This article is intended to shed some light on the main differences between trading on paper and trading in real financial markets, leveraging on some crucial insights provided by André F. Perold in his Implementation Shortfall paper.

There are several elements that drag down the performance of our fictitious, paper portfolios. For instance, transacting on paper only requires a pen and a theoretical background that allows you to make wise decisions, and this is very well provided by university studies. There are however many factors that disappoint us when opening for the first time our real trading account. Most of all, the fact that we would have been more profitable on paper!

In real financial markets you do not know the price at which you will be able to execute an order, the time in which you will be able to execute such order, or whether you will be able to execute such order at all.

To make the reader aware of the differences, let us imagine we are running both a paper and a real portfolio. The former captures your ideal choices, the latter captures instead your actual choices. The performance of this fictitious portfolio will tell you a lot about your skills at selecting good stocks, but your actual portfolio will reflect all those elements that do not allow you to translate your wishes in reality.

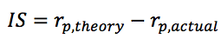

The Implementation Shortfall plays a crucial role in capturing all that, as it is defined as the difference between theoretical returns and actual returns. That is:

There are several elements that drag down the performance of our fictitious, paper portfolios. For instance, transacting on paper only requires a pen and a theoretical background that allows you to make wise decisions, and this is very well provided by university studies. There are however many factors that disappoint us when opening for the first time our real trading account. Most of all, the fact that we would have been more profitable on paper!

In real financial markets you do not know the price at which you will be able to execute an order, the time in which you will be able to execute such order, or whether you will be able to execute such order at all.

To make the reader aware of the differences, let us imagine we are running both a paper and a real portfolio. The former captures your ideal choices, the latter captures instead your actual choices. The performance of this fictitious portfolio will tell you a lot about your skills at selecting good stocks, but your actual portfolio will reflect all those elements that do not allow you to translate your wishes in reality.

The Implementation Shortfall plays a crucial role in capturing all that, as it is defined as the difference between theoretical returns and actual returns. That is:

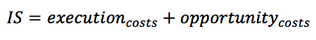

It therefore measures the degree to which you are unable to exploit your stock picking skills, by building in the formula both the execution costs (arising from the transaction you execute) and opportunity costs (arising from the transactions you fail to execute). The formula can be indeed restated as follows:

Measuring the shortfall this way shows how the reduction of the shortfall is a matter of trade-off between execution and opportunity costs. The minimization of executions costs per se may not be good if it involves extremely high opportunity costs, and vice versa. Monitoring the IS will enable you to measure the factors that might affect the performance of your portfolio and separate bad research from poor implementation.

Let us go deeper into the analysis of the formula, execution costs include brokerage commissions, transfer taxes and price impact. The latter is the difference between the price you could have transacted on paper (i.e. the bid-ask midpoint at the time of the decision to trade) and the price you actually transacted at; for instance if you sell at the bid prevailing at the time you decided to trade your price impact will be half the bid-ask spread.

Opportunity cost, on the other hand, are mirrored by the so-called adverse selection, which arises from your unwillingness to incur the price impact. Some of the transactions that execute on paper often do not execute in reality. For instance, when you place a limit order to buy or sell, you are offering the market important information. If orders execute it is because you are offering the best price, while if you are not able to do so it is because the market likes the security better than the price you are offering for it. Meanwhile, your paper portfolio owns both the securities the market likes and the ones it does not like. Therefore, the IS quantifies the adverse section costs through the opportunity cost of the trades the market chooses not to execute.

The main element affecting the amount of your Implementation Shortfall is how quickly you trade. If you trade aggressively you will tend to pay a bigger price to transact, since it is much harder to find the other side of the trade immediately rather than over the next couple of hours. Nevertheless, this would allow you to have a bigger portion of your ideal/theoretical portfolio in place, thus lowering your opportunity costs. On the other hand, if you trade slowly your execution costs will be lower but you will have a smaller portion of your theoretical portfolio in place, thus increasing opportunity costs.

To conclude, I offer some basic thoughts that might help the reader in her decision making process. Once you obtain your IS measure, it is crucial that you are able to separate and quantify the execution and opportunity costs. If the bulk of the shortfall is given by execution costs, then your performance is being hit by price impact and, as a consequence, you should trade less aggressively. If the shortfall is mostly represented by opportunity costs, then your performance is being hurt by slow trading. As a consequence, your focus should be on speeding up execution.

Federico Rendina

Let us go deeper into the analysis of the formula, execution costs include brokerage commissions, transfer taxes and price impact. The latter is the difference between the price you could have transacted on paper (i.e. the bid-ask midpoint at the time of the decision to trade) and the price you actually transacted at; for instance if you sell at the bid prevailing at the time you decided to trade your price impact will be half the bid-ask spread.

Opportunity cost, on the other hand, are mirrored by the so-called adverse selection, which arises from your unwillingness to incur the price impact. Some of the transactions that execute on paper often do not execute in reality. For instance, when you place a limit order to buy or sell, you are offering the market important information. If orders execute it is because you are offering the best price, while if you are not able to do so it is because the market likes the security better than the price you are offering for it. Meanwhile, your paper portfolio owns both the securities the market likes and the ones it does not like. Therefore, the IS quantifies the adverse section costs through the opportunity cost of the trades the market chooses not to execute.

The main element affecting the amount of your Implementation Shortfall is how quickly you trade. If you trade aggressively you will tend to pay a bigger price to transact, since it is much harder to find the other side of the trade immediately rather than over the next couple of hours. Nevertheless, this would allow you to have a bigger portion of your ideal/theoretical portfolio in place, thus lowering your opportunity costs. On the other hand, if you trade slowly your execution costs will be lower but you will have a smaller portion of your theoretical portfolio in place, thus increasing opportunity costs.

To conclude, I offer some basic thoughts that might help the reader in her decision making process. Once you obtain your IS measure, it is crucial that you are able to separate and quantify the execution and opportunity costs. If the bulk of the shortfall is given by execution costs, then your performance is being hit by price impact and, as a consequence, you should trade less aggressively. If the shortfall is mostly represented by opportunity costs, then your performance is being hurt by slow trading. As a consequence, your focus should be on speeding up execution.

Federico Rendina