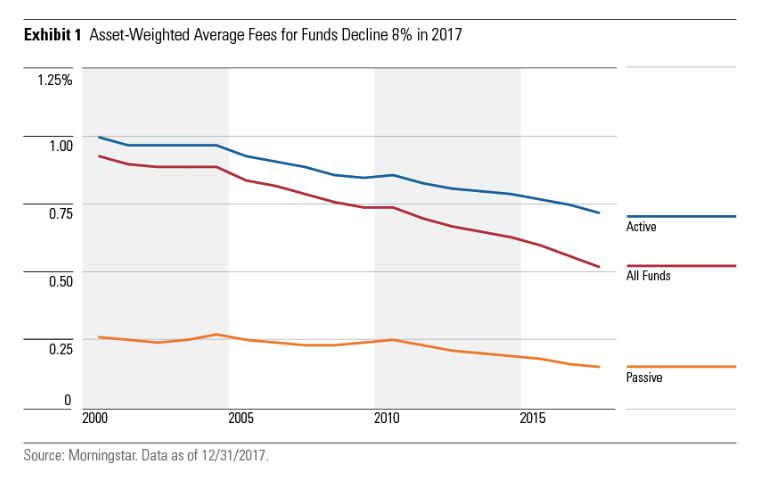

Robinhood is a mobile stock trading app characterized by a zero-fee system “on a mission to democratize the financial system” – as quoted by the two founders. The platform, with its friendly graphic and the tutoring that it offers both for beginners and expert, has made stock trading really simple and at the most affordable price: zero. Robinhood can be consider as a pioneer in this field, and has been immediately followed by many other companies, such as WeBull, E*trade, TD Ameritrade, Firstrade, Freetrade and Schwab. It is clear that the disruption that Robinhood brought into the market has completely shaped brokers’ business. Indeed, given this environment of low interest rates and the fierce competition of the online brokerage landscape, we can observe a global trend of declining fees.

The trend is strongly affecting traditional banks, asset managers and brokers, over all asset classes. The majority of them - given their structure in terms of employees and technology - is still charging their regular fees, while a few of them have entered the zero-fee business but not without sacrifices. Examples are Charles Schwab, TD Ameritrade and even J.P. Morgan – that recently announced a forthcoming commissions-free trading app -, and are all entering the business with the aim of cross-selling other services to the new clients.

“There are certain parts of finance that have become commoditized, and trading is one of them”, said Devin Ryan, an analyst at JMP Securities LLC. Indeed, this fierce price competition started online is affecting all market participants. In addition, the era of declining interest rates is not helping brokers and is making their situation worse for two reasons. The first one is that declining interest rates, causes declining return expectations, and force the investors to focus more on reducing their investment’s costs. Therefore, investors have become more sensitive to the cost structure of their investments, leading to a fierce battle between brokers to steal each other's customers through lower fees. Secondly, on the other hand, lower interest rates depress the ability of the brokers to gain interest over the unused cash. The result is a great shrunk of profitability.

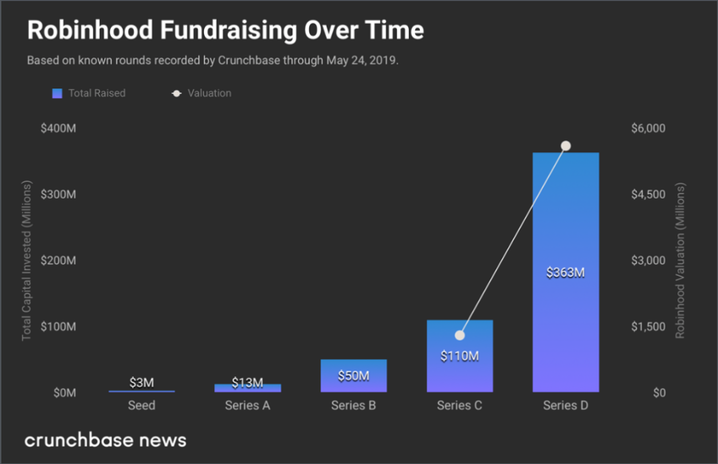

Robinhood has been founded by two roommates, Vladimir Tenev and Baiju Bhatt, that, after moving to New York, matured an experience in the world of finance finding out that Wall Street firms pay close to zero net fees, while Americans were requested to pay a regular fee. In 2013, they moved to California and there they founded Robinhood, a company that leverages technology to encourage everyone to participate in financial markets. The platform is structured in a very simple way, providing basic information on possible investments, and allowing customers to create an account and buy shares directly on their smartphone. In September 2014 the firm had a waiting list of 500.000 and reached 6 million users at the end of 2018, mostly belonging to the “millennial” generation. In the same year the firm was valued $5.6billion, more than 4 times the $1.3billion valuation reached the year before - 2017. Its value growing steadily, and during Series E funding round this summer the Company was valued $7.6 billion, by raising $323m. Moreover, since its foundation, Robinhood has collected a total amount of $872m in funding over 8 rounds. In March it has made its first acquisition and now the market is wondering if it will use all its cash to realize more strategic acquisitions or it will invest heavily to organically expand the business. Rumours of a public debut are also rising.

“There are certain parts of finance that have become commoditized, and trading is one of them”, said Devin Ryan, an analyst at JMP Securities LLC. Indeed, this fierce price competition started online is affecting all market participants. In addition, the era of declining interest rates is not helping brokers and is making their situation worse for two reasons. The first one is that declining interest rates, causes declining return expectations, and force the investors to focus more on reducing their investment’s costs. Therefore, investors have become more sensitive to the cost structure of their investments, leading to a fierce battle between brokers to steal each other's customers through lower fees. Secondly, on the other hand, lower interest rates depress the ability of the brokers to gain interest over the unused cash. The result is a great shrunk of profitability.

Robinhood has been founded by two roommates, Vladimir Tenev and Baiju Bhatt, that, after moving to New York, matured an experience in the world of finance finding out that Wall Street firms pay close to zero net fees, while Americans were requested to pay a regular fee. In 2013, they moved to California and there they founded Robinhood, a company that leverages technology to encourage everyone to participate in financial markets. The platform is structured in a very simple way, providing basic information on possible investments, and allowing customers to create an account and buy shares directly on their smartphone. In September 2014 the firm had a waiting list of 500.000 and reached 6 million users at the end of 2018, mostly belonging to the “millennial” generation. In the same year the firm was valued $5.6billion, more than 4 times the $1.3billion valuation reached the year before - 2017. Its value growing steadily, and during Series E funding round this summer the Company was valued $7.6 billion, by raising $323m. Moreover, since its foundation, Robinhood has collected a total amount of $872m in funding over 8 rounds. In March it has made its first acquisition and now the market is wondering if it will use all its cash to realize more strategic acquisitions or it will invest heavily to organically expand the business. Rumours of a public debut are also rising.

The reasons behind its growth are many, but targeting millennials is for sure one of the main factors. Indeed, by analysing the data, most of its clients are investors at their first experience, and it is highly probable a high rate of leavings. Moreover, the range of services offered could result not attractive for more experienced investors that may prefer more structured platforms. Indeed, the support given to the client consists only in simple graphs and some tutorials.

Today’s battle around the zero is threatening Robinhood supremacy. As stated by a UBS’s senior equity analyst, Brennan Hawken, “there is no reason at all to keep using Robinhood when you have the same zero-fee opportunity from a known brand”. Actually, other great companies like TD Ameritrade have declared they would no longer charge for individual stocks and this is going to mean a strong competition for Robinhood. Moreover, we have to point out that Robinhood is currently offering a simple range of products (even if it’s trying to improve these weaknesses by spreading the supplied services, as shown by the recent introduction of Cash Management) and it is not so unlikely that some investors may prefer a more informed and diversified service, even though this could mean paying a reasonable fee.

When we analyse Robinhood business model a simple question arises: how does it make money? Firstly, when comparing Robinhood with the other brokers we should highlight its cost savings. Is clear that technology reduces the transaction costs; furthermore, Robinhood has a quite small team of brokerages (comparing to the ones of the competitors). In addition, they expect to further reduce their expenses by developing an internal clearing price system. While, on revenues side, they mainly make money by gaining interest off the unused cash deposited by the client, by margin lending and by some fees for special services. Another important profit channel is the Gold Subscription: it offers many advantages in terms of time (to execute orders and to obtain market data) and costs between 10$ and 15$ a month. Finally, it seems that Robinhood generates a great percentage of its revenues from payment for order flow, a compensation earned for directing orders to third parties for trade execution. Usually, these third parties are market makers, that pay for the liquidity coming from retail investors, with the aim of decreasing their risk exposure. Though the initial scepticism about Robinhood’s safety, they managed to be more and more trusted by marketing strategies and by entering the SIPC (Security Investment Protection Corporation).

Is spreading the access to the financial world to anyone - its “democratization” - a good idea? This issue doesn’t regard only the zero-commission firms, but, more in general, all the fintech sector. According to the World Bank the fall in the cost of international payments has saved customers more than $60 billion since 2010. The overwhelmed profits of the banks, gained through fees and charges, led to a common opinion that the actual “bundled” banking system is effectively non-efficient. On the other side, the fall of the costs offsets with a huge lack of information, as not every platform offered is designed with a complete and clear package of information, allowing the firm to omit unwanted details with the risk of deviating the choices of the customers. Furthermore, there is also the chance for the clients of not fully understanding the prospects and this would possibly lead them to make wrong estimations about the future of their stocks, compromising the success and the safety of the investment. Indeed, investments are no longer guaranteed by the traditional brokerage firms and banks, but investors became 100% responsible for their own decisions. Moreover, many experts have criticized this new system because the possibility of making investments so easily may induce people to take impulsive investment decisions. Consequently, another possible risk is that a simple event or announce could generate euphoria among investors, leading to dangerous financial assets bubbles (like the ones that we have recently seen on Bitcoin, Beyond Meat and cannabis companies).

Today’s battle around the zero is threatening Robinhood supremacy. As stated by a UBS’s senior equity analyst, Brennan Hawken, “there is no reason at all to keep using Robinhood when you have the same zero-fee opportunity from a known brand”. Actually, other great companies like TD Ameritrade have declared they would no longer charge for individual stocks and this is going to mean a strong competition for Robinhood. Moreover, we have to point out that Robinhood is currently offering a simple range of products (even if it’s trying to improve these weaknesses by spreading the supplied services, as shown by the recent introduction of Cash Management) and it is not so unlikely that some investors may prefer a more informed and diversified service, even though this could mean paying a reasonable fee.

When we analyse Robinhood business model a simple question arises: how does it make money? Firstly, when comparing Robinhood with the other brokers we should highlight its cost savings. Is clear that technology reduces the transaction costs; furthermore, Robinhood has a quite small team of brokerages (comparing to the ones of the competitors). In addition, they expect to further reduce their expenses by developing an internal clearing price system. While, on revenues side, they mainly make money by gaining interest off the unused cash deposited by the client, by margin lending and by some fees for special services. Another important profit channel is the Gold Subscription: it offers many advantages in terms of time (to execute orders and to obtain market data) and costs between 10$ and 15$ a month. Finally, it seems that Robinhood generates a great percentage of its revenues from payment for order flow, a compensation earned for directing orders to third parties for trade execution. Usually, these third parties are market makers, that pay for the liquidity coming from retail investors, with the aim of decreasing their risk exposure. Though the initial scepticism about Robinhood’s safety, they managed to be more and more trusted by marketing strategies and by entering the SIPC (Security Investment Protection Corporation).

Is spreading the access to the financial world to anyone - its “democratization” - a good idea? This issue doesn’t regard only the zero-commission firms, but, more in general, all the fintech sector. According to the World Bank the fall in the cost of international payments has saved customers more than $60 billion since 2010. The overwhelmed profits of the banks, gained through fees and charges, led to a common opinion that the actual “bundled” banking system is effectively non-efficient. On the other side, the fall of the costs offsets with a huge lack of information, as not every platform offered is designed with a complete and clear package of information, allowing the firm to omit unwanted details with the risk of deviating the choices of the customers. Furthermore, there is also the chance for the clients of not fully understanding the prospects and this would possibly lead them to make wrong estimations about the future of their stocks, compromising the success and the safety of the investment. Indeed, investments are no longer guaranteed by the traditional brokerage firms and banks, but investors became 100% responsible for their own decisions. Moreover, many experts have criticized this new system because the possibility of making investments so easily may induce people to take impulsive investment decisions. Consequently, another possible risk is that a simple event or announce could generate euphoria among investors, leading to dangerous financial assets bubbles (like the ones that we have recently seen on Bitcoin, Beyond Meat and cannabis companies).

Maria D’Amato - 18/11/2019