In 2016, the Non-Performing Loans market was one of the most appealing topics in the financial news: in the EU, it constituted a burden amounting to 9% of total GDP. From this point on, a huge stimulus to the secondary market of these products has been developed: as an example, Italy has halved its outstanding level to 115.5€ bn together with an organizational action on the management procedures of NPLs.

The NPLs secondary market, however, is complex by many points of view, but first let’s consider what are the reasons why we need it. A bank who has a huge NPE (Non-Performing Exposure) in its Balance Sheet may be interested in selling the loans to ease its position, indeed NPLs exposures can tie up scarce bank resources, including capital. To realize the selling there are two options: direct selling of the Loan or securitization of the NPLs.

The direct selling is extremely problematic for a variety of reasons: first of all, we are moving in a “market for lemons” environment as banks have an information advantage on their investors and this, together with a series of institutional obstacles (such as the legal framework and the time investing process) contribute to enforce a bid-ask spread which tends to delay the transactions.

The key determining factors of this spread are:

- the higher return requested by the investors.

- the indirect costs of working out impaired assets, which are accounted only on the banks’ side and not on the investors’ one.

- the recoverable amount of the loan.

- its predictable cash flows (also influenced by the default rate).

All these elements contribute to the generation of a value adjustment which is the difference between the price offered by the bank and the one that investors are willing to offer.

Further complications showed up in 2016, when Single Supervisory Mechanism has been accused to force banks sell each type of NPLs disregarding the recovery chances of the underlying assets in order to clean up quickly the balance sheets: the ECB, the SSM itself and the Bank of Italy, explicitly denied this accuse as well as each case has been and is carefully evaluated by the competent administrators.

Then, as mentioned above, another channel for the developing of the secondary market is securitization process. In a nutshell, we have a pool of assets selected by a bank which are then sold by a SPV to investors in different tranches (which differ by rating and risk profile): a typical and interesting feature on this standard model has been put in place by the Italian Government: the GACS (“Garanzia sulla cartolarizzazione delle sofferenze”) is the unconditional and payable of first demand guarantee issued by the Ministry of Economics and Finance on senior tranches of a NPLs credits securitization. The first scheme has been introduced in 2016 and, thanks to its success, renewed in March 2019 with some updates on the rating procedure of the tranche and the performance objectives. A total amount of €6 billion of this type of transaction is estimated for 2020.

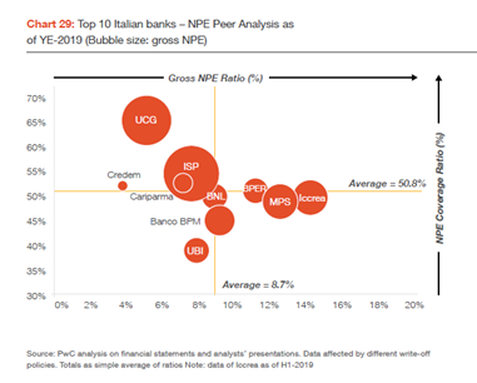

If we now focus on the Italian example, we can see that the level of non-performing exposure is gradually lowering, despite still above the European average. In addition, before the pandemic (that is partially erasing such progress), Italian banks showed off some of the highest coverage ratios among Europe, with UniCredit on the top with a ratio of 64.6% (currently at 62.7%). The coverage ratio measures a bank's ability to absorb potential losses from its non-performing loans and is calculated as follows: (Loans - Reserve balance) / Total amount of non-performing loans.

According to 2019 data, the worst category of NPL, the “Bad Loans” has been well managed by all the easing structure, and now the biggest exposure (61€ Bn) is on Unlikely to Pay debts: these are indeed the small businesses and non-financial companies which are “at risk” after the economic disruption due to COVID-19. UTP exposure is more complex to manage as it implies a mix of strategies in the perspective of a recovery. Not surprisingly, the 82% of this exposure is held by the Italian top 10 banks. Among them, worth of mention, for NPE ratio and coverage ratio, is UniCredit S.p.A.

UniCredit, in line with its latest industrial plan, will be one of the top players in the NPE market in 2020 with approx. €8.5bn of ongoing transactions. Over the years various actions have been taken in this direction, among which, by size, it should be remembered the FINO securitisations (in 2017) and PRISMA transaction (in 2019).

The NPLs secondary market, however, is complex by many points of view, but first let’s consider what are the reasons why we need it. A bank who has a huge NPE (Non-Performing Exposure) in its Balance Sheet may be interested in selling the loans to ease its position, indeed NPLs exposures can tie up scarce bank resources, including capital. To realize the selling there are two options: direct selling of the Loan or securitization of the NPLs.

The direct selling is extremely problematic for a variety of reasons: first of all, we are moving in a “market for lemons” environment as banks have an information advantage on their investors and this, together with a series of institutional obstacles (such as the legal framework and the time investing process) contribute to enforce a bid-ask spread which tends to delay the transactions.

The key determining factors of this spread are:

- the higher return requested by the investors.

- the indirect costs of working out impaired assets, which are accounted only on the banks’ side and not on the investors’ one.

- the recoverable amount of the loan.

- its predictable cash flows (also influenced by the default rate).

All these elements contribute to the generation of a value adjustment which is the difference between the price offered by the bank and the one that investors are willing to offer.

Further complications showed up in 2016, when Single Supervisory Mechanism has been accused to force banks sell each type of NPLs disregarding the recovery chances of the underlying assets in order to clean up quickly the balance sheets: the ECB, the SSM itself and the Bank of Italy, explicitly denied this accuse as well as each case has been and is carefully evaluated by the competent administrators.

Then, as mentioned above, another channel for the developing of the secondary market is securitization process. In a nutshell, we have a pool of assets selected by a bank which are then sold by a SPV to investors in different tranches (which differ by rating and risk profile): a typical and interesting feature on this standard model has been put in place by the Italian Government: the GACS (“Garanzia sulla cartolarizzazione delle sofferenze”) is the unconditional and payable of first demand guarantee issued by the Ministry of Economics and Finance on senior tranches of a NPLs credits securitization. The first scheme has been introduced in 2016 and, thanks to its success, renewed in March 2019 with some updates on the rating procedure of the tranche and the performance objectives. A total amount of €6 billion of this type of transaction is estimated for 2020.

If we now focus on the Italian example, we can see that the level of non-performing exposure is gradually lowering, despite still above the European average. In addition, before the pandemic (that is partially erasing such progress), Italian banks showed off some of the highest coverage ratios among Europe, with UniCredit on the top with a ratio of 64.6% (currently at 62.7%). The coverage ratio measures a bank's ability to absorb potential losses from its non-performing loans and is calculated as follows: (Loans - Reserve balance) / Total amount of non-performing loans.

According to 2019 data, the worst category of NPL, the “Bad Loans” has been well managed by all the easing structure, and now the biggest exposure (61€ Bn) is on Unlikely to Pay debts: these are indeed the small businesses and non-financial companies which are “at risk” after the economic disruption due to COVID-19. UTP exposure is more complex to manage as it implies a mix of strategies in the perspective of a recovery. Not surprisingly, the 82% of this exposure is held by the Italian top 10 banks. Among them, worth of mention, for NPE ratio and coverage ratio, is UniCredit S.p.A.

UniCredit, in line with its latest industrial plan, will be one of the top players in the NPE market in 2020 with approx. €8.5bn of ongoing transactions. Over the years various actions have been taken in this direction, among which, by size, it should be remembered the FINO securitisations (in 2017) and PRISMA transaction (in 2019).

Indeed, in the fourth quarter 2019 UniCredit finalized a securitization of an NPL Residential Mortgage Portfolio on €4.1 billion (GBV) through the vehicle PRISMA SPV S.r.l., of which 92% of Senior note (supported by the GACS) and 5% of mezzanine and Junior Notes are held by UniCredit itself. This “re-purchase” is a common mechanism of internal credit enhancement justified by the information advantage of the bank about the recovery period of the underlying assets of the securitized product. As at 30 June 2020, the gross book value of the NPE belonging to the Non-Core perimeter amounted to approximately €3.4 billion. The other deteriorated exposures diminished to €16.7 Bn, accounting for a gross decreasing of 31.2%. Thanks to these operations the NPL ratio was at 2.7% (2Q20), below the sample average taken from the EBA (3.0%).

Moreover, on 2 July 2020 UniCredit informed that, in June, it has reached an agreement with Banca Ifis ("IFIS") in relation to the disposal of a non-performing unsecured individual credit portfolio, in Italy. The portfolio consists entirely of Italian unsecured individual credits with a claim value of approximately €155 million.

Finally, on 22 October 2020, Illimity Bank bought a NPLs package, made up by guaranteed corporate bonds, from UniCredit for an amount of 692Mln of gross book value.

Maria D’Amato

Moreover, on 2 July 2020 UniCredit informed that, in June, it has reached an agreement with Banca Ifis ("IFIS") in relation to the disposal of a non-performing unsecured individual credit portfolio, in Italy. The portfolio consists entirely of Italian unsecured individual credits with a claim value of approximately €155 million.

Finally, on 22 October 2020, Illimity Bank bought a NPLs package, made up by guaranteed corporate bonds, from UniCredit for an amount of 692Mln of gross book value.

Maria D’Amato