When we focus our attention on the East, we tend to look at the performances of the largest capital markets such as China’s or Japan’s ones. To understand the real potential of Asia’s economy, however, those countries that people consider less significant play a key role too. Bangladesh is one of those countries. In recent years, indeed, it showed one of the most suggestive trends and created uncertainty about the future of its sustainability. Will it reveal itself to be a temporary or a lasting growth? To answer it is useful to analyze Bangladesh’s path from two different points of view: the development of the Real Economy and the Investing and Financial Strategy.

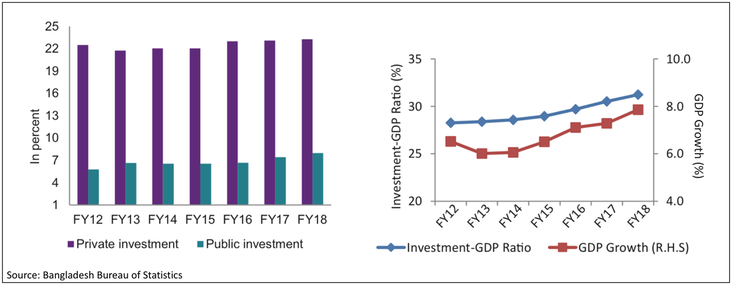

The increase in Bangladeshi Real Economy started with a massive expansive fiscal policy nearly ten years ago. As shown in the first chart, the public investment showed a positive trend between 2012 and 2018 followed by a stable GDP growth between 6% and 8% during the same period (second chart). Even Bangladesh Bank’s monetary policy aimed to reach higher GDP levels to reduce the risks connected to a possible trade war in 2019. Furthermore, a goal of Bangladeshi strategy was the development of facilities in order to raise capital from foreign countries. This is the reason why the growth was more significant in the transport and communication sector which gained 43.8 percent from the previous year and in the industrial sector which increased by around 22.5 percent in FY18 up from FY17.

We figured out how Bangladesh achieved its objectives of building solid economic structure, but in the last few months the country has moved to the second step: the investing strategy. One great news came at the beginning of March when Bangladesh and Saudi Arabia signed an investment agreement which will develop in the following years. During the meeting between the heads of the two states emerged <<how much Saudi Arabia is interested in the progress of economic relations with the Asiatic country>>, as the Bangladeshi Prime Minster said. As a consequence, the Kingdom will invest $15 billion in Bangladesh through 16 different projects on different sectors including electricity, railways, electronics and aeronautics.

We figured out how Bangladesh achieved its objectives of building solid economic structure, but in the last few months the country has moved to the second step: the investing strategy. One great news came at the beginning of March when Bangladesh and Saudi Arabia signed an investment agreement which will develop in the following years. During the meeting between the heads of the two states emerged <<how much Saudi Arabia is interested in the progress of economic relations with the Asiatic country>>, as the Bangladeshi Prime Minster said. As a consequence, the Kingdom will invest $15 billion in Bangladesh through 16 different projects on different sectors including electricity, railways, electronics and aeronautics.

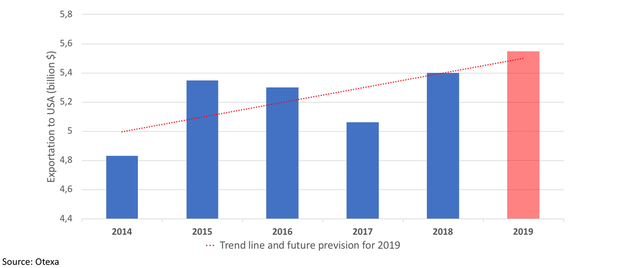

Agreements have been reached not only in the Middle East but also in the US. Indeed, exportations to USA grew 6.42% in just one period, reaching $5.40 billion dollars at the end of 2018. Moreover, the spread between 2018 and 2014 amounts to $0.57 billion (third chart), that is an ambitious achievement for a developing country. If we focus on the positive trend of the last five years, we can see how Bangladesh, with its evolution, aims at getting a role inside the commercial network worldwide, maybe as an alternative player of giants such as China or India.

Despite everything said, investments and exportations need solid financial markets and institutions to ensure a correct and efficient funds allocation. The previous year has been characterized by a stabilization of capital markets through different moves. Firstly, the Dhaka Stock Exchange (DSE) joined the United Nations Sustainable Stock Exchanges Initiative (SSE) on July 2018. This move could be an opportunity through which Bangladesh could create a dialogue with the other United Nation stock exchanges. Secondly, both the primary and the secondary markets have been innovated with a view to promoting public placements and raising the market capitalization of the country but also to protecting foreign investors.

As a result, the DSE showed a negative trend in the second semester of the previous year but gained 14.03% points between December 2018 and January 2019. After that “euphoric month” the index is slightly decreasing nowadays, but that does not seem to be a significant problem for Bangladesh. The fact that at the beginning of February Bangladesh Bank approved three new Private Commercial Banks (People’s Bank, Citizen Bank and Bengal Bank) may be a signal of the optimism of those who began to invest in Bangladesh’s economy. Optimism may further increase if we look at the data: today the number of Private and Commercial banks amount to 58, while six years ago only 9 could operate in the country.

In view of the above, Bangladesh is setting the basis for an economic and financial evolution for the future and, of course, the process cannot be considered as finished. 2019, indeed, will be a year of economic growth but marked by a series of peaks and troughs in the financial market.

Although the goal of reaching the huge players of Asia still remains difficult, the strategy adopted by Bangladesh has been effective up to now.

Lorenzo Masserini

Despite everything said, investments and exportations need solid financial markets and institutions to ensure a correct and efficient funds allocation. The previous year has been characterized by a stabilization of capital markets through different moves. Firstly, the Dhaka Stock Exchange (DSE) joined the United Nations Sustainable Stock Exchanges Initiative (SSE) on July 2018. This move could be an opportunity through which Bangladesh could create a dialogue with the other United Nation stock exchanges. Secondly, both the primary and the secondary markets have been innovated with a view to promoting public placements and raising the market capitalization of the country but also to protecting foreign investors.

As a result, the DSE showed a negative trend in the second semester of the previous year but gained 14.03% points between December 2018 and January 2019. After that “euphoric month” the index is slightly decreasing nowadays, but that does not seem to be a significant problem for Bangladesh. The fact that at the beginning of February Bangladesh Bank approved three new Private Commercial Banks (People’s Bank, Citizen Bank and Bengal Bank) may be a signal of the optimism of those who began to invest in Bangladesh’s economy. Optimism may further increase if we look at the data: today the number of Private and Commercial banks amount to 58, while six years ago only 9 could operate in the country.

In view of the above, Bangladesh is setting the basis for an economic and financial evolution for the future and, of course, the process cannot be considered as finished. 2019, indeed, will be a year of economic growth but marked by a series of peaks and troughs in the financial market.

Although the goal of reaching the huge players of Asia still remains difficult, the strategy adopted by Bangladesh has been effective up to now.

Lorenzo Masserini