Joe Biden’s presidency in the White House has resulted in a major strengthening of antitrust laws in the United States, compared to his predecessor’s more pro-business regulations. The United States’ M&A landscape has been strongly impacted by this, whilst its banking sector finds itself in a peculiar situation. What is the significance of antitrust in these scenarios? And most importantly, what evolutions will we see?

History of Antitrust Regulations

Antitrust Regulations represent an essential tool for promoting competition in markets and protecting consumers from abusive business practices. These regulations aim to prevent monopolies, grant fair competition, and ensure that consumers have access to a wide range of goods and services at reasonable prices. In the US, over the last ten years, antitrust regulations have undergone significant changes, reflecting economic conditions and political priorities of the two Presidents.

Trump

During the Trump administration it was possible to observe a general trend of reduced antitrust enforcement and deregulation. The process started with the ex-President appointing officials with pro-business and anti-regulation views to key positions. The most important one was Makan Delrahim, nominated Assistant Attorney General for the Antitrust Division at the Department of Justice (DOJ) in September 2017, serving until January 2021.

Before analyzing his approach, it is important to remember that if the DOJ determines that a proposed M&A could harm competition, it may require structural and behavioral remedies to address those concerns. While the former procedure requires the merging parties to divest certain assets or spin-offs to eliminate potential competitive concerns, the latter impose specific conditions on the merged company's future behavior, in order to pursue the same objective.

Delrahim believed that antitrust enforcement should be grounded in sound economic principles, rather than promoting opposition to all mergers or business practices, favoring a focus on structural remedies over behavioral commitments. The Iranian politician viewed behavioral remedies as potentially ineffective in promoting competition, due to their reliance on the company's future compliance with the imposed conditions, which may be difficult for regulators to monitor and enforce.

According to a report by the American Antitrust Institute, antitrust enforcement by the Justice Department and Federal Trade Commission declined significantly between 2017 and 2019. Along with the aforementioned officials-scheme, we can determine other main causes. One is represented by the withdrawal from the Trans-Pacific Partnership (TPP), which contained provisions on intellectual property and antitrust issues. Furthermore, some of the regulatory barriers for companies, such as net neutrality rules, were removed. In addition to that, there was a progressive push for weakening the Consumer Financial Protection Bureau, whose main goal is to protect consumers from unfair, deceptive, or abusive practices and take action against unlawful companies.

Among the most resounding cases of this deregulation, in November 2017, the DOJ sued to block the merger between AT&T and Time Warner. The case went to trial, and in June 2018, a judge ruled in favor of the merger, allowing it to proceed. Analogous situation in February 2019, when the Justice Department intervened to interrupt the merger of T-Mobile and Sprint. After the case was taken to trial, a judge issued a ruling in February 2020 that favored the merger, clearing the way for its completion.

Biden

The Biden administration has signaled a significant shift in antitrust enforcement compared to its predecessor. The President has made clear that he intends to take a more aggressive approach to antitrust enforcement, particularly in the technology industry, characterized by giants such as Amazon, Apple, Facebook, and Google.

One of the key figures leading the administration's interventionist effort is Lina Khan, appointed as chair of the Federal Trade Commission (FTC) in June 2021. Khan is known for being a vocal advocate for aggressive enforcement against these tech companies.

An important trait which defines her policy is the fact that she has called for a more holistic approach to antitrust, which takes into account not only traditional measures of market power, but also the broader social and economic impacts of dominant tech platforms.

First of all, in June 2021, the Department of Justice and FTC jointly withdrew guidelines issued in 2020 that had relaxed scrutiny of vertical mergers while the following month, the President, signed an executive order which included 72 initiatives, many of which aimed to increase scrutiny of technology companies, with increased antitrust enforcement.

Examples of these implementations are observable in August 2021, when Facebook was sentenced to pay a $5 billion fine. In the same year, Google, which was previously filed for allegedly engaging in anticompetitive practices, was forced by the DOJ to make changes to its business practices.

More recently, Biden has called for banking regulators to toughen up their supervision and regulation of large regional banks, in light of the collapse of SVB. The White House has asked federal regulators, in consultation with the Treasury department, to consider rolling back Trump-era rules that loosened liquidity and capital requirements for banks with between $100bn and $250bn in assets. Moreover, the administration is also pushing banks to improve their stress tests, especially related to a possible future increase-rates scenario. The White House’s proposals align with Michael Barr ones, who leads financial oversight at the FED, suggesting that there needs to be more stringent capital and liquidity standards for lenders with more than $100bn in assets.

Antitrust Regulations represent an essential tool for promoting competition in markets and protecting consumers from abusive business practices. These regulations aim to prevent monopolies, grant fair competition, and ensure that consumers have access to a wide range of goods and services at reasonable prices. In the US, over the last ten years, antitrust regulations have undergone significant changes, reflecting economic conditions and political priorities of the two Presidents.

Trump

During the Trump administration it was possible to observe a general trend of reduced antitrust enforcement and deregulation. The process started with the ex-President appointing officials with pro-business and anti-regulation views to key positions. The most important one was Makan Delrahim, nominated Assistant Attorney General for the Antitrust Division at the Department of Justice (DOJ) in September 2017, serving until January 2021.

Before analyzing his approach, it is important to remember that if the DOJ determines that a proposed M&A could harm competition, it may require structural and behavioral remedies to address those concerns. While the former procedure requires the merging parties to divest certain assets or spin-offs to eliminate potential competitive concerns, the latter impose specific conditions on the merged company's future behavior, in order to pursue the same objective.

Delrahim believed that antitrust enforcement should be grounded in sound economic principles, rather than promoting opposition to all mergers or business practices, favoring a focus on structural remedies over behavioral commitments. The Iranian politician viewed behavioral remedies as potentially ineffective in promoting competition, due to their reliance on the company's future compliance with the imposed conditions, which may be difficult for regulators to monitor and enforce.

According to a report by the American Antitrust Institute, antitrust enforcement by the Justice Department and Federal Trade Commission declined significantly between 2017 and 2019. Along with the aforementioned officials-scheme, we can determine other main causes. One is represented by the withdrawal from the Trans-Pacific Partnership (TPP), which contained provisions on intellectual property and antitrust issues. Furthermore, some of the regulatory barriers for companies, such as net neutrality rules, were removed. In addition to that, there was a progressive push for weakening the Consumer Financial Protection Bureau, whose main goal is to protect consumers from unfair, deceptive, or abusive practices and take action against unlawful companies.

Among the most resounding cases of this deregulation, in November 2017, the DOJ sued to block the merger between AT&T and Time Warner. The case went to trial, and in June 2018, a judge ruled in favor of the merger, allowing it to proceed. Analogous situation in February 2019, when the Justice Department intervened to interrupt the merger of T-Mobile and Sprint. After the case was taken to trial, a judge issued a ruling in February 2020 that favored the merger, clearing the way for its completion.

Biden

The Biden administration has signaled a significant shift in antitrust enforcement compared to its predecessor. The President has made clear that he intends to take a more aggressive approach to antitrust enforcement, particularly in the technology industry, characterized by giants such as Amazon, Apple, Facebook, and Google.

One of the key figures leading the administration's interventionist effort is Lina Khan, appointed as chair of the Federal Trade Commission (FTC) in June 2021. Khan is known for being a vocal advocate for aggressive enforcement against these tech companies.

An important trait which defines her policy is the fact that she has called for a more holistic approach to antitrust, which takes into account not only traditional measures of market power, but also the broader social and economic impacts of dominant tech platforms.

First of all, in June 2021, the Department of Justice and FTC jointly withdrew guidelines issued in 2020 that had relaxed scrutiny of vertical mergers while the following month, the President, signed an executive order which included 72 initiatives, many of which aimed to increase scrutiny of technology companies, with increased antitrust enforcement.

Examples of these implementations are observable in August 2021, when Facebook was sentenced to pay a $5 billion fine. In the same year, Google, which was previously filed for allegedly engaging in anticompetitive practices, was forced by the DOJ to make changes to its business practices.

More recently, Biden has called for banking regulators to toughen up their supervision and regulation of large regional banks, in light of the collapse of SVB. The White House has asked federal regulators, in consultation with the Treasury department, to consider rolling back Trump-era rules that loosened liquidity and capital requirements for banks with between $100bn and $250bn in assets. Moreover, the administration is also pushing banks to improve their stress tests, especially related to a possible future increase-rates scenario. The White House’s proposals align with Michael Barr ones, who leads financial oversight at the FED, suggesting that there needs to be more stringent capital and liquidity standards for lenders with more than $100bn in assets.

The M&A landscape

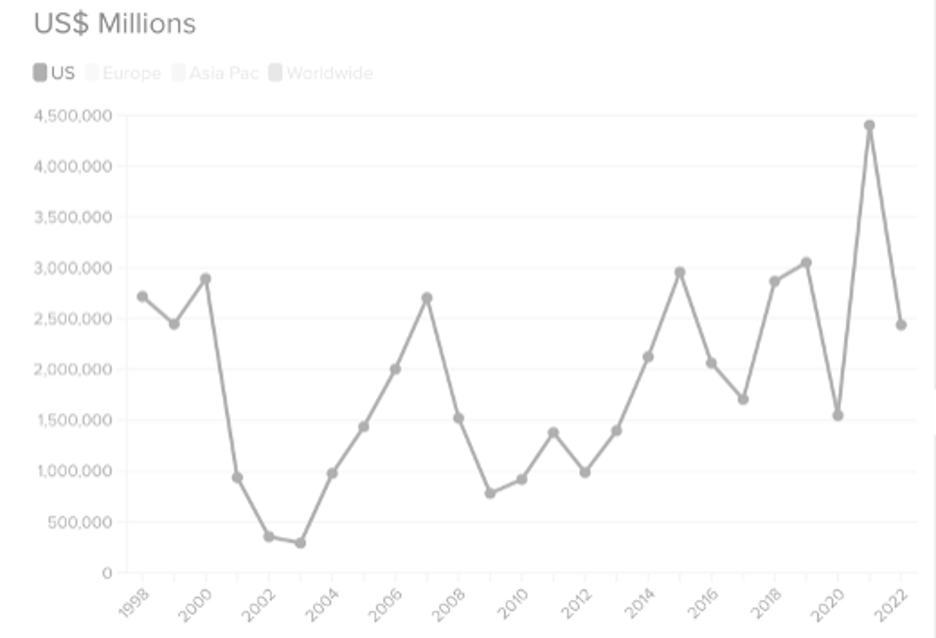

One cannot mention antitrust regulations without mentioning M&A as well. 2021 was a record-breaking year both for value and volume of deals, expected after the economies reopened from Covid – 19 lockdowns.

To the contrary, 2022 and Q1 of 2023, have been negative years for this sector, with 2023 on pace to be the worst year in a decade. Under rising interest rates, high inflation, fear of recession and the collapse of Silicon Valley Bank, markets have been under constant pressure, stopping many deals from happening. In the U.S, M&A volumes of deals in Q1 of 2023 dropped by 44% (largest annual decline since 2001) to $282.7 billion compared to last year’s $504.8 billion in Q1. So far in 2023, only a few sectors have been carrying most of the value of M&A transactions. The healthcare industry accounted for close to 1/5 of all transactions, with technology being a close second. In the healthcare industry, M&A activity was strong, because of companies rushing to acquire new patented products from smaller competitors. Furthermore, the emergence of AI supported deals in the technology sector.

One cannot mention antitrust regulations without mentioning M&A as well. 2021 was a record-breaking year both for value and volume of deals, expected after the economies reopened from Covid – 19 lockdowns.

To the contrary, 2022 and Q1 of 2023, have been negative years for this sector, with 2023 on pace to be the worst year in a decade. Under rising interest rates, high inflation, fear of recession and the collapse of Silicon Valley Bank, markets have been under constant pressure, stopping many deals from happening. In the U.S, M&A volumes of deals in Q1 of 2023 dropped by 44% (largest annual decline since 2001) to $282.7 billion compared to last year’s $504.8 billion in Q1. So far in 2023, only a few sectors have been carrying most of the value of M&A transactions. The healthcare industry accounted for close to 1/5 of all transactions, with technology being a close second. In the healthcare industry, M&A activity was strong, because of companies rushing to acquire new patented products from smaller competitors. Furthermore, the emergence of AI supported deals in the technology sector.

Global YTD M&A Values

Source: Refinitiv

Source: Refinitiv

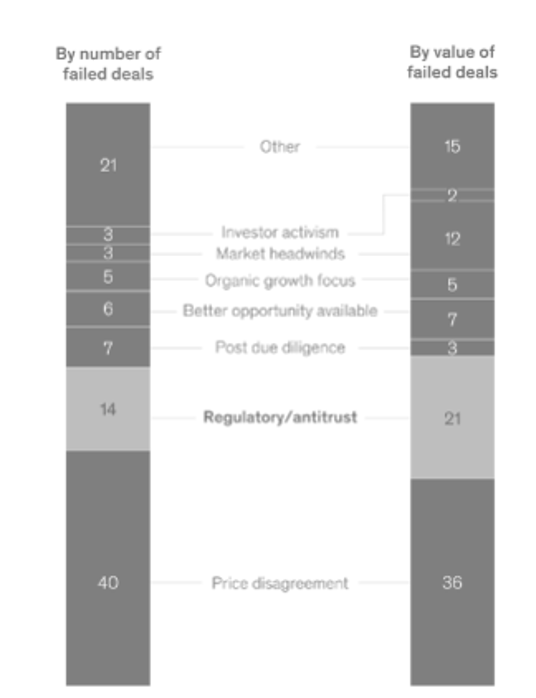

With the large amounts of macro factors influencing deal activity, oftentimes other factors are forgotten.

One of the main ones being the tighter antitrust laws enacted by the Biden administration. This is portrayed by data which indicates that transactions reviewed by the FTC doubled from 2020 to 2021. In research published by McKinsey & Company, it is estimated that 14% of deals fail to close due to antitrust issues. The percentage is even bigger if we consider the value of the deals, 21% of all M&A deal value fails to close, suggesting that higher valued deals have a lower success rate. The companies affected by these laws usually see their share price dropping and their reputation dwindling, further contributing to the market difficulties we have seen lately.

One of the main ones being the tighter antitrust laws enacted by the Biden administration. This is portrayed by data which indicates that transactions reviewed by the FTC doubled from 2020 to 2021. In research published by McKinsey & Company, it is estimated that 14% of deals fail to close due to antitrust issues. The percentage is even bigger if we consider the value of the deals, 21% of all M&A deal value fails to close, suggesting that higher valued deals have a lower success rate. The companies affected by these laws usually see their share price dropping and their reputation dwindling, further contributing to the market difficulties we have seen lately.

Main reasons why M&A transactions fail to close

Source: McKinsey

Source: McKinsey

In the last few months, there have been several deals affected by antitrust laws, some of them highly publicized.

The biggest one yet, being the acquisition of Activision by Microsoft. The deal was supposed to be an all-cash transaction valued at $68.7 billion, with Microsoft paying $95.00 per share. FTC had other plans, as shortly after the deal was announced they released an official statement on why this deal would break antitrust laws. The main complaint being that through the acquisition Microsoft had the means and the motive to harm not only their main competitor Sony, but also the customers, by offering higher pricing and lower gaming quality.

More recently FTC also blocked a deal involving International Exchange (Owners of the NYSE) from acquiring Black Knight (Mortgage Software Provider) for the reported value of $13.1 Billion. This is a big loss for ICE, who in recent years had been pushing for the digitalization of the mortgage business. The main reasoning behind this block was that FTC feared that home buyers would have to pay higher fees, as ICE and Black Knight are two of the largest providers of mortgage loan technology. In response to this, ICE agreed to divest one of Black Knight’s systems, reducing the cost of their acquisition from the original $13.1 billion to $11.7 billion. Even after this development, FTC continues to oppose the deal.

Lastly, another deal to keep an eye on is the possible acquisition of Life Storage by Public Storage. Even though the offer to acquire Life Storage got rejected by the latter, if the deal goes through in the future the chances that it will eventually get blocked by FTC are high. Both Public Storage and Life storage, are some of the largest self-storage operators in the USA, respectively first and fourth by market share. FTC, in the past has blocked deals between companies with lower market shares, so the blocking of this deal seems to be an obvious choice.

In conclusion, the FTC has been strongly enforcing their antitrust laws in recent years, preventing leaders in their respective sectors from expanding through horizontal or vertical mergers.

The biggest one yet, being the acquisition of Activision by Microsoft. The deal was supposed to be an all-cash transaction valued at $68.7 billion, with Microsoft paying $95.00 per share. FTC had other plans, as shortly after the deal was announced they released an official statement on why this deal would break antitrust laws. The main complaint being that through the acquisition Microsoft had the means and the motive to harm not only their main competitor Sony, but also the customers, by offering higher pricing and lower gaming quality.

More recently FTC also blocked a deal involving International Exchange (Owners of the NYSE) from acquiring Black Knight (Mortgage Software Provider) for the reported value of $13.1 Billion. This is a big loss for ICE, who in recent years had been pushing for the digitalization of the mortgage business. The main reasoning behind this block was that FTC feared that home buyers would have to pay higher fees, as ICE and Black Knight are two of the largest providers of mortgage loan technology. In response to this, ICE agreed to divest one of Black Knight’s systems, reducing the cost of their acquisition from the original $13.1 billion to $11.7 billion. Even after this development, FTC continues to oppose the deal.

Lastly, another deal to keep an eye on is the possible acquisition of Life Storage by Public Storage. Even though the offer to acquire Life Storage got rejected by the latter, if the deal goes through in the future the chances that it will eventually get blocked by FTC are high. Both Public Storage and Life storage, are some of the largest self-storage operators in the USA, respectively first and fourth by market share. FTC, in the past has blocked deals between companies with lower market shares, so the blocking of this deal seems to be an obvious choice.

In conclusion, the FTC has been strongly enforcing their antitrust laws in recent years, preventing leaders in their respective sectors from expanding through horizontal or vertical mergers.

The importance of Antitrust in the banking sector

Although less present in the news, the US also faces a particular situation regarding bank antitrust laws.

On March 12th, 2023, banks were shaken by Treasury, FED and FDIC announcements related to the failure of the Silicon Valley Bank. In the aftermath of this event, as previously stated, the Biden administration was demanding banking regulators to strengthen regulations and supervision.

Furthermore, another major problem in the American banking system is the level of industry consolidation. The White House has addressed this issue, declaring the intention to build up reforms that will support competition in America and reduce industry consolidation. In the last decades, we can observe an increase in the degree of industry concentration in sectors such as healthcare and financial services. Looking at common measures of market concentration, the H-H Index of the US banking sector is approximately 3.500, which is exceptionally high considering that the threshold is close to 1800. Among the sectors identified by Biden’s executive order (“Executive order on promoting competition in the American Economy”) the banking sector was present already in July 2021.

Today in the US $12.7 trillion in assets, that represent over 52 % of all assets owned by the U.S, are controlled by five major actors: Citigroup, Bank of America, Goldman Sachs, Morgan Stanley, and JPMorgan & Chase. Several empirical studies illustrate the importance of promoting competition in the banking sector to reduce financial fragility. Indeed, a negative relationship between increase in competition and systematic risk was found. In addition, more competition encourages banks to take on more diversified risk.

In another study conducted on a sample of European banks (1997-2005), data shows that banks that are subject to lower competition and have limited opportunities of diversification are more subject to financial fragility. When industry concentration is high, and the market is controlled by few companies, consumers, families and other companies in the market suffer. Poor competition is costly for economic agents not only in the banking sector but also in terms of higher prices and lower wages for a median American household (5.000$ per year). Furthermore, Poor competition can negatively affect economic growth, productivity growth, business investment, and wealth. Reviving bank antitrust can play a critical role in boosting the competition in the financial sector and in the US economy. Promoting the competition in the banking sector is critical because “Concentration in the banking sector accelerates concentration generally”.

Looking at the effects that poor competition has on the Banking and Consumer finance sector, industry concentration led to a rise in the cost for consumers, restricted credit for small business and distress for low-income communities. Empirical studies among the effects of high concentration in the banking sector identify the reinforcement of the position of incumbent firms because the potential entrants experience more difficulty in obtaining financing from banks compared to a situation in which the banking sector is more competitive.

Reviving the bank anti-trust is key according to, this will boost competition in the banking sector and throughout the U.S. economy.

Although less present in the news, the US also faces a particular situation regarding bank antitrust laws.

On March 12th, 2023, banks were shaken by Treasury, FED and FDIC announcements related to the failure of the Silicon Valley Bank. In the aftermath of this event, as previously stated, the Biden administration was demanding banking regulators to strengthen regulations and supervision.

Furthermore, another major problem in the American banking system is the level of industry consolidation. The White House has addressed this issue, declaring the intention to build up reforms that will support competition in America and reduce industry consolidation. In the last decades, we can observe an increase in the degree of industry concentration in sectors such as healthcare and financial services. Looking at common measures of market concentration, the H-H Index of the US banking sector is approximately 3.500, which is exceptionally high considering that the threshold is close to 1800. Among the sectors identified by Biden’s executive order (“Executive order on promoting competition in the American Economy”) the banking sector was present already in July 2021.

Today in the US $12.7 trillion in assets, that represent over 52 % of all assets owned by the U.S, are controlled by five major actors: Citigroup, Bank of America, Goldman Sachs, Morgan Stanley, and JPMorgan & Chase. Several empirical studies illustrate the importance of promoting competition in the banking sector to reduce financial fragility. Indeed, a negative relationship between increase in competition and systematic risk was found. In addition, more competition encourages banks to take on more diversified risk.

In another study conducted on a sample of European banks (1997-2005), data shows that banks that are subject to lower competition and have limited opportunities of diversification are more subject to financial fragility. When industry concentration is high, and the market is controlled by few companies, consumers, families and other companies in the market suffer. Poor competition is costly for economic agents not only in the banking sector but also in terms of higher prices and lower wages for a median American household (5.000$ per year). Furthermore, Poor competition can negatively affect economic growth, productivity growth, business investment, and wealth. Reviving bank antitrust can play a critical role in boosting the competition in the financial sector and in the US economy. Promoting the competition in the banking sector is critical because “Concentration in the banking sector accelerates concentration generally”.

Looking at the effects that poor competition has on the Banking and Consumer finance sector, industry concentration led to a rise in the cost for consumers, restricted credit for small business and distress for low-income communities. Empirical studies among the effects of high concentration in the banking sector identify the reinforcement of the position of incumbent firms because the potential entrants experience more difficulty in obtaining financing from banks compared to a situation in which the banking sector is more competitive.

Reviving the bank anti-trust is key according to, this will boost competition in the banking sector and throughout the U.S. economy.

How the US economy will react: outlook & uncertainties

Although we have never witnessed such a complicated and uncertain economic situation, some assumptions can be made about the short-term future outlook: as long as the Biden administration is in charge, the M&A market will most likely remain stalled because of a mix between antitrust regulations and increasing cost of capital brought by an unstable and stricter banking sector.

The skepticism from authorities will also keep growing, given the continuous criticism attributed to the underenforcement of antitrust laws in the M&A sector. In addition to this, the focus of antitrust regulations will shift generally, and the societal and political impact which derives from M&A will be assessed in a more thorough manner. There will be higher levels of inspection for all types of acquirers, even ones with low merger control risk, for example financial sponsors. Although, as previously mentioned, this will clearly decrease deal flow furthermore, the larger amount of regulations will result in a market where more ethical grounds are followed, increasing fair competition and equal opportunities.

The banking sector will most likely see macroeconomic changes - in the next few years - that will permanently change the whole dynamic of the sector and the relationships between a bank and another. It is believed that, as previously stated, the key to a stable banking sector is brought by risk diversification, which can only be reached through strict policies that aim to lower the industry concentration.

It is quite easy to understand that, following big events such as the SVB failure and the CS scandal, the banking industry will most likely take a turn towards more severe inspections that will force banks to be even more careful (we have already witnessed such a big banking revolution in 2008). This change will most likely go unnoticed by the majority of us, but the overall banking environment will not witness gigantic consolidations for a quiet minute, bringing more risk diversification and more competition to the industry. Banks will be observed much more carefully and taking an intentional wrong step - from now on - could be fatal.

Although we have never witnessed such a complicated and uncertain economic situation, some assumptions can be made about the short-term future outlook: as long as the Biden administration is in charge, the M&A market will most likely remain stalled because of a mix between antitrust regulations and increasing cost of capital brought by an unstable and stricter banking sector.

The skepticism from authorities will also keep growing, given the continuous criticism attributed to the underenforcement of antitrust laws in the M&A sector. In addition to this, the focus of antitrust regulations will shift generally, and the societal and political impact which derives from M&A will be assessed in a more thorough manner. There will be higher levels of inspection for all types of acquirers, even ones with low merger control risk, for example financial sponsors. Although, as previously mentioned, this will clearly decrease deal flow furthermore, the larger amount of regulations will result in a market where more ethical grounds are followed, increasing fair competition and equal opportunities.

The banking sector will most likely see macroeconomic changes - in the next few years - that will permanently change the whole dynamic of the sector and the relationships between a bank and another. It is believed that, as previously stated, the key to a stable banking sector is brought by risk diversification, which can only be reached through strict policies that aim to lower the industry concentration.

It is quite easy to understand that, following big events such as the SVB failure and the CS scandal, the banking industry will most likely take a turn towards more severe inspections that will force banks to be even more careful (we have already witnessed such a big banking revolution in 2008). This change will most likely go unnoticed by the majority of us, but the overall banking environment will not witness gigantic consolidations for a quiet minute, bringing more risk diversification and more competition to the industry. Banks will be observed much more carefully and taking an intentional wrong step - from now on - could be fatal.

Conclusion

Overall, the current change in antitrust legislation is having and will have a large-scale impact on the US economy. On one hand there is M&A, which is experiencing a slow-down from the tighter laws imposed by the Biden Administration, as conveyed by the numerous unclosed deals. On the other, there is the banking system in the US, which is currently suffering from a lack of competition, and is subject to all the negative effects deriving from the latter. From whichever angle one approaches it, we come to understand the importance of antitrust laws, and most significantly the fundamental impact which a change in them can have on the state of the economy.

Overall, the current change in antitrust legislation is having and will have a large-scale impact on the US economy. On one hand there is M&A, which is experiencing a slow-down from the tighter laws imposed by the Biden Administration, as conveyed by the numerous unclosed deals. On the other, there is the banking system in the US, which is currently suffering from a lack of competition, and is subject to all the negative effects deriving from the latter. From whichever angle one approaches it, we come to understand the importance of antitrust laws, and most significantly the fundamental impact which a change in them can have on the state of the economy.

By Pietro Casnigo, Andrea Cavenago, Ettore Marku, Najwa Sadki

Sources:

- Financial Times

- Bain&Company

- FTC

- McKinsey

- WSJ

- Refinitiv

- Reuters

- Kress, 2022