After any crisis, there is (always) a rebirth: besides its devastating effects all over the globe, also Covid-19 has paved the way for a renaissance, with new ideas, opportunities and challenges. For instance, our world has undergone a transition towards interconnection and reciprocal dependence, wherein any distance can be easily coped with and a domino effect among countries is always around the corner. In addition, most people are now more careful about their health and regard their nutrition as the first step towards wellness and longevity. Similarly, more and more consumers are now making their purchases online, with such services as buy-now-pay-later gaining increasing popularity. Therefore, with a perfect mix of both consumer awareness, larger funds available and cutting-edge technologies, healthcare, fintech and food are among the fastest-growing industries.

What is going on beneath the surface? What shall we expect within the next few years? Are these trends here to stay?

What is going on beneath the surface? What shall we expect within the next few years? Are these trends here to stay?

HEALTHCARE

Sprung almost out of the blue, Covid-19 first appeared in 2019 as an “abnormal” form of flu. Nevertheless, day after day, we are realizing how its impact has changed us and the world we live in forever. Among the others, one certainty has emerged particularly vigorous: as human beings, we are fragile and a .1-micron wide virus can bring us to the knees. Aware of our limits, science represents the “shield of last resort” against the unknown. As a matter of fact, Covid-19 has been extremely effective in paving the way for latent, slow-growth trends in the healthcare industry, which now sees unstoppable development thanks to both enhanced technologies and larger funding opportunities.

Addressing four major macro sections, a new shape of healthcare is getting clearer and clearer.

Collaborative ecosystem

Following the vulnerabilities of healthcare organizations evidenced globally by Covid-19 in terms of safety, equipment, data availability, and infrastructure, it has become apparent how “going alone” is the wrong strategy: building upon this mindset, ad hoc collaborations, as well as collective effort with providers, suppliers and non-health-care companies, represent a successful way to close gaps and innovate with partners that bring unique skills to solve problems.

1. More Strategic and Agile Supply Chains

As witnessed by the shortcomings of face masks and similar basic medical equipment at the beginning of the pandemic, ensuring a solid supply chain and additional strategical provisions is fundamental to face last-minute demand booms and unexpected events.

Through cooperative competition, or “coopetition”, leveraging on big-box stores, nationwide pharmaceutical chains and other new entrants’ capabilities, it would be possible to lower the cost of care, increase downstream market capture and pivot around core specialty services, with a major focus on patient care. On the one hand, organizations like CVS and Walmart now offer basic primary care, simple diagnostic services and chronic disease management, an effective way to simplify organizational services, increase access and provide better patient care at a lower cost. On the other hand, thanks to latest generation technologies, emerging new entrants can offer services at a lower cost and often at a higher quality than is possible for some organizations.

Patient and workforce engagement

3. Patient Consumerization

While today we can order and receive goods the same day, as well as track them minute by minute from order placement to delivery, a vast number of patients has to wait weeks or months for an appointment - and even more for the exam results to be available. Therefore, organizations need to face their current barriers to consumer satisfaction and deploy analytics and patient-centric technologies to improve the convenience, speed and transparency of care.

4. Personalization of Care

Despite being extremely convenient and user-friendly, it has been highlighted how an “ideal” therapy, both virtual or in person, requires personalization as a priority. In particular, patients feel safer if clinicians take time to listen, show they care and communicate clearly: for improvement efforts to be successful, they must be associated with programs that drive measurable outcomes.

5. Workforce Diversity and Safety

Digital Acceleration

6. Virtual Care

From telehealth visits to virtual hospital care and home-based care, the emergence of virtual care solutions across the care is definitely Covid-19’s most vigorous improvement: in February 2020, less than 1% of Medicare primary care visits were conducted via telehealth, by April, driven by the pandemic, the volume had risen to 43%.

7. Artificial Intelligence and Automation

Bussiness Growth

8. Revenue Diversification

Data is becoming the currency of tomorrow and large organizations are making big investments to better leverage and monetize the use of data to improve productivity, enhance patient care and drive additional funding for key programs. Similarly, these organizations can monetize data/intellectual property through relationships with nontraditional partners in pharma and big tech.

Sprung almost out of the blue, Covid-19 first appeared in 2019 as an “abnormal” form of flu. Nevertheless, day after day, we are realizing how its impact has changed us and the world we live in forever. Among the others, one certainty has emerged particularly vigorous: as human beings, we are fragile and a .1-micron wide virus can bring us to the knees. Aware of our limits, science represents the “shield of last resort” against the unknown. As a matter of fact, Covid-19 has been extremely effective in paving the way for latent, slow-growth trends in the healthcare industry, which now sees unstoppable development thanks to both enhanced technologies and larger funding opportunities.

Addressing four major macro sections, a new shape of healthcare is getting clearer and clearer.

Collaborative ecosystem

Following the vulnerabilities of healthcare organizations evidenced globally by Covid-19 in terms of safety, equipment, data availability, and infrastructure, it has become apparent how “going alone” is the wrong strategy: building upon this mindset, ad hoc collaborations, as well as collective effort with providers, suppliers and non-health-care companies, represent a successful way to close gaps and innovate with partners that bring unique skills to solve problems.

1. More Strategic and Agile Supply Chains

As witnessed by the shortcomings of face masks and similar basic medical equipment at the beginning of the pandemic, ensuring a solid supply chain and additional strategical provisions is fundamental to face last-minute demand booms and unexpected events.

- Increasing storage and self-distribution. Rather than just-in-time delivery from distributors, self-distribution models allow organizations to buy in bulk, control distribution and minimize their reliance on items at risk of being depleted.

- Deeper relationships and back-up suppliers. Striking a strategic balance between price, performance and trust seems to be a winning approach: getting the lowest price but missing a relationship that cannot be “prioritized” in a crisis is not ideal, neither is excessive dependence on one single supplier without having plans B, C and D in place.

- New supply chain models for new care settings. With healthcare futurists believing that most care is likely to shift from hospitals to home, in outpatient settings or virtually within the next years, adapting to this new way of care will imply setting up brand-new types of relationships between all the parties involved, especially in terms of supplies and delivery methods.

- Smarter, faster, predictive information. Not only could automation software and artificial intelligence (AI) in health care supply chains free up personnel from repetitive tasks and reduce human error to 0, but they could also assist decision-makers in identifying trends and providing resources to workers.

Through cooperative competition, or “coopetition”, leveraging on big-box stores, nationwide pharmaceutical chains and other new entrants’ capabilities, it would be possible to lower the cost of care, increase downstream market capture and pivot around core specialty services, with a major focus on patient care. On the one hand, organizations like CVS and Walmart now offer basic primary care, simple diagnostic services and chronic disease management, an effective way to simplify organizational services, increase access and provide better patient care at a lower cost. On the other hand, thanks to latest generation technologies, emerging new entrants can offer services at a lower cost and often at a higher quality than is possible for some organizations.

Patient and workforce engagement

3. Patient Consumerization

While today we can order and receive goods the same day, as well as track them minute by minute from order placement to delivery, a vast number of patients has to wait weeks or months for an appointment - and even more for the exam results to be available. Therefore, organizations need to face their current barriers to consumer satisfaction and deploy analytics and patient-centric technologies to improve the convenience, speed and transparency of care.

4. Personalization of Care

Despite being extremely convenient and user-friendly, it has been highlighted how an “ideal” therapy, both virtual or in person, requires personalization as a priority. In particular, patients feel safer if clinicians take time to listen, show they care and communicate clearly: for improvement efforts to be successful, they must be associated with programs that drive measurable outcomes.

5. Workforce Diversity and Safety

- Inclusion and diversity. Thanks to a more diversified background and fresh approaches, diverse teams of physicians and inclusive cultures drive better outcomes (especially among diverse patient populations), more effective problem-solving, greater engagement and higher employee retention.

- Flexibility. Investing on IT tools and programs is regarded as a worthy opportunity for large organization to grant enhanced flexibility to their employees.

- Physical and mental health. The issue of employee safety was amplified by COVID-19 and organizations need to keep a pulse on staff burnout, continually looking for ways to make their jobs more sustainable and expanding access to mental health services.

Digital Acceleration

6. Virtual Care

From telehealth visits to virtual hospital care and home-based care, the emergence of virtual care solutions across the care is definitely Covid-19’s most vigorous improvement: in February 2020, less than 1% of Medicare primary care visits were conducted via telehealth, by April, driven by the pandemic, the volume had risen to 43%.

7. Artificial Intelligence and Automation

- Quality and efficiency in radiology. With solutions to reduce redundant tasks, eliminate bias-based reading errors, identify data patterns in images to predict risk and enhance workflow processes, AI is having a big positive impact in radiology. For instance, a partnership between GE Healthcare and Intel is currently trying to both enhance patient care and reduce costs for hospitals and health systems through the use of digital imaging solutions, deployed via edge and cloud. In particular, this solution will offer greater hospital efficiency through increased asset performance, reduced patient risk and dosage exposure (i.e., faster image processing) and expedited time to diagnosis and treatment.

- Real-time analytics to expedite care. Large organizations are employing real-time information to drive the care process. Combining systems engineering, predictive analytics and problem-solving, for example, command center software platforms manage patient flow in and through the health system while aiming to preserve clinical quality, safety and the patient experience.

- Productivity in nonclinical areas. Automation processes allow to streamline health system business operations that rely heavily on repetitive tasks, such as supply chain, revenue cycle and customer service.

Bussiness Growth

8. Revenue Diversification

Data is becoming the currency of tomorrow and large organizations are making big investments to better leverage and monetize the use of data to improve productivity, enhance patient care and drive additional funding for key programs. Similarly, these organizations can monetize data/intellectual property through relationships with nontraditional partners in pharma and big tech.

Athenahealth bought by private equity firms Hellman & Friedman, Bain Capital

Shaping one of the biggest leveraged buyouts (i.e., an acquisition completed almost entirely with borrowed funds) of 2021, Athenahealth, a healthcare software company, has been acquired by investment firms Hellman & Friedman and Bain Capital for $17 billion. Veritas Capital and Evergreen Coast Capital, Elliott’s private equity subsidiary, previously bought the company in 2018 for $5.5 billion and eventually combined it with Virence Health Technologies, which Veritas had assembled from parts of G.E.’s health care division.

Working with over 140,000 healthcare providers in 50 states, Athenahealth helps doctors and hospitals collect money from health insurers and the government for services they provide. AthenaOne is Athenahealth's fully integrated suite of cloud-based services, combining practice management (athenaCollector), an electronic health record (EHR) system (athenaClinicals), and care coordination (athenaCommunicator) into a single packaged offering. Furthermore, in 2020 Athenahealth launched an embedded telehealth tool to allow practitioners to conduct virtual visits without having to download separate software or use another third-party app.

Shaping one of the biggest leveraged buyouts (i.e., an acquisition completed almost entirely with borrowed funds) of 2021, Athenahealth, a healthcare software company, has been acquired by investment firms Hellman & Friedman and Bain Capital for $17 billion. Veritas Capital and Evergreen Coast Capital, Elliott’s private equity subsidiary, previously bought the company in 2018 for $5.5 billion and eventually combined it with Virence Health Technologies, which Veritas had assembled from parts of G.E.’s health care division.

Working with over 140,000 healthcare providers in 50 states, Athenahealth helps doctors and hospitals collect money from health insurers and the government for services they provide. AthenaOne is Athenahealth's fully integrated suite of cloud-based services, combining practice management (athenaCollector), an electronic health record (EHR) system (athenaClinicals), and care coordination (athenaCommunicator) into a single packaged offering. Furthermore, in 2020 Athenahealth launched an embedded telehealth tool to allow practitioners to conduct virtual visits without having to download separate software or use another third-party app.

FINTECH

During the past decade, the financial services industry has experienced a process of technological development. This digitalization has been driven by the emergence of new technologies, the evolution of client expectations, the availability of digital wallets and other factors. The COVID-19 pandemic has accelerated these trends with an increasing demand for contactless payment worldwide, creating opportunities for some new fintech. Indeed, according to research published by the Swiss Finance Institute, during COVID-19, the daily average rate of Fintech app downloads increased from 29.2% to 32.8%. These innovations are essential for keeping the same pace in economic activity during the pandemic, by reaching more persons and at the same time reducing face-to-face interactions.

How are fintechs innovating to recover?

Fintechs have many features that allow them to rapidly create and deliver new solutions. These characteristics include being comfortable in partnering within the broader financial services industry and beyond, being unburdened by complex legacy systems and having the allowance to analyze various types of data.

Fintechs exploited their strengths to help businesses and individuals recover from the effects of COVID-19. As an example, Paypal has reduced fees on chargebacks and instant fund transfers from business accounts to bank accounts, Stripe is fast-tracking support for telemedicine platforms, and Revolut and other fintechs, have developed a charitable-giving feature that enables their customers to donate to those plagued by COVID-19, directly from the app.

Moreover, new products addressed to the evolving economic environment were introduced by many fintechs, like in the UK, where Wiserfunding and other fintechs have created a business-lending taskforce to simplify the process of making funds of banks and private debts lenders available to businesses during the pandemic.

Future opportunities

New partnership opportunities that could help fintechs expanding are other fintechs, big techs and non-financial services firm. Indeed, they could partner with other financial institutions that usually benefit from capital, distribution access, but often lack digital solutions. Other opportunities could be found in healthcare, by integrating payments and other financial products.

The economic disruption brought by the pandemic made financial inclusion extremely important for both developed and developing economies. According to the World Bank, 1.7 billion individuals are unbanked, while the Federal Deposit Insurance Corporation estimated in 2018 that 6.5% of US households were unbanked and 16% were underbanked. This may result in financial difficulty, but thanks to the role of fintechs, recent government programs to help low-income households would be more effective.

During the past decade, the financial services industry has experienced a process of technological development. This digitalization has been driven by the emergence of new technologies, the evolution of client expectations, the availability of digital wallets and other factors. The COVID-19 pandemic has accelerated these trends with an increasing demand for contactless payment worldwide, creating opportunities for some new fintech. Indeed, according to research published by the Swiss Finance Institute, during COVID-19, the daily average rate of Fintech app downloads increased from 29.2% to 32.8%. These innovations are essential for keeping the same pace in economic activity during the pandemic, by reaching more persons and at the same time reducing face-to-face interactions.

How are fintechs innovating to recover?

Fintechs have many features that allow them to rapidly create and deliver new solutions. These characteristics include being comfortable in partnering within the broader financial services industry and beyond, being unburdened by complex legacy systems and having the allowance to analyze various types of data.

Fintechs exploited their strengths to help businesses and individuals recover from the effects of COVID-19. As an example, Paypal has reduced fees on chargebacks and instant fund transfers from business accounts to bank accounts, Stripe is fast-tracking support for telemedicine platforms, and Revolut and other fintechs, have developed a charitable-giving feature that enables their customers to donate to those plagued by COVID-19, directly from the app.

Moreover, new products addressed to the evolving economic environment were introduced by many fintechs, like in the UK, where Wiserfunding and other fintechs have created a business-lending taskforce to simplify the process of making funds of banks and private debts lenders available to businesses during the pandemic.

Future opportunities

New partnership opportunities that could help fintechs expanding are other fintechs, big techs and non-financial services firm. Indeed, they could partner with other financial institutions that usually benefit from capital, distribution access, but often lack digital solutions. Other opportunities could be found in healthcare, by integrating payments and other financial products.

The economic disruption brought by the pandemic made financial inclusion extremely important for both developed and developing economies. According to the World Bank, 1.7 billion individuals are unbanked, while the Federal Deposit Insurance Corporation estimated in 2018 that 6.5% of US households were unbanked and 16% were underbanked. This may result in financial difficulty, but thanks to the role of fintechs, recent government programs to help low-income households would be more effective.

American Express acquires Kabbage

In August 2020, American Express acquired an online lending platform called Kabbage for a nondisclosure amount to offer better products to small businesses. American Express is a multinational corporation specialized in payment card services, headquartered in New York. In 2017, it was nominated by Forbes as one of the most valuable companies in the world, and in 2020, the company reported 36.087$bn in revenues net of expenses.

Kabbage was an Atlanta-based fintech founded in 2008, providing direct funding to small businesses and customers. It was the fourth largest processor of SBA payroll support loans (PPP). Due to COVID-19 diseases, Kabbage stopped its core business - making small business loans - as it thought only the government could deal with the risk involved (since small businesses were closed and thus didn't generate revenue). All previously made small business loans were securitised and weren’t included in the transaction.

After stopping lending, Kabbage used its online platform to facilitate the government's Paycheck Protection Program (PPP) for tiny businesses. PPP loans are made by the US Treasury and forgivable if spent on rent and basic expenses. With the transaction, a new entity was born, to serve both the PPP loans and Kabbage's securitised small business loans. The reasons behind the acquisition are Kabbage's technology for gathering and analysing data for loan underwriting, and new developed non-lending products such as cash flow management tools. AmEx hopes the acquisition would help to grow in merchant cash advances, small business lending and cash flow management.

In August 2020, American Express acquired an online lending platform called Kabbage for a nondisclosure amount to offer better products to small businesses. American Express is a multinational corporation specialized in payment card services, headquartered in New York. In 2017, it was nominated by Forbes as one of the most valuable companies in the world, and in 2020, the company reported 36.087$bn in revenues net of expenses.

Kabbage was an Atlanta-based fintech founded in 2008, providing direct funding to small businesses and customers. It was the fourth largest processor of SBA payroll support loans (PPP). Due to COVID-19 diseases, Kabbage stopped its core business - making small business loans - as it thought only the government could deal with the risk involved (since small businesses were closed and thus didn't generate revenue). All previously made small business loans were securitised and weren’t included in the transaction.

After stopping lending, Kabbage used its online platform to facilitate the government's Paycheck Protection Program (PPP) for tiny businesses. PPP loans are made by the US Treasury and forgivable if spent on rent and basic expenses. With the transaction, a new entity was born, to serve both the PPP loans and Kabbage's securitised small business loans. The reasons behind the acquisition are Kabbage's technology for gathering and analysing data for loan underwriting, and new developed non-lending products such as cash flow management tools. AmEx hopes the acquisition would help to grow in merchant cash advances, small business lending and cash flow management.

FOOD INDUSTRY

New trends in the food industry are emerging. The impact of the COVID-19 pandemic has required quick innovations to adapt to a new reality. Consumers’ priorities and preferences have dramatically evolved, and changes are going to last.

A focus on wellbeing and health

The top trend is an increased focus on wellbeing and health. After a long period at home during lockdowns, people have modified their lifestyles and diets to improve states of mind, moods, and long-term health. According to Accenture’s 2020 report "How will COVID-19 change the consumer?", 69% of people are likely to continue with healthy habits they had developed during the pandemic.

Consumers have also understood that some healthier and local ingredients are better for the planet.

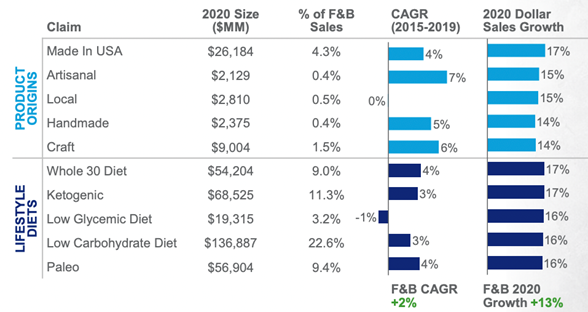

As the following chart shows, US consumers are increasingly buying products that come from within national boundaries and that are handmade rather than industrial. Brands are celebrating these kinds of ingredients, emphasizing the quality and sustainability of the production processes.

New trends in the food industry are emerging. The impact of the COVID-19 pandemic has required quick innovations to adapt to a new reality. Consumers’ priorities and preferences have dramatically evolved, and changes are going to last.

A focus on wellbeing and health

The top trend is an increased focus on wellbeing and health. After a long period at home during lockdowns, people have modified their lifestyles and diets to improve states of mind, moods, and long-term health. According to Accenture’s 2020 report "How will COVID-19 change the consumer?", 69% of people are likely to continue with healthy habits they had developed during the pandemic.

Consumers have also understood that some healthier and local ingredients are better for the planet.

As the following chart shows, US consumers are increasingly buying products that come from within national boundaries and that are handmade rather than industrial. Brands are celebrating these kinds of ingredients, emphasizing the quality and sustainability of the production processes.

Source: IRI Report 2020

Alternative food formulations and meat substitutes

Increasingly, consumers are looking for alternative food formulations that allow them to avoid unwanted ingredients and align food choices with their personal, nutritional, or ethical goals. According to the 2020 IRI innovation report, dollar sales of foods with a low-carbohydrate positioning, ketogenic, or carrying a diet claim grew more than 15%, outperforming the F&B industry average growth of 13%. Also, the market for plant-based protein products has expanded, with a 9% growth of sales in the US in 2020.

Although plant-based meat substitutes and related products were created for vegans and vegetarians at first, omnivores are now the target segment for these foods. More consumers enjoy eating them because they are perceived as healthier, they cause less harm to the environment, avoid mistreatment and intensive breeding of animals. For instance, in 2021 Nestlé has unveiled the “vrimp”, a plant-based version of the shrimp made from peas, seaweed, and the roots of konjac, after releasing “Vuna” fake tuna last year. Another substitute for beef, chicken, and pork is insects. Although consumers in rich and developed countries are reluctant to introduce them in their diet, they are already very popular in South Korea or South American countries, such as Colombia and Mexico.

Increasingly, consumers are looking for alternative food formulations that allow them to avoid unwanted ingredients and align food choices with their personal, nutritional, or ethical goals. According to the 2020 IRI innovation report, dollar sales of foods with a low-carbohydrate positioning, ketogenic, or carrying a diet claim grew more than 15%, outperforming the F&B industry average growth of 13%. Also, the market for plant-based protein products has expanded, with a 9% growth of sales in the US in 2020.

Although plant-based meat substitutes and related products were created for vegans and vegetarians at first, omnivores are now the target segment for these foods. More consumers enjoy eating them because they are perceived as healthier, they cause less harm to the environment, avoid mistreatment and intensive breeding of animals. For instance, in 2021 Nestlé has unveiled the “vrimp”, a plant-based version of the shrimp made from peas, seaweed, and the roots of konjac, after releasing “Vuna” fake tuna last year. Another substitute for beef, chicken, and pork is insects. Although consumers in rich and developed countries are reluctant to introduce them in their diet, they are already very popular in South Korea or South American countries, such as Colombia and Mexico.

Nutritional supplements and the acquisition of The Bountiful company by Nestlé

The pandemic has also increased the consumption of vitamins, minerals, and nutritional supplements, as consumers think that they can boost immunity and improve their overall health. To capitalize on this growing demand, in April 2021 the Swiss packaged-food group Nestlé SA agreed to buy the core brands of The Bountiful Company for $5.75 billion. The latter is a manufacturer, marketer, and seller of supplements previously backed by private equity firm KKR. The acquisition included the brands Nature’s Bounty®, Solgar®, Osteo Bi-Flex®, Puritan’s Pride®, Sundown®, and Ester-C®. These brands generated revenues of $1.87 billion in the year to March 2021, with a solid EBITDA margin of 18.3%.

The vitamins and supplements sector is very fragmented, nevertheless attractive. In an interview for CNBC, Greg Behar, CEO of Nestle Health Science, stated that they foresee that this category will continue to grow at 5-6% in the next few years. After this acquisition, Nestlé has gained 5%, thus becoming the largest company in terms of market shares.

The deal was successfully completed in August 2021 and the company officially became part of Nestlé Health Science. “This acquisition complements our existing health and nutrition portfolio in terms of brands and channels,” said Greg Behar. Nestlé paid 3.1 times the value of The Bountiful Company’s revenues and 16.8 times of its EBITDA. According to Greg Behar, this was a “very reasonable price when you benchmark it with other acquisitions in the space”.

The deal has given Nestlè Health Science scale and opportunities for expansion in e-commerce sales, which now amount to 40%. The Bountiful Company has multiplied its e-commerce footprint by 5x in the last two years and Nestlé believes that it can accelerate that momentum. They are aiming for further expansion and maybe other acquisitions.

The pandemic has also increased the consumption of vitamins, minerals, and nutritional supplements, as consumers think that they can boost immunity and improve their overall health. To capitalize on this growing demand, in April 2021 the Swiss packaged-food group Nestlé SA agreed to buy the core brands of The Bountiful Company for $5.75 billion. The latter is a manufacturer, marketer, and seller of supplements previously backed by private equity firm KKR. The acquisition included the brands Nature’s Bounty®, Solgar®, Osteo Bi-Flex®, Puritan’s Pride®, Sundown®, and Ester-C®. These brands generated revenues of $1.87 billion in the year to March 2021, with a solid EBITDA margin of 18.3%.

The vitamins and supplements sector is very fragmented, nevertheless attractive. In an interview for CNBC, Greg Behar, CEO of Nestle Health Science, stated that they foresee that this category will continue to grow at 5-6% in the next few years. After this acquisition, Nestlé has gained 5%, thus becoming the largest company in terms of market shares.

The deal was successfully completed in August 2021 and the company officially became part of Nestlé Health Science. “This acquisition complements our existing health and nutrition portfolio in terms of brands and channels,” said Greg Behar. Nestlé paid 3.1 times the value of The Bountiful Company’s revenues and 16.8 times of its EBITDA. According to Greg Behar, this was a “very reasonable price when you benchmark it with other acquisitions in the space”.

The deal has given Nestlè Health Science scale and opportunities for expansion in e-commerce sales, which now amount to 40%. The Bountiful Company has multiplied its e-commerce footprint by 5x in the last two years and Nestlé believes that it can accelerate that momentum. They are aiming for further expansion and maybe other acquisitions.

Sources

by Alessandro Chen, Alessandro Maraldi, Margherita Magenta

- Financial Times

- World Bank

- Deloitte

- Accenture

- IRI

- Bloomberg

- CNBC

- The Wall Street Journal

- Bountiful Company’s website

by Alessandro Chen, Alessandro Maraldi, Margherita Magenta