Sukuk, plural for sakk, “legal instrument”, is the Arabic name for financial certificates, incorrectly named “Islamic bonds”. These instruments are bonds complying with the fundamental principles of Islam. For the record, Sharia (the religious Islamic law) doesn’t allow the payment of interests and the financing of businesses involving non-compliant activities: gambling, alcohol, pork, etc. In detail, the Islamic finance imposes prohibitions on:

1. Transactions in unethical goods and services;

2. Earning returns from a loan contract (Interest);

3. Compensation-based restructuring of debts;

4. Excessive uncertainty in contracts;

5. Gambling and chance-based games;

6. Trading in debt contracts at discount;

7. Forward-foreign exchange transactions.

Because of this, Sukuk were developed as an alternative investment to conventional ones which are not considered permissible by many Muslims. These securities bend the problem of the interest payment by interposing, generally, a tangible asset in the investment: in doing so, Sukuk holders receive their profit as a sort of rent (which is allowed under Islamic law).

Analysing the characteristics of these particular securities we can notice a series of similarities and differences with bonds: as mentioned above, sukuk should indicate partial ownership of an asset and their face value is priced according to the value of the assets backing them, meaning that the value can increase when the assets’ one increase. Moreover. sukuk securities are tendentially bought to be held until their expiration date: therefore only a few of them are traded on the secondary market, even considering that some of them aren’t neither allowed to (it depends on the specificity of the certificate). Also, sukuk investors share the risk of the underlying asset and have no certainty that they will get all their initial investment back as the value due to the holder on maturity should be the current market value of the assets. In the end, sukuk don’t always need underwriters as they use Special Purpose Vehicles to be the trustee of the sukuk.

The International Islamic Financial Market (IIFM) estimates global sukuk issuance this year to be in the range of US$130 billion (RM544 billion) to US$135 billion. According to it, a great push to this growth is given by the domestic issuances of Malaysia, Indonesia and Gulf Cooperation Countries (GCC-including Saudi Arabia, Kuwait etc.): they totalled US$42.2billion only considering sukuk with a maturity of more than 18 months. Malaysia is, in particular, the leading country in sukuk issuance: based on the information ,provided by The Malaysian Reserve, issuance of corporate sukuk represents roughly the 70%-75% of total corporate bond issuance for the country, which is substantiated in a forecast ranging between RM80 billion and RM90 billion in 2020. So, the current year seems to be a thriving environment for Sukuk market: the announce of Bank Negara Malaysia’s CEO said that lower rate environment should augurs well for their issuance. Indeed, the financing level will allow companies with good credit to issue sukuk and be able to enjoy lower cost of funds as a result; at the same time, also the long-term investors demand is expected to increase, due to the nature of liabilities of the bonds. Moreover, it’s foreseeable that, especially in periods of growing instability and uncertainty, investors generally seek shelter in safer investments, which is exactly what sukuk offer.

According to Fitch Ratings Inc, global sukuk issuance rose 6% in 2019 because the range of issuers largely broadened, although supply was concentrated geographically. In addition to the traditional investor base of Islamic banks, also other regional and international investors are nowadays interested in this market and, notably, in sukuk funds and sub-funds. The inclusion of rated sukuk from five GCC countries in the JP Morgan EM Bond Index from 2019 has supported this process.

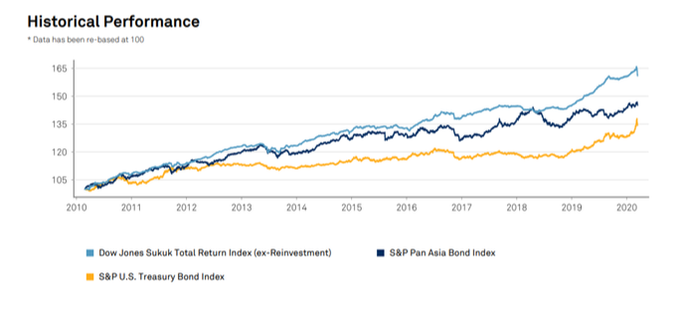

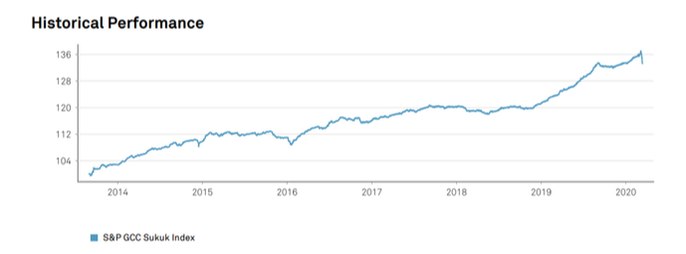

In the following graphics you can see the Historical performance of The Dow Jones Sukuk Total Return (ex-Reinvestment), designed to track the performance of sukuk, and the one of its subindex: the S&P GCC Sukuk Index, designed to measure the performance of U.S. dollar-denominated, investment-grade sukuk from Gulf Cooperation Council (GCC) countries of risk. It’s clear from them the huge contribution of the mentioned countries on the overall performance.

1. Transactions in unethical goods and services;

2. Earning returns from a loan contract (Interest);

3. Compensation-based restructuring of debts;

4. Excessive uncertainty in contracts;

5. Gambling and chance-based games;

6. Trading in debt contracts at discount;

7. Forward-foreign exchange transactions.

Because of this, Sukuk were developed as an alternative investment to conventional ones which are not considered permissible by many Muslims. These securities bend the problem of the interest payment by interposing, generally, a tangible asset in the investment: in doing so, Sukuk holders receive their profit as a sort of rent (which is allowed under Islamic law).

Analysing the characteristics of these particular securities we can notice a series of similarities and differences with bonds: as mentioned above, sukuk should indicate partial ownership of an asset and their face value is priced according to the value of the assets backing them, meaning that the value can increase when the assets’ one increase. Moreover. sukuk securities are tendentially bought to be held until their expiration date: therefore only a few of them are traded on the secondary market, even considering that some of them aren’t neither allowed to (it depends on the specificity of the certificate). Also, sukuk investors share the risk of the underlying asset and have no certainty that they will get all their initial investment back as the value due to the holder on maturity should be the current market value of the assets. In the end, sukuk don’t always need underwriters as they use Special Purpose Vehicles to be the trustee of the sukuk.

The International Islamic Financial Market (IIFM) estimates global sukuk issuance this year to be in the range of US$130 billion (RM544 billion) to US$135 billion. According to it, a great push to this growth is given by the domestic issuances of Malaysia, Indonesia and Gulf Cooperation Countries (GCC-including Saudi Arabia, Kuwait etc.): they totalled US$42.2billion only considering sukuk with a maturity of more than 18 months. Malaysia is, in particular, the leading country in sukuk issuance: based on the information ,provided by The Malaysian Reserve, issuance of corporate sukuk represents roughly the 70%-75% of total corporate bond issuance for the country, which is substantiated in a forecast ranging between RM80 billion and RM90 billion in 2020. So, the current year seems to be a thriving environment for Sukuk market: the announce of Bank Negara Malaysia’s CEO said that lower rate environment should augurs well for their issuance. Indeed, the financing level will allow companies with good credit to issue sukuk and be able to enjoy lower cost of funds as a result; at the same time, also the long-term investors demand is expected to increase, due to the nature of liabilities of the bonds. Moreover, it’s foreseeable that, especially in periods of growing instability and uncertainty, investors generally seek shelter in safer investments, which is exactly what sukuk offer.

According to Fitch Ratings Inc, global sukuk issuance rose 6% in 2019 because the range of issuers largely broadened, although supply was concentrated geographically. In addition to the traditional investor base of Islamic banks, also other regional and international investors are nowadays interested in this market and, notably, in sukuk funds and sub-funds. The inclusion of rated sukuk from five GCC countries in the JP Morgan EM Bond Index from 2019 has supported this process.

In the following graphics you can see the Historical performance of The Dow Jones Sukuk Total Return (ex-Reinvestment), designed to track the performance of sukuk, and the one of its subindex: the S&P GCC Sukuk Index, designed to measure the performance of U.S. dollar-denominated, investment-grade sukuk from Gulf Cooperation Council (GCC) countries of risk. It’s clear from them the huge contribution of the mentioned countries on the overall performance.

A wide variety of sukuk bonds can be issued like: Ijkarah (similar to leasing contracts), Murabahah (similar to deferred payment contracts) and many others, but a very specific niche is trending today: Green Sukuk. The world’s first one has been launched by Malaysia on 27 June 2017 and now the Green Sukuk and Working Party is still promoting and developing Shari’ah-compliant products to invest in climate change solutions: these investment are addressed in renewable energy and other environmental assets (some of the eligible are solar parks, biogas plants, wind energy and electric vehicles). Proceeds will be used to fund sustainable infrastructure or to finance the payment of a government-granted green subsidy.

The aim of the issuers regards the expression of Islamic’s concern for protecting the environment and realizing a bond architecture which will offer to investors a confident opportunity to comply with Shari’ah law and, mostly, its ethical standards. They offer reasonable risk-adjusted returns and are properly marketed, though their main attractive characteristic is that they provide investors the certainty that their money will be used for a determined and specific purpose, which is an aspect that influences the majority of environment-focused investments. Additionally, some experts affirm that for Sukuk it’s easy being green because is an inherent characteristic from them to adhere to certain values and beliefs.

Maria D’Amato

Want to keep up with our most recent articles? Subscribe to our weekly newsletter here.