THE DIMENSION OF THIS PHENOMENON

“Everything with a green label is basically being bought”.

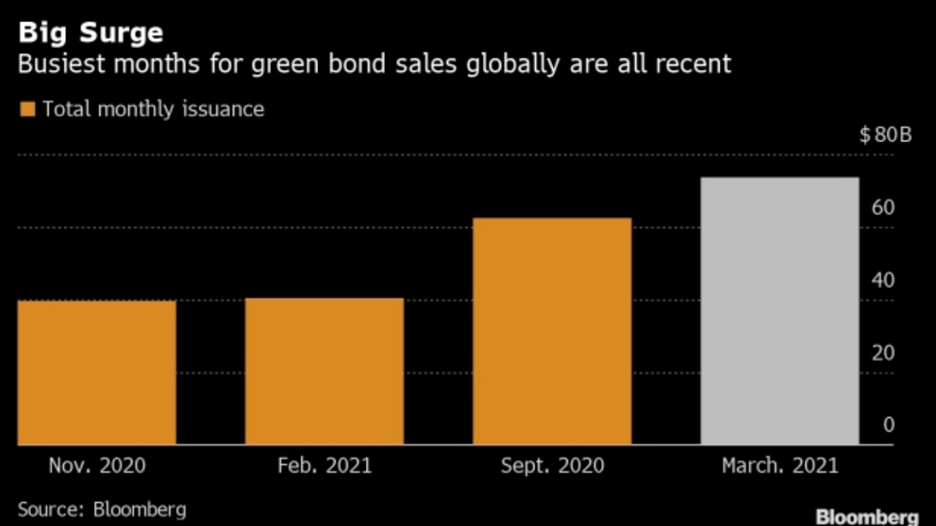

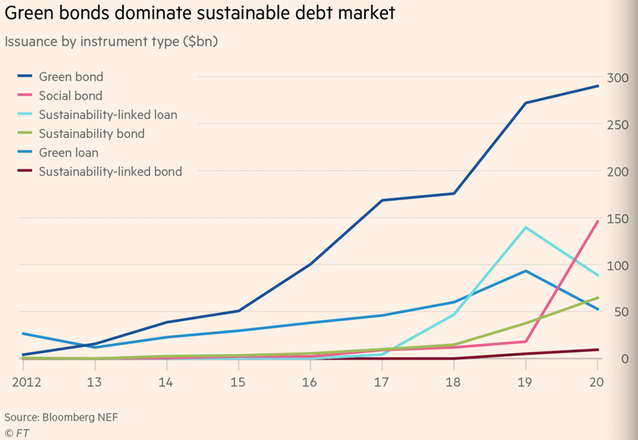

These are the words used by Mitch Reznick, head of fixed income at Federated Hermes, to describe what can be defined as a green bonds fever. A green bond (also known as climate bonds) can be defined as a fixed-income instrument with the aim of raising money for projects linked to climate and environment. The size of the green bond market has been experiencing remarkable growth in the last years. Let's the numbers talk: from 2007 to 2018, the estimated cumulative green bond issuance was around US$ 521bn; nowadays BBVA Global Market Research estimates it around US$ 1 trillion. The trend is increasing, considering also the fact in 2020 alone has been issued US$ 351bn, corresponding to an annual increase of more than 37%. EU has made some major effort to show its alignment with ESG criteria, considering both the €100bn social bonds issuance by the European Commission in the next years and the considerable percentage - around 30% - of the Next Generation EU (corresponding roughly to €225bn) that will be raised through green bonds. The catalysts of this phenomenon have undoubtedly been the Paris Agreement and the UN Sustainable Development Goals, setting as investment target US$ 90 trillion in climate by 2030.

“Everything with a green label is basically being bought”.

These are the words used by Mitch Reznick, head of fixed income at Federated Hermes, to describe what can be defined as a green bonds fever. A green bond (also known as climate bonds) can be defined as a fixed-income instrument with the aim of raising money for projects linked to climate and environment. The size of the green bond market has been experiencing remarkable growth in the last years. Let's the numbers talk: from 2007 to 2018, the estimated cumulative green bond issuance was around US$ 521bn; nowadays BBVA Global Market Research estimates it around US$ 1 trillion. The trend is increasing, considering also the fact in 2020 alone has been issued US$ 351bn, corresponding to an annual increase of more than 37%. EU has made some major effort to show its alignment with ESG criteria, considering both the €100bn social bonds issuance by the European Commission in the next years and the considerable percentage - around 30% - of the Next Generation EU (corresponding roughly to €225bn) that will be raised through green bonds. The catalysts of this phenomenon have undoubtedly been the Paris Agreement and the UN Sustainable Development Goals, setting as investment target US$ 90 trillion in climate by 2030.

GREENIUM

The results of an analysis involving 50+ green bonds, which collectively raised US$ 62.7bn, stresses a very peculiar data: green bonds enjoyed lower borrowing costs, a phenomenon which has taken the name “greenium”. More specifically, looking at the primary market, green bonds price on average at yields between 0.1 and 0.15 percentage points lower, which is still somewhat significant given the low rate environment.

The roots of this phoenomenon may be analyzed according to two main perspectives. According to some investors, this may be a sign of mispriced credit risks. On the other hand, many analysts pointed out that there is no need to worry as the greenium is simply the result of the most classical economic law: supply and demand. More and more investors, indeed, have allocated capital in a restricted set of assets, which might have created the difference in the yield.

The results of an analysis involving 50+ green bonds, which collectively raised US$ 62.7bn, stresses a very peculiar data: green bonds enjoyed lower borrowing costs, a phenomenon which has taken the name “greenium”. More specifically, looking at the primary market, green bonds price on average at yields between 0.1 and 0.15 percentage points lower, which is still somewhat significant given the low rate environment.

The roots of this phoenomenon may be analyzed according to two main perspectives. According to some investors, this may be a sign of mispriced credit risks. On the other hand, many analysts pointed out that there is no need to worry as the greenium is simply the result of the most classical economic law: supply and demand. More and more investors, indeed, have allocated capital in a restricted set of assets, which might have created the difference in the yield.

THE “BIDEN” EARTHQUAKE

Despite lacking centralized support from previous American policymakers, the US has a vast green bond market (US$ 200bn), which accounts for more than one-fifth of the global market. However, this is not enough from multiple points of view, for example, by looking at the overall size of its bond market or just estimating the amount of funding needed to finance a transition to a low carbon economy. Nowadays, the green bond market is dominated by euro bonds (their market share is greater than 60%) but we may soon assist to an American comeback thanks to a true game-changer: Biden’s US$ 2tn economic plan, which would also leveraged US$ 5tn private investments. It can have a huge impact for several reasons:

Amount of funding required: Biden’s administration set a clear goal: relying 100% on clean energy and cutting at least 50% infrastructure emissions. Making parallelism with the Next Generation EU, part of the debt is likely to be collected through green bonds. Assuming that the plan’s percentage financed through this financial instrument is more or less the same as its European counterpart, we may expect issuance of bonds for more than US$ 2.1tn. This would probably fuel the trend, increasing, even more, the issuance of ESG bonds.

International Commitment: On his first day of presidency, Biden rejoined the Paris agreement and announced that the USA would host a Leaders’ Climate Summit on the occasion of the Earth day (20/4/2021). He clearly stated that “climate considerations are an essential element of U.S. foreign policy”. International cooperation concerning green finance standards – thanks also the publication of the EU Green Bond Standard – will give regulatory certainty both to buyers and issuers, and contribute to the growth of the American green bond market.

U.S. Treasury Green bond: It is probably just a matter of time. More than 20 states have already adopted centralized financial instruments of this type. Let’s think about Italy, UK, and Germany. Cynically, the green bonds correspond (for now) to lower borrowing costs and so they may prove to be perfect for Biden’s onerous infrastructure plan. Treasury Green Bond will be seen as a high-profile proof of dedication to the UN Sustainable Development Goals and provide the global debt markets with a new green benchmark.

GREENWASHING – A MEMORANDUM

“Sustainability needs to be authentic integrated strategy with milestones and an execution plan in place to reach a company’s long-term goals”.

With these words Bridge Gawcett, global co-head of sustainability & corporate transitions at Citigroup Inc., expresses what the final aim of green bonds should be and expresses concerns about a more than actual risk: greenwashing, that is the misrepresentation of environmental credential just to enjoy lower borrowing costs and boost their reputation. To fight this phenomenon, the 2020 RBC Global Asset Management Responsible Investment Survey found that in the near future more steps must be done to ensure transparency around proxy records to facilitate the usage of ESG and trace back the creation of real impact.

Andrea De Chiro

Want to keep up with our most recent articles? Subscribe to our weekly newsletter here.