Introduction

Following Russia’s invasion of Ukraine on February 24, there has been much discussion of its global implications. Markets were swept with uncertainty and countries began to respond to Russia’s actions politically and economically. This article examines the financial positions of Japan, India, and China. It also takes a deeper dive into the effects of the invasion on China’s geopolitical stance and its goal of destabilizing the dollar as the dominant currency while increasing the strength of its own.

The Financial Implications of the Russia- Ukraine Crisis in Japan

Prime Minister Kishida Fumio has openly and publicly condemned Russia’s war of aggression, saying that Russia’s acts that use force to change borders are a challenge to international order, European security, and Indo-Pacific security. Japan’s public opinion has been consistent, remaining unified in opposition to the conflict, driven partly by public sentiment that stems from historical and territorial disputes dating back to WW2.

Though Japanese policymakers see trade relations with Russia as less important than Japan’s relations with China, the United States, and even Southeast Asia, the conflict has still impacted and involved Japan despite its work to keep distance prior. In response to Putin’s continued attacks, Japan has prohibited exports to Russia that include cutting-edge technology exports like semiconductors along with a lengthy list of Russian military and security entities banned from accessing Japanese exports of any kind.

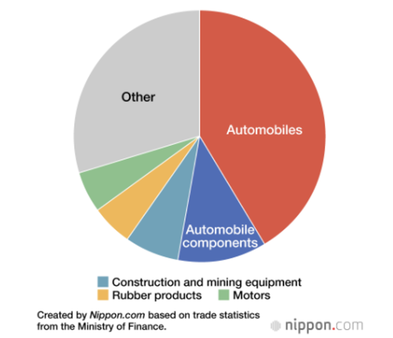

In 2021, Japanese imports to Russia increased by 37.4% to ¥862.4 billion primarily through the sale of automobiles and components. While sanctions have been imposed in response to prohibiting semiconductor exports, the total export value for these goods in 2021 comprised only about ¥584 million or 0.1% of the overall value.

Following Russia’s invasion of Ukraine on February 24, there has been much discussion of its global implications. Markets were swept with uncertainty and countries began to respond to Russia’s actions politically and economically. This article examines the financial positions of Japan, India, and China. It also takes a deeper dive into the effects of the invasion on China’s geopolitical stance and its goal of destabilizing the dollar as the dominant currency while increasing the strength of its own.

The Financial Implications of the Russia- Ukraine Crisis in Japan

Prime Minister Kishida Fumio has openly and publicly condemned Russia’s war of aggression, saying that Russia’s acts that use force to change borders are a challenge to international order, European security, and Indo-Pacific security. Japan’s public opinion has been consistent, remaining unified in opposition to the conflict, driven partly by public sentiment that stems from historical and territorial disputes dating back to WW2.

Though Japanese policymakers see trade relations with Russia as less important than Japan’s relations with China, the United States, and even Southeast Asia, the conflict has still impacted and involved Japan despite its work to keep distance prior. In response to Putin’s continued attacks, Japan has prohibited exports to Russia that include cutting-edge technology exports like semiconductors along with a lengthy list of Russian military and security entities banned from accessing Japanese exports of any kind.

In 2021, Japanese imports to Russia increased by 37.4% to ¥862.4 billion primarily through the sale of automobiles and components. While sanctions have been imposed in response to prohibiting semiconductor exports, the total export value for these goods in 2021 comprised only about ¥584 million or 0.1% of the overall value.

2021 Export Breakdown from Japan to Russia. Source: Ministry of Finance

Along with export sanctions, public and political support, Japan has also supported Moscow's removal from the SWIFT international banking system, a more decisive and effective stance than actions taken against Putin in past conflicts.

The most complicated financial implication of the crisis remains the immediate concern for Japan in terms of its energy security. Although government figures show that a mere 4% of Japan's crude oil and 9% of its liquified natural gas is supplied by Russia, stake in projects on the Russian island of Sakhalin complicate the issue. Shareholders in Sakhalin-1 which produces oil include Rosneft and a Japanese government-led consortium with a 30% stake. Sakhalin-1 is said to produce 220,000 barrels of oil a day. Sakhalin-2 produces natural gas that is liquefied and shipped overseas. Japan buys about 60% of the output from the project led by gas exporter Gazprom, with a stake also held by Japan’s Mitsui & Co. and Mitsubishi. SODECO (Japan's Sakhalin Oil and Gas Development Co.) has a 30% stake in Sakhalin-1 and to further ties to the oil project, Japan's Ministry of Economy, Trade and Industry has a 50% stake in SODECO.

While other prominent investors like ExxonMobil, BP, and Shell made statements that indicated that they would discontinue operations at its Sakhalin-1 oil and gas development in Russia amid the Ukraine invasion. Japan has not pulled out of investments despite the disapproval of the Russia- Ukraine conflict.

The Financial Implications of the Russia- Ukraine Crisis in India

On February 26th, the United Nations Security Council held a meeting to vote and discuss resolutions demanding the immediate end of Russian military attacks on Ukraine. India remained one of only three countries present that abstained from formal opposition. Privately, the Indian Prime Minister urged Putin to cease violence and take part in international dialogues to promote peace, but publically representatives have refrained from taking a hard stance against Russia.

The Delhi-Moscow relationship was established because of a “special and privileged” strategic partnership in the 70s and 80s and has persisted due to common interests and opinions, especially in terms of the balance of power in Eurasia. Additionally, the minimal security interests that India has in Europe help to explain its stance.

From a financial standpoint, the lack of opposition from India in the Russia-Ukraine conflict can also be viewed as a result of financial dependencies between both powers on military arms, ammunition, oil, and more.

A highlight of the defense cooperation has been the US$5.43 billion deal for the S-400 air defense system, which Russia began delivering in December 2021. Russian-made weapons have been critical to India’s ability to protect against external tensions in China as well as Pakistan. While India has remained neutral in comparison to China, private calls for cease of violence are still driven by the negative financial implications that have and will continue to impact India's stressed economy.

India primarily imports fuels, precious stones, mineral oils, boilers, fertilizers, equipment, and machinery, among other goods from Russia. Exports include pharma products, vehicles, organic chemicals, and more to Russia. In the fiscal year ended March 2021, India and Russia had bilateral trade of $8.1 billion with $2.6 billion in exports to Russia and $5.5 billion in imports.

Rising crude oil prices driven by the conflict have had an impact on India’s markets by contributing to rupee depreciation, rising fiscal deficit, and increasing inflation. According to estimates, a 10% surge in oil prices can increase inflation by 40 basis points (bps), raise the fiscal deficit by 30 bps, and reduce GDP growth by 20 bps. However, long-term growth forecasts for the overall Indian market remain resilient.

One sector that will be especially adversely affected is the pharmaceutical sector. Leading Indian Pharmaceutical companies, Sun Pharmaceuticals and Dr. Reddy’s Laboratories (DRL), have had a presence in Russia and Ukraine for three decades. Today, both companies run production in this region. The pharmaceutical industry depends on imports for 90% of its API (Active Pharmaceutical Ingredient) needs, and the Ukraine crisis is predicted to increase the overall volatility of API prices because of a large portion of production coming from these territories which have become a major concern for the sector.

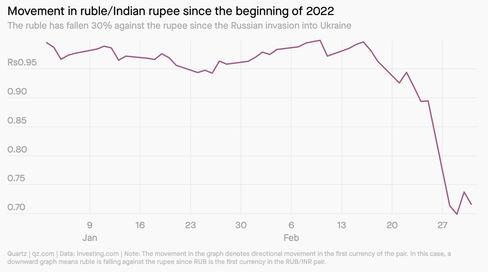

The current sanctions have also become a growing concern because of payments, both current and past for Pharma exports. The Pharmaceuticals Export Promotion Council (Pharmexcil) reported that in 2020-21, pharma exports to Russia and Ukraine amounted to $591 million and $181 million, respectively, or less than 3 percent of total pharma exports. About $400 million in unrealized receipts for exports that have already been shipped and most of those unrealized receipts come from Russia, which means steep financial for exporters and continued uncertainty with Russia's volatile currency and ban from SWIFT.

The most complicated financial implication of the crisis remains the immediate concern for Japan in terms of its energy security. Although government figures show that a mere 4% of Japan's crude oil and 9% of its liquified natural gas is supplied by Russia, stake in projects on the Russian island of Sakhalin complicate the issue. Shareholders in Sakhalin-1 which produces oil include Rosneft and a Japanese government-led consortium with a 30% stake. Sakhalin-1 is said to produce 220,000 barrels of oil a day. Sakhalin-2 produces natural gas that is liquefied and shipped overseas. Japan buys about 60% of the output from the project led by gas exporter Gazprom, with a stake also held by Japan’s Mitsui & Co. and Mitsubishi. SODECO (Japan's Sakhalin Oil and Gas Development Co.) has a 30% stake in Sakhalin-1 and to further ties to the oil project, Japan's Ministry of Economy, Trade and Industry has a 50% stake in SODECO.

While other prominent investors like ExxonMobil, BP, and Shell made statements that indicated that they would discontinue operations at its Sakhalin-1 oil and gas development in Russia amid the Ukraine invasion. Japan has not pulled out of investments despite the disapproval of the Russia- Ukraine conflict.

The Financial Implications of the Russia- Ukraine Crisis in India

On February 26th, the United Nations Security Council held a meeting to vote and discuss resolutions demanding the immediate end of Russian military attacks on Ukraine. India remained one of only three countries present that abstained from formal opposition. Privately, the Indian Prime Minister urged Putin to cease violence and take part in international dialogues to promote peace, but publically representatives have refrained from taking a hard stance against Russia.

The Delhi-Moscow relationship was established because of a “special and privileged” strategic partnership in the 70s and 80s and has persisted due to common interests and opinions, especially in terms of the balance of power in Eurasia. Additionally, the minimal security interests that India has in Europe help to explain its stance.

From a financial standpoint, the lack of opposition from India in the Russia-Ukraine conflict can also be viewed as a result of financial dependencies between both powers on military arms, ammunition, oil, and more.

A highlight of the defense cooperation has been the US$5.43 billion deal for the S-400 air defense system, which Russia began delivering in December 2021. Russian-made weapons have been critical to India’s ability to protect against external tensions in China as well as Pakistan. While India has remained neutral in comparison to China, private calls for cease of violence are still driven by the negative financial implications that have and will continue to impact India's stressed economy.

India primarily imports fuels, precious stones, mineral oils, boilers, fertilizers, equipment, and machinery, among other goods from Russia. Exports include pharma products, vehicles, organic chemicals, and more to Russia. In the fiscal year ended March 2021, India and Russia had bilateral trade of $8.1 billion with $2.6 billion in exports to Russia and $5.5 billion in imports.

Rising crude oil prices driven by the conflict have had an impact on India’s markets by contributing to rupee depreciation, rising fiscal deficit, and increasing inflation. According to estimates, a 10% surge in oil prices can increase inflation by 40 basis points (bps), raise the fiscal deficit by 30 bps, and reduce GDP growth by 20 bps. However, long-term growth forecasts for the overall Indian market remain resilient.

One sector that will be especially adversely affected is the pharmaceutical sector. Leading Indian Pharmaceutical companies, Sun Pharmaceuticals and Dr. Reddy’s Laboratories (DRL), have had a presence in Russia and Ukraine for three decades. Today, both companies run production in this region. The pharmaceutical industry depends on imports for 90% of its API (Active Pharmaceutical Ingredient) needs, and the Ukraine crisis is predicted to increase the overall volatility of API prices because of a large portion of production coming from these territories which have become a major concern for the sector.

The current sanctions have also become a growing concern because of payments, both current and past for Pharma exports. The Pharmaceuticals Export Promotion Council (Pharmexcil) reported that in 2020-21, pharma exports to Russia and Ukraine amounted to $591 million and $181 million, respectively, or less than 3 percent of total pharma exports. About $400 million in unrealized receipts for exports that have already been shipped and most of those unrealized receipts come from Russia, which means steep financial for exporters and continued uncertainty with Russia's volatile currency and ban from SWIFT.

Ruble volatility since the beginning of 2022. Source: Quartz

China’s Political Interests

China’s political position is very delicate. In fact, Beijing is walking what some policy analysts are calling a diplomatic tightrope. Not only is President Xi Jinping looking to maintain China’s power and position on the world stage, but he is also weighing the conflict’s domestic significance and what it could mean for his smooth re-election for a third term as the party’s general secretary later this year. Thus, his leadership in navigating China’s response to the crisis is particularly important.

In early February, Xi hosted Putin at a China-Russia summit and declared that their friendship had “no limits.” They expanded their existing oil and gas partnership through two new agreements worth $117.5 billion, with the China National Petroleum Corporation (CNPC) and Russia’s Gazprom agreeing to supply 10 billion cubic meters (bcm) of gas from Russia to China per year in addition to the purchase of 100 million tonnes of crude oil from Russia’s Rosneft over the next 10 years. However, the more salient outcome of the conference was the show of force that came from strengthening the China-Russia partnership. In recent years, Xi has continued to identify the U.S. as a significant threat to Chinese interests. Thus, showing a close-knit relationship with Russia also helps to weaken U.S. dominance on the global stage. Nevertheless, it is apparent that the Russia-China friendship must have some limits if Xi hopes to maintain China’s purported neutrality and more importantly, avoid U.S. penalties.

On February 25th, in the spirit of “neutrality,” China refused to condemn Russia’s attack on Ukraine. Rather than vetoing the U.N. Security Council resolution that would have denounced Russia’s invasion, China chose to abstain. China has also refused to use the term “invasion” with regard to Russia’s actions and has formally recognized Putin’s “legitimate security concerns.” On March 18, foreign ministry spokesperson, Zhao Lijan, reaffirmed that China stands “for respecting the sovereignty and territorial integrity of all countries” and went on to note that China has consistently promoted peace talks and has put forward a six-point humanitarian initiative for Ukraine. Moreover, much of the Chinese perspective of the Ukraine crisis is marked by criticism towards the U.S. Rather than blaming Russia, China has shifted the blame towards the U.S., citing its leadership in promoting NATO’s eastward expansion and instigating the crisis. In the same press conference, Lijan called on the U.S. to reflect on its role in fueling this crisis and the subsequent damage to Ukraine. By turning the lens towards the U.S., China is able to justify its ties with Russia while continuing to promote its vision for a new world order that minimizes U.S. dominance.

China’s Financial Interests

Beijing’s reluctance to extend more aid towards Russia and maintain neutrality is reflected in its trade relationships. The EU and the U.S. are two of China’s biggest trade partners. Just last year, the EU accounted for about 15% of the country’s total export and the U.S. for approximately 18%. Thus, offering too much support to Russia could lead to unwanted backlash and consequences for the Chinese economy. It is also unclear the extent to which China could offer its support. In spite of the new trade agreements with Russia earlier this year, neither offers immediate relief for the Russian economy and with Russia only accounting for 2% of China’s total export, China’s top priority is keeping stability in its own economy. In fact, amidst reports that China was perhaps willing to supply armed drones to Russia, the Hang Seng China Enterprises index fell 7.2% on March 15, but rallied later in the week when Vice Premier Liu He calmed investors by promising looser policies that would help to protect capital markets. Foreign Minister Wang Yi also reasserted that, “China is not a party to the crisis, nor does it want the sanctions to affect China.” Thus, it is clear that China does not want to place increased pressure on its own markets or face the potential for the U.S. to impose secondary sanctions – a potential China was reminded of by President Biden earlier this week when he warned Xi of the consequences should China provide assistance to Russia.

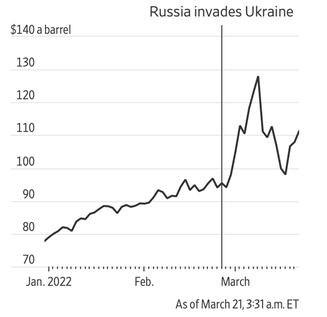

Furthermore, with China being the world’s largest importer of crude oil, the volatility in oil prices carries a lot of uncertainty for the Chinese economy. Last year, China imported $253 billion in crude oil. Following Russia’s invasion of Ukraine, prices spiked to nearly $130 per barrel and are currently at $111 (as of March 21), which is still well above the $77 they were trading at earlier this year. The steep rise in prices could slow growth in the Chinese economy. However, there has been some speculation that China could offset this hike by leveraging its neutral position with Russia for cheaper barrels, but again, the Chinese are wary of extending economic assistance towards Russia.

China’s political position is very delicate. In fact, Beijing is walking what some policy analysts are calling a diplomatic tightrope. Not only is President Xi Jinping looking to maintain China’s power and position on the world stage, but he is also weighing the conflict’s domestic significance and what it could mean for his smooth re-election for a third term as the party’s general secretary later this year. Thus, his leadership in navigating China’s response to the crisis is particularly important.

In early February, Xi hosted Putin at a China-Russia summit and declared that their friendship had “no limits.” They expanded their existing oil and gas partnership through two new agreements worth $117.5 billion, with the China National Petroleum Corporation (CNPC) and Russia’s Gazprom agreeing to supply 10 billion cubic meters (bcm) of gas from Russia to China per year in addition to the purchase of 100 million tonnes of crude oil from Russia’s Rosneft over the next 10 years. However, the more salient outcome of the conference was the show of force that came from strengthening the China-Russia partnership. In recent years, Xi has continued to identify the U.S. as a significant threat to Chinese interests. Thus, showing a close-knit relationship with Russia also helps to weaken U.S. dominance on the global stage. Nevertheless, it is apparent that the Russia-China friendship must have some limits if Xi hopes to maintain China’s purported neutrality and more importantly, avoid U.S. penalties.

On February 25th, in the spirit of “neutrality,” China refused to condemn Russia’s attack on Ukraine. Rather than vetoing the U.N. Security Council resolution that would have denounced Russia’s invasion, China chose to abstain. China has also refused to use the term “invasion” with regard to Russia’s actions and has formally recognized Putin’s “legitimate security concerns.” On March 18, foreign ministry spokesperson, Zhao Lijan, reaffirmed that China stands “for respecting the sovereignty and territorial integrity of all countries” and went on to note that China has consistently promoted peace talks and has put forward a six-point humanitarian initiative for Ukraine. Moreover, much of the Chinese perspective of the Ukraine crisis is marked by criticism towards the U.S. Rather than blaming Russia, China has shifted the blame towards the U.S., citing its leadership in promoting NATO’s eastward expansion and instigating the crisis. In the same press conference, Lijan called on the U.S. to reflect on its role in fueling this crisis and the subsequent damage to Ukraine. By turning the lens towards the U.S., China is able to justify its ties with Russia while continuing to promote its vision for a new world order that minimizes U.S. dominance.

China’s Financial Interests

Beijing’s reluctance to extend more aid towards Russia and maintain neutrality is reflected in its trade relationships. The EU and the U.S. are two of China’s biggest trade partners. Just last year, the EU accounted for about 15% of the country’s total export and the U.S. for approximately 18%. Thus, offering too much support to Russia could lead to unwanted backlash and consequences for the Chinese economy. It is also unclear the extent to which China could offer its support. In spite of the new trade agreements with Russia earlier this year, neither offers immediate relief for the Russian economy and with Russia only accounting for 2% of China’s total export, China’s top priority is keeping stability in its own economy. In fact, amidst reports that China was perhaps willing to supply armed drones to Russia, the Hang Seng China Enterprises index fell 7.2% on March 15, but rallied later in the week when Vice Premier Liu He calmed investors by promising looser policies that would help to protect capital markets. Foreign Minister Wang Yi also reasserted that, “China is not a party to the crisis, nor does it want the sanctions to affect China.” Thus, it is clear that China does not want to place increased pressure on its own markets or face the potential for the U.S. to impose secondary sanctions – a potential China was reminded of by President Biden earlier this week when he warned Xi of the consequences should China provide assistance to Russia.

Furthermore, with China being the world’s largest importer of crude oil, the volatility in oil prices carries a lot of uncertainty for the Chinese economy. Last year, China imported $253 billion in crude oil. Following Russia’s invasion of Ukraine, prices spiked to nearly $130 per barrel and are currently at $111 (as of March 21), which is still well above the $77 they were trading at earlier this year. The steep rise in prices could slow growth in the Chinese economy. However, there has been some speculation that China could offset this hike by leveraging its neutral position with Russia for cheaper barrels, but again, the Chinese are wary of extending economic assistance towards Russia.

Brent-crude future prices this year. Source: Factset

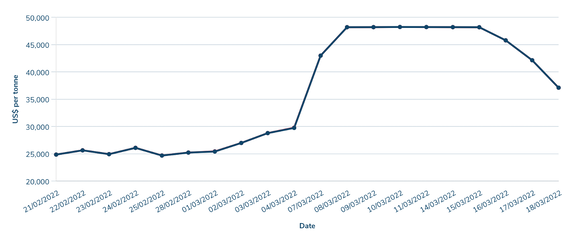

China is also sensitive to changes in other commodities. In 2021 alone, exports of electronic items contributed 17.1 percentage points to China’s 30% export growth. Two commodities vital to electronics are nickel, which is largely produced in Russia and used in EV battery production, and neon, which is used in the production of semiconductor chips and is supplied by Ukraine. Last week, the London Metal Exchange halted trading after the price of nickel soared to over $100,000 per metric ton. Since then, the LME has imposed daily price limits and the price of Nickel has been in free fall (trading at $37,000 as of March 21). Such volatility and the further shock to the semiconductor supply present significant challenges for the global supply chain and the Chinese, the world’s largest EV producer.

Nickel Prices. Source: LME

China’s purpose: less dollars, more renminbi

The Chinese central bank supported increasing the use of the renminbi in commercial transactions, which would change the equilibrium between global currencies. On one hand, "the dollar is king." Despite the comeback of some currencies in the last few days (for example, the euro against the US currency yesterday traveled around 1.10), the US currency is strengthened against many national currencies. On the other hand, the Chinese renminbi has begun to gain power over the dollar.

The use of the renminbi is widening throughout the world, offering China a greater opportunity to break the dominance of Western countries in global payments and finance. The Chinese currency finally overtook the Japanese yen in SWIFT’s international payments, ranking fourth in the world for the first time, and Saudi Arabia is considering whether to use the Chinese yuan for oil sales, leaving the U.S dollars. This is a pretty big deal. The petrodollar system is one of the major drivers that guaranteed the reputation of the USD as the world reserve currency. The world as we know it is changing rapidly.

Since 2014, in response to the backlash from the West to the Russian invasion of Crimea, Moscow and Beijing have sought to remove the US dollar from their trade deals. For example, from the Chinese purchase of Russian gas, the renminbi occupies a large slice of Russian foreign reserves. Currently, the Kremlin central bank holds 73 billion renminbi assets among its assets, comprising 13 percent of its total reserves. And, for the first time in history, in 2020, less than half of the commercial transactions between Russia and China took place in dollars. Consequently, the renminbi and the ruble rose by 25%. The central banks of the two countries also signed a currency exchange agreement, which was recently renewed for RMB 150 billion – further proving the consistency of the Russia-China relationship.

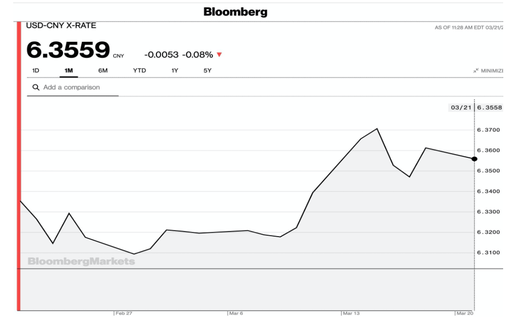

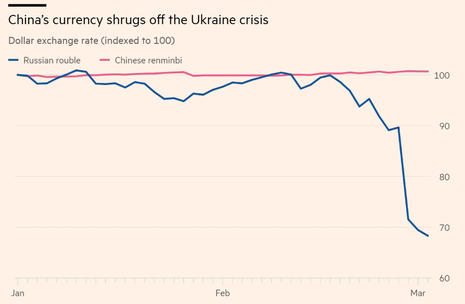

However, despite the sanctions imposed on Russia, which have left the ruble down more than 30 percent this year, the renminbi, the currency of Putin's strategic trading partner, has remained remarkably steady. The Chinese currency hit a four-year high of around RMB 6.31 against the dollar, despite a recent slowdown in the growth of the Chinese economy.

The Chinese central bank supported increasing the use of the renminbi in commercial transactions, which would change the equilibrium between global currencies. On one hand, "the dollar is king." Despite the comeback of some currencies in the last few days (for example, the euro against the US currency yesterday traveled around 1.10), the US currency is strengthened against many national currencies. On the other hand, the Chinese renminbi has begun to gain power over the dollar.

The use of the renminbi is widening throughout the world, offering China a greater opportunity to break the dominance of Western countries in global payments and finance. The Chinese currency finally overtook the Japanese yen in SWIFT’s international payments, ranking fourth in the world for the first time, and Saudi Arabia is considering whether to use the Chinese yuan for oil sales, leaving the U.S dollars. This is a pretty big deal. The petrodollar system is one of the major drivers that guaranteed the reputation of the USD as the world reserve currency. The world as we know it is changing rapidly.

Since 2014, in response to the backlash from the West to the Russian invasion of Crimea, Moscow and Beijing have sought to remove the US dollar from their trade deals. For example, from the Chinese purchase of Russian gas, the renminbi occupies a large slice of Russian foreign reserves. Currently, the Kremlin central bank holds 73 billion renminbi assets among its assets, comprising 13 percent of its total reserves. And, for the first time in history, in 2020, less than half of the commercial transactions between Russia and China took place in dollars. Consequently, the renminbi and the ruble rose by 25%. The central banks of the two countries also signed a currency exchange agreement, which was recently renewed for RMB 150 billion – further proving the consistency of the Russia-China relationship.

However, despite the sanctions imposed on Russia, which have left the ruble down more than 30 percent this year, the renminbi, the currency of Putin's strategic trading partner, has remained remarkably steady. The Chinese currency hit a four-year high of around RMB 6.31 against the dollar, despite a recent slowdown in the growth of the Chinese economy.

Dollar-renminbi exchange rate. Source: Bloomberg

In order to become more independent of Western-controlled financial infrastructures such as SWIFT, China has spent the last decade building out its renminbi-denominated Cross-Border Interbank Payments System (CIPS). In 2020, CIPS payments increased about 20%, reaching RMB 45.2 trillion. Since the removal of seven Russian banks from SWIFT following Russia’s invasion, there has been some speculation regarding whether Chinese banks will help to alleviate the impact of the sanctions on Russia through the use of CIPS. Doing so, would represent a historic opportunity for its currency. China would be able to exploit the international isolation of the ruble to expand the use of its reminbi based payment infrastructure. However, the CIPS infrastructure pales in comparison to SWIFT (only processing approximately 13,000 transactions per day versus SWIFT’s 40 million messages), and CIPS counts approximately 1,200 member institutions across 100 countries, which is significantly smaller than SWIFT’s 11,000 members. Besides, Chinese banks are still heeding the potential of secondary sanctions, as many transactions still rely on the dollar. Thus, the threat of any possible retaliation from Western countries limits the ability of Chinese financial institutions to give sustainable backing to Russia.

As we can see below, the renminbi is currently holding up considerably against the ruble. But if sanctions were extended against the Chinese economy, it would be very unlikely that the renminbi could continue to show its strength. Hence, it is unlikely that China will extend aid on this front.

As we can see below, the renminbi is currently holding up considerably against the ruble. But if sanctions were extended against the Chinese economy, it would be very unlikely that the renminbi could continue to show its strength. Hence, it is unlikely that China will extend aid on this front.

Source: Financial Times

Jensen Gutzwiller

Ava Trahan

Leonardo Grandini