Nikkei 225 is considered the most representative index not only for the Japanese economy but also for the entire Asian region. The Japanese economy shows an incredible reliance on two main sectors: electric components and automotive, accounting for more than 50% of its GDP. It is not a surprise, indeed, that the two sectors have a 41% share of the Nikkei 225 index total weight. Concerning the Automotive sector, Japan has one of the biggest and long-lasting conglomerates, the “zaibatsu” area. The Electric Machinery industry is less consolidated and basically divided in big firms, which are leader in this sector, and third-party medium sized firms which are part of the supply chain in the electric components production.

The automotive industry is more consolidated with respect to the Electric counterpart, due to the economies of scale needed in order to cover the big sunk costs producing vehicles. In the last two decades, big companies such Toyota, Nissan, Honda, Suzuki, Mazda, Mitsubishi and Subaru have delocalized their plants from Japan to every continent, especially in continental Asia, in order to create their global hegemony in the global automotive industry. They strongly rely on the Chinese market as a growth driver and they had a leading role in Chinese car production. Since 2009, China has surpassed Japan in the number of cars produced. In the meanwhile, China has become the most important market after the US for Japanese car producers, even more important of the entire European region.

The automotive industry is more consolidated with respect to the Electric counterpart, due to the economies of scale needed in order to cover the big sunk costs producing vehicles. In the last two decades, big companies such Toyota, Nissan, Honda, Suzuki, Mazda, Mitsubishi and Subaru have delocalized their plants from Japan to every continent, especially in continental Asia, in order to create their global hegemony in the global automotive industry. They strongly rely on the Chinese market as a growth driver and they had a leading role in Chinese car production. Since 2009, China has surpassed Japan in the number of cars produced. In the meanwhile, China has become the most important market after the US for Japanese car producers, even more important of the entire European region.

In the last two weeks, the main Japanese car maker have released their quarterly earnings for the last quarter of 2018, revising downward their earnings outlook for 2019. Toyota Motor Corporation has released their FY2018 results missing earnings forecasts. Finally, Honda Motors Inc. has recorded a 40.2% decrease of their operating revenues YoY. This cannot be only explained only by the cyclicality of the car industry, which is following the turning economic cycle as can be seen from figure 1. It can be seen how the main US competitors as General Motors and Ford have upbeat the consensus estimates for revenues and earnings given the fact that 2018 has been still a positive year for global carmakers both in the US and in Europe.

At the same time, Japanese carmakers are paying their strong presence in the Chinese market with respect to their global competitors. The electric components companies have a massive presence in the Asian region as well and their profitability mainly depend on the investments growth rate. Until now, they strongly benefited from the digitalization of emerging markets and the raising middle class but a slowdown of the Chinese economy could put a severe break to their expansion in the Asian region which represent the first market so far, taking into account that India and China are the two countries are the highest infrastructures and communication investments growth rate.

At the same time, Japanese carmakers are paying their strong presence in the Chinese market with respect to their global competitors. The electric components companies have a massive presence in the Asian region as well and their profitability mainly depend on the investments growth rate. Until now, they strongly benefited from the digitalization of emerging markets and the raising middle class but a slowdown of the Chinese economy could put a severe break to their expansion in the Asian region which represent the first market so far, taking into account that India and China are the two countries are the highest infrastructures and communication investments growth rate.

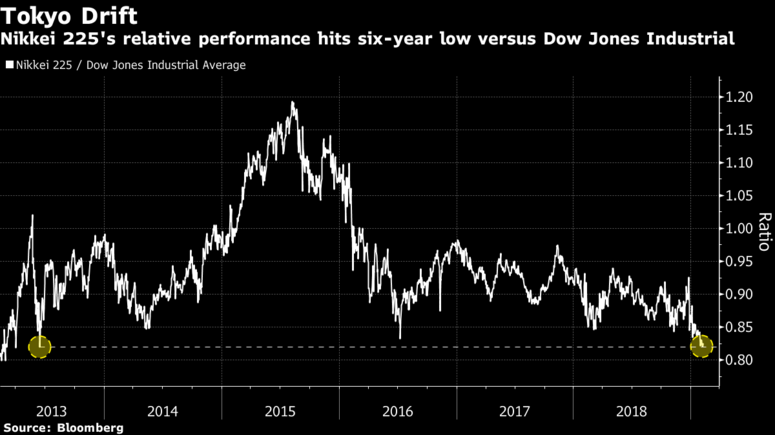

The Nikkei 225 performance is already paying the strong reliance on the automotive industry. From figure 2, it can be seen how the ratio between Nikkei 225 with respect to the DJIA has hit its lowest level since 2013 figure 2, and it represents a clear signal that the Japanese companies are suffering their overexposure on Chinese market.

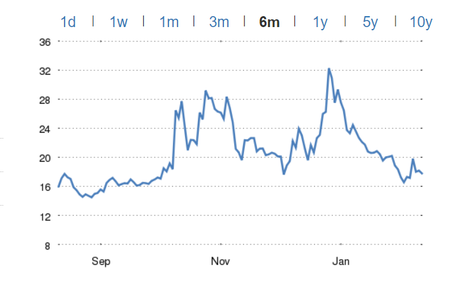

Nikkei 225 index is already famous for its incredibly high annual volatility, especially in bearish periods figure 3, and this trend could strongly affect the access to equity markets for Japanese companies. A prolonged slowdown in the Asian region can put into serious trouble Japanese equities and rapidly translate in a damaging sell-off of the main two sectors on which the third biggest economy in the world is based.

Nikkei 225 index is already famous for its incredibly high annual volatility, especially in bearish periods figure 3, and this trend could strongly affect the access to equity markets for Japanese companies. A prolonged slowdown in the Asian region can put into serious trouble Japanese equities and rapidly translate in a damaging sell-off of the main two sectors on which the third biggest economy in the world is based.

Riccardo Nocita