Introduction

With global inflation at unprecedented levels following fiscal and monetary stimulus during the covid-19 pandemic, the post-pandemic economic reopening and the Ukraine war, governments are under pressure to respond decisively to the emerging cost-of-living crisis. On the other hand, they should act in a fiscally responsive way that does not strangle the economy. In the US, this response comes in the form of the Inflation Reduction Act, a landmark legislation passed by Congress in August 2022. In this article, we are going to explain how the law aims to reconcile seemingly contrasting goals of targeted stimulus for innovation, fiscal sustainability, and inflation reduction.

Inflation in the United States

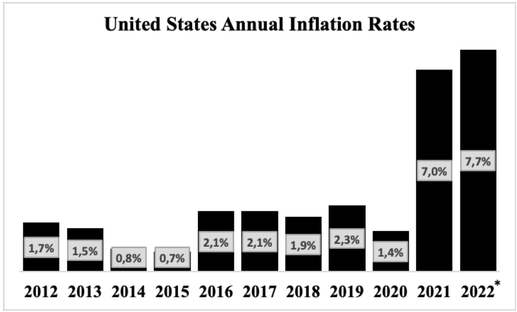

Inflation in the United States was relatively low for a very long period, so for many Americans the rapid prices hikes are something unknown. From 1991 to the end of 2019, monthly inflation averaged about 2.3%, and only exceeded 5% four times. Now, Americans declare Inflation the nation’s top problem and addressing the problem has become a top priority for the government.

Currently, the United States is recording an inflation rate (CPI) of 7.7% for the last twelve month that ended in October 2022. This marked the first deceleration in inflation since August 2021, probably the end of the era of steep climbing inflation, but it remains among the highest of the 21st century. Furthermore, on a month-to-month basis, for October, the CPI increased by 0.4%, matching the increase from the previous month. Housing was responsible for more than half of the monthly increase, while food and gasoline were also heavy determinants.

Currently, the United States is recording an inflation rate (CPI) of 7.7% for the last twelve month that ended in October 2022. This marked the first deceleration in inflation since August 2021, probably the end of the era of steep climbing inflation, but it remains among the highest of the 21st century. Furthermore, on a month-to-month basis, for October, the CPI increased by 0.4%, matching the increase from the previous month. Housing was responsible for more than half of the monthly increase, while food and gasoline were also heavy determinants.

* as of October 2022

The sustained inflation has resulted in the increase of Interest Rates by the Federal Reserve. Currently, as of the last meeting on November 2nd, policy rates are in a range of 3.75% to 4.00%. Furthermore, according to U.S Central Bank own projections, rates are expected to reach a peak of 4.50% to 4.75% in 2023. All this, to bring inflation to its long-term target of around 2%. However, as rates continue to hike, the cost of borrowing will continue to get more expensive as more rates are likely to follow.

Successive rate hikes discourage borrowing, which added to the global economic turmoil caused by the supply chain breakdowns, the energy crisis, among others, results in many economists estimating a recession – a sustained decline of economic activity for at least two consecutive quarters- for 2023. A Bloomberg survey to 42 economists predicted the probability of a recession over the next year is now of 60%, up 10% from a month earlier. Moreover, a Bloomberg probability model built by Anna Wong - Chief US Economist - and Eliza Winger, after analyzing 13 macroeconomic and financial indicators, states a 100% probability of entering a recession by October 2023 (Bloomberg, 2022). Their previous model, prior to the update, claimed the chance of a recession by October 2023 at 65%, meaning economic conditions have worsened.

Successive rate hikes discourage borrowing, which added to the global economic turmoil caused by the supply chain breakdowns, the energy crisis, among others, results in many economists estimating a recession – a sustained decline of economic activity for at least two consecutive quarters- for 2023. A Bloomberg survey to 42 economists predicted the probability of a recession over the next year is now of 60%, up 10% from a month earlier. Moreover, a Bloomberg probability model built by Anna Wong - Chief US Economist - and Eliza Winger, after analyzing 13 macroeconomic and financial indicators, states a 100% probability of entering a recession by October 2023 (Bloomberg, 2022). Their previous model, prior to the update, claimed the chance of a recession by October 2023 at 65%, meaning economic conditions have worsened.

The Inflation Reduction Act and its Impact on the Energy Market

Investors and governments have increasingly focused more of their efforts on sustainability and the global transition to net zero. The Inflation Reduction Act (IRA) was passed in August of 2022 and is intended to help lower inflation by reducing the deficit, lowering prescription drug prices, and investing into domestic energy production while promoting clean energy. The law, as passed, will aim to raise $738 billion and authorize $394 billion in spending on energy and climate change, $238 billion on reducing the deficit, three years of Affordable Care Act subsidies, prescription drug reform to lower prices, and tax reform. This law will set a precedent for other nations and is the largest bill ever passed in addressing climate change in the US and will attempt to reduce greenhouse gas emissions in the US 40% by 2030 compared to 2005 levels. A large focus of this bill is on energy and will have considerable effects on American infrastructure and national security.

The IRA will benefit a wide range of companies in the energy sector ranging from utilities, clean energy companies, nuclear reactors and storage facilities, and provide broad incentives for the broader sector to focus on transitioning their businesses. For example, the US Department of Energy’s Loan Program Office will receive roughly $12 billion to improve its existing loan authority by tenfold and create a new loan program capped at $250 billion to upgrade or replace energy infrastructure. The majority of the $394 billion in energy and climate funding is in the form of tax credits. Corporations are the biggest recipient, with roughly $216 billion worth of tax credits. These are designed to spur private investment in clean energy, transport, and manufacturing. There is also an effort to incentives consumers through, allocating $43 billion in IRA tax credits to lower emissions by making EVs, energy-efficient appliances, rooftop solar panels, geothermal heating, and home batteries more affordable. The combination of improving existing infrastructure and incentivizing private investment and innovation, and fiscally responsible investments will create new jobs and improve U.S. energy security reducing its dependence on foreign nations.

Another one of the intended outcomes of the IRA, is improving the United States’ energy security. This law was passed at a time where many western nations were experiencing significant increase in energy prices, concerns over storage and their dependence on foreign nations. By investing so heavily in clean energy. The economic future of the United States is closely related with its national security. AS a result, the American supply chain has several areas of weakness including energy dependence as well as minerals and other important goods. Former Director of National Intelligence Admiral Dennis Blair, a member of SAFE, said “that’s been our common theme: to reduce and eliminate American and allied vulnerability to pressure from countries that wish us ill and don’t share our values.” The IRA is a critical component to the future economic success and security in the United States and its implementation and outcome will have measurable effects on society and the broader economy.

What is clear is the IRA targets various important issues that are directly and indirectly related to climate change. What many members of government and investors have raised concerns about, is in regard to the exact timeline and quantifiable effects this will have. While further investment and government support will assist the US in its energy transition, it is not certain how successful it will be and therefore difficult to ascribe a value to it.

The IRA will benefit a wide range of companies in the energy sector ranging from utilities, clean energy companies, nuclear reactors and storage facilities, and provide broad incentives for the broader sector to focus on transitioning their businesses. For example, the US Department of Energy’s Loan Program Office will receive roughly $12 billion to improve its existing loan authority by tenfold and create a new loan program capped at $250 billion to upgrade or replace energy infrastructure. The majority of the $394 billion in energy and climate funding is in the form of tax credits. Corporations are the biggest recipient, with roughly $216 billion worth of tax credits. These are designed to spur private investment in clean energy, transport, and manufacturing. There is also an effort to incentives consumers through, allocating $43 billion in IRA tax credits to lower emissions by making EVs, energy-efficient appliances, rooftop solar panels, geothermal heating, and home batteries more affordable. The combination of improving existing infrastructure and incentivizing private investment and innovation, and fiscally responsible investments will create new jobs and improve U.S. energy security reducing its dependence on foreign nations.

Another one of the intended outcomes of the IRA, is improving the United States’ energy security. This law was passed at a time where many western nations were experiencing significant increase in energy prices, concerns over storage and their dependence on foreign nations. By investing so heavily in clean energy. The economic future of the United States is closely related with its national security. AS a result, the American supply chain has several areas of weakness including energy dependence as well as minerals and other important goods. Former Director of National Intelligence Admiral Dennis Blair, a member of SAFE, said “that’s been our common theme: to reduce and eliminate American and allied vulnerability to pressure from countries that wish us ill and don’t share our values.” The IRA is a critical component to the future economic success and security in the United States and its implementation and outcome will have measurable effects on society and the broader economy.

What is clear is the IRA targets various important issues that are directly and indirectly related to climate change. What many members of government and investors have raised concerns about, is in regard to the exact timeline and quantifiable effects this will have. While further investment and government support will assist the US in its energy transition, it is not certain how successful it will be and therefore difficult to ascribe a value to it.

How to Fund the Inflation Reduction Act – and How to Reinvest

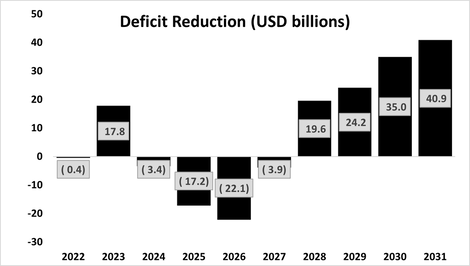

When it comes to official figures, the Congressional Budget Office (CBO) just released a final score of the Inflation Reduction Act, finding it would reduce deficits by $238 billion over a decade.

Although not significantly, the final law slightly changed from the initial draft, which was projected to save $300 billion by 2031. These adjustments—some made for procedural reasons—included the elimination of the carried interest provision and the inflation-based cap on the cost of commercial drugs, tweaks to the corporate book income minimum tax, the addition of a 1 percent tax on stock buybacks, expanded Medicare coverage of insulin, an extension of the current limits on loss deductibility for pass-through entities, and the removal of IRS pay and hiring flexibility

Due to new Treasury Department guidelines that limits audits for households earning less than $400,000 per annum and the aforementioned elimination of pay and hiring flexibilities, CBO also decreased its projection for income from additional IRS funding. As a result of the sum of those policies, we can see how the increase in revenue offsets the increase in expenses by a total of $238 billion.

In this next section, we will dig deeper into the various reforms, and how they manage to bring down the costs and increase the government’s revenue, starting with health savings.

Due to new Treasury Department guidelines that limits audits for households earning less than $400,000 per annum and the aforementioned elimination of pay and hiring flexibilities, CBO also decreased its projection for income from additional IRS funding. As a result of the sum of those policies, we can see how the increase in revenue offsets the increase in expenses by a total of $238 billion.

In this next section, we will dig deeper into the various reforms, and how they manage to bring down the costs and increase the government’s revenue, starting with health savings.

The IRA includes three main elements to reform Medicare drug pricing policy:

On top of this, the IRA also prescribes a few key policies aimed at raising revenue by targeting companies and tax evaders; among those policies, we can find:

- It provides the Secretary of Health & Human Services (HHS) with the authority to negotiate prescription drug prices for Medicare and requires them to do so, though this authority is more limited than the authority proposed in previous reform packages.

- It aims to limit the rate at which companies increase the prices of existing prescription drugs in Medicare by requiring the payment of inflationary rebates, a policy which has worked effectively in the Medicaid context.

- It restructures the Medicare Part D benefit both to limit patients’ out-of-pocket costs and to rebalance the bearing of risk for stakeholders in that program, a policy change which has previously had more bipartisan support than the other two elements.

On top of this, the IRA also prescribes a few key policies aimed at raising revenue by targeting companies and tax evaders; among those policies, we can find:

- A 15% corporate minimum tax: The IRA creates a new IRC §55(b)(2) and §56A that contains the framework for the new corporate AMT regime and generally imposes a 15% tax on the Adjusted Financial Statement Income (AFSI) of an Applicable Corporation. Applicable Corporations will pay the greater of either:

- 15% of AFSI less the corporate AMT foreign tax credit.

- the sum of the regular tax liability reduced by the foreign tax credit allowable and base erosion and anti-abuse tax (BEAT) liability.

- The new regime applies to tax years that begin after December 31, 2022 and can impact both public and private corporations.

- An increased tax enforcement: Overall, IRS audits plunged by 44% between fiscal years 2015 and 2019, according to a 2021 Treasury Inspector General for Tax Administration report. While audits dropped by 75% for Americans making $1 million or more, the percentage fell by 33% for low-to-moderate income filers claiming the earned income tax credit, known as EITC, according to a report from the American news company CNBC.

- Imposition of a 1% tax on stocks buybacks: the Buyback Tax imposes on each “covered corporation” a non-deductible tax equal to 1% of the fair market value of any stock of the covered corporation which is repurchased by such corporation during taxable years after December 31, 2022, unless an exception applies.

- 2-year extension of the limitation on excess business losses: The excess business loss limitation was put in place for tax years starting after 2017, but was postponed to tax years beginning after 2020 by the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) in response to the COVID-19 pandemic. Thanks to this newly approved legislation, the excess business loss limitation was extended through 2028.

How the IRA Contributes to Deficit Reductio

Large and sustained budget deficits are harmful to the fiscal health of any country, and the United States is not the exception. As a result of the Covid-19 pandemic, the US federal deficit has increased to unprecedented levels. For Fiscal Year 2020, the government incurred in a deficit of ~$3.1 trillion, about 3 times larger than that of 2019. The deficit accounted 15.2% of the GDP, the greatest deficit as a share of the economy since 1945.

It is important to take into account the size of the impact Covid-19 had on Budget Deficits. For FY2020, the budget can be split into two distinct halves, October-March and April-September, and the differences are quite significant. For the first half, the deficit was around 8% higher than that of its previous year, however, for the second half, it rose to 8 times the size of those of its previous year. This occurred as a result of economic losses and policy changes. Nonwithheld income, payroll and corporate income taxes revenue all fell, as well as payment of taxes could be differed and in general there were fewer people employed, lower wages, and less economic activity.

For FY2021, the government ran a deficit of ~$2.8 trillion. This represents a 12% decrease in comparison to FY2020, however, it still was three times that of FY2019, as Covid-19 relief spending continued to happen, and even increase. The deficit accounted for approximately 13% of the GDP, the second largest deficit as a share of the economy since 1945.

For FY2022, the government ran a deficit ~$1.4 trillion, approximately half to that of FY2021, the largest one year drop in US history. On one hand, the deficit decrease occurred because of increased revenues (21% higher) as a result the general economic recovery, higher taxes revenue, higher wages and employment, and the payment of deferred taxes. On the other hand, reduced expenses (8% lower), as well as the ending of pandemic relief spending, accounted for most for most of the yearly reduction.

For FY2021, the deficit decrease would have been greater if it had not been for the Biden’s administration student loan forgiveness program. Around USD ~378 billions of spending went towards cancelling a significant portion of students debt. The Congressional Budget Office estimates that around 43 million borrowers will be benefitted with up to $20,000 in forgiveness.

While in the short term the budget picture has improved and further efforts have been done, such as The Inflation Reduction Act of 2022, the US still faces a tough economic situation. As inflation keeps rising and a recession is highly likely, there are very high risks that the fiscal situation will get worse as spending will have to increase again to help American citizens through the tough times that may be ahead.

Signed in August 2022, the Inflation Reduction Act (IRA) will make a historic down payment on deficit reduction to fight inflation, while investing in local energy generation and manufacturing, aiming to reduce carbon emissions, expanding the Affordable Care Act program through 2025 and allow Medicare to negotiate prescription drug prices. The legislation is expected to result in a deficit reduction of 300 billion, requiring total investments of $437 billion, and contributing to a deficit reduction of around $300 billion.

It is important to take into account the size of the impact Covid-19 had on Budget Deficits. For FY2020, the budget can be split into two distinct halves, October-March and April-September, and the differences are quite significant. For the first half, the deficit was around 8% higher than that of its previous year, however, for the second half, it rose to 8 times the size of those of its previous year. This occurred as a result of economic losses and policy changes. Nonwithheld income, payroll and corporate income taxes revenue all fell, as well as payment of taxes could be differed and in general there were fewer people employed, lower wages, and less economic activity.

For FY2021, the government ran a deficit of ~$2.8 trillion. This represents a 12% decrease in comparison to FY2020, however, it still was three times that of FY2019, as Covid-19 relief spending continued to happen, and even increase. The deficit accounted for approximately 13% of the GDP, the second largest deficit as a share of the economy since 1945.

For FY2022, the government ran a deficit ~$1.4 trillion, approximately half to that of FY2021, the largest one year drop in US history. On one hand, the deficit decrease occurred because of increased revenues (21% higher) as a result the general economic recovery, higher taxes revenue, higher wages and employment, and the payment of deferred taxes. On the other hand, reduced expenses (8% lower), as well as the ending of pandemic relief spending, accounted for most for most of the yearly reduction.

For FY2021, the deficit decrease would have been greater if it had not been for the Biden’s administration student loan forgiveness program. Around USD ~378 billions of spending went towards cancelling a significant portion of students debt. The Congressional Budget Office estimates that around 43 million borrowers will be benefitted with up to $20,000 in forgiveness.

While in the short term the budget picture has improved and further efforts have been done, such as The Inflation Reduction Act of 2022, the US still faces a tough economic situation. As inflation keeps rising and a recession is highly likely, there are very high risks that the fiscal situation will get worse as spending will have to increase again to help American citizens through the tough times that may be ahead.

Signed in August 2022, the Inflation Reduction Act (IRA) will make a historic down payment on deficit reduction to fight inflation, while investing in local energy generation and manufacturing, aiming to reduce carbon emissions, expanding the Affordable Care Act program through 2025 and allow Medicare to negotiate prescription drug prices. The legislation is expected to result in a deficit reduction of 300 billion, requiring total investments of $437 billion, and contributing to a deficit reduction of around $300 billion.

The Legislation is expected to have such significant effect in inflation reduction as it will combat both the rising energy prices and the healthcare cost for families, as well as it will help reduce the deficit. Furthermore, according to researchers at University Massachusetts Amherst, through a 10-year period the IRA climate-based programs will generate over 900,000 jobs per year (PERI, 2022).

Conclusion

The Inflation Reduction Act represents a very ambitious package of legislation which seeks to tackle many challenges at once. It is based on the widely accepted rationale that targeted investments in the energy sector, which is a major driver of inflation and geopolitical dependence, can create innovation and additional production capacity, which will ultimately bring down prices. It builds on other pieces of signature Democratic legislation in its effort to limit drug price increases and raise taxes from wealthy corporations. However, many of the measures included in the act take time to fully unfold their potential, especially when it comes to building a strategically important clean energy industry and expanding the tax base. In the meantime, short-term investments and support for households will continue drag down the fiscal balance, and further external shocks may still derail the economy. Therefore, while the Act does not lack ambition, its diligent and effective implementation will now be paramount to its success.

By Stefano Graziosi, Nicolas Lockhart and Alejandro Morales

Sources

- Boesler, M. (October 6, 2022) Fed Headed for 4.5%-4.75% Interest Rate by Early 2023, Evans Says. Bloomberg. https://www.bloomberg.com/news/articles/2022-10-06/evans-says-fed-headed-for-4-5-4-75-interest-rate-by-early-2023?sref=WD5fEjzY

- Committee for a Responsible Federal Budget (September 7, 2022). CBO Scores IRA with $238 Billion of Deficit Reduction. https://www.crfb.org/blogs/cbo-scores-ira-238-billion-deficit-reduction

- Cox, J. (October 21, 2022). U.S. budget deficit cut in half for biggest decrease ever amid Covid spending declines. CNBC. https://www.cnbc.com/2022/10/21/us-budget-deficit-cut-in-half-for-biggest-decrease-ever-amid-covid-spending-declines.html

- Current US Inflation Rates: 2000-2022 (2022).. US Inflator Calculator. https://www.usinflationcalculator.com/inflation/current-inflation-rates/

- Cutler, David M. (September 1, 2022). "Medicare Enters the Pharmaceutical Purchasing Business". JAMA Health Forum. American Medical Association (AMA). 3 (9): e223630. doi:10.1001/jamahealthforum.2022.3630.

- Deficit Tracker. Bipartisan Policy Center (July 12, 2022).. https://bipartisanpolicy.org/report/deficit-tracker/

- Desilver, D. (June 15, 2022). In the U.S. and around the world, inflation is high and getting higher. Pew Research Center. https://www.pewresearch.org/fact-tank/2022/06/15/in-the-u-s-and-around-the-world-inflation-is-high-and-getting-higher/

- Dore, K. C. (August 10, 2022). With the IRS hiring more employees, here’s who agents may target for audits. CNBC. https://www.cnbc.com/2022/08/09/with-new-agents-heres-who-the-irs-may-target-for-audits.html

- Financial Advisor IQ (October 18, 2022). U.S. Recession in Next 12 Months ‘Effectively Certain’: Bloomberg Economists https://financialadvisoriq.com/c/3790474/487244/recession_next_months_effectively_certain_bloomberg_economists?referrer_module=emailMorningNews&module_order=3&login=1&code=WW5KMVkyVkFkSGR2Wkc5bmMzTnZZMmxoYkM1amIyMHNJRGt6T1Rjek1UTXNJRE01TkRRd01EWTBPQT09

- FORVIS (November 17, 2022). IRA’s New Corporate Alternative Minimum Tax – What You Need to Know. https://www.forvis.com/article/2022/11/ira-s-new-corporate-alternative-minimum-tax-what-you-need-know

- Health Affairs (2022, August 10). Understanding The Democrats’ Drug Pricing Package. Retrieved December 2, 2022, from https://www.healthaffairs.org/content/forefront/understanding-democrats-drug-pricing-package

- Investopedia (September 6, 2022). How Prescription Drug Negotiations Will Impact Medicare Beneficiaries. https://www.investopedia.com/perscription-drug-negotiations-medicare-beneficiaries-6503437

- Kim, J. (August 13, 2022). What the Inflation Reduction Act does and doesn't do about rising prices. NPR. https://www.npr.org/2022/08/11/1116229743/inflation-reduction-act-questions-answered

- Kimball, S. (August 13, 2022). Passage of Inflation Reduction Act gives Medicare historic new powers over drug prices. CNBC. https://www.cnbc.com/2022/08/12/drug-prices-passage-of-inflation-reduction-act-gives-medicare-historic-new-powers.html

- Penn Wharton. (August 22, 2022). Senate-passed Inflation Reduction Act: Estimates of Budgetary and Macroeconomic Effects. https://budgetmodel.wharton.upenn.edu/issues/2022/8/12/senate-passed-inflation-reduction-act

- Political Economy Research Institute (PERI) University of Massachusetts Amherst (August 4, 2022). Job Creation Estimates Through Proposed Inflation Reduction Act.https://peri.umass.edu/publication/item/1633-job-creation-estimates-through-proposed-inflation-reduction-act

- Tepper, T. (Novermber 10, 2022). Why Is Inflation So High? Forbes. https://www.forbes.com/advisor/investing/why-is-inflation-rising-right-now/

- The White House (October 21, 2022). Remarks by President Biden on Historic Deficit Reduction. https://www.whitehouse.gov/briefing-room/speeches-remarks/2022/10/21/remarks-by-president-biden-on-historic-deficit-reduction/

- Winters, M. (November 2, 2022). The Fed announces 4th consecutive ‘jumbo’ interest rate hike of 75 basis points—here are 4 things that will be more expensive. CNBC, https://www.cnbc.com/2022/11/02/fed-raises-borrowing-costs-with-another-jumbo-interest-rate-hike.html#:~:text=Rates%20are%20expected%20to%20peak,to%205%25%20by%20March%202023.