Introduction

Sustainability will be a defining theme for financial markets and the global economy over the next decade. Awareness among investors and companies is rapidly shifting, and alternative fuel sources such as hydrogen are being investigated further for future implementation. While significant progress has been made along with many oil companies investing in hydrogen projects, many obstacles remain before hydrogen is readily adopted.

There are several problems that many companies have encountered in the pursuit of hydrogen as an alternative fuel source. Today, hydrogen is primarily made from fossil fuels, specifically natural gas, and the challenge is to create it using renewable energy and produce it on a scale that meets consumer demand. Furthermore, hydrogen is highly reactive and explosive as well as difficult to store and transport, resulting in it being very expensive. Hydrogen is incredibly difficult to store because devices that utilize it require specific welding technologies using argon and storing it in liquid form is extremely costly given that it requires temperatures very close to the absolute zero to liquefy. Moreover, it can quickly become explosive enclosed in spaces containing air. In fact the flammability range of hydrogen, defining the percentage of gas required to be combined with air and steam to cause ignition, is one of the broadest, from 4% to 74% of hydrogen in air to potentially cause ignition. As a result, there is a sufficient amount of risk associated with using hydrogen within homes and transportation from a safety perspective.

Despite the many obstacles the industry must deal with, there is increasing government support and investment on behalf of major corporations. For example, the US Energy Department has stated it intends to reduce the cost of hydrogen by 80% to $1 per Kg, over the next decade, by supporting pilot projects and investments. In July 2021, the US DOE also announced $52.5 million to accelerate the progress in clean hydrogen stating “next-generation hydrogen technologies, including fuel cells, will be critical to addressing the climate crisis and developing new industries here at home”. Additionally, Chevron has been very active in the renewable energy space with its recent acquisition of Renewable Energy Group and its partnership with engine maker Cummins to explore hydrogen infrastructure and fuel-cell vehicles, following a similar agreement in April with car maker Toyota. In Europe, Volkswagen has shifted its focus away from hydrogen research to hydrogen batteries with Shell and Daimler Truck AG to push the adoption of hydrogen fuel-cell trucks. Increased government support coupled with several energy companies shifting their focus on hydrogen and clean energy will facilitate the broader adoption of hydrogen in the US and abroad.

Why hydrogen?

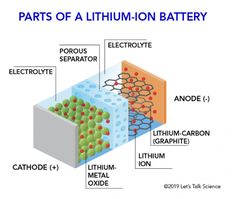

While the shift to renewable carbon neutral energies is considered the long-term goal of most countries, there are huge problems in its practical implementation today. Renewable energies are characterized by large volatility and intermittence in power production, meaning that energy must be stored in peak production times in order to have energy supply available during throughs in production. A present-day solution to this uncertainty is to use lithium-ion batteries to store excess electrical energy. In these batteries, the current supplied is stored by combining the electrons with lithium ions. Although this system allows to store and release energy in base of demand, these batteries risk overheating and they are particularly expensive compared to other batteries, while being around 100 times less energy dense than gasoline. Furthermore, the manufacturing of these batteries implies carbon dioxide emissions, both in the extraction of the raw material metals and in their reconversion to cells.

Sustainability will be a defining theme for financial markets and the global economy over the next decade. Awareness among investors and companies is rapidly shifting, and alternative fuel sources such as hydrogen are being investigated further for future implementation. While significant progress has been made along with many oil companies investing in hydrogen projects, many obstacles remain before hydrogen is readily adopted.

There are several problems that many companies have encountered in the pursuit of hydrogen as an alternative fuel source. Today, hydrogen is primarily made from fossil fuels, specifically natural gas, and the challenge is to create it using renewable energy and produce it on a scale that meets consumer demand. Furthermore, hydrogen is highly reactive and explosive as well as difficult to store and transport, resulting in it being very expensive. Hydrogen is incredibly difficult to store because devices that utilize it require specific welding technologies using argon and storing it in liquid form is extremely costly given that it requires temperatures very close to the absolute zero to liquefy. Moreover, it can quickly become explosive enclosed in spaces containing air. In fact the flammability range of hydrogen, defining the percentage of gas required to be combined with air and steam to cause ignition, is one of the broadest, from 4% to 74% of hydrogen in air to potentially cause ignition. As a result, there is a sufficient amount of risk associated with using hydrogen within homes and transportation from a safety perspective.

Despite the many obstacles the industry must deal with, there is increasing government support and investment on behalf of major corporations. For example, the US Energy Department has stated it intends to reduce the cost of hydrogen by 80% to $1 per Kg, over the next decade, by supporting pilot projects and investments. In July 2021, the US DOE also announced $52.5 million to accelerate the progress in clean hydrogen stating “next-generation hydrogen technologies, including fuel cells, will be critical to addressing the climate crisis and developing new industries here at home”. Additionally, Chevron has been very active in the renewable energy space with its recent acquisition of Renewable Energy Group and its partnership with engine maker Cummins to explore hydrogen infrastructure and fuel-cell vehicles, following a similar agreement in April with car maker Toyota. In Europe, Volkswagen has shifted its focus away from hydrogen research to hydrogen batteries with Shell and Daimler Truck AG to push the adoption of hydrogen fuel-cell trucks. Increased government support coupled with several energy companies shifting their focus on hydrogen and clean energy will facilitate the broader adoption of hydrogen in the US and abroad.

Why hydrogen?

While the shift to renewable carbon neutral energies is considered the long-term goal of most countries, there are huge problems in its practical implementation today. Renewable energies are characterized by large volatility and intermittence in power production, meaning that energy must be stored in peak production times in order to have energy supply available during throughs in production. A present-day solution to this uncertainty is to use lithium-ion batteries to store excess electrical energy. In these batteries, the current supplied is stored by combining the electrons with lithium ions. Although this system allows to store and release energy in base of demand, these batteries risk overheating and they are particularly expensive compared to other batteries, while being around 100 times less energy dense than gasoline. Furthermore, the manufacturing of these batteries implies carbon dioxide emissions, both in the extraction of the raw material metals and in their reconversion to cells.

An alternative to using batteries to store energy is to use hydrogen as an energy vector. Hydrogen is one of the most common elements and it is a gas at room temperature with a liquefaction point of -253°C. Although common, hydrogen is very frequently found in compounds, such as water and methane, given its atomic structure composed of one proton and one electron, such that it has to be extracted if pure hydrogen is required.

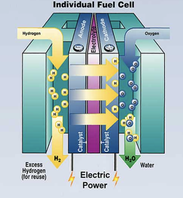

The advantage provided by hydrogen is that it can be inputted in fuel cells to generate electricity, where the only by-products are water and heat. Hydrogen gas in the cell is separated into its proton and electron by a catalyst. Once separated, the electron travels through a wire to the other electrode of the cell, containing oxygen. The electron combines with the oxygen in the electrode forming oxygen ions. These ions then combine with the original hydrogen ions (protons) which in the meantime have traveled through the electrolyte attracted by the negative charge of the oxygen electrode. In this combination water is produced, while current is created by the flow of electrons through the wire. This implies that electrical energy in fuel cells can be produced according to demand as long as hydrogen fuel and oxygen are available. While research is being performed to optimize the type of electrolytes, membranes and atmospheric conditions required to increase the cell efficiency, the present-day uncertainty on the future of hydrogen stems from the way it is manufactured. Hydrogen is often considered a vector of energy rather than a source of energy given that it has to be generated for it to be used for energy production. This consequently makes its production method of primary importance in determining its carbon footprint.

The advantage provided by hydrogen is that it can be inputted in fuel cells to generate electricity, where the only by-products are water and heat. Hydrogen gas in the cell is separated into its proton and electron by a catalyst. Once separated, the electron travels through a wire to the other electrode of the cell, containing oxygen. The electron combines with the oxygen in the electrode forming oxygen ions. These ions then combine with the original hydrogen ions (protons) which in the meantime have traveled through the electrolyte attracted by the negative charge of the oxygen electrode. In this combination water is produced, while current is created by the flow of electrons through the wire. This implies that electrical energy in fuel cells can be produced according to demand as long as hydrogen fuel and oxygen are available. While research is being performed to optimize the type of electrolytes, membranes and atmospheric conditions required to increase the cell efficiency, the present-day uncertainty on the future of hydrogen stems from the way it is manufactured. Hydrogen is often considered a vector of energy rather than a source of energy given that it has to be generated for it to be used for energy production. This consequently makes its production method of primary importance in determining its carbon footprint.

The hydrogen color scale

To distinguish hydrogen based on its production methods, a color code has been assigned to each type of hydrogen. Grey hydrogen for example is produced by extracting hydrogen from fossil fuels such as methane. It is the most used in the present day given that it is the cheapest and the most efficient but it also generates CO2. It is important to notice however that an important percentage of hydrogen produced in this way today is used for oil refining (in removing sulfur from fuels) or for the production of ammonia and steel, not for the production of electricity. The two most common ways of producing grey hydrogen are steam-methane reforming and electrolysis of water using electricity produced in methane power plants. The first method involves heating methane with steam under pressure, heat and a catalyst to obtain carbon dioxide and hydrogen molecules, while the second uses electric energy to decompose hydrogen ions and oxygen molecules. Once broken down, ions move to the other electrode after passing through a filtering membrane and take in the electrons to form hydrogen gas.

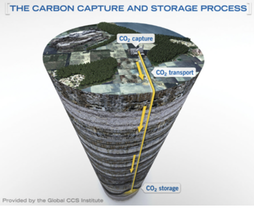

A second group is blue hydrogen. It is always produced with fossil fuels but the carbon dioxide is captured and stored with Carbon Capture and Storage (CCS) techniques. The carbon dioxide is separated from other waste materials either before or after combustion, it is then compressed and transported via pipe or ship to where it can be pumped underground and kept for permanent storage. Although this is considered a solution for the removal of emissions in polluting industries which cannot easily be converted to renewable energy, it requires a lot of energy meaning that the process has to be improved further for it to be implemented on a large scale.

Green hydrogen is produced by using the energy generated by renewable energies to electrolyze water. In this way renewable energies can be stored and deployed when needed. Finally, a minor category is pink hydrogen, produced through nuclear power plants.

The main advantage of hydrogen compared to other renewable solutions is that it can be transported in a low-cost fashion in a gaseous form through pipelines. In particular, it can be mixed with natural gas and transported through natural gas pipelines without requiring important changes in the pipeline structure. This means that hydrogen can be used to quickly cut back on emissions and reach the net zero objectives set internationally. Alternative means of transport include the transformation of hydrogen in ammonia (NH3) given that it liquifies at -33°C and contains more hydrogen per cubic meter than liquid hydrogen. This would decrease hydrogen’s transport costs, estimated to be three times its cost of production.

To distinguish hydrogen based on its production methods, a color code has been assigned to each type of hydrogen. Grey hydrogen for example is produced by extracting hydrogen from fossil fuels such as methane. It is the most used in the present day given that it is the cheapest and the most efficient but it also generates CO2. It is important to notice however that an important percentage of hydrogen produced in this way today is used for oil refining (in removing sulfur from fuels) or for the production of ammonia and steel, not for the production of electricity. The two most common ways of producing grey hydrogen are steam-methane reforming and electrolysis of water using electricity produced in methane power plants. The first method involves heating methane with steam under pressure, heat and a catalyst to obtain carbon dioxide and hydrogen molecules, while the second uses electric energy to decompose hydrogen ions and oxygen molecules. Once broken down, ions move to the other electrode after passing through a filtering membrane and take in the electrons to form hydrogen gas.

A second group is blue hydrogen. It is always produced with fossil fuels but the carbon dioxide is captured and stored with Carbon Capture and Storage (CCS) techniques. The carbon dioxide is separated from other waste materials either before or after combustion, it is then compressed and transported via pipe or ship to where it can be pumped underground and kept for permanent storage. Although this is considered a solution for the removal of emissions in polluting industries which cannot easily be converted to renewable energy, it requires a lot of energy meaning that the process has to be improved further for it to be implemented on a large scale.

Green hydrogen is produced by using the energy generated by renewable energies to electrolyze water. In this way renewable energies can be stored and deployed when needed. Finally, a minor category is pink hydrogen, produced through nuclear power plants.

The main advantage of hydrogen compared to other renewable solutions is that it can be transported in a low-cost fashion in a gaseous form through pipelines. In particular, it can be mixed with natural gas and transported through natural gas pipelines without requiring important changes in the pipeline structure. This means that hydrogen can be used to quickly cut back on emissions and reach the net zero objectives set internationally. Alternative means of transport include the transformation of hydrogen in ammonia (NH3) given that it liquifies at -33°C and contains more hydrogen per cubic meter than liquid hydrogen. This would decrease hydrogen’s transport costs, estimated to be three times its cost of production.

US Government Hydrogen Policy Over The Years

The future implementation of hydrogen on a global scale is dependent on the policy framework adopted by developed countries. US government policy regarding renewable energy, for example, has adopted widely varying political attitudes toward low-carbon technologies at the federal level over the different administrations. Also at the state level there are great variations between different state policies, especially due to the different infrastructure needs and financial interests.

In 2003, the G.W. Bush administration, in an effort to reduce the country’s dependence on foreign oil and reduce the environmental impact of the transportation industry, created the Hydrogen Posture Plan and committed $1.2 billion to the development of hydrogen technologies.

In 2005, the Energy Policy Act was passed which called for a major research and development initiative regarding technologies and infrastructure for the production, purification, distribution, storage, and use of hydrogen energy, fuel cells, aiming to demonstrate and commercialize the use of hydrogen for various sectors, such as transportation, utility, industrial, and residential.

In 2009, the Obama administration decided to reduce funds, since the Department of Energy estimated that the technologies needed for the deployment of fuel cell vehicles would take around 15 years before becoming commercially ready and economically viable.

In January 2021, the Biden Administration officially re-signed the Paris Agreement on behalf of the US, proving its support for the decarbonization process and the green transition, of which green hydrogen is a crucial part.

Industry experts have concluded that in order for hydrogen’s true potential to materialize it is essential for coordination at a state level, at least in some areas. For instance, given the fact that most hydrogen activity currently is very close to where it is produced, in order for it to be transported across borders, state cooperation is necessary to ensure that the appropriate infrastructure is available and that there are no problems caused from discrepancies between state regulations for hydrogen transport.

The Potential Of Latin America

Regarding Latin America, in 2019, there were only three pilot low-carbon hydrogen production projects in Argentina, Chile, and Costa Rica. Today, eleven countries so far have either published or are currently preparing their national long-term hydrogen strategies, planning a series of over 25 low-carbon hydrogen projects, some of which are gigawatt-scale and are targeting export markets rather than domestic demand. Low-carbon hydrogen could therefore be one of the key drivers of the green transition of the region. However, a crucial issue is that the viability of large-scale deployment of low-carbon hydrogen is closely dependent on many technologies which are still in development and the possibility of significant cost reductions (which would actually allow the reduction of global emissions in applications that may not be suitable for direct electrification). Latin American countries may also be able to leverage some of the existing industrial and technological capabilities, value chains and infrastructure to accelerate their long-term low-carbon deployment plans. It is also important to note that certain countries such as Brazil could potentially produce and export synthetic fuels, which require both hydrogen and carbon, given the availability of biogenic carbon from existing biofuels and bioelectricity production facilities.

The Case Of Chile

In Latin America, Chile is one of the countries with the most potential and ambitious future in the green hydrogen landscape. In November 2020, it presented a plan in its National Strategy for Green Hydrogen, receiving an endorsement from the Government and the Ministry of Energy, which estimates Chile could produce up to 160 megatons of green hydrogen yearly. In late December, the Chilean National Development Agency selected six green hydrogen production projects for development, reaching a total of more than 40 such projects proposed or under development. Essentially, it aims to have 5 GW of electrolysis capacity under development by 2025, to become the world's lowest-cost producer of green hydrogen by 2030 and one of the three largest ones by 2040, when the local market will be worth approximately $33 billion, including $24 billion in exports.

According to IRENA (International Renewable Energy Agency), Chile is one of the several countries that are currently net energy importers but can “emerge as green hydrogen exporters” in the future. Etienne Gabel, IHS Markit Senior Director, reports that Chile has positioned itself appropriately in the export markets, having signed free trade and tax agreements with countries that account for more than 80% of global GDP. In order to achieve this, therefore, it must be able to produce green hydrogen at low prices, with the national strategy plan setting a goal of $1.50/kg by 2030. Industry experts believe that this is feasible since Chile is an ideal location to develop green hydrogen thanks to its 4,000-mile coastline and access to water and plentiful renewable energy supply (solar in Northern Chile and wind in Southern Chile).

"The country has unparalleled solar and wind resources and business-friendly power regulations. On the policy side, they are doing everything they can. The private sector is answering the call. Overall, this [round of approved projects] is very promising... Whether this will materialize in billions of dollars of investment remains to be seen. But this first step looks good," Gabel added.

To support the pilot projects, the Chilean government committed $50 million in financing and the Ministry of Energy formed a task force to monitor and make recommendations to the projects and contribute to the policymaking process to promote foreign investment. Additionally, CORFO released an RFI, accumulating $12 billion to be invested in potential green hydrogen projects.

Certain risks related to Chile’s endeavor include the shipping cost disadvantages for the key markets of Asia and Europe, given its geographical position on the southwestern coast of South America. Moreover, the cost could influence the form in which hydrogen is going to be exported since most of the projects are planned with ammonia as the primary end-product since it is easier and cheaper to ship. Changes in the government’s policies after recent elections and social unrest and the rewriting of Chile’s constitution, whose first draft is to be ready by July 2022, could also have an impact on the infrastructure necessary since an article about environmental protection is likely to be included. Despite these risks, however, the green hydrogen industry surely remains a major opportunity for Chile, especially considering its extensive strategy set out.

Hydrogen will play an increasingly important role in the way companies and people use energy, but due to the challenges involved with harnessing hydrogen cheaply, it is unlikely we see an economy solely powered by hydrogen. Many companies, including BP, have stated that they do not expect green hydrogen to contribute materially to their core business until the 2030s. Nevertheless, with the investments on behalf of corporations and government support, many countries will reach a point where an increased percentage of their energy comes from hydrogen.

Sources:

By Nicolas Lockhart, Sofia Frasson and Stergios Mastoris

The future implementation of hydrogen on a global scale is dependent on the policy framework adopted by developed countries. US government policy regarding renewable energy, for example, has adopted widely varying political attitudes toward low-carbon technologies at the federal level over the different administrations. Also at the state level there are great variations between different state policies, especially due to the different infrastructure needs and financial interests.

In 2003, the G.W. Bush administration, in an effort to reduce the country’s dependence on foreign oil and reduce the environmental impact of the transportation industry, created the Hydrogen Posture Plan and committed $1.2 billion to the development of hydrogen technologies.

In 2005, the Energy Policy Act was passed which called for a major research and development initiative regarding technologies and infrastructure for the production, purification, distribution, storage, and use of hydrogen energy, fuel cells, aiming to demonstrate and commercialize the use of hydrogen for various sectors, such as transportation, utility, industrial, and residential.

In 2009, the Obama administration decided to reduce funds, since the Department of Energy estimated that the technologies needed for the deployment of fuel cell vehicles would take around 15 years before becoming commercially ready and economically viable.

In January 2021, the Biden Administration officially re-signed the Paris Agreement on behalf of the US, proving its support for the decarbonization process and the green transition, of which green hydrogen is a crucial part.

Industry experts have concluded that in order for hydrogen’s true potential to materialize it is essential for coordination at a state level, at least in some areas. For instance, given the fact that most hydrogen activity currently is very close to where it is produced, in order for it to be transported across borders, state cooperation is necessary to ensure that the appropriate infrastructure is available and that there are no problems caused from discrepancies between state regulations for hydrogen transport.

The Potential Of Latin America

Regarding Latin America, in 2019, there were only three pilot low-carbon hydrogen production projects in Argentina, Chile, and Costa Rica. Today, eleven countries so far have either published or are currently preparing their national long-term hydrogen strategies, planning a series of over 25 low-carbon hydrogen projects, some of which are gigawatt-scale and are targeting export markets rather than domestic demand. Low-carbon hydrogen could therefore be one of the key drivers of the green transition of the region. However, a crucial issue is that the viability of large-scale deployment of low-carbon hydrogen is closely dependent on many technologies which are still in development and the possibility of significant cost reductions (which would actually allow the reduction of global emissions in applications that may not be suitable for direct electrification). Latin American countries may also be able to leverage some of the existing industrial and technological capabilities, value chains and infrastructure to accelerate their long-term low-carbon deployment plans. It is also important to note that certain countries such as Brazil could potentially produce and export synthetic fuels, which require both hydrogen and carbon, given the availability of biogenic carbon from existing biofuels and bioelectricity production facilities.

The Case Of Chile

In Latin America, Chile is one of the countries with the most potential and ambitious future in the green hydrogen landscape. In November 2020, it presented a plan in its National Strategy for Green Hydrogen, receiving an endorsement from the Government and the Ministry of Energy, which estimates Chile could produce up to 160 megatons of green hydrogen yearly. In late December, the Chilean National Development Agency selected six green hydrogen production projects for development, reaching a total of more than 40 such projects proposed or under development. Essentially, it aims to have 5 GW of electrolysis capacity under development by 2025, to become the world's lowest-cost producer of green hydrogen by 2030 and one of the three largest ones by 2040, when the local market will be worth approximately $33 billion, including $24 billion in exports.

According to IRENA (International Renewable Energy Agency), Chile is one of the several countries that are currently net energy importers but can “emerge as green hydrogen exporters” in the future. Etienne Gabel, IHS Markit Senior Director, reports that Chile has positioned itself appropriately in the export markets, having signed free trade and tax agreements with countries that account for more than 80% of global GDP. In order to achieve this, therefore, it must be able to produce green hydrogen at low prices, with the national strategy plan setting a goal of $1.50/kg by 2030. Industry experts believe that this is feasible since Chile is an ideal location to develop green hydrogen thanks to its 4,000-mile coastline and access to water and plentiful renewable energy supply (solar in Northern Chile and wind in Southern Chile).

"The country has unparalleled solar and wind resources and business-friendly power regulations. On the policy side, they are doing everything they can. The private sector is answering the call. Overall, this [round of approved projects] is very promising... Whether this will materialize in billions of dollars of investment remains to be seen. But this first step looks good," Gabel added.

To support the pilot projects, the Chilean government committed $50 million in financing and the Ministry of Energy formed a task force to monitor and make recommendations to the projects and contribute to the policymaking process to promote foreign investment. Additionally, CORFO released an RFI, accumulating $12 billion to be invested in potential green hydrogen projects.

Certain risks related to Chile’s endeavor include the shipping cost disadvantages for the key markets of Asia and Europe, given its geographical position on the southwestern coast of South America. Moreover, the cost could influence the form in which hydrogen is going to be exported since most of the projects are planned with ammonia as the primary end-product since it is easier and cheaper to ship. Changes in the government’s policies after recent elections and social unrest and the rewriting of Chile’s constitution, whose first draft is to be ready by July 2022, could also have an impact on the infrastructure necessary since an article about environmental protection is likely to be included. Despite these risks, however, the green hydrogen industry surely remains a major opportunity for Chile, especially considering its extensive strategy set out.

Hydrogen will play an increasingly important role in the way companies and people use energy, but due to the challenges involved with harnessing hydrogen cheaply, it is unlikely we see an economy solely powered by hydrogen. Many companies, including BP, have stated that they do not expect green hydrogen to contribute materially to their core business until the 2030s. Nevertheless, with the investments on behalf of corporations and government support, many countries will reach a point where an increased percentage of their energy comes from hydrogen.

Sources:

- Clean energy institute, university of Washington

- US Department of Energy

- Smithsonian Institution

- International Energy Agency (IEA)

- Accenture

- Global CCS institute

- Siemens

- Financial Times

- Wall Street Journal

- IHS Markit

- International Trade Administration US Department of Commerce

- CMS

- S&P Global Commodity Insights

By Nicolas Lockhart, Sofia Frasson and Stergios Mastoris