, as it led, on one side, to the closure of schools and education institutes, and, on the other, it generated a higher demand for digital products, also sustained by a greater access to the Internet across the globe.

In fact, in April, the virus caused “nationwide school closures in 190 countries, impacting 90% of total enrolled learners, or almost 1.6 billion people globally”. Thus, the pandemic is challenging both education institutions and students to re-think the entire education process in order to find ways to provide successful education programs with remote learning. Furthermore, at a more general level, Coronavirus has intensified the demand for digital education products, as testified by a 90% increase in educational app downloads during March 2020, with respect to the weekly average for Q4 2019.

In 2019 the global Education Technology industry value amounted up to $76.4 billion. Now, it is expected to grow at a compounded annual growth rate (CAGR) of 18.1% until 2027. According to other estimates, the EdTech market is expected to be worth $350 billion by 2025.

By looking at this data, thus, the consolidation trend that is taking place is no surprise. The urge to adopt new technologies in order to overcome the challenges imposed by the coronavirus outbreak, paved the way to venture capitalists and other investors, who started a race to inject money in this promising sector. Seeking to meet the increasing demand in the EdTech industry, the market saw a proliferation of start-ups. In addition, nowadays we witness continuous M&A activity revolving around EdTech, testifying the consolidation trend that this industry is currently going through.

One notable example of this is the recent announcement by Course Hero of the acquisition of Symbolab. The former is a platform specialized in supplying course materials, as well as a creating a community for students where to share resources; the latter is an AI-powered calculator, that will likely complement Course Hero current offering by providing solutions to complex mathematical problems, leading to a probable increase in subscriptions.

Another evidence of the above-mentioned shift in the industry is the acquisition of MysteryScience by Discovery Education. The acquirer serves 45 million students by providing digital education materials; the target, MysteryScience, is the leader within the K-12 segment (i.e., from kindergarten to 12th grade school) and offers multimedia content to “explore science mysteries” by enabling collaboration between teachers and students. This deal should lead to a win-win situation, by allowing Discovery Education to further penetrate the K-5 market and by granting to MysteryScience the buyer’s global reach and valuable relationship within the industry.

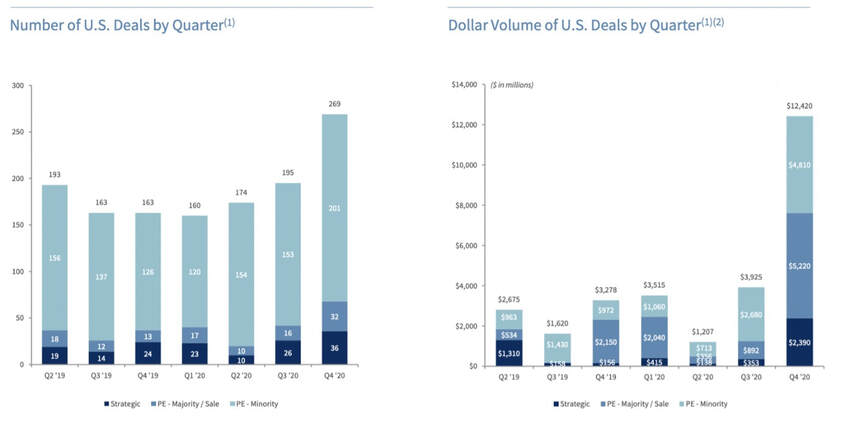

In general, this tendency is testified also by the comparison between the M&A and capital raising activity that has characterized the EdTech industry so far with the past quarters. As shown by the graphs below, the number of deals in the US grew from 195 in Q4 2019 to 269 in Q4 2020, hitting a record 38% increase. Moreover, it is even more impressing if we consider such deals in dollar volume: in Q4 2020, the transactions announced accounted for over $12.4 billion, as compared to Q4 2019, when such figure was barely above $3 billion.

Due to the nature of this industry, which is relatively new, and which experienced skyrocketing growth in the past few months, the great majority of the deals (approximately 75% of the total number of deals announced in Q4 2020) are minority PE deals, seeking to find profitable opportunities in the realm of unicorns and start-ups that recently flourished.

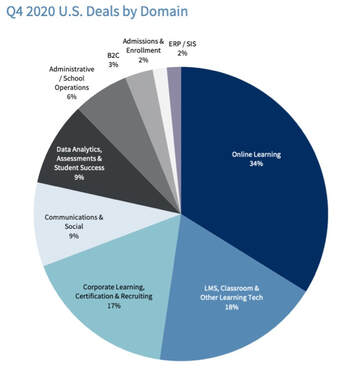

In line with what we have previously highlighted, such deals mainly cover the Online Learning (34% of deals), followed by Classroom and Other Learning Technologies (18%) and Corporate Learning and Recruiting (17%).

Generally speaking, the trend of consolidation is also justified by the fact that the main experts of the segment believe that targeted and personalized content is key to succeed in the industry, especially if we consider Online Learning, which, as highlighted above, currently accounts for the largest shares of deals. The value driver that allows to achieve a sustainable competitive advantage is the “smartness” of the materials provided, which differentiates these new platforms from online free tutorials and similar content. Thus, among the others, one of the reasons why we are witnessing such M&A activity is the attempt to secure the necessary know-how and technology to retain the competitive advantage granted by such creative contents, which will likely affect the ability to compete in the future as well.

These insights further confirm how much the pandemic has impacted the EdTech Industry, by forcing remote learning and working, and thus prompted growth in this sector. Indeed, COVID-19 forced the “largest-ever remote learning experiment” and these deals signal the efforts undertaken in order to exploit the gap in the demand created by the COVID-19 outbreak of remote activities. Therefore, due to the great impact of the virus, it is mandatory to ask whether, once the pandemic will end, the EdTech industry will slow its growth and possibly be subject to a minor decline due to the recovery of traditional teaching methods or remote learning will coexist with the traditional one and EdTech will continue its escalation.

Renaissance to acquire Nearpod

As mentioned above, this period has been characterized by a huge number of deals in the EdTech sector. The majority of them is not big in size, also because this sector has established itself in recent years and mainly start-ups are in it. Thus, we decided to analyze Renaissance Learning’s acquisition of Nearpod, which represents a relatively big deal in EdTech and has been recently announced.

About Renaissance

Renaissance, a portfolio company of Francisco Partners Management since 2018, is a provider of research-based learning information system software, school improvement programs, teacher training and consulting, based in USA. It represents a global leader supplier of assessment, reading and math solutions for pre-K-12 schools and districts. The facilities offered by this company are used in about one-third of US schools, but also worldwide, in more than 100 countries.

About Nearpod

Nearpod is an EdTech startup founded in 2012 and based in Miami. It offers an interactive instructional platform, which combines real-time lessons and dynamic media for both live and in distance learning experiences.

At first Nearpod was designed to be used in classroom, but after the COVID-19 outbreak it was promptly switched in a platform available for remote-learning, too.

Nearpod helps students of all 50 states and it is used in more than 1,800 school districts.

Even due to the new use of digital platforms for distance learning, in 2020 the company grew by roughly 50%: this platform is now present in all 50 American states and used by more than 1M of teachers and by 2-3M students online per day.

About the deal

On February 23 it was announced that Renaissance Learning has entered into a definitive agreement to acquire Nearpod for $650 million from a group of investors. The group of investors includes Reach capital, Krillion Ventures, Insight Partners, GSV Ventures, Cito Ventures, Miami Angels, Storm Ventures LLC and Rothenberg Ventures LLC.

The payment will be financed all in cash, in particular with a $358 million first lien term loan and $135 million second lien term loan, for a total of $493 million; the remaining part will be founded through an equity contribution from Francisco Partners Management. The deal is subject to pending regulatory approval.

It is possible to read in the Moody’s credit rating report that “pro forma for the transaction, the company will have good liquidity with $71 million cash on balance sheet to fund seasonal working capital needs and is expected to generate positive free cash flow of over $30 million over the next year.”

According to what the executives of the two companies said, Nearpod will maintain its brand and now there are no plans to combine Nearpod in a specific way with Renaissance products. However, after the transaction, Renaissance Learning will count roughly more 300 employees from Nearpod, reaching a combined headcount of nearly 1,500.

The financial advisor of the target company of this transaction is UBS Investment Bank.

Deal rationale

It is easy to individuate the deal rationale in the official press release published the day of the announcement: “to unlock an unparalleled level of student insights”.

With the Coronavirus outbreak and the need to switch lessons from in presence to in distance mode, it has become necessary the use of digital platform for education, not in substitution of teachers, but to support their job. Thanks to the combination of these two entities, it will be possible to use the same platform for all the needs of a class.

As the CEO of Renaissance said, “The combination of Renaissance and Nearpod will empower teachers to drive the full learner experience with a deep set of real-time data, content, and tools to accelerate learning and growth for all students.”

Elena Donati

Dario Spinelli

Gloria Urbini Capanni

Want to keep up with our most recent articles? Subscribe to our weekly newsletter here.

These insights further confirm how much the pandemic has impacted the EdTech Industry, by forcing remote learning and working, and thus prompted growth in this sector. Indeed, COVID-19 forced the “largest-ever remote learning experiment” and these deals signal the efforts undertaken in order to exploit the gap in the demand created by the COVID-19 outbreak of remote activities. Therefore, due to the great impact of the virus, it is mandatory to ask whether, once the pandemic will end, the EdTech industry will slow its growth and possibly be subject to a minor decline due to the recovery of traditional teaching methods or remote learning will coexist with the traditional one and EdTech will continue its escalation.

Renaissance to acquire Nearpod

As mentioned above, this period has been characterized by a huge number of deals in the EdTech sector. The majority of them is not big in size, also because this sector has established itself in recent years and mainly start-ups are in it. Thus, we decided to analyze Renaissance Learning’s acquisition of Nearpod, which represents a relatively big deal in EdTech and has been recently announced.

About Renaissance

Renaissance, a portfolio company of Francisco Partners Management since 2018, is a provider of research-based learning information system software, school improvement programs, teacher training and consulting, based in USA. It represents a global leader supplier of assessment, reading and math solutions for pre-K-12 schools and districts. The facilities offered by this company are used in about one-third of US schools, but also worldwide, in more than 100 countries.

About Nearpod

Nearpod is an EdTech startup founded in 2012 and based in Miami. It offers an interactive instructional platform, which combines real-time lessons and dynamic media for both live and in distance learning experiences.

At first Nearpod was designed to be used in classroom, but after the COVID-19 outbreak it was promptly switched in a platform available for remote-learning, too.

Nearpod helps students of all 50 states and it is used in more than 1,800 school districts.

Even due to the new use of digital platforms for distance learning, in 2020 the company grew by roughly 50%: this platform is now present in all 50 American states and used by more than 1M of teachers and by 2-3M students online per day.

About the deal

On February 23 it was announced that Renaissance Learning has entered into a definitive agreement to acquire Nearpod for $650 million from a group of investors. The group of investors includes Reach capital, Krillion Ventures, Insight Partners, GSV Ventures, Cito Ventures, Miami Angels, Storm Ventures LLC and Rothenberg Ventures LLC.

The payment will be financed all in cash, in particular with a $358 million first lien term loan and $135 million second lien term loan, for a total of $493 million; the remaining part will be founded through an equity contribution from Francisco Partners Management. The deal is subject to pending regulatory approval.

It is possible to read in the Moody’s credit rating report that “pro forma for the transaction, the company will have good liquidity with $71 million cash on balance sheet to fund seasonal working capital needs and is expected to generate positive free cash flow of over $30 million over the next year.”

According to what the executives of the two companies said, Nearpod will maintain its brand and now there are no plans to combine Nearpod in a specific way with Renaissance products. However, after the transaction, Renaissance Learning will count roughly more 300 employees from Nearpod, reaching a combined headcount of nearly 1,500.

The financial advisor of the target company of this transaction is UBS Investment Bank.

Deal rationale

It is easy to individuate the deal rationale in the official press release published the day of the announcement: “to unlock an unparalleled level of student insights”.

With the Coronavirus outbreak and the need to switch lessons from in presence to in distance mode, it has become necessary the use of digital platform for education, not in substitution of teachers, but to support their job. Thanks to the combination of these two entities, it will be possible to use the same platform for all the needs of a class.

As the CEO of Renaissance said, “The combination of Renaissance and Nearpod will empower teachers to drive the full learner experience with a deep set of real-time data, content, and tools to accelerate learning and growth for all students.”

Elena Donati

Dario Spinelli

Gloria Urbini Capanni

Want to keep up with our most recent articles? Subscribe to our weekly newsletter here.