Although large scale, pivotal transitions in the energy sector are few and far between, when they do come about, early adopters have historically fared better than contrarians. Following an extensive history of periods of accelerated growth as a result of rapid adaptation to changing demand, BP, an oil behemoth, is once again facing another crucial change – growing market desire for greener, renewable energy. The company has had to question the sustainability of their current business model, and soon felt pressured towards a net-zero goal, which has influenced its recent acquisition of Archaea Energy Inc. for $4.1bn, a large renewable energy producer in the United States of America.

A Brief Summary of BP’s Long History

The history of BP is a story of energy transitions. It begins back in 1901 when the businessman William Knox D’Arcy was granted a 60-year concession in search for oil and gas across Persia (Iran). After seven years of pointless drillings made under the direction of engineer George Reynolds and with the financings of the Burmah Oil Company, in 1908, a large amount of oil was found. Then, the following year, the Burmah Oil Company created the subsidiary Anglo-Persian Oil Company (APOC). This is the company that, after many changes in the name, we call British Petroleum since 1954; or better, BP PLC since 2000. In 1914, just six weeks before the beginning of the First World War, the British government, led by Winston Churchill, entered the company as the controlling shareholder. The driving rationale behind this deal was the energy transition: the fuelling of war ships, like many other energy-intensive processes, was moving from coal to oil.

In the 1920-30s, the age of the automobile, another dynamic transition was made from oil to gas. In fact, APOC expanded its gas sales across Europe – BP-labelled gasoline pumps exponentially spread in Britain, from 69 (1921) to over 6000 (1925). Despite this growth, the company would have to face off considerable challenges in the near future.

As a consequence of the destruction caused by the Second World War, the increasing national impetus of Iran led to the nationalisation of the Iranian oil industry in 1951. Having lost one of its main sources of business, the newly anointed British Petroleum Company was forced to diversify its oil extraction sources to other regions such as Kuwait, Qatar, and Iraq. Compelled to further the internationalisation of the company, BP became the first corporation to strike oil in the North Sea, reaping great benefits from its first-mover advantage.

The decade of the ‘70s were, for BP, years of huge economic issues which resulted in crucial structural changes within the organisation. Due to Middle Eastern political instability and the two oil crises, BP needed to reshape its entire blueprint, based on Middle Eastern oil, to a more international one, with a frontier exploration strategy of new areas such as Alaska, African and Asian countries.

After the Thatcher era and the privatization wave, by the late 1980s, BP became privately owned for the first time in its history and a few years later faced a deep financial crisis caused by a combination of low oil prices and heavy debt. After the restructuring of the company in 1995, BP consolidated its position through a series of acquisitions, most notably Amoco, ARCO and Burmah Castrol. However, the era of the oil industry was nearly over. As a matter of fact, in 1999 the UK oil production peaked, then began to decline at the rate of around 7% per year.

A Brief Summary of BP’s Long History

The history of BP is a story of energy transitions. It begins back in 1901 when the businessman William Knox D’Arcy was granted a 60-year concession in search for oil and gas across Persia (Iran). After seven years of pointless drillings made under the direction of engineer George Reynolds and with the financings of the Burmah Oil Company, in 1908, a large amount of oil was found. Then, the following year, the Burmah Oil Company created the subsidiary Anglo-Persian Oil Company (APOC). This is the company that, after many changes in the name, we call British Petroleum since 1954; or better, BP PLC since 2000. In 1914, just six weeks before the beginning of the First World War, the British government, led by Winston Churchill, entered the company as the controlling shareholder. The driving rationale behind this deal was the energy transition: the fuelling of war ships, like many other energy-intensive processes, was moving from coal to oil.

In the 1920-30s, the age of the automobile, another dynamic transition was made from oil to gas. In fact, APOC expanded its gas sales across Europe – BP-labelled gasoline pumps exponentially spread in Britain, from 69 (1921) to over 6000 (1925). Despite this growth, the company would have to face off considerable challenges in the near future.

As a consequence of the destruction caused by the Second World War, the increasing national impetus of Iran led to the nationalisation of the Iranian oil industry in 1951. Having lost one of its main sources of business, the newly anointed British Petroleum Company was forced to diversify its oil extraction sources to other regions such as Kuwait, Qatar, and Iraq. Compelled to further the internationalisation of the company, BP became the first corporation to strike oil in the North Sea, reaping great benefits from its first-mover advantage.

The decade of the ‘70s were, for BP, years of huge economic issues which resulted in crucial structural changes within the organisation. Due to Middle Eastern political instability and the two oil crises, BP needed to reshape its entire blueprint, based on Middle Eastern oil, to a more international one, with a frontier exploration strategy of new areas such as Alaska, African and Asian countries.

After the Thatcher era and the privatization wave, by the late 1980s, BP became privately owned for the first time in its history and a few years later faced a deep financial crisis caused by a combination of low oil prices and heavy debt. After the restructuring of the company in 1995, BP consolidated its position through a series of acquisitions, most notably Amoco, ARCO and Burmah Castrol. However, the era of the oil industry was nearly over. As a matter of fact, in 1999 the UK oil production peaked, then began to decline at the rate of around 7% per year.

Source: BP

Another Energy Transition and a New Strategy

In the new millennium, the company was, once again, ready to face a new pivotal energy transition. An unprecedented urgency in demand for new sources of energy, determined by a rise in population and incomes in Emerging Market Economies (EMEs) as well as the progressive technological improvements necessary for an amelioration in the energy mix, signalled a remarkable megatrend, to which BP reacted by promising to transcend the oil sector and to go "Beyond Petroleum".

Consequently, the company moved towards a greener business, experimenting pioneering alternatives like wind, solar, biofuels, carbon capture and storage, and gas-fired power generation. BP did not invest only in renewables but also committed to a process of decarbonisation concerning energy infrastructure, housing, transport, and agriculture.

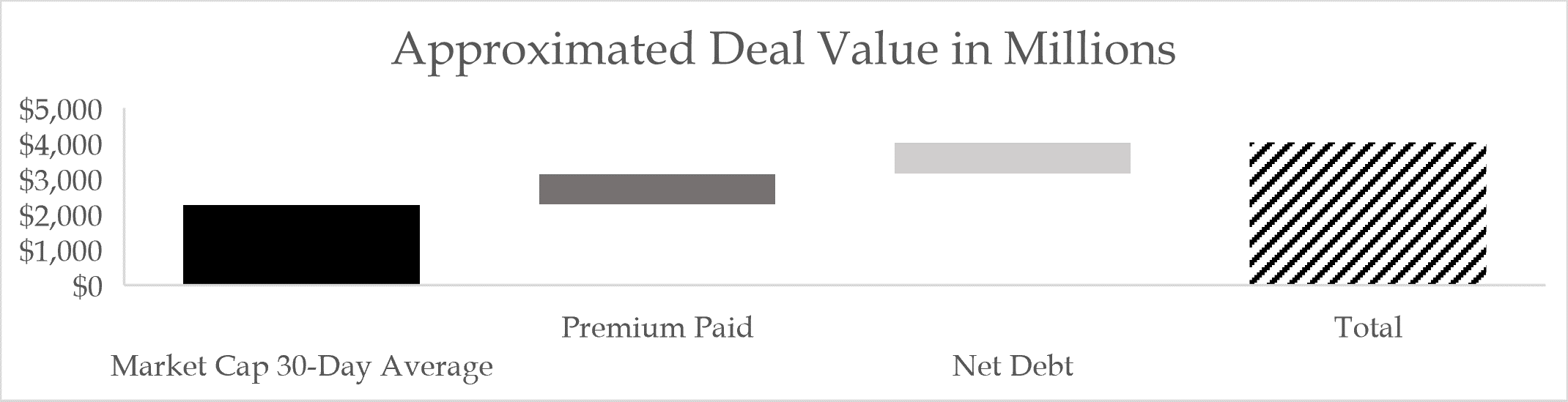

Nowadays, the company has made it its mission to achieve a rapid transition away from a dependence on oil in order to guarantee a liveable environment and a flourishing economy. BP’s ambition is to undertake huge investments and acquisitions of varying sizes in order to become a net zero company by 2050. Indeed, BP’s buying spree is expected to increase its capital expenditure to $15.5bn in 2022. The biggest acquisition by the energy behemoth this year has taken place in October with the investment in Archaea Energy, a renewable energy company focused on the production of Renewable Natural Gas with a 30-day average market cap of above $2.2 billion prior the acquisition announcement.

What is RNG?

Renewable Natural Gas (RNG), also known as biomethane, is a type of biogas that is fully interchangeable with conventional gas, and acts as a net-zero alternative. It is a product that results from the decomposition of organic matters – in a lot of cases it simply represents a side product of waste. Examples of biogas sources abound coming from landfills, from livestock operations, from wastewater treatment, and many more. The transportation from these sources can either happen in as compressed natural gas (CNG) or liquified natural gas (LNG), which makes it possible to distribute it through the already existing gas grid. Furthermore, RNG shows a high energy efficiency of up to 70%.

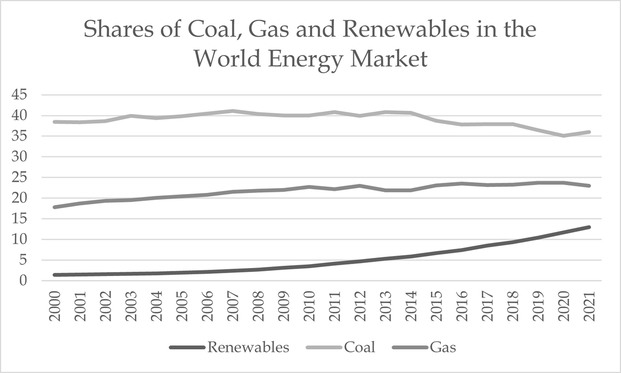

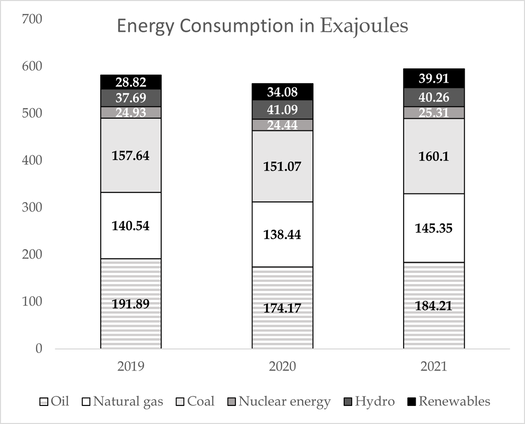

The global energy industry is comprised of many different sub-industries, depending on sources and uses. Energy is indispensable in today’s economy, both for industries and households, and the concerns over environmental sustainability are causing important shifts in the structure of demand. This, combined with geopolitical tensions, is leading to pressure on many large, established energy conglomerates to shift their strategies so as to lower their carbon footprints. Political agendas and increased climate awareness, predominantly but not exclusively in rich, industrialized countries, also act as catalysts of this transition to sustainability, providing incentives, but also creating more strict regulatory frameworks to address pollution. Fossil fuels, including petroleum and natural gas, remain primary energy sources, however, from 2010 to 2020, global renewable energy production grew steadily, with a total increase of 77% over the decade, demonstrating that remarkable steps have already been taken towards a net-zero objective. The graph below shows the growth Renewables have undergone in the past 3 years alone:

In the new millennium, the company was, once again, ready to face a new pivotal energy transition. An unprecedented urgency in demand for new sources of energy, determined by a rise in population and incomes in Emerging Market Economies (EMEs) as well as the progressive technological improvements necessary for an amelioration in the energy mix, signalled a remarkable megatrend, to which BP reacted by promising to transcend the oil sector and to go "Beyond Petroleum".

Consequently, the company moved towards a greener business, experimenting pioneering alternatives like wind, solar, biofuels, carbon capture and storage, and gas-fired power generation. BP did not invest only in renewables but also committed to a process of decarbonisation concerning energy infrastructure, housing, transport, and agriculture.

Nowadays, the company has made it its mission to achieve a rapid transition away from a dependence on oil in order to guarantee a liveable environment and a flourishing economy. BP’s ambition is to undertake huge investments and acquisitions of varying sizes in order to become a net zero company by 2050. Indeed, BP’s buying spree is expected to increase its capital expenditure to $15.5bn in 2022. The biggest acquisition by the energy behemoth this year has taken place in October with the investment in Archaea Energy, a renewable energy company focused on the production of Renewable Natural Gas with a 30-day average market cap of above $2.2 billion prior the acquisition announcement.

What is RNG?

Renewable Natural Gas (RNG), also known as biomethane, is a type of biogas that is fully interchangeable with conventional gas, and acts as a net-zero alternative. It is a product that results from the decomposition of organic matters – in a lot of cases it simply represents a side product of waste. Examples of biogas sources abound coming from landfills, from livestock operations, from wastewater treatment, and many more. The transportation from these sources can either happen in as compressed natural gas (CNG) or liquified natural gas (LNG), which makes it possible to distribute it through the already existing gas grid. Furthermore, RNG shows a high energy efficiency of up to 70%.

The global energy industry is comprised of many different sub-industries, depending on sources and uses. Energy is indispensable in today’s economy, both for industries and households, and the concerns over environmental sustainability are causing important shifts in the structure of demand. This, combined with geopolitical tensions, is leading to pressure on many large, established energy conglomerates to shift their strategies so as to lower their carbon footprints. Political agendas and increased climate awareness, predominantly but not exclusively in rich, industrialized countries, also act as catalysts of this transition to sustainability, providing incentives, but also creating more strict regulatory frameworks to address pollution. Fossil fuels, including petroleum and natural gas, remain primary energy sources, however, from 2010 to 2020, global renewable energy production grew steadily, with a total increase of 77% over the decade, demonstrating that remarkable steps have already been taken towards a net-zero objective. The graph below shows the growth Renewables have undergone in the past 3 years alone:

Source: Statista

Archaea Energy (The Acquiree)

Archaea Energy is a renewable energy company born in 2018 aimed at harnessing the power of landfill gas. The primary scope of the company is to decarbonise the fossil natural gas infrastructures and to develop biogas facilities which capture waste emissions from landfills and convert biogas into Renewable Natural Gas (RNG) or use the landfill gas to produce renewable electricity power. The company underwent great inorganic growth in 2021 when the SPAC Rice Acquisition Corp combined with Archaea Energy LLC and Aria Energy LLC, a company with over 30 years of experience in renewable energy. The resulting corporation, the current Archaea Energy, is a technology-driven firm based in the United States which has an intrinsic growth potential given by innovative and sustainable practices such as the combination of RNG projects with carbon sequestration. In this procedure, methane (CH4) and carbon dioxide (CO2) are captured and processed: methane is upgraded into pipeline-quality RNG which displaces fossil fuels, while CO2 is captured and sequestered, further reducing overall emissions. This approach beneficially uses over 90% of the methane, which is one of the most polluting gases on earth (over a 20-year horizon, it has 56 times the global warming impact of CO2).

Due to the peculiar business of Archaea, it is not difficult to understand why BP was interested in acquiring the company. This transaction may support the net zero ambition of BP, add a distinctive value for the company, and accelerate the growth of its strategic bioenergy transition growth engine. Furthermore, the buyer would take advantage of the existing business to expand in the US, a key fast-growing geography for biogas. The deal may also have a positive impact on the acquired company because BP would be able to provide Archaea access to world-class platforms, capabilities, and capital resources, which are crucial for its capital-intensive growth plans. Archaea would also access a broader customer base, both improving its financial performances and helping many of BP’s customers achieve their decarbonization goals. In the end, Archaea will exploit the pre-existing BP bioenergy business as a way to further its own growth into international markets.

The Acquisition

Despite most firms delaying their acquisitions due to the current geopolitical and economic environment, BP will acquire its acquisition of the large US biogas producer Archaea, which marks BP’s biggest transaction in this energy sub-sector, ever. This is a considerable investment in one of their five transition businesses, which include: hydrogen, convenience, biofuels, charging, and renewables.

The acquisition is part of one of the most ambitious corporate strategies in the energy sector, where BP aims to cut 40% of its natural gas and oil production by 2030. Another interim goal, more than 40% of capital expenditure of investments into the five transition businesses, shall be reached by 2025.

While BP invested $750 million into low-carbon projects in 2020 and already massively stepped this up in 2021 with $2.2 billion, this figure will increase further in 2022 with the $3.3 billion investment in Archaea.

In this all-in cash transaction, BP will pay $26.00 for each of the roughly 120 million Class A and Class B common stock shares issued and outstanding as of September 30, 2022 (data from the current 10-Q report published on the SEC database). The 30-day average stock price before the announcement was $18.83 and therefore implies a 38% premium that will be paid. Looking at the 90-day average of the share price, this implies an even higher premium of 47%. On top of that there are approximately $800-900 million of net debt that BP must finance.

Archaea Energy is a renewable energy company born in 2018 aimed at harnessing the power of landfill gas. The primary scope of the company is to decarbonise the fossil natural gas infrastructures and to develop biogas facilities which capture waste emissions from landfills and convert biogas into Renewable Natural Gas (RNG) or use the landfill gas to produce renewable electricity power. The company underwent great inorganic growth in 2021 when the SPAC Rice Acquisition Corp combined with Archaea Energy LLC and Aria Energy LLC, a company with over 30 years of experience in renewable energy. The resulting corporation, the current Archaea Energy, is a technology-driven firm based in the United States which has an intrinsic growth potential given by innovative and sustainable practices such as the combination of RNG projects with carbon sequestration. In this procedure, methane (CH4) and carbon dioxide (CO2) are captured and processed: methane is upgraded into pipeline-quality RNG which displaces fossil fuels, while CO2 is captured and sequestered, further reducing overall emissions. This approach beneficially uses over 90% of the methane, which is one of the most polluting gases on earth (over a 20-year horizon, it has 56 times the global warming impact of CO2).

Due to the peculiar business of Archaea, it is not difficult to understand why BP was interested in acquiring the company. This transaction may support the net zero ambition of BP, add a distinctive value for the company, and accelerate the growth of its strategic bioenergy transition growth engine. Furthermore, the buyer would take advantage of the existing business to expand in the US, a key fast-growing geography for biogas. The deal may also have a positive impact on the acquired company because BP would be able to provide Archaea access to world-class platforms, capabilities, and capital resources, which are crucial for its capital-intensive growth plans. Archaea would also access a broader customer base, both improving its financial performances and helping many of BP’s customers achieve their decarbonization goals. In the end, Archaea will exploit the pre-existing BP bioenergy business as a way to further its own growth into international markets.

The Acquisition

Despite most firms delaying their acquisitions due to the current geopolitical and economic environment, BP will acquire its acquisition of the large US biogas producer Archaea, which marks BP’s biggest transaction in this energy sub-sector, ever. This is a considerable investment in one of their five transition businesses, which include: hydrogen, convenience, biofuels, charging, and renewables.

The acquisition is part of one of the most ambitious corporate strategies in the energy sector, where BP aims to cut 40% of its natural gas and oil production by 2030. Another interim goal, more than 40% of capital expenditure of investments into the five transition businesses, shall be reached by 2025.

While BP invested $750 million into low-carbon projects in 2020 and already massively stepped this up in 2021 with $2.2 billion, this figure will increase further in 2022 with the $3.3 billion investment in Archaea.

In this all-in cash transaction, BP will pay $26.00 for each of the roughly 120 million Class A and Class B common stock shares issued and outstanding as of September 30, 2022 (data from the current 10-Q report published on the SEC database). The 30-day average stock price before the announcement was $18.83 and therefore implies a 38% premium that will be paid. Looking at the 90-day average of the share price, this implies an even higher premium of 47%. On top of that there are approximately $800-900 million of net debt that BP must finance.

Source: SEC

Information, provided by the proxy reports of Archaea, shows that both companies have been first engaged with each other as entities involved in the Mavrix LLC joint venture in 2021, when BP had already expressed a strong interest in the biogas industry. Over the following few months, BP’s management developed an interest beyond the partnership already existing and expressed this, according to SEC filings, for the first time in June 2022.

However, BP was not the only one with an interest in Archaea. Over the summer of 2022 several companies, strategic buyers, as well as financial sponsors, expressed their interest. Archaea engaged BofA Securities as a financial advisor, and Kirkland & Ellis LLP as a legal advisor which assisted the board on this deal. In the end, seven entities signed a confidential agreement, entering them into the first-round bidding.

In general, it is said, that strategic buyers are often able to offer a higher bid since they will be able to realise synergies and have a lower cost of capital. This was certainly the case in this auction, where several strategic buyers and financial sponsors took part in the process. BP finally surpassed all offers with a first bid of $27 per share, which was then reduced to $25. BP justified this reduction by different modelled cost structures after the due diligence. However, after a call between the board of Archaea and representatives of BP, they were able to reach a final agreement on $26 per share.

On November 11th the Board of Archaea invited its Shareholders to a virtual meeting which took place in December, where they voted over the merger agreement. It declared itself in favour of the proposal. BP’s chief executive Bernard Looney, very much in favour of the transaction, publicly said, that “it’s the best deal I’ve seen inside the company since we did Aker BP in 2016” and outlines it as “absolutely the right deal” for its shareholders.

Conclusion

The renewable energy megatrend has proven its persistence, and even a grandiose oil colossus like BP has been able to recognise this. Instead of fighting back and trying to swim against the current, BP has, paradoxically, become one of the biggest investors in the energy transition, accelerating the downfall of their current energy winners.

BP’s keenness to lead the energy transition is evident. Whether or not the corporation’s large commitments have been made at an excessively early stage is at question, however. Although it is an energy sector with an extraordinary pace of innovation, there is no telling when renewables will overtake traditional sources of energy – nonetheless, a bet BP must be willing to take, in an attempt to avoid having to catch up later on, or, even worse, being left behind.

However, BP was not the only one with an interest in Archaea. Over the summer of 2022 several companies, strategic buyers, as well as financial sponsors, expressed their interest. Archaea engaged BofA Securities as a financial advisor, and Kirkland & Ellis LLP as a legal advisor which assisted the board on this deal. In the end, seven entities signed a confidential agreement, entering them into the first-round bidding.

In general, it is said, that strategic buyers are often able to offer a higher bid since they will be able to realise synergies and have a lower cost of capital. This was certainly the case in this auction, where several strategic buyers and financial sponsors took part in the process. BP finally surpassed all offers with a first bid of $27 per share, which was then reduced to $25. BP justified this reduction by different modelled cost structures after the due diligence. However, after a call between the board of Archaea and representatives of BP, they were able to reach a final agreement on $26 per share.

On November 11th the Board of Archaea invited its Shareholders to a virtual meeting which took place in December, where they voted over the merger agreement. It declared itself in favour of the proposal. BP’s chief executive Bernard Looney, very much in favour of the transaction, publicly said, that “it’s the best deal I’ve seen inside the company since we did Aker BP in 2016” and outlines it as “absolutely the right deal” for its shareholders.

Conclusion

The renewable energy megatrend has proven its persistence, and even a grandiose oil colossus like BP has been able to recognise this. Instead of fighting back and trying to swim against the current, BP has, paradoxically, become one of the biggest investors in the energy transition, accelerating the downfall of their current energy winners.

BP’s keenness to lead the energy transition is evident. Whether or not the corporation’s large commitments have been made at an excessively early stage is at question, however. Although it is an energy sector with an extraordinary pace of innovation, there is no telling when renewables will overtake traditional sources of energy – nonetheless, a bet BP must be willing to take, in an attempt to avoid having to catch up later on, or, even worse, being left behind.

SOURCES

- Public SEC Filings of Archaea

- Financial Times

- BP PLC

- United Nations Framework Convention on Climate Change

- Archaea Energy

- Statista Global Renewable Energy Trends Report 2021

- Statista Global LNG Industry Report 2022

- Global Energy Prices

- U.S. Department of Energy

- FactSet