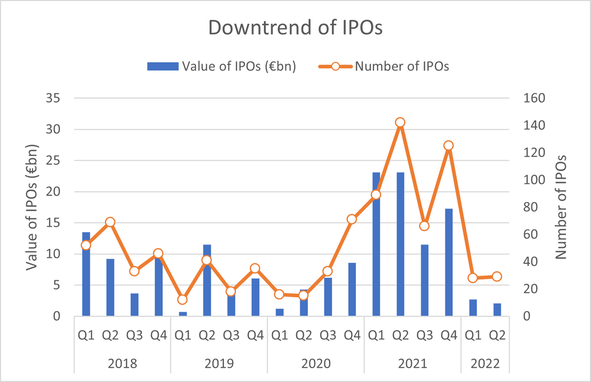

Driven by the reopening of economies around the world, 2021 represented a record year for the global IPO market. Analysts were expecting that the market would lose some of its momentum entering the new year, as the record growth of 2021 was, according to many, not sustainable. However, nobody could have anticipated that the market would experience such a sharp decline in the volume of deals and value raised. Given today's general macroeconomic environment, this slowdown is not surprising. In a market filled with uncertainty, higher volatility, rising interest rates, and falling stock indexes, many top executives chose to adopt a wait-and-see approach, pushing back on the plans they had initially laid out to take their companies public.

Nevertheless, some executives chose to pursue their listing plans notwithstanding the unfavorable conditions. At the start of September, top Volkswagen (VW) executives started ventilating the possibility of listing Porsche on the Frankfurt stock exchange. On the 29th of September, the IPO would take place, and Porsche would become Germany's second-largest listing, following the one of Deutsche Telekom in 1996. Until the start of November, Porsche has performed relatively well on the market, reaching a valuation comparable to VW's.

This article will analyze some of the reasons behind this successful IPO. We will first introduce the automotive industry in which Porsche and VW operate and then investigate Porsche's history. We will then explain how the IPO was structured and how the stock has performed following its listing. In the final part of the article, we will highlight some of the key reasons which have allowed Porsche to benefit from a higher initial valuation and some of the factors that might have attracted interest from investors.

Industry Analysis

Globally, the automotive industry remains a key driver of industrial output, with modest growth due to its maturity and consolidation. Demand for individual vehicles will likely not see great increases over the next couple of years as a result of changing trends in consumer behaviour, the increase in popularity of car sharing platforms, as well as rising climate change awareness and sustainability concerns. However, the structure of this demand is very likely to change – hybrid and electric vehicles are becoming more appealing to consumers not just for the aforementioned reasons, but also due to the current fuel crisis and expanding government incentives to encourage the acquisition of such cars (i.e., lower taxes, cash repayments, investments in charging station infrastructure and so on).

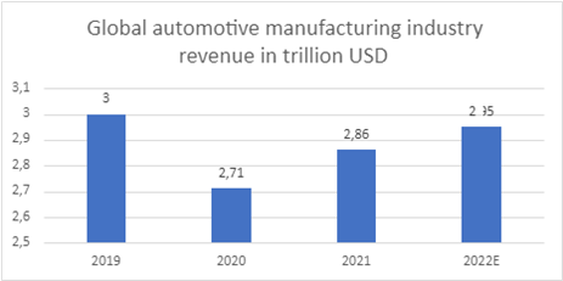

The graph below shows that the global automotive manufacturing revenues were greatly affected by the pandemic over the past four years. In 2019, global revenues amounted to USD 3 trillion. In 2020, the first pandemic year, there was a decrease of USD 290 billion. In the following years, as restrictions were slowly eased and governments adapted to the reality of the crucial necessity to keep businesses operating, revenues modestly increased, with the projections for 2022 being USD 50 billion below the pre-pandemic level.

Nevertheless, some executives chose to pursue their listing plans notwithstanding the unfavorable conditions. At the start of September, top Volkswagen (VW) executives started ventilating the possibility of listing Porsche on the Frankfurt stock exchange. On the 29th of September, the IPO would take place, and Porsche would become Germany's second-largest listing, following the one of Deutsche Telekom in 1996. Until the start of November, Porsche has performed relatively well on the market, reaching a valuation comparable to VW's.

This article will analyze some of the reasons behind this successful IPO. We will first introduce the automotive industry in which Porsche and VW operate and then investigate Porsche's history. We will then explain how the IPO was structured and how the stock has performed following its listing. In the final part of the article, we will highlight some of the key reasons which have allowed Porsche to benefit from a higher initial valuation and some of the factors that might have attracted interest from investors.

Industry Analysis

Globally, the automotive industry remains a key driver of industrial output, with modest growth due to its maturity and consolidation. Demand for individual vehicles will likely not see great increases over the next couple of years as a result of changing trends in consumer behaviour, the increase in popularity of car sharing platforms, as well as rising climate change awareness and sustainability concerns. However, the structure of this demand is very likely to change – hybrid and electric vehicles are becoming more appealing to consumers not just for the aforementioned reasons, but also due to the current fuel crisis and expanding government incentives to encourage the acquisition of such cars (i.e., lower taxes, cash repayments, investments in charging station infrastructure and so on).

The graph below shows that the global automotive manufacturing revenues were greatly affected by the pandemic over the past four years. In 2019, global revenues amounted to USD 3 trillion. In 2020, the first pandemic year, there was a decrease of USD 290 billion. In the following years, as restrictions were slowly eased and governments adapted to the reality of the crucial necessity to keep businesses operating, revenues modestly increased, with the projections for 2022 being USD 50 billion below the pre-pandemic level.

Source: IBISWorld, Statista

Cars for individual consumers are legally defined as “light vehicles”. In terms of sales volumes, this sector is projected to reach 98.9 million units sold in 2025, a 30% increase from the 75.8 million units sold in 2021 and a 19.7% increase over the 82.6 million units estimated throughout 2022. Over the following years, however, the growth rate is projected to decrease, as this industry consolidates and re-enters a phase of sustained, low growth.

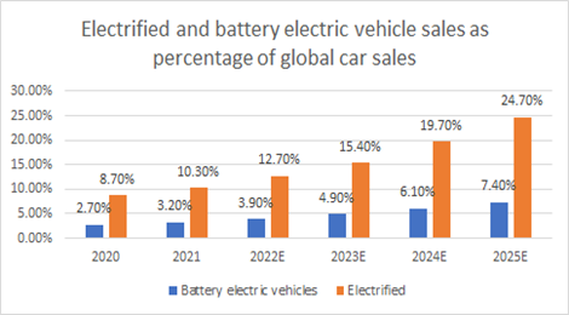

The change in the structure of demand will very likely be driven by electric vehicles. More precisely, the share of electric vehicle revenues in the aggregate industry income is predicted to increase dramatically, as per JPMorgan Chase estimates outlined below.

The change in the structure of demand will very likely be driven by electric vehicles. More precisely, the share of electric vehicle revenues in the aggregate industry income is predicted to increase dramatically, as per JPMorgan Chase estimates outlined below.

Source: JPMorgan Chase

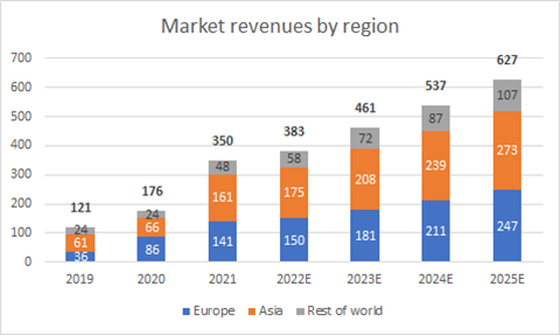

Europe is establishing itself as a high potential market, and many manufacturers are committing to earning greater percentages of their revenues from electric cars. A forecast of revenues from electric vehicle sales, split by region, emphasizes a 31.5% annual average global growth from 2019 through 2025, largely driven by Asia and Europe.

Source: Statista Mobility Market Outlook 2022

A McKinsey report predicts the market has considerable room for growth. More specifically, it is expected that new business models monetising proprietary software and technology, shared mobility, and connectivity, will lead to an increase of 30% in global industry revenues by 2030. One-time vehicle sales growth, forecasted around a rather modest 2%, will be driven primarily by growth in emerging economies. This will also lead to increases in aftermarket sales. Developed countries with an established, large vehicle base will instead be the platform for the technology-induced growth in the context of changing consumer attitudes toward shared mobility. The same report predicts that, by 2030, one in ten vehicles sold will be shared.

Germany has long been a hotbed of automotive manufacturing, with brands like Volkswagen, Audi, BMW, Mercedes-Benz and Porsche establishing its reputation for reliable, high-quality products. The Volkswagen Group, a conglomerate holding company which owns, among others, the namesake brand, is the global industry leader, with revenues of USD 296.1 billion and over 672,000 employees. The group comprises a grand total of 10 brands, among which Audi, Lamborghini, Bentley, Porsche and Ducati.

About Porsche

Porsche was founded in 1931, but its operational history can be more accurately described as beginning in 1948, with the production of the Type 356, the brand’s first model. The company began collaborating with Volkswagen in 1969 on several models and engines, and, in 2011, the two companies merged. The entity responsible for the actual production is Dr. Ing. h.c. F. Porsche AG, commonly known as Porsche AG, and it is entirely owned by Volkswagen AG. The holding company, which initially had the same name, is now called Porsche SE, and it owns a stake in Volkswagen, thus indirectly partially controlling the luxury manufacturer.

Porsche had revenues of USD 19.3 billion in 2021. Sport cars, together with large SUVs (namely the Cayenne) were the core segments of Porsche, accounting for 48% and 27.6% of revenues respectively. This aligns with an overall market trend: as it can be observed with Rolls Royce, Aston Martin, and especially Bentley, the launch of their SUV models (the Cullinan, the DBX and the Bentayga, respectively) greatly improved their income and led to record sales. The firm has a forecasted compound annual growth rate of 1.6% between 2013 and 2026, exhibiting stable growth, affected only by the recent exogenous shocks. Overall, from 2013 to 2019, the firm’s revenues grew by 23.89%.

In 2021, Porsche had a 5.6% share of the global luxury car market, ranking 8th, with Mercedes-Benz and BMW leading the rankings. However, the firm was the uncontested leader in terms of sports car revenues share, accounting for 14.4% of global income in this segment. Porsche falls outside the top 10 global manufacturers for SUVs (1.6% of worldwide SUV sales in 2021) as it focuses on the premium side of a very wide market. Top global manufacturers are Ford, Toyota and Chevrolet, which instead focus on the more affordable products with mass market appeal.

The firm is committed to expanding its electric vehicle offerings. It offers its Panamera and Cayenne models in hybrid versions, and it launched the all-electric Taycan in 2019.

Beating the IPO Market

The environment in which the IPO took place is far from ideal. Due to increasing interest rates, high inflation, geopolitical uncertainties and underperforming markets, the global volume of the IPO market has fallen 68% compared to 2021, and it is not expected to recover soon. Many firms that were planning to go public in 2022 are not willing to sell their shares at a significant discount and postponed their IPO.

Germany has long been a hotbed of automotive manufacturing, with brands like Volkswagen, Audi, BMW, Mercedes-Benz and Porsche establishing its reputation for reliable, high-quality products. The Volkswagen Group, a conglomerate holding company which owns, among others, the namesake brand, is the global industry leader, with revenues of USD 296.1 billion and over 672,000 employees. The group comprises a grand total of 10 brands, among which Audi, Lamborghini, Bentley, Porsche and Ducati.

About Porsche

Porsche was founded in 1931, but its operational history can be more accurately described as beginning in 1948, with the production of the Type 356, the brand’s first model. The company began collaborating with Volkswagen in 1969 on several models and engines, and, in 2011, the two companies merged. The entity responsible for the actual production is Dr. Ing. h.c. F. Porsche AG, commonly known as Porsche AG, and it is entirely owned by Volkswagen AG. The holding company, which initially had the same name, is now called Porsche SE, and it owns a stake in Volkswagen, thus indirectly partially controlling the luxury manufacturer.

Porsche had revenues of USD 19.3 billion in 2021. Sport cars, together with large SUVs (namely the Cayenne) were the core segments of Porsche, accounting for 48% and 27.6% of revenues respectively. This aligns with an overall market trend: as it can be observed with Rolls Royce, Aston Martin, and especially Bentley, the launch of their SUV models (the Cullinan, the DBX and the Bentayga, respectively) greatly improved their income and led to record sales. The firm has a forecasted compound annual growth rate of 1.6% between 2013 and 2026, exhibiting stable growth, affected only by the recent exogenous shocks. Overall, from 2013 to 2019, the firm’s revenues grew by 23.89%.

In 2021, Porsche had a 5.6% share of the global luxury car market, ranking 8th, with Mercedes-Benz and BMW leading the rankings. However, the firm was the uncontested leader in terms of sports car revenues share, accounting for 14.4% of global income in this segment. Porsche falls outside the top 10 global manufacturers for SUVs (1.6% of worldwide SUV sales in 2021) as it focuses on the premium side of a very wide market. Top global manufacturers are Ford, Toyota and Chevrolet, which instead focus on the more affordable products with mass market appeal.

The firm is committed to expanding its electric vehicle offerings. It offers its Panamera and Cayenne models in hybrid versions, and it launched the all-electric Taycan in 2019.

Beating the IPO Market

The environment in which the IPO took place is far from ideal. Due to increasing interest rates, high inflation, geopolitical uncertainties and underperforming markets, the global volume of the IPO market has fallen 68% compared to 2021, and it is not expected to recover soon. Many firms that were planning to go public in 2022 are not willing to sell their shares at a significant discount and postponed their IPO.

Source: PwC

Even after Porsche went public, its relationship with Volkswagen remains very close. The two companies in fact share the same CEO, Oliver Blume. Not only that, but eleven individuals hold positions in the boards of more than two companies of the group. According to a survey carried out by Bernstein, 70% of the investors see the dual mandate negatively as it has risen questions over possible conflicts of interest. Despite those concerns, VW has declared that Oliver Blume will keep his role as CEO of both Porsche and VW. This opaque corporate structure, however, is not unheard in the automotive industry. Many successful car companies such as BMW, Ford and Toyota are in fact owned and controlled by families. For those reasons, the investors in the automotive industry must consider a complex corporate structure such as the one of Porsche and VW.

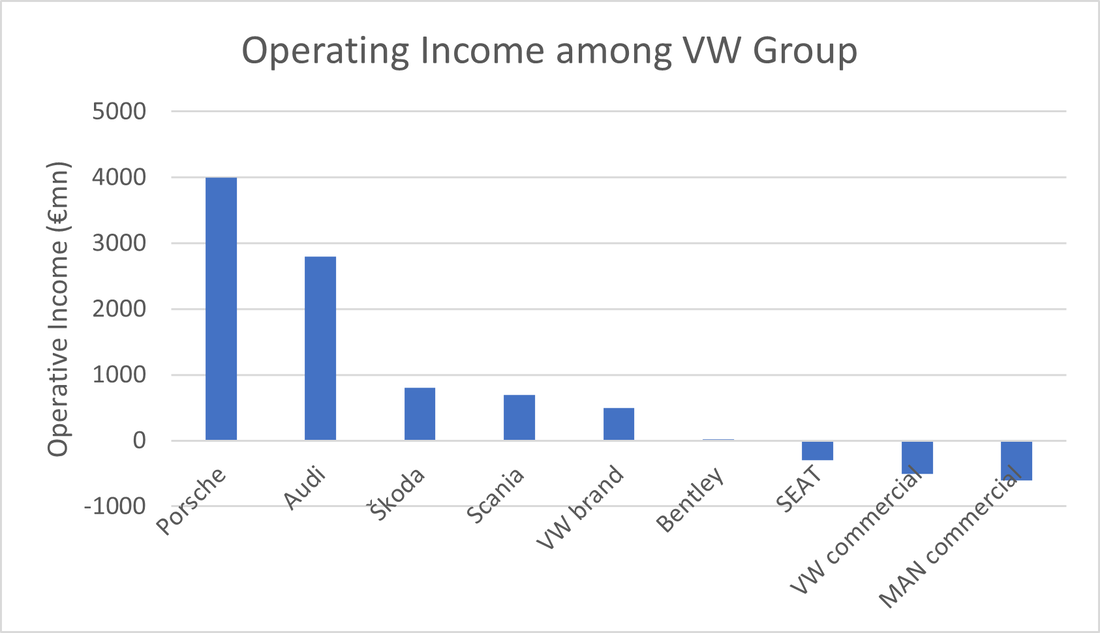

Despite the unfavourable market conditions and the poor corporate governance, the IPO has been a success. This was determined mainly by three elements. The first one concerns the outstanding financial performance of Porsche, that has the highest operating income among the VW group. The second element is that the IPO has generated a discrete interest among institutional investors, such as QIA, Norges Bank, T. Rowe Price and ADQ. In fact, roughly 40 per cent of the floated shares has been acquired by cornerstone investors. The third reason that played a role in the success of the IPO is that many investors are already familiar with the business. Porsche, in fact, has already been listed before, has a long history and is an iconic brand.

Despite the unfavourable market conditions and the poor corporate governance, the IPO has been a success. This was determined mainly by three elements. The first one concerns the outstanding financial performance of Porsche, that has the highest operating income among the VW group. The second element is that the IPO has generated a discrete interest among institutional investors, such as QIA, Norges Bank, T. Rowe Price and ADQ. In fact, roughly 40 per cent of the floated shares has been acquired by cornerstone investors. The third reason that played a role in the success of the IPO is that many investors are already familiar with the business. Porsche, in fact, has already been listed before, has a long history and is an iconic brand.

Source: Volkswagen AG

For all those reasons, the IPO has been able to generate significant interest among investors. The appropriate price set by VW has left room for an appreciation of the shares over time – those who bought them at the set price of €82.50, the top of the pricing range, have already experienced a substantial capital gain as the shares reached €100.00 on October 27, making Porsche the most valuable European carmaker. Through the IPO, Volkswagen raised €9.4bn and roughly half of that amount will be paid to investors as a special one-off dividend.

Ownership Structure

The total shares issued are 911 million; 50% are ordinary shares and 50% are preferred shares, with no voting rights but with a priority over receiving dividends. Only 25% of the preferred shares (so 12.5% of the capital) has been floated, while 25% plus one of the ordinary shares has been acquired by Porsche SE, at a 7.5% premium. Therefore, no voting shares of Porsche AG will be available to the public, and the company will remain under the control of VW. It’s also worth noticing that Porsche SE owns 53.3% voting shares of Volkswagen AG and therefore the Porsche-Piëch family indirectly controls the overall group.

Now, after the listing of Porsche AG, there are four distinct listed entities connected to Volkswagen and strictly related to each other: Volkswagen AG (the overall group), Traton SE (the truck business), Porsche AG and Porsche SE (a holding company controlled by the Porsche and Piëch families).

Selling the IPO and Valuation Considerations

One of the most crucial elements of an IPO is often the equity story and the traction and interest it can generate among potential investors. In this case the goal of the story was to advocate that Porsche, similarly to Ferrari, was indeed to be valued by investors as a luxury company. The reason is that, in this way, VW could ensure that the valuation of Porsche would benefit from the generally higher multiples of the luxury industry. The P/E multiple that Ferrari achieved in its very successful 2015 IPO was 30x, while that of an automotive company such as VW is around 4x. To ensure that Porsche would reach a similar valuation to Ferrari's, the top management team at VW carried out a series of steps. Two of the most notable ones have been hiring the same advisors as the Ferrari IPO and advocating for the selection of luxury firms (e.g., LVHM, Hermes and Cristian Dior) as comparable companies to be used in the valuation process. The final valuation of Porsche positioned it to have a P/E of 16x and a total value of around €75bn, so it is fair to say that investors will be pricing Porsche as a luxury company to a certain extent.

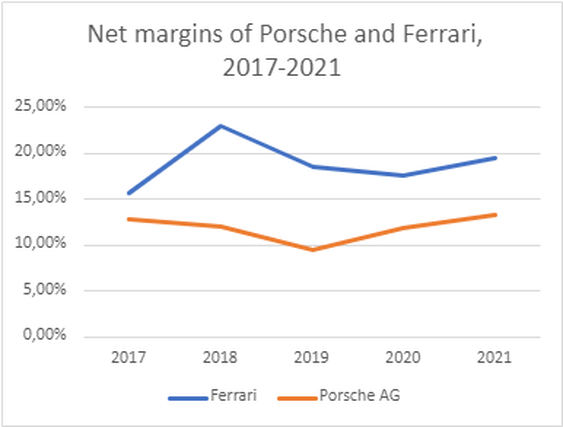

Porsche has proven to have some relevant elements of a luxury brand, yet the market valuation is only partially on the same level as Ferrari. Two crucial metrics that reinforce this thesis are both the margins and the “exclusivity” of the brand. For what concerns the first element, as can be seen below, the margins that Porsche has been posting over recent years have been lower than those of Ferrari.

Ownership Structure

The total shares issued are 911 million; 50% are ordinary shares and 50% are preferred shares, with no voting rights but with a priority over receiving dividends. Only 25% of the preferred shares (so 12.5% of the capital) has been floated, while 25% plus one of the ordinary shares has been acquired by Porsche SE, at a 7.5% premium. Therefore, no voting shares of Porsche AG will be available to the public, and the company will remain under the control of VW. It’s also worth noticing that Porsche SE owns 53.3% voting shares of Volkswagen AG and therefore the Porsche-Piëch family indirectly controls the overall group.

Now, after the listing of Porsche AG, there are four distinct listed entities connected to Volkswagen and strictly related to each other: Volkswagen AG (the overall group), Traton SE (the truck business), Porsche AG and Porsche SE (a holding company controlled by the Porsche and Piëch families).

Selling the IPO and Valuation Considerations

One of the most crucial elements of an IPO is often the equity story and the traction and interest it can generate among potential investors. In this case the goal of the story was to advocate that Porsche, similarly to Ferrari, was indeed to be valued by investors as a luxury company. The reason is that, in this way, VW could ensure that the valuation of Porsche would benefit from the generally higher multiples of the luxury industry. The P/E multiple that Ferrari achieved in its very successful 2015 IPO was 30x, while that of an automotive company such as VW is around 4x. To ensure that Porsche would reach a similar valuation to Ferrari's, the top management team at VW carried out a series of steps. Two of the most notable ones have been hiring the same advisors as the Ferrari IPO and advocating for the selection of luxury firms (e.g., LVHM, Hermes and Cristian Dior) as comparable companies to be used in the valuation process. The final valuation of Porsche positioned it to have a P/E of 16x and a total value of around €75bn, so it is fair to say that investors will be pricing Porsche as a luxury company to a certain extent.

Porsche has proven to have some relevant elements of a luxury brand, yet the market valuation is only partially on the same level as Ferrari. Two crucial metrics that reinforce this thesis are both the margins and the “exclusivity” of the brand. For what concerns the first element, as can be seen below, the margins that Porsche has been posting over recent years have been lower than those of Ferrari.

Source: Volkswagen AG, Porsche AG

The second crucial element for luxury companies is the exclusivity of their products. Two metrics can define this: the first is the entry point (cheapest vehicle) at which consumers can buy their entrance to the brand, and the second is the volume of cars produced. In both categories, Porsche is lagging with respect to Ferrari. The cheapest vehicle sold by Porsche costs around $65,000, much closer to the cheapest Mercedes ($35,000) than the most affordable Ferrari ($250,000). VW top management has tried to argue the irrelevance of this point. Instead, they highlighted that Porsche still sells 15,000 of its models at a supercar price range, comparable to Ferrari. Nevertheless, a few carmakers (e.g. Ford, which has a price listing for its GT supercars at half a million dollars) are selling supercars within their portfolios and are far off from being considered luxury brands. In this regard, exclusivity in the entry point seems to be a sounder measure in determining whether a brand should fall within the luxury category.

For what instead concerns the volume of cars sold, we see that Porsche far outweighs Ferrari as the former produces roughly 300,000 vehicles a year compared with the only 10,000 cars of the Italian supercar maker. According to some analysts, a higher volume and a lower entry point can significantly impact the customer base and, consequently, their willingness (or ability) to spend in turbulent times. A Porsche customer is more likely to curb its spending compared to a Ferrari customer, meaning that Porsche as a business is more cyclical as its revenue line is more vulnerable to macroeconomic shocks. This “cyclicality” component often reflects a higher risk for the company and, consequently, a lower overall valuation.

Another consideration worth highlighting is the extent to which, following the IPO we can expect a significant change in the stock price of VW. The immediate effect of the IPO was a drastic fall in the share price of VW, which has however been steadily recovering over the last couple of weeks. Overall, analysts believe that there will be a minor long-term effect. They argue that at the end of the day, VW will own less of their most prized assets and that the proposed investment activity seems more focused on stabilizing the current balance sheet rather than expanding it. An element that could change in the long term is the corporate strategy of VW, which considering the success of the Porsche IPO could proceed to IPO some of its crucial portfolio brands.

Key Takeaways

Porsche’s IPO could also impact the general market sentiment, leading some executives to decide to take their companies public. However, we do not believe this would be a good idea for many companies. The success of this IPO rests upon Porsche’s strong brand identity and ability to gain a favourable valuation, given its capability to command a premium for the products it sells. As Porsche has many characteristics of a luxury company, it is insulated from intense macroeconomic pressure, differentiating it from many other companies in the market. Therefore, while the Porsche IPO story is undoubtedly one of success, we expect it to be one of the few we will be reading about until macroeconomic conditions drastically change.

For what instead concerns the volume of cars sold, we see that Porsche far outweighs Ferrari as the former produces roughly 300,000 vehicles a year compared with the only 10,000 cars of the Italian supercar maker. According to some analysts, a higher volume and a lower entry point can significantly impact the customer base and, consequently, their willingness (or ability) to spend in turbulent times. A Porsche customer is more likely to curb its spending compared to a Ferrari customer, meaning that Porsche as a business is more cyclical as its revenue line is more vulnerable to macroeconomic shocks. This “cyclicality” component often reflects a higher risk for the company and, consequently, a lower overall valuation.

Another consideration worth highlighting is the extent to which, following the IPO we can expect a significant change in the stock price of VW. The immediate effect of the IPO was a drastic fall in the share price of VW, which has however been steadily recovering over the last couple of weeks. Overall, analysts believe that there will be a minor long-term effect. They argue that at the end of the day, VW will own less of their most prized assets and that the proposed investment activity seems more focused on stabilizing the current balance sheet rather than expanding it. An element that could change in the long term is the corporate strategy of VW, which considering the success of the Porsche IPO could proceed to IPO some of its crucial portfolio brands.

Key Takeaways

Porsche’s IPO could also impact the general market sentiment, leading some executives to decide to take their companies public. However, we do not believe this would be a good idea for many companies. The success of this IPO rests upon Porsche’s strong brand identity and ability to gain a favourable valuation, given its capability to command a premium for the products it sells. As Porsche has many characteristics of a luxury company, it is insulated from intense macroeconomic pressure, differentiating it from many other companies in the market. Therefore, while the Porsche IPO story is undoubtedly one of success, we expect it to be one of the few we will be reading about until macroeconomic conditions drastically change.

By Federico Adorini, Teodor Matei, Filippo Reina

Sources:

- Bloomberg

- Factiva

- Helgi Library

- Macrotrends

- McKinsey

- Porsche AG

- Porsche SE

- Reuters

- Statista

- The Wall Street Journal

- Volkswagen AG

- Financial Times

- PWC

- CNBC