Sports teams were traditionally viewed as trophy assets owned by wealthy individuals. Financial returns have never been the primary reason to acquire a sports team. Thus, it is not surprising that most clubs have been consistently unprofitable. However, things started to change. In the last few years, we have witnessed an increase in financial sponsors' investments in the sports industry. European football clubs are the most popular targets, either for buyouts or minority investments. But what are the factors driving the surge of investments? And will PE firms be able to add financial discipline to the beautiful game?

Europe’s Sports Industry

Europe stands as a global leader in the sports industry, with a value exceeding €150bn, as of 2023. This market size encompasses a vast range of sports-related activities, from professional sports leagues and sporting goods manufacturing to sports media, betting, and tourism.

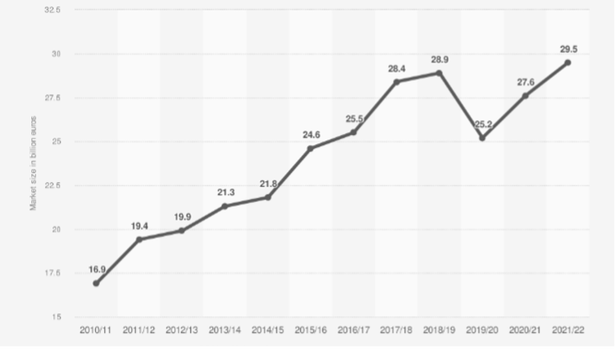

Among the professional sports leagues and teams, football plays a key role. Over the past decade, the size of the professional football market has nearly doubled, reaching an all-time high of €29.5bn last year. The most important clubs are Real Madrid, FC Barcelona, and Manchester United, consistently present in the top ranks of the most valuable sports franchises globally, with each being valued at over €3bn.

Europe stands as a global leader in the sports industry, with a value exceeding €150bn, as of 2023. This market size encompasses a vast range of sports-related activities, from professional sports leagues and sporting goods manufacturing to sports media, betting, and tourism.

Among the professional sports leagues and teams, football plays a key role. Over the past decade, the size of the professional football market has nearly doubled, reaching an all-time high of €29.5bn last year. The most important clubs are Real Madrid, FC Barcelona, and Manchester United, consistently present in the top ranks of the most valuable sports franchises globally, with each being valued at over €3bn.

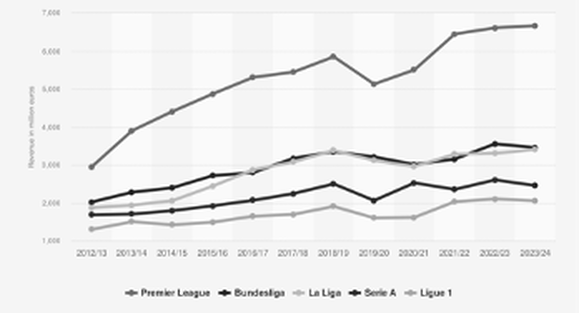

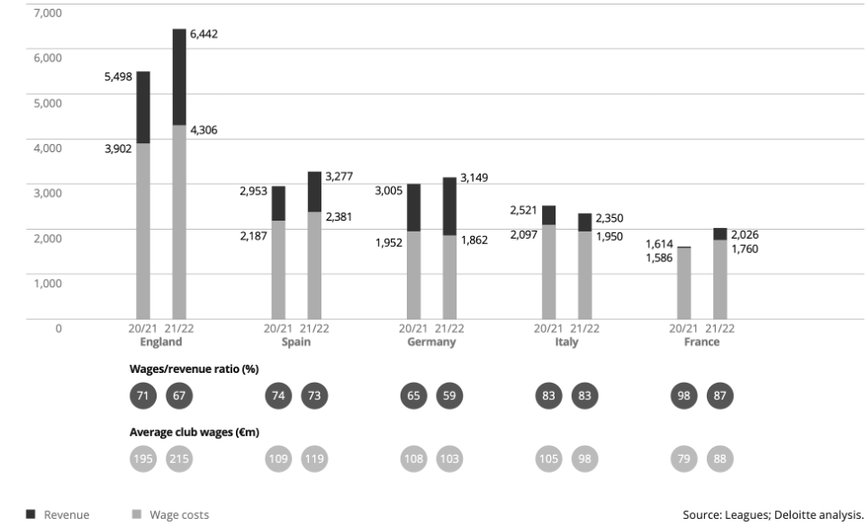

In the 2021/2022 season, the English Premier League generated approximately €6.5bn in revenue, mainly from broadcasting deals. In the continent, it is followed well behind by the Spanish Liga and the German Bundesliga. Overall, the so-called Big-Five European leagues, which also include the Italian Serie A and the French League 1, reported €17.2bn in revenue.

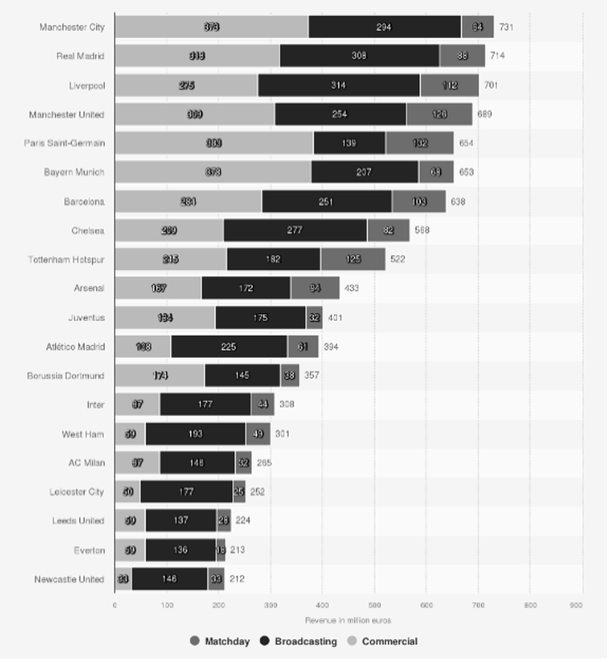

Football teams have a diversified income structure and the possibility to exploit multiple business areas. The most important one is given by sponsorships with corporations and advertising partnerships, fundamental to the financial health of sports teams. Teams display sponsor logos on their jerseys and across their stadiums with hospitality, VIP areas, and pitch-side advertising. For example, FC Barcelona's shirt sponsorship with Spotify is reportedly worth €70mn annually. Furthermore, societies monetize their digital presence through website ads, social media sponsorships, and subscription-based content founded on fanbase engagement. Related to this aspect, sales of branded merchandise, such as jerseys, caps, and memorabilia, significantly increase the revenue streams of sports teams. In 2020, Real Madrid reported over €60mn in merchandising revenue, which made up 24.7% of total sales.

The second most important revenue source is represented by broadcasting rights. Television networks, both domestic and international, pay substantial sums for the rights to broadcast matches, allowing teams to connect with fans from all corners of the world, further bolstering their brand. Digital streaming provides flexibility for fans to access content on various devices and platforms, increasing the reach of the team's content. From 2018 to 2021, the UEFA Champions League’s Teams sold their broadcasting rights for a staggering €3.2bn.

Ticket sales make up the lowest part. They can vary significantly depending on the size and popularity of the team, high-demand matches, and iconic clubs can command premium ticket prices. For example, in the 2021/2022 season, the English Premier League's matchday revenue exceeded a record of €900mn.

The second most important revenue source is represented by broadcasting rights. Television networks, both domestic and international, pay substantial sums for the rights to broadcast matches, allowing teams to connect with fans from all corners of the world, further bolstering their brand. Digital streaming provides flexibility for fans to access content on various devices and platforms, increasing the reach of the team's content. From 2018 to 2021, the UEFA Champions League’s Teams sold their broadcasting rights for a staggering €3.2bn.

Ticket sales make up the lowest part. They can vary significantly depending on the size and popularity of the team, high-demand matches, and iconic clubs can command premium ticket prices. For example, in the 2021/2022 season, the English Premier League's matchday revenue exceeded a record of €900mn.

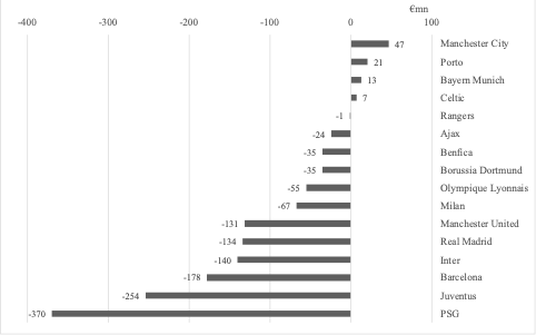

The profitability of football teams varies widely based on factors such as the team's performance, its fan base, and its management. Top-tier clubs are characterized by the presence of wealthy investors or ownership groups that infuse significant capital into the club to acquire top players, world-class coaching staff, and facilities. For example, clubs like Paris Saint-Germain and Manchester City have gained financial backing respectively from Nasser Al-Khelaifi and Sheikh Mansour, wealthy owners who have transformed their clubs into global football powerhouses, by allowing them to pay large transfer fees and high player salaries.

On the other hand, self-sustaining football clubs primarily rely on their own revenue streams to cover operating expenses. This model is commonly found in clubs of varying sizes and levels of success, which tend to invest in developing young talents through their academies and aim to sell players for substantial transfer fees when opportunities arise. When young talents reach a certain level of skill and marketability, they are sold to other clubs at a profit.

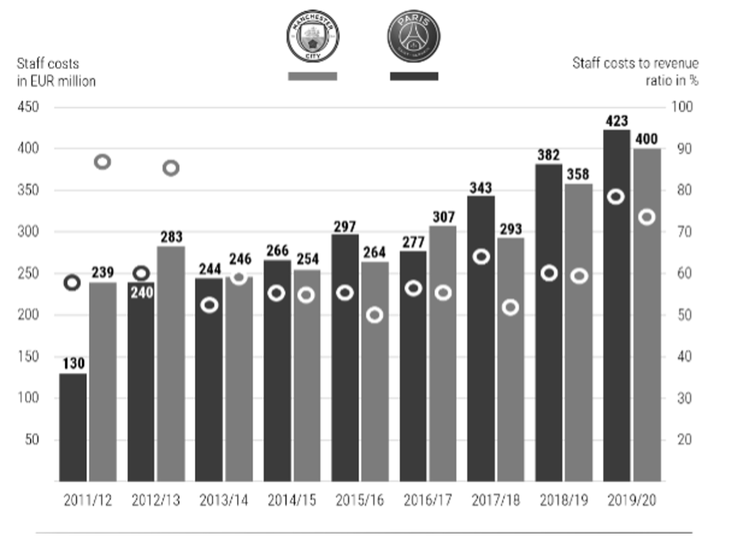

Football clubs are hardly profitable for several reasons, among all the significant costs caused by players and staff wages. This includes coaches, medical professionals, administrative personnel, and technical staff, necessary to ensure the proper functioning of the team. The wages/revenue ratio for most clubs is between 60 and 90%, as the chart below shows.

Football clubs are hardly profitable for several reasons, among all the significant costs caused by players and staff wages. This includes coaches, medical professionals, administrative personnel, and technical staff, necessary to ensure the proper functioning of the team. The wages/revenue ratio for most clubs is between 60 and 90%, as the chart below shows.

The Covid-19 pandemic pushed many clubs into financial distress, with UEFA estimating that European clubs lost over €10bn during the crisis. Premier League clubs alone reported pre-tax losses amounting to almost €2bn in the seasons starting in 2020 and 2021. Moreover, the desire for sports success, often fueled by owners with vast resources, has led to rapid cost inflation, particularly in the form of player salaries and transfer fees. Despite the revenue growth, the football culture prioritizes spending on players and investments in infrastructure over profit generation. This is testified by the fact that clubs have historically reinvested their income into the team rather than accumulating profits. The financial situation of football clubs started improving after the pandemic, but most of them remained loss-making firms.

Given these prospects of the European football industry, let us discuss why clubs have become increasingly targeted by private equity firms.

Macroeconomic Environment

The macroeconomic environment has a significant impact on the private equity industry in EMEA, including the sports sector, which has recently gained a lot of attention. PE firms are carefully monitoring the macroeconomic environment and adjusting their investment strategies accordingly. The most significant macro factors impacting investment activity are economic growth, market interest rates, and consumer confidence.

Economic growth is one of the most important macroeconomic factors that impacts PE investment in sports in EMEA as investors must conduct analyses and make predictions of the future before executing an investment idea. A strong economy leads to increased consumer spending on sports tickets, merchandise, and other sports-related products and services. This increased spending makes sports teams and leagues more valuable and attractive to PE investors. Hence, the sports industry, while not the most cyclical, still is somewhat dependent on the macroeconomic conditions. For example, the EMEA sports market is expected to grow from €282.5bn in 2022 to €382.1bn by 2029, at a CAGR of 5.1%. This growth is being driven by several factors, including the increasing popularity of sports in EMEA, the rising disposable incomes of consumers, and the growing investment in sports infrastructure and broadcasting.

Rising interest rates can make it more expensive for PE firms to finance their investments. This can lead to a decrease in investment activity in the sports sector.

For example, the European Central Bank (ECB) has been raising interest rates in an effort to combat inflation. This has led to an increase in the cost of capital for PE firms in EMEA, which could dampen their investment activity in the sports sector in the coming months. As current interest rates are frozen at 4.5% for the Euro Area and 5.25% for the UK, investors do not expect further interest rate hikes and we should see a rebound in PE activity in EMEA.

Consumer confidence is a measure of how optimistic consumers are about the future of the economy. When consumer confidence is high, consumers are more likely to spend money on sports tickets, merchandise, and other sports-related products and services, seeing as the industry can be categorized as “leisure and entertainment”, and not a necessity for most. This increased spending makes sports teams and leagues more valuable and attractive to investors during favorable macroeconomic conditions. Unfortunately, consumer confidence in EMEA has been declining in recent months due to concerns about inflation and rising interest rates. This decline in consumer confidence could lead to a decrease in investment activity in the sports sector in the coming months. But the good news is that as inflation starts to slow down, consumer confidence should begin to grow, especially as Central Banks are expected to begin lowering interest rates in mid-2024.

The recent macroeconomic conditions have had a mixed impact on PE investment in sports in EMEA. On the one hand, the COVID-19 pandemic caused a significant decline in sports revenue, which led to a decrease in investment activity in 2020. However, the industry has since rebounded strongly, as sports fans returned to stadiums and arenas and sports leagues resumed their full seasons. In 2022, PE firms invested a record €11.5bn in the sports sector in EMEA, up from €7.8bn in 2021. This investment was spread across a variety of sub-sectors, including professional sports teams and leagues, media and broadcasting rights, sports betting and gambling, and sports technology.

However, the current economic environment is challenging again. Rising inflation and interest rates are putting a strain on consumer spending and corporate budgets. This could lead to a slowdown in investment activity in the sports sector in EMEA in the coming months. Still, we are already starting to see a bit of improvement after such a challenging period and we are expecting a speedy recovery in mid-2024.

Financial sponsors are adjusting their investment strategies in response to the current macroeconomic environment. Some firms are focusing on investing in more defensive assets, such as sports broadcasting rights. These assets are typically less volatile than other types of sports assets, such as professional sports teams and leagues. Nonetheless, economic uncertainty does not seem to have stopped PE's appetite for sports investments.

The macroeconomic environment has a significant impact on the private equity industry in EMEA, including the sports sector, which has recently gained a lot of attention. PE firms are carefully monitoring the macroeconomic environment and adjusting their investment strategies accordingly. The most significant macro factors impacting investment activity are economic growth, market interest rates, and consumer confidence.

Economic growth is one of the most important macroeconomic factors that impacts PE investment in sports in EMEA as investors must conduct analyses and make predictions of the future before executing an investment idea. A strong economy leads to increased consumer spending on sports tickets, merchandise, and other sports-related products and services. This increased spending makes sports teams and leagues more valuable and attractive to PE investors. Hence, the sports industry, while not the most cyclical, still is somewhat dependent on the macroeconomic conditions. For example, the EMEA sports market is expected to grow from €282.5bn in 2022 to €382.1bn by 2029, at a CAGR of 5.1%. This growth is being driven by several factors, including the increasing popularity of sports in EMEA, the rising disposable incomes of consumers, and the growing investment in sports infrastructure and broadcasting.

Rising interest rates can make it more expensive for PE firms to finance their investments. This can lead to a decrease in investment activity in the sports sector.

For example, the European Central Bank (ECB) has been raising interest rates in an effort to combat inflation. This has led to an increase in the cost of capital for PE firms in EMEA, which could dampen their investment activity in the sports sector in the coming months. As current interest rates are frozen at 4.5% for the Euro Area and 5.25% for the UK, investors do not expect further interest rate hikes and we should see a rebound in PE activity in EMEA.

Consumer confidence is a measure of how optimistic consumers are about the future of the economy. When consumer confidence is high, consumers are more likely to spend money on sports tickets, merchandise, and other sports-related products and services, seeing as the industry can be categorized as “leisure and entertainment”, and not a necessity for most. This increased spending makes sports teams and leagues more valuable and attractive to investors during favorable macroeconomic conditions. Unfortunately, consumer confidence in EMEA has been declining in recent months due to concerns about inflation and rising interest rates. This decline in consumer confidence could lead to a decrease in investment activity in the sports sector in the coming months. But the good news is that as inflation starts to slow down, consumer confidence should begin to grow, especially as Central Banks are expected to begin lowering interest rates in mid-2024.

The recent macroeconomic conditions have had a mixed impact on PE investment in sports in EMEA. On the one hand, the COVID-19 pandemic caused a significant decline in sports revenue, which led to a decrease in investment activity in 2020. However, the industry has since rebounded strongly, as sports fans returned to stadiums and arenas and sports leagues resumed their full seasons. In 2022, PE firms invested a record €11.5bn in the sports sector in EMEA, up from €7.8bn in 2021. This investment was spread across a variety of sub-sectors, including professional sports teams and leagues, media and broadcasting rights, sports betting and gambling, and sports technology.

However, the current economic environment is challenging again. Rising inflation and interest rates are putting a strain on consumer spending and corporate budgets. This could lead to a slowdown in investment activity in the sports sector in EMEA in the coming months. Still, we are already starting to see a bit of improvement after such a challenging period and we are expecting a speedy recovery in mid-2024.

Financial sponsors are adjusting their investment strategies in response to the current macroeconomic environment. Some firms are focusing on investing in more defensive assets, such as sports broadcasting rights. These assets are typically less volatile than other types of sports assets, such as professional sports teams and leagues. Nonetheless, economic uncertainty does not seem to have stopped PE's appetite for sports investments.

Private Equity Investments in Sports

Since the beginning of 2023, there has been increased private equity interest across the entire sports sector. These institutional investors see secular growth opportunities in what has been classified as an ‘uncorrelated asset class’ by several funds. In the past 20 years, the increase in sports assets has averaged 10-12% to the S&P 500’s 7.03% (adjusted for inflation). Sports teams are particularly desirable due to factors such as finite and scarce assets, recurring revenue streams from content deals, and demonstrating resiliency during periods of macroeconomic turbulence. There are also greater investment opportunities due to the modern arrival of significant institutional capital, providing additional liquidity and professionalization to already well-established and regarded organizations. The salary cap structure, which ties player and team expenses to overall revenues, adjusts for any downsides for sponsors shelling out large sums on sports even in times of rising interest rates and the detrimental effect on balance sheets. Although there is not necessarily a preferred sport for such strategic partnerships, GMF Capital’s share in Motorsport Network Media and CVC Capital Partners’ investment in the Women’s Tennis Association is nowhere near as large deals as those that have occurred involving European football clubs.

Since the beginning of 2023, there has been increased private equity interest across the entire sports sector. These institutional investors see secular growth opportunities in what has been classified as an ‘uncorrelated asset class’ by several funds. In the past 20 years, the increase in sports assets has averaged 10-12% to the S&P 500’s 7.03% (adjusted for inflation). Sports teams are particularly desirable due to factors such as finite and scarce assets, recurring revenue streams from content deals, and demonstrating resiliency during periods of macroeconomic turbulence. There are also greater investment opportunities due to the modern arrival of significant institutional capital, providing additional liquidity and professionalization to already well-established and regarded organizations. The salary cap structure, which ties player and team expenses to overall revenues, adjusts for any downsides for sponsors shelling out large sums on sports even in times of rising interest rates and the detrimental effect on balance sheets. Although there is not necessarily a preferred sport for such strategic partnerships, GMF Capital’s share in Motorsport Network Media and CVC Capital Partners’ investment in the Women’s Tennis Association is nowhere near as large deals as those that have occurred involving European football clubs.

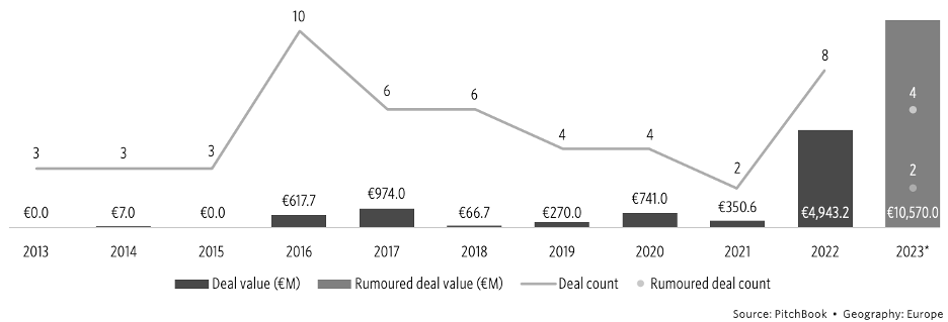

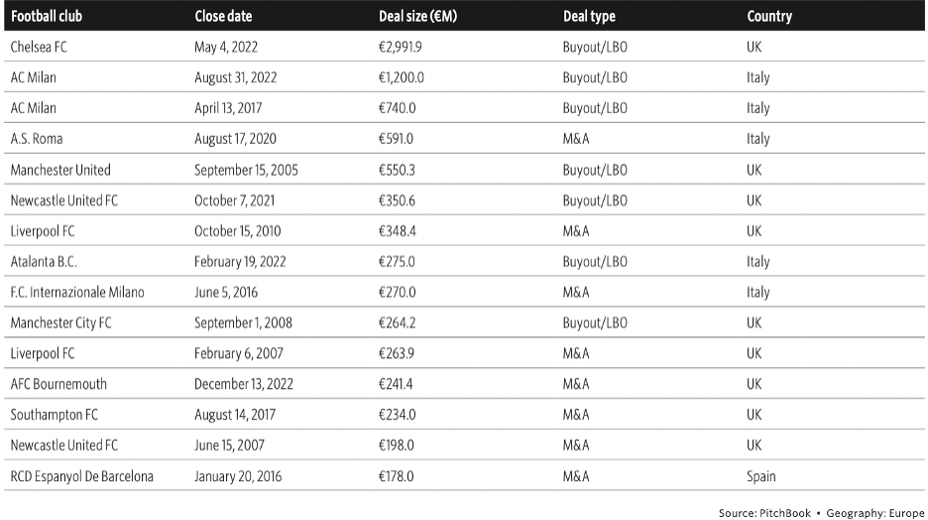

A combination of the financial distress from COVID-19 and high-performing private capital markets has led to Europe’s “Big Five” football leagues seeing a plethora of dealmaking. In the Big Five, 35.7% of the clubs have PE, VC, or private debt participation at the club-ownership level. These industries have turned to ownership of football teams in pursuit of uncorrelated returns, diversification, buy-and-build strategies, and prestige. The total deal value has soared from €66.7mn in 2018 to €4.9bn in 2022, and 2023 is expected to have the greatest total to date. Such value is due to contributions from Tricor Pacific Capital’s purchase of Treaty United FC, Dynasty Equity’s minority stake in Liverpool FC, and US Triestina Calcio 1918’s 100 percent acquisition by LBK Capital. Most recently, 777 Partners announced its plans to acquire a majority share of Everton FC, which is a unique deal due to its circumstances and the club’s financial performance.

In mid-September, British-Iranian businessman Farhad Moshiri signed an agreement with 777 partners for his 94.1% stake in the club to be acquired. The abrupt announcement is likely due to Everton’s breaking of Financial Fair Play rules, which poses a threat to the entire organization. The rules state that clubs are limited to a total loss of £105mn (€120.4mn) over three years. However, Everton announced losses of £44.7mn (€51.2mn) in 2022, £121.3mn (€139mn) in 2021, £139.9mn (€160.4mn) in 2020, £111.8mn (€128.1mn) in 2019 and £13.1mn (€15mn) in 2018, which is far higher than the rules allow for, even with the COVID-19 allowances. As a result, Everton is facing the threat of a 12-point deduction, which would give them a total of -5 points (as of 28/10/2023), a number that would almost guarantee relegation from the English Premier League by the season’s end. Therefore, it makes sense why Moshiri was so quick to sell his stake in the club he has been a shareholder of since 2016.

In mid-September, British-Iranian businessman Farhad Moshiri signed an agreement with 777 partners for his 94.1% stake in the club to be acquired. The abrupt announcement is likely due to Everton’s breaking of Financial Fair Play rules, which poses a threat to the entire organization. The rules state that clubs are limited to a total loss of £105mn (€120.4mn) over three years. However, Everton announced losses of £44.7mn (€51.2mn) in 2022, £121.3mn (€139mn) in 2021, £139.9mn (€160.4mn) in 2020, £111.8mn (€128.1mn) in 2019 and £13.1mn (€15mn) in 2018, which is far higher than the rules allow for, even with the COVID-19 allowances. As a result, Everton is facing the threat of a 12-point deduction, which would give them a total of -5 points (as of 28/10/2023), a number that would almost guarantee relegation from the English Premier League by the season’s end. Therefore, it makes sense why Moshiri was so quick to sell his stake in the club he has been a shareholder of since 2016.

Such dire circumstances are certainly justification for new ownership, especially from a firm with a worth of €11.12bn and experience with other football clubs around the world such as Genoa CFC (Italy), Vasco da Gama (Brazil), Hertha BSC (Germany), Standard de Liege (Belgium), Red Star FC (France), Sevilla FC (Spain), and Melbourne Victory FC (Australia). The specific financials of the deal have yet to be announced, but due to Everton’s failing financial position, the revenue multiples of 5.3x for Chelsea FC and 4.5x for AC Milan in 2022 (making them the first football clubs valued in the billions) are likely to be much higher than what will be applied to Everton’s €207.5mn in sales.

The deal involving Everton and 777 Capital Partners is particularly unique as the strategic investor is taking a great risk with what is essentially a bankrupt company. This goes to show that there is an opportunity for private equity entry in any aspect of the athletic industry.

The deal involving Everton and 777 Capital Partners is particularly unique as the strategic investor is taking a great risk with what is essentially a bankrupt company. This goes to show that there is an opportunity for private equity entry in any aspect of the athletic industry.

Future Outlook

The allure of European sports teams, with their rich histories and extensive fan bases, has witnessed a surge in private equity (PE) investments. In the short to medium term, this trend is expected to continue at an impressive pace. As stated by Smith (2020), "European football, in particular, offers a unique blend of tradition and commercial potential, attracting a wide range of investors." Financial metrics hint at a steady growth trajectory, supported by substantial revenue streams from broadcasting rights, sponsorships, and other commercial opportunities unique to sports franchises. As European football continues to globalize, capturing audiences in burgeoning markets like Asia and North America, the sector's valuations may see further appreciation (Jones, 2022). Indeed, the interest from new markets and new sectors will likely sustain sponsorship revenues, which will remain the main source of income. Speculation suggests that PE firms, especially those with portfolios in entertainment and media, could close major deals with some of Europe’s iconic teams in the coming years (Wilson, 2022). However, as Thompson (2021) notes, potential regulatory changes and fan opposition could pose significant challenges.

From a broader long-term perspective, the fundamental factors that currently drive PE interest in European sports need scrutiny. The vast and passionate fan base, global appeal, and commercial opportunities inherent in sports teams are enduring advantages (Smith, 2020). Nevertheless, as Jones (2022) argues, "The sustainability of the current rate of investments hinges on the evolution of the broadcasting landscape and emerging technologies." One major consideration is the shift in broadcasting rights and how technological advances may transform viewership patterns. The rise of streaming platforms and the potential decentralization of broadcasting could either be a boon or a challenge for revenue streams (Martin, 2023). Still, media rights are expected to grow, as streaming services like Amazon and DAZN join traditional broadcasters in their bids to live-stream football matches.

One possible threat is posed by higher competition. Deep-pocketed football clubs in the Major League Soccer and Saudi Pro League are investing a lot to attract top players and managers, in an attempt to gain popularity. They lack the history and established fan base of their European counterparts, but they can pay higher salaries and are building top-notch stadiums and training facilities. In the future, they may be able to gain market share at the expense of Europe’s Big Five. Moreover, the ethical debate around the commercialization of clubs that we previously mentioned may become more pronounced, leading to potential reputational risks for PE firms (Wilson, 2022). In conclusion, while the allure of European sports is undeniable, PE firms must navigate an evolving landscape with agility and foresight.

Overall, while the European sports sector offers an intriguing blend of history, passion, and commercial viability, the landscape is not without its complexities. The intersection of tradition and modern commerce always treads a fine line. PE firms can bring in fresh capital, innovative management practices, and international exposure, but they must also be sensitive to the deeply rooted fan cultures and the societal implications of their investments. The balance between financial returns and maintaining the ethos of the sport will be pivotal in determining the success of PE investments in the long run.

The allure of European sports teams, with their rich histories and extensive fan bases, has witnessed a surge in private equity (PE) investments. In the short to medium term, this trend is expected to continue at an impressive pace. As stated by Smith (2020), "European football, in particular, offers a unique blend of tradition and commercial potential, attracting a wide range of investors." Financial metrics hint at a steady growth trajectory, supported by substantial revenue streams from broadcasting rights, sponsorships, and other commercial opportunities unique to sports franchises. As European football continues to globalize, capturing audiences in burgeoning markets like Asia and North America, the sector's valuations may see further appreciation (Jones, 2022). Indeed, the interest from new markets and new sectors will likely sustain sponsorship revenues, which will remain the main source of income. Speculation suggests that PE firms, especially those with portfolios in entertainment and media, could close major deals with some of Europe’s iconic teams in the coming years (Wilson, 2022). However, as Thompson (2021) notes, potential regulatory changes and fan opposition could pose significant challenges.

From a broader long-term perspective, the fundamental factors that currently drive PE interest in European sports need scrutiny. The vast and passionate fan base, global appeal, and commercial opportunities inherent in sports teams are enduring advantages (Smith, 2020). Nevertheless, as Jones (2022) argues, "The sustainability of the current rate of investments hinges on the evolution of the broadcasting landscape and emerging technologies." One major consideration is the shift in broadcasting rights and how technological advances may transform viewership patterns. The rise of streaming platforms and the potential decentralization of broadcasting could either be a boon or a challenge for revenue streams (Martin, 2023). Still, media rights are expected to grow, as streaming services like Amazon and DAZN join traditional broadcasters in their bids to live-stream football matches.

One possible threat is posed by higher competition. Deep-pocketed football clubs in the Major League Soccer and Saudi Pro League are investing a lot to attract top players and managers, in an attempt to gain popularity. They lack the history and established fan base of their European counterparts, but they can pay higher salaries and are building top-notch stadiums and training facilities. In the future, they may be able to gain market share at the expense of Europe’s Big Five. Moreover, the ethical debate around the commercialization of clubs that we previously mentioned may become more pronounced, leading to potential reputational risks for PE firms (Wilson, 2022). In conclusion, while the allure of European sports is undeniable, PE firms must navigate an evolving landscape with agility and foresight.

Overall, while the European sports sector offers an intriguing blend of history, passion, and commercial viability, the landscape is not without its complexities. The intersection of tradition and modern commerce always treads a fine line. PE firms can bring in fresh capital, innovative management practices, and international exposure, but they must also be sensitive to the deeply rooted fan cultures and the societal implications of their investments. The balance between financial returns and maintaining the ethos of the sport will be pivotal in determining the success of PE investments in the long run.

Conclusion

European football clubs have become one of the main targets of private equity firms due to several features, notably their strong brand, steadily growing revenues, and countercyclicality. The macro scenario is also supporting their investment thesis. However, there are several risks, posed by increasing competition and very high costs, especially wages. The future outlook suggests that while PE investments in European sports offer attractive opportunities, firms must navigate an evolving landscape with agility, recognizing the need to balance financial returns with the preservation of the sport's ethos and fan culture. As the sector continues to globalize and face technological advancements, the ability to adapt and foresee potential challenges will be crucial for the long-term success of PE investments in European sports. The development of this new intersection of entertainment and business should be enjoyable to watch in the next few years — but not as fun as the games themselves.

European football clubs have become one of the main targets of private equity firms due to several features, notably their strong brand, steadily growing revenues, and countercyclicality. The macro scenario is also supporting their investment thesis. However, there are several risks, posed by increasing competition and very high costs, especially wages. The future outlook suggests that while PE investments in European sports offer attractive opportunities, firms must navigate an evolving landscape with agility, recognizing the need to balance financial returns with the preservation of the sport's ethos and fan culture. As the sector continues to globalize and face technological advancements, the ability to adapt and foresee potential challenges will be crucial for the long-term success of PE investments in European sports. The development of this new intersection of entertainment and business should be enjoyable to watch in the next few years — but not as fun as the games themselves.

By Andrea Cavenago, Elias Emery, Pietro Golzio, Anastasia Larionova

Sources

- Bain & Company

- Clifford Chance

- Deloitte

- FactSet

- Financial Times

- KPMG

- Norton Rose Fulbright

- PE Hub Europe

- PitchBook

- Quartz

- Statista

- Swiss Ramble

- The Athletic

- Washington Post

- Yahoo Sports