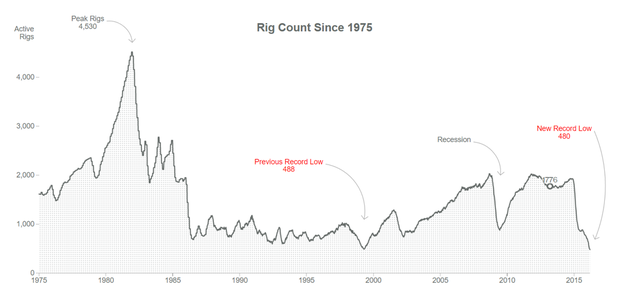

The last five years represent the fastest expansion of U.S. oil production in history, driven by new technologies like the horizontal drilling through shale rocks. The oil production in the U.S. climbed from 5.6m bbl/day in 2011 to 9.6m bbl/day in 2015 and the number of active oil rigs more than doubled from 798 in early 2011 to 1.930 in October 2014.

But the U.S. shale revolution was driven by small and undercapitalized companies that sold over 241 billion $ in bonds during the period from 2007 to 2014 with the belief that oil price couldn’t ever suffer a long period decrease much less a crash

But the U.S. shale revolution was driven by small and undercapitalized companies that sold over 241 billion $ in bonds during the period from 2007 to 2014 with the belief that oil price couldn’t ever suffer a long period decrease much less a crash

But in late 2014 a perfect storm hit oil markets; OPEC countries, leaded by Saudi Arabia, worried to lose market shares, started an oversupplying policy that dumped oil prices to lower than 30$/bbl in early 2016. The oil price decline dealt a strong hit to U.S. oil industry that has a high break-even (estimated on average around 60-70$/bbl) on its extraction operations. Because of the oil crash, the US crude oil production plunged 600 thousand bbl/day and the number of active oil rigs set a new record low at only 480. However, the demand is still weak, mostly due to China’s economy slowdown, and oil inventories are rising at their all-time high and the end of Iran’s sanctions will not help a recovery of oil price.

If the hit was terrible for oil companies it risks now to be fatal for shale oil companies overwhelmed by a monstre debt amount. Investor are now facing a 19 billion $ wave of junk bonds defaults as at least nine shale oil companies, such as Energy XXI Ltd., SandRidge Energy Inc. and Goodrich Petroleum Corp. , announced missed debt payments triggering a countdown to default; since 2015 48 oil&gas companies have fallen in Chapter 11 bankruptcy reorganization owing more than 17 billion $. Even than the cost of extraction of shale has fallen 40% the last year very few of U.S. companies is the sector can be profitable with oil at 30$/bbl and the market reacted with violence turning shale companies’ stocks in “penny stocks” and halving the value of their bonds.

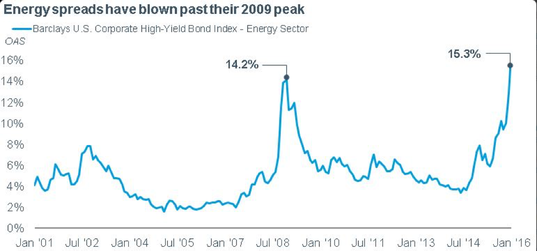

The alarm bell rings on energy companies’ bond market; Fitch Ratings notes that currently there are 77 billion $ of energy bonds trading below 50 cents per dollar, below the levels reached on the wave of the financial crisis , a sign that the storm that hit so hard in 2015 could hit stronger in next months. Most of shale oil companies’ bonds are rated as junk (BB+ or lower) by credit rating agencies and the yield of these bonds is skyrocketing since the oil crash started.

If the hit was terrible for oil companies it risks now to be fatal for shale oil companies overwhelmed by a monstre debt amount. Investor are now facing a 19 billion $ wave of junk bonds defaults as at least nine shale oil companies, such as Energy XXI Ltd., SandRidge Energy Inc. and Goodrich Petroleum Corp. , announced missed debt payments triggering a countdown to default; since 2015 48 oil&gas companies have fallen in Chapter 11 bankruptcy reorganization owing more than 17 billion $. Even than the cost of extraction of shale has fallen 40% the last year very few of U.S. companies is the sector can be profitable with oil at 30$/bbl and the market reacted with violence turning shale companies’ stocks in “penny stocks” and halving the value of their bonds.

The alarm bell rings on energy companies’ bond market; Fitch Ratings notes that currently there are 77 billion $ of energy bonds trading below 50 cents per dollar, below the levels reached on the wave of the financial crisis , a sign that the storm that hit so hard in 2015 could hit stronger in next months. Most of shale oil companies’ bonds are rated as junk (BB+ or lower) by credit rating agencies and the yield of these bonds is skyrocketing since the oil crash started.

In the last weeks oil price had a rebound rising closer to 40$/bbl but that is not enough. Someone now thinks that the price may have bottomed at 26$ last month but actually the market is really far from a stabilization around sostainable prices for high-cost producers like US shale companies. The reality is that the problem of oversupplying is not resolved and seems that OPEC countries are far from an agreement to cut production.

So what future for U.S. shale industry? No one knows. The only certain thing is that if the oil price will remain that low for a long period maybe the half of these companies have no possibility to survive, even though the oil will recover 50$ or 60$ (a 50% rally from actual level). They need 70$ more than a man needs a glass of water in the middle of the Mojave.

Tomaso Giorgi

So what future for U.S. shale industry? No one knows. The only certain thing is that if the oil price will remain that low for a long period maybe the half of these companies have no possibility to survive, even though the oil will recover 50$ or 60$ (a 50% rally from actual level). They need 70$ more than a man needs a glass of water in the middle of the Mojave.

Tomaso Giorgi