The Goldman Sachs Group, Inc., worth over $120 billion on the New York Stock Exchange (NYSE), is set to undergo a major reorganization, planning to reportedly combine its four main divisions into three. Needing little introduction, the American company has been leading the global banking industry for several years and still maintains its leadership position, as the firm’s 2022 Q3 results show. In fact, net revenues have reached $11.98 billion ($36.77 billion YTD), and the company ranked #1 worldwide in completed M&A deals and equity-related offerings. Nevertheless, the Wall Street giant aims at a further increase in revenues by focusing on fee-based clients and to embark on a new technology-oriented era of customer care. After an overview of the bank’s major activities, this article will focus on Goldman Sachs’ reshuffle, the rationales behind it, and the implications it will have on the future of the bank.

Overview

Goldman Sachs’s structure has not changed since a previous major internal reorganization in 2020. CEO David Solomon’s tendency to reform the company’s structure and culture is no secret. The main purposes of his plan were to “strengthen [the] core businesses, diversify products and services and operate more efficiently”. Following the 2020 reorganization, the bank is currently organized into four main divisions: Global Markets, Asset Management, Consumer & Wealth Management, and Investment Banking.

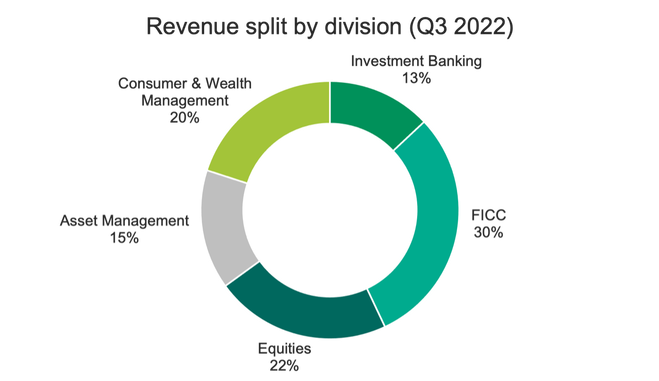

The Global Markets division is composed of Equities and Fixed Income, Currencies, and Commodities (FICC), therefore interest rate products, like bonds and credit products. Moreover, the division operates with financial derivative contracts, such as futures and options. It is the most prominent segment in terms of revenues, accounting for over half the net revenues, precisely 52%, with a $6.20 billion net revenue, from Q3 2022. In 2020, the exact year of Goldman’s last reorganization, the division brought in $21.2 billion in net revenue, equivalent to 48% of total revenues.

The Asset Management division includes Equity, Fixed Income and Alternative Investments, such as hedge funds, credit funds, private equity, currencies, Real Estate, and asset allocation strategy. While Global Markets is specialized in assisting clients in transactions in both liquid and illiquid markets, Asset Management strategically protects and increases clients’ wealth. Generating revenue mostly from management fees, this segment holds for 15% of the Q3 2022 net revenue, bringing in $1.82 billion. Meanwhile, the company’s 2020 annual report states that the division accounted for 18%, with net revenues as high as $8.0 billion.

Having generated $6.0 billion in net revenues in 2020 (13% of total net revenue), the Consumer & Wealth Management division oversees the preservation of clients’ wealth and assets, by managing major investments, and maximizes a company’s profits by reducing taxes owed. The segment deals with financial planning, investment management, deposit taking, investment advisory and lending. It generates revenue mostly from management fees, incentive fees, private banking, and lending. Holding for 20% of the third quarter of 2022, C&W brought in the record of $2.38 billion, 18% more than last year’s third quarter.

Lastly, the Investment Banking division provides corporate and institutional clients with advice on a wide array of financial transactions. Along with M&A advisory, the segment also offers equity and debt underwriting, that is assisting clients in generating capital, by issuing equity and debt securities. Considering the company’s Q3 2022 revenues, the IB division displayed a less positive performance, compared to the other three segments, accounting for 13% of total net revenues. In fact, net revenues of the IB segment amounted to $1.58 billion, 57% lower than Q3 2021 and 26% lower than the second quarter of 2022. However, this can be blamed not on Goldman Sachs, but on the overall poor industry-wide performance on underwiring, completed M&A deals and net-losses on hedges. In 2020, instead, the performance of the Investment Banking division was stronger, accounting for 21% of total net revenues and bringing in $9.4 billion.

Along with the 2020 reorganization, Goldman Sachs’s EMEA offices expanded as well. While London is still home to the headquarters for the EMEA region, the company’s Birmingham office opened in 2021, with the intention of moving the Engineering segment of the firm to this city, as many firms want to expand from the British capital, after the pandemic occurred. The Engineering division is a distinguishing feature of Goldman Sachs. Striving for digital innovation, the teams of this segment conduct various activities related to problem solving and risk management. For instance, cyber security analysts protect data possessed by the firm, by assessing cyber risks, as well as developing cutting-edge security software. Therefore, engineers at Goldman Sachs make use of their quantitative knowledge to find solutions to financial and business problems.

The reorganization

On October 18th, 2022, alongside the publication of its third-quarter earnings, Goldman Sachs announced another major reshuffle, resulting in the combination of the firm’s biggest businesses into three divisions.

One division will house Goldman's Investment Banking and Trading operations and will be led by Ashok Varadhan, leader of Goldman’s trading business, and Dan Dees and Jim Esposito, its co-heads of investment banking. This structure will make the division more closely resemble those of rivals such as JPMorgan Chase and Morgan Stanley.

The second will include its Wealth Management and Asset Management businesses, as well as its Marcus online consumer banking unit. Leaders of asset management and Wealth management businesses will assume various responsibilities atop their newly merged unit.

The third division will be made of transaction banking, Goldman's fintech platforms, specialty lender GreenSky, plus the firm’s ventures with Apple Inc. and General Motors Company. This division will be headed by Stephanie Cohen, previously in charge of the Consumer and Wealth Management businesses.

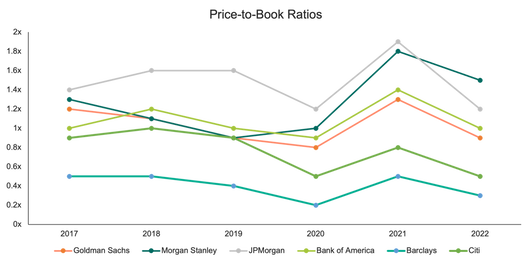

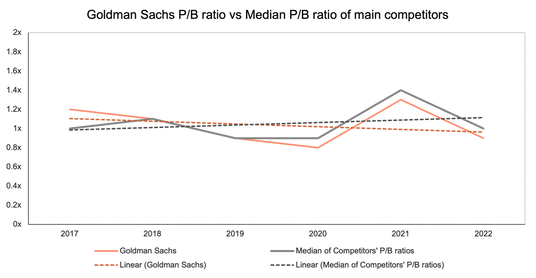

The goal is to transform Goldman’s culture and practices into something more streamlined and better oriented toward a “client-centric organizational structure”. By taking this decision, the business aims at increasing management fees, enlarging the share of business it captures from rivals, and expanding its vice to the largest clients with the most complex needs using a renewed digital platform. Furthermore, the reorganization aims at addressing Goldman Sachs’ low stock market valuation. In fact, even though the firm delivered record profits and its share price hit a record high last year, its price-to-book ratio, comparing the company’s stock price against the value of its assets, has lagged behind competitors such as Morgan Stanley, JPMorgan Chase, Bank of America, Barclays or Citi as the graphs below show*:

*All data refer to the third quarter’s values of each year

Looking to the future

Global investment banks restructure all the time, but usually they are limited to movements of some teams internally within divisions. Instead, Goldman Sachs’ announced large reorganization highlights that the leading investment bank in the world has some qualms about its current business plan’s ability to create future growth.

Looking towards the medium- and long-term view of the company, there were several reasons for the reorganization.

Firstly, Goldman has recently moved into consumer banking with Marcus, but there has been some skepticism both internally and externally regarding this venture. The reorganization hopes to quell some of these doubts.

Additionally, in response to investors often discounting the successes of the firm’s trading and investment banking divisions, criticizing the sustainability under adverse conditions of the huge profits gained when the markets favored risk-takers and bold deals, the reshuffle hopes to ‘recession-proof’ the business and to shift revenue preferences more towards steady fees rather than revenues that come from more volatile activities.

One way to do this would be by emphasizing management fees generated through the Asset Management division as a more stable source of income compared to Advisory fees generated through the Investment Banking division. This move, together with increased attention toward client companies’ employees as customers, to reduce the cost of attracting new users, will allow the bank to continue having strong results with a quickly deteriorating macro environment and further central bank tightening on the horizon.

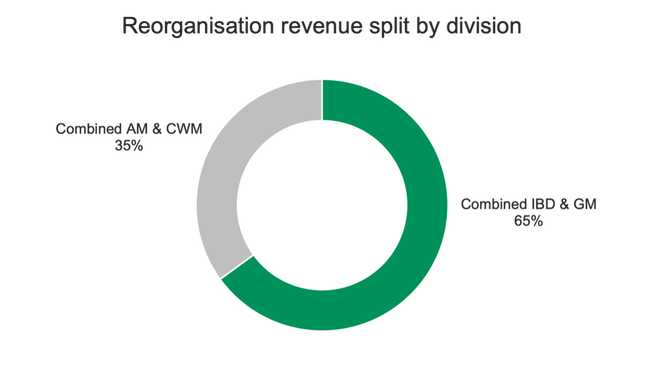

The reorganization will result in a more skewed divisional structure in terms of revenue. The combined IBD and GM division will make up around 65% of total revenues based on Q3 2022 results and the combined AM and CWM division will make up around 35% of total revenues. The new transaction banking arm will have a much more limited contribution to revenues but will allow for specialized budgeting towards high growth areas such as Goldman’s FinTech platforms and ventures with partner companies (Apple and General Motors). Additionally, as Goldman’s consumer banking platform grows, we will start to see more revenues through interest spreads. Moving into 2023 and 2024 interest rate spreads, which will continue to be high, will allow the Marcus platform to mature and hopefully begin to contribute more to the company’s revenues.

By Edoardo Barion, Matilde Chiavenato, and Zaiim Premji

SOURCES

- The New York Times

- Reuters

- The Wall Street Journal

- Financial Times

- CNN

- Bloomberg

- CNBC

- Goldman Sachs’ 2020 Annual Report

- Goldman Sachs’ Q3 2022 Report

- Goldman Sachs’ Official Website