Dealmakers are accustomed to face uncertainty, but the latest market trends brought a grade of volatility even the most experienced investors struggle to bear. Brexit, Trade war, and now the Covid-19 crisis dealt a heavy blow to cross-border M&A activities. Here is an analysis of what happened and of what investors should expect going forward.

What are cross-border deals and how they evolved in the last two decades

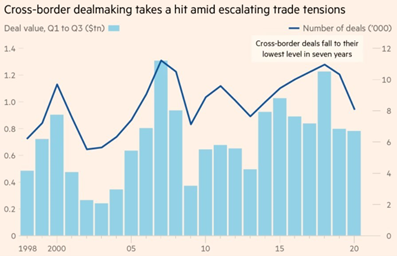

Starting from 1999 roughly 30% of the total volume of M&A was constituted by cross-border deals. This type of deals are transactions involving companies whose headquarters are located in different countries. Cross-border deals saw their maximum expansion between 1991 and 1998. During this timespan, their number increased sixfold. The peak was reached in 2007, which was a tremendous year for M&A, both in terms of deal volumes and number of transactions. The main driver of the increase in cross-border transaction during this period was globalization.

From the 2007 peak, numbers decreased sharply due to the financial crisis, which had a deep and long-lasting impact of M&A activities, both domestic and cross-border. Deals activity started to recover only after several years. In particular, 2014 and 2015 were the years of the rebound, with a year-on-year growth of 63% and 72% respectively. The pace of the increase started to slow down in 2016 and halted again after 2018, with the rise in tensions between US and China, Brexit and the Coronavirus emergency.

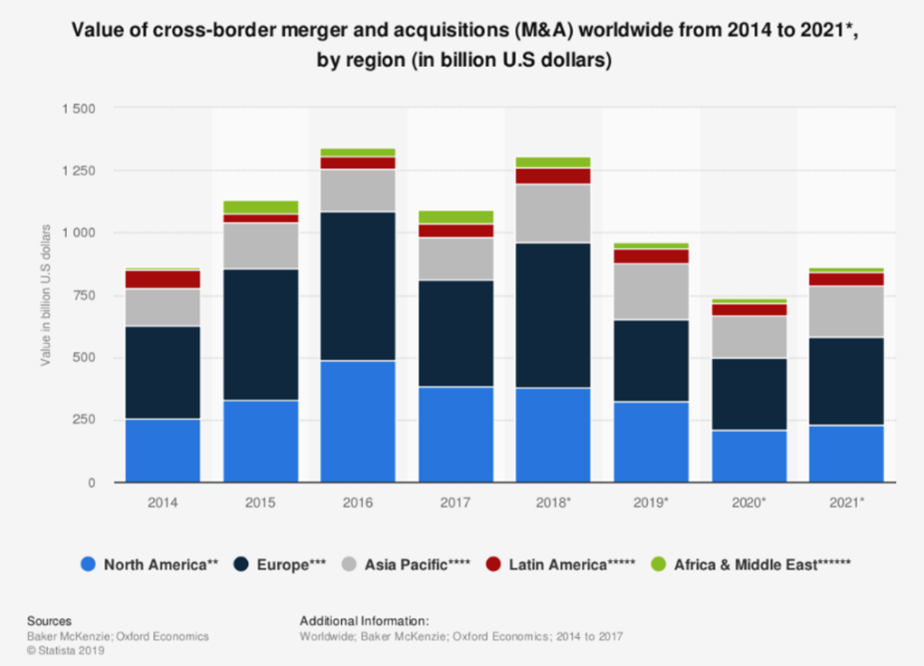

Cross-border deals occur all over the world. However, they are more concentrated in North America and Europe, due to the strength of their economy and the presence of well-developed capital market. These two regions, in fact, accounted for more 50% of cross-border deals by value in the last eight years. The graph below depicts the evolution of cross-border transactions per region from 2014 to 2021 (expected).

What are cross-border deals and how they evolved in the last two decades

Starting from 1999 roughly 30% of the total volume of M&A was constituted by cross-border deals. This type of deals are transactions involving companies whose headquarters are located in different countries. Cross-border deals saw their maximum expansion between 1991 and 1998. During this timespan, their number increased sixfold. The peak was reached in 2007, which was a tremendous year for M&A, both in terms of deal volumes and number of transactions. The main driver of the increase in cross-border transaction during this period was globalization.

From the 2007 peak, numbers decreased sharply due to the financial crisis, which had a deep and long-lasting impact of M&A activities, both domestic and cross-border. Deals activity started to recover only after several years. In particular, 2014 and 2015 were the years of the rebound, with a year-on-year growth of 63% and 72% respectively. The pace of the increase started to slow down in 2016 and halted again after 2018, with the rise in tensions between US and China, Brexit and the Coronavirus emergency.

Cross-border deals occur all over the world. However, they are more concentrated in North America and Europe, due to the strength of their economy and the presence of well-developed capital market. These two regions, in fact, accounted for more 50% of cross-border deals by value in the last eight years. The graph below depicts the evolution of cross-border transactions per region from 2014 to 2021 (expected).

Vaue of cross-border M&A worldwide by region in USD

Click here to edit.

Source: Statista

What is the relationship between globalization and cross-border deals?

Understanding the consequences of globalization is paramount to properly unravel the reasons that pushed companies to undertake cross-border deals in the last decade.

Globalization has brought competition to a much greater scale. As a result, in today’s market remaining competitive in the supply chain has become increasingly more important and urgent. Indeed, the necessity of cutting costs has forced many companies to move their manufacturing overseas, where lower labour costs more than offset the increase in costs related to the logistics. This expansion was often carried out via M&A operations.

The other side of the coin is that in a globalized world companies have the opportunity expand their presence outside their country of incorporation more easily. In fact, if cost management is obviously a key consideration to succeed in today’s markets, increasing revenue is also paramount to remaining competitive. As a result, the necessity to increase sales is also a key driver of the increase in cross-border M&A activity. Even more so when considering the case of saturated industries where competitors compete on price and thus increasing scale is a “must” in order to remain in business. To this respect, many companies that are well established in developed markets have been trying to expand to other developed region as well as emerging economies. In particular, these last allow at the same time to reduce the cost of production while ensuring exposure to a growing market.

The current state of cross border deals

Dealmakers are accustomed to face uncertainty, but the latest market trends brought a grade of volatility even the most experienced investors struggle to bear. Among the main drivers underlying the decrease in M&A, and specifically cross-border M&A activity, we must highlight the disruption caused by Covid-19 throughout the world. While the spread of COVID-19 was accelerating around the world in February/March, global equity indices reached historic peaks. Nevertheless, just in a couples of weeks, markets dropped dramatically. From their peaks through March 18, 2020, most indices lost between 30% and 35%. At the same time, volatility skyrocketed, with the VIX index reaching 83% - the last time such uncertainty was experienced it was 2008 and Lehman Brothers had just collapsed.

The M&A market is naturally affected by capital markets and real economy’s trends. Indeed, prior to the crisis, the number of M&A deals globally was already decreasing. This downward trend is likely to accelerate in the short term. Historically, M&A activity has correlated strongly with the evolution of stock prices and risk, namely volatility. From 2000 through 2019, the correlation between the value of the MSCI World index and M&A volume was approximately 80%, as shown from in graph below.

Understanding the consequences of globalization is paramount to properly unravel the reasons that pushed companies to undertake cross-border deals in the last decade.

Globalization has brought competition to a much greater scale. As a result, in today’s market remaining competitive in the supply chain has become increasingly more important and urgent. Indeed, the necessity of cutting costs has forced many companies to move their manufacturing overseas, where lower labour costs more than offset the increase in costs related to the logistics. This expansion was often carried out via M&A operations.

The other side of the coin is that in a globalized world companies have the opportunity expand their presence outside their country of incorporation more easily. In fact, if cost management is obviously a key consideration to succeed in today’s markets, increasing revenue is also paramount to remaining competitive. As a result, the necessity to increase sales is also a key driver of the increase in cross-border M&A activity. Even more so when considering the case of saturated industries where competitors compete on price and thus increasing scale is a “must” in order to remain in business. To this respect, many companies that are well established in developed markets have been trying to expand to other developed region as well as emerging economies. In particular, these last allow at the same time to reduce the cost of production while ensuring exposure to a growing market.

The current state of cross border deals

Dealmakers are accustomed to face uncertainty, but the latest market trends brought a grade of volatility even the most experienced investors struggle to bear. Among the main drivers underlying the decrease in M&A, and specifically cross-border M&A activity, we must highlight the disruption caused by Covid-19 throughout the world. While the spread of COVID-19 was accelerating around the world in February/March, global equity indices reached historic peaks. Nevertheless, just in a couples of weeks, markets dropped dramatically. From their peaks through March 18, 2020, most indices lost between 30% and 35%. At the same time, volatility skyrocketed, with the VIX index reaching 83% - the last time such uncertainty was experienced it was 2008 and Lehman Brothers had just collapsed.

The M&A market is naturally affected by capital markets and real economy’s trends. Indeed, prior to the crisis, the number of M&A deals globally was already decreasing. This downward trend is likely to accelerate in the short term. Historically, M&A activity has correlated strongly with the evolution of stock prices and risk, namely volatility. From 2000 through 2019, the correlation between the value of the MSCI World index and M&A volume was approximately 80%, as shown from in graph below.

M&A acvivity closely follows caital markets development

Source: Refinitiv; S&P Capital IQ; BCG analysis

The outbreak of the novel coronavirus created national emergencies worldwide, with countries experiencing not only health and medical crises, but also economic breakdowns and social discontent. Governments enlisted extraordinary measures as locking down the movement of people and, in doing so, halting economic activity, particularly in international trade and investment. Most M&A deals were therefore cancelled or delayed in the last few months, including some notorious ones, such as Tiffany-LVMH. Withdrawals were due to COVID-19 related concerns and changing circumstances, such as altered business plans. At the same time, many companies will likely postpone their not-yet-announced acquisition plans because of financing difficulty and negotiation complexity created by the crisis. The United Nations Conference on Trade and Development forecasted international trade and international investment to drop respectively 30% and 40% in 2020.

Cross-border dealmaking takes a hit amid escalating trade tensions

Source: Financial Times

It was not just the contraction of economic activity due to covid-19 that led to the decrease in cross-border investments. International migration, trade and investments were already under scrutiny by protectionist trends. Prior to the pandemic, governments around the world enacted widespread tariffs, leading to trade retaliation and prolonged disputes, putting further pressure on dealmakers in cross-border transactions. The main reason behind these pre-pandemic protectionist actions was protecting nationalist interests.

The most notable examples of “nationalist” policies are those that led to the increase in tensions between the US and China, which escalated in the trade war. Started in 2018, with the US imposition of tariffs and trade barriers to lower the country’s increasing trade deficit and stop the allegedly theft of American technological intellectual property (Silicon Valley patents), the conflict is still incumbent. The outcome has been, by now, a worsening in US and China economies, that led to a global slowdown and a shift in American supply-chain to other Asian countries. Since 2016 Trump’s election, commercial relations reached the lowest level since many years: the Trump administration started imposing new tariffs and an increased scrutiny regarding goods acquired from China. Chinese acquisitions of US companies fell by almost 95% in 2018 from a peak two years before. Chinese spending on US companies fell from $55.3bn in 2016 to just $3bn last year, with American authorities rejecting several large deals. One of the largest deals to be axed was the US$1.2bn acquisition of MoneyGram, a US money transfer business, by Ant Financial, a Chinese online payment company owned by Alibaba. It was rejected by the US Committee on Foreign Investment, which cited national security concerns.

Another key element to consider in our already highly uncertain economic pattern is Brexit. Even though the exit of the UK from EU was voted in 2016, treaties are still in the making. Given the fact that London is, for now, the financial beating heart of EMEA, where the majority of deals is finalized, investors still see Brexit as a huge question mark for M&A, especially cross-border deals. The EU Cross Border Mergers Directive allows mergers between companies incorporated in different European Economic Area (EEA) states, provided certain rules are satisfied. The regime, by now enacted into English law, comes from EU legislation and with the UK leaving UE, then references to “EEA member states” would cease to include the UK. UK government has stated in “Structuring your business if there’s no Brexit deal” that, in the event of a no-deal Brexit, the EU cross border mergers regime will no longer be available to UK companies.

The pandemic has only accelerated protectionist trends. Borders are highly restricted, and governments have exploited national security exemption to prevent exports of certain products, most notably medical supplies but also foodstuffs and household goods. Along with people and goods, capital movements have also been withheld. During the pandemic, politicians accused global supply chains of making countries less secure, claiming the importance of domestic production of key industries. National self-sufficiency was promoted at the cost of international investment growth. Governments also pushed defensive policies to prevent takeovers of distressed, domestic firms by foreign entities. These policies included strengthening oversight of transactions that involve a foreign investor or buyer in particular industries. This enhanced scrutiny of international transactions shows how the pandemic has expanded the definition “predatory acquirer” to any foreign entity.

To get a deeper understanding, we analysed the projections of cross-border M&A activity in a selection of industries that are particularly interesting for the way they were affected.

Manufacturing

Manufacturing is among the industries most affected by the pandemic. In the first half of 2020 M&A market experienced a rise in uncertainty, leading to large-scale deal postponements and withdrawals as investors struggled with the impacts of COVID-19. While the challenging economic situation has slowed M&A activity, it also created areas of opportunity for value creation. Strategic investors have generally focused on liquidity, cost containment and short-term portfolio protection, but given the latest protectionist trends are also evaluating M&A as a means of securing supply chains.

As drivers in Manufacturing M&A activity investors foresee:

In the first half of 2020, within-border deals accounted for 71% of deal volume in H1. The first quarter still showed important results, mainly represented by the conclusion of deals already completed prior the start of the pandemic. The Q2 has been clearly affected by restrictions, showing a massive drop in the total value of cross-border deals: this sector suffered a lot the trend will likely continue until the end of the health emergency. Among the most important Cross-border deals, it is worth to highlight the Danfoss acquisition of Eaton Corp PLC’s hydraulics cylinder business for $3.3b.

The most notable examples of “nationalist” policies are those that led to the increase in tensions between the US and China, which escalated in the trade war. Started in 2018, with the US imposition of tariffs and trade barriers to lower the country’s increasing trade deficit and stop the allegedly theft of American technological intellectual property (Silicon Valley patents), the conflict is still incumbent. The outcome has been, by now, a worsening in US and China economies, that led to a global slowdown and a shift in American supply-chain to other Asian countries. Since 2016 Trump’s election, commercial relations reached the lowest level since many years: the Trump administration started imposing new tariffs and an increased scrutiny regarding goods acquired from China. Chinese acquisitions of US companies fell by almost 95% in 2018 from a peak two years before. Chinese spending on US companies fell from $55.3bn in 2016 to just $3bn last year, with American authorities rejecting several large deals. One of the largest deals to be axed was the US$1.2bn acquisition of MoneyGram, a US money transfer business, by Ant Financial, a Chinese online payment company owned by Alibaba. It was rejected by the US Committee on Foreign Investment, which cited national security concerns.

Another key element to consider in our already highly uncertain economic pattern is Brexit. Even though the exit of the UK from EU was voted in 2016, treaties are still in the making. Given the fact that London is, for now, the financial beating heart of EMEA, where the majority of deals is finalized, investors still see Brexit as a huge question mark for M&A, especially cross-border deals. The EU Cross Border Mergers Directive allows mergers between companies incorporated in different European Economic Area (EEA) states, provided certain rules are satisfied. The regime, by now enacted into English law, comes from EU legislation and with the UK leaving UE, then references to “EEA member states” would cease to include the UK. UK government has stated in “Structuring your business if there’s no Brexit deal” that, in the event of a no-deal Brexit, the EU cross border mergers regime will no longer be available to UK companies.

The pandemic has only accelerated protectionist trends. Borders are highly restricted, and governments have exploited national security exemption to prevent exports of certain products, most notably medical supplies but also foodstuffs and household goods. Along with people and goods, capital movements have also been withheld. During the pandemic, politicians accused global supply chains of making countries less secure, claiming the importance of domestic production of key industries. National self-sufficiency was promoted at the cost of international investment growth. Governments also pushed defensive policies to prevent takeovers of distressed, domestic firms by foreign entities. These policies included strengthening oversight of transactions that involve a foreign investor or buyer in particular industries. This enhanced scrutiny of international transactions shows how the pandemic has expanded the definition “predatory acquirer” to any foreign entity.

To get a deeper understanding, we analysed the projections of cross-border M&A activity in a selection of industries that are particularly interesting for the way they were affected.

Manufacturing

Manufacturing is among the industries most affected by the pandemic. In the first half of 2020 M&A market experienced a rise in uncertainty, leading to large-scale deal postponements and withdrawals as investors struggled with the impacts of COVID-19. While the challenging economic situation has slowed M&A activity, it also created areas of opportunity for value creation. Strategic investors have generally focused on liquidity, cost containment and short-term portfolio protection, but given the latest protectionist trends are also evaluating M&A as a means of securing supply chains.

As drivers in Manufacturing M&A activity investors foresee:

- Acquisitions and investment to strengthen supply chains as renewed interest in domestic and near-shore suppliers and opportunities to acquire suppliers of established core product lines.

- New business models to accelerate digital transformation in terms of automation and Internet of Things (IoT) connectivity.

- Regulatory and sustainability-driven investment to strengthen supply in green tech/next-generation materials and energy.

- Access to talent and specialised skills, to ensure the best technology investments and sector-specific business services.

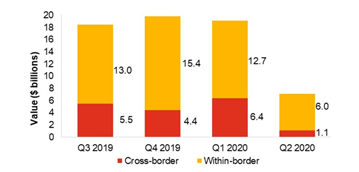

In the first half of 2020, within-border deals accounted for 71% of deal volume in H1. The first quarter still showed important results, mainly represented by the conclusion of deals already completed prior the start of the pandemic. The Q2 has been clearly affected by restrictions, showing a massive drop in the total value of cross-border deals: this sector suffered a lot the trend will likely continue until the end of the health emergency. Among the most important Cross-border deals, it is worth to highlight the Danfoss acquisition of Eaton Corp PLC’s hydraulics cylinder business for $3.3b.

Cross-border deals by value

Source: Refinitiv

TMT

TMT is among the industries least affected by the pandemic. As the covid-19 pandemic continues to strike the global economy, investors view Technology, Media & Telecommunications (TMT) as highly attractive, with the Nasdaq Composite Index hitting all-time highs, supported by many companies directly benefitting from the ongoing crisis. COVID-19 accelerated the business shift to all things digital: e-commerce displaces traditional stores, food-delivery apps capitalise on social-distancing restrictions, consumers switch to streaming over traditional media and smart working trend increases. Digitalisation will spur companies to use M&A to improve their capabilities in this field. TMT companies that deliver value in the current environment will be strongly positioned when the economy recovers. The large technology companies will continue to do well, although they will need to deal with increasing regulatory scrutiny globally.

These trends are expected to be drivers of M&A activity across TMT:

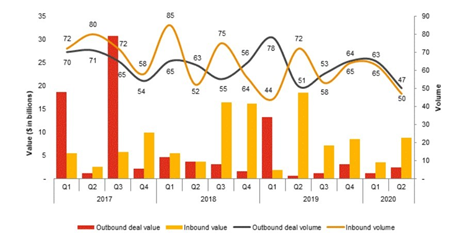

On the other hand, the graph below shows that Cross Border deals by value strongly decreased in the first two quarters of 2020. In fact, Domestic deals provided the majority of 2020 deal value as three of the four megadeals were domestic, including the $13b Koch - Infor megadeal. Outbound (domestic acquirer makes payment to a foreign shareholder) and inbound (the payment is made by a foreign acquirer to a domestic shareholder) deals in 2020 made up 15% and 14% of deal volume, respectively. Inbound deals accounted for roughly 17% of deal value, largely due to Just Eat Takeaway.Com’s acquisition of Grubhub. Outbound deals accounted for roughly 5% of deal value, largely due to the Zynga’s acquisition of Peak mobile gaming.

TMT is among the industries least affected by the pandemic. As the covid-19 pandemic continues to strike the global economy, investors view Technology, Media & Telecommunications (TMT) as highly attractive, with the Nasdaq Composite Index hitting all-time highs, supported by many companies directly benefitting from the ongoing crisis. COVID-19 accelerated the business shift to all things digital: e-commerce displaces traditional stores, food-delivery apps capitalise on social-distancing restrictions, consumers switch to streaming over traditional media and smart working trend increases. Digitalisation will spur companies to use M&A to improve their capabilities in this field. TMT companies that deliver value in the current environment will be strongly positioned when the economy recovers. The large technology companies will continue to do well, although they will need to deal with increasing regulatory scrutiny globally.

These trends are expected to be drivers of M&A activity across TMT:

- TMT M&A activity will become more common as companies look to capitalise on sector shifts emerging from COVID-19.

- Telecommunications companies globally have seen a significant increase in demand for their services, which has highlighted the need for infrastructure upgrades, namely wireless, wireline, fibre and 5G.

- Cloud, SaaS and security companies have performed well, although high valuations may deter investors from pursuing significant M&A deal activity.

On the other hand, the graph below shows that Cross Border deals by value strongly decreased in the first two quarters of 2020. In fact, Domestic deals provided the majority of 2020 deal value as three of the four megadeals were domestic, including the $13b Koch - Infor megadeal. Outbound (domestic acquirer makes payment to a foreign shareholder) and inbound (the payment is made by a foreign acquirer to a domestic shareholder) deals in 2020 made up 15% and 14% of deal volume, respectively. Inbound deals accounted for roughly 17% of deal value, largely due to Just Eat Takeaway.Com’s acquisition of Grubhub. Outbound deals accounted for roughly 5% of deal value, largely due to the Zynga’s acquisition of Peak mobile gaming.

Cross-border deals by value

Source: Pwc Technology Deal Insight: Midyear 2020

Recently, many tech companies started looking for investments in underpenetrated markets such as India but have been met with restrictions regarding acquisitions. Therefore, the large tech companies have made significant investments in Indian companies such as Facebook’s $5.7 b investment in Reliance Jio Platforms. Similarly, Alphabet has made a commitment to invest $10 billion in India over the next five to seven years.

Pharmaceuticals

Pharmaceuticals is among the industries least affected by the pandemic. In times of crisis and disruption, investors have historically viewed Pharmaceuticals & Life Sciences (PLS) as attractive, reflecting the industry’s traditional resilience in the face of economic challenges. COVID-19 has been no exception: interest in biotech companies and divestitures of non-core assets remains largely unchanged. Unfortunately, M&A activity in pharmaceutical markets was lower than experts estimated. Also, there were not many megadeals in Q1 and Q2 compared with 2019 (where the value of the largest deal was $99.5 billion). The biggest deals in the first half of 2020 were Thermo Fisher Scientific - Qiagen for $11.5 b related to COVID-19 research and Gilead Sciences acquisition of Forty-Seven for $4.9 b in the oncology field.

Some key areas that investors expect to be active are:

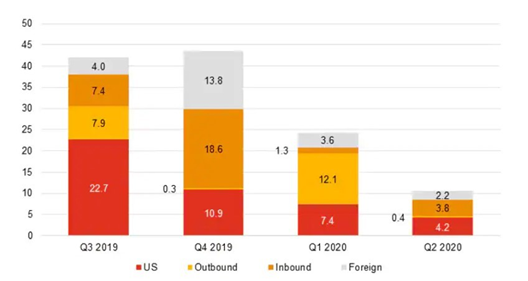

Looking at the origin of deals in the graph below, the situation is similar to what happened in TMT but with some peculiarities. The first thing to notice is that between Q3 2019 and Q4 2019 the number of Within-border deals fell sharply: this trend continued in the first half of 2020 even considering the huge reduction in the overall number of deals. In H1 2020 only 27 of the 99 deals concluded were US to US. At the same time, US acquisition of foreign companies remained low: through half the year there were only 8 out of 99 deals for $12.5 b, which surprisingly represented 36% of the total.

Pharmaceuticals

Pharmaceuticals is among the industries least affected by the pandemic. In times of crisis and disruption, investors have historically viewed Pharmaceuticals & Life Sciences (PLS) as attractive, reflecting the industry’s traditional resilience in the face of economic challenges. COVID-19 has been no exception: interest in biotech companies and divestitures of non-core assets remains largely unchanged. Unfortunately, M&A activity in pharmaceutical markets was lower than experts estimated. Also, there were not many megadeals in Q1 and Q2 compared with 2019 (where the value of the largest deal was $99.5 billion). The biggest deals in the first half of 2020 were Thermo Fisher Scientific - Qiagen for $11.5 b related to COVID-19 research and Gilead Sciences acquisition of Forty-Seven for $4.9 b in the oncology field.

Some key areas that investors expect to be active are:

- Companies directly involved in tackling the spread of COVID-19, such as those carrying out diagnostics and vaccine development.

- Mid-size biotech companies, especially involved in gene therapy and oncology, will continue to attract interest from big pharma.

- Device manufacturers and drug companies across a variety of therapeutic areas not related to COVID-19, have faced significant challenges due to restrictions on elective procedures.

- Specialist drug discovery companies should continue to receive interest from strategic buyers reshaping their R&D and innovative drug development portfolios.

Looking at the origin of deals in the graph below, the situation is similar to what happened in TMT but with some peculiarities. The first thing to notice is that between Q3 2019 and Q4 2019 the number of Within-border deals fell sharply: this trend continued in the first half of 2020 even considering the huge reduction in the overall number of deals. In H1 2020 only 27 of the 99 deals concluded were US to US. At the same time, US acquisition of foreign companies remained low: through half the year there were only 8 out of 99 deals for $12.5 b, which surprisingly represented 36% of the total.

Cross-border deals by value

Source: PwC Analysis

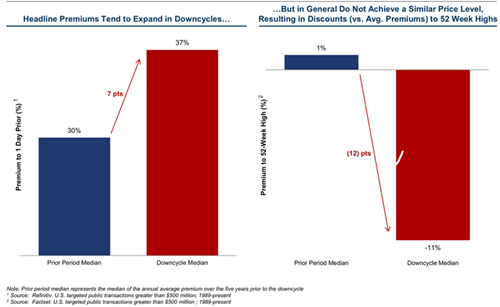

Implications of the decrease

An interesting empirical result, typical of period of crises, is that the headline premiums tend to be lower before the crises than during them: the level of premium during down cycle usually tends to expand but they do not compensate the total valuation of the M&A market. In other words, the expansion of the premium is not big enough to recover the peak. Premiums looks higher because there is a shrinking in valuation on standalone valuation. The market is getting lost and also market participants are less certain because there is no stability in the long-term sustainable valuation of a company. The value of a company standalone needs a bit of time to stabilize and there is need to reassess the new standalone value: there is an artificial expansion in premium, but nevertheless the total valuation offers never reach the peak of the time before the crises. To sum up, the premium, that is the value to pay to shareholders in order to share synergies, is higher since it is difficult to look at synergies and to distinguish them from the standalone value, that for the reasons mentioned above is unstable. As a consequence, during down cycle stocks are more considered: the real valuation of a company is more difficult to achieve, so the behaviour to offer more shares is a way to share with the selling shareholder both downside and upside. That is why also the sponsor activity usually drops, since sponsors usually pay cash.

An interesting empirical result, typical of period of crises, is that the headline premiums tend to be lower before the crises than during them: the level of premium during down cycle usually tends to expand but they do not compensate the total valuation of the M&A market. In other words, the expansion of the premium is not big enough to recover the peak. Premiums looks higher because there is a shrinking in valuation on standalone valuation. The market is getting lost and also market participants are less certain because there is no stability in the long-term sustainable valuation of a company. The value of a company standalone needs a bit of time to stabilize and there is need to reassess the new standalone value: there is an artificial expansion in premium, but nevertheless the total valuation offers never reach the peak of the time before the crises. To sum up, the premium, that is the value to pay to shareholders in order to share synergies, is higher since it is difficult to look at synergies and to distinguish them from the standalone value, that for the reasons mentioned above is unstable. As a consequence, during down cycle stocks are more considered: the real valuation of a company is more difficult to achieve, so the behaviour to offer more shares is a way to share with the selling shareholder both downside and upside. That is why also the sponsor activity usually drops, since sponsors usually pay cash.

Source: Refinitiv and FactSet

What to expect going forward

To conclude, even though there are good signs for cross border M&A activity, such as low interest rates, an increasing number of distressed companies in the need for capital infusions and relatively strong US dollar, a new scenario, with enhanced nationalist scrutiny, will affect cross border M&A deals. Making predictions on future trends is not an easy task: the first big question regards the length and seriousness of the Covid-19 second wave in Europe and UK. After the incredible March market crash, investors recovered in just a couple of months the heavy losses, but the recent restrictions put in place in many EU countries in these days are making fear rise again. These strong fluctuations in the market value of many listed companies and the difficulties in finding the right long-term valuation will for sure lead to an increase of stocks as a mean of payment in addiction to an increase of debt. In this context, stock payments are seen as a way to share the risk between the parties, which are reluctant using cash, even though many large companies increased their pile of cash during the years after the 2008 financial meltdown.

Considering the above-mentioned US-China tensions, the election of Joe Biden is an important event that can change US attitude toward Allies and international organizations. Probably, Donald Trump will exploit any legal procedure to try to reverse the election, but it is very unlikely that these actions will change the results. Biden considers China as a problem and from the beginning of his electoral campaign, he agreed with Trump on the necessity to stop Chinese expansion desires. It is difficult to say if the relationship between the two countries will improve or not, but the approach of Biden will be completely different from the one his predecessor. We expect more international collaboration and not unilateral actions.

A final threat is Brexit, and it seems that it will last long. The fears of a No Deal between EU and UK are higher than ever, and it is inevitable that even in the better scenario, UK companies will be affected by the end of the Free Trade Agreement. After many difficulties in managing the pandemic, Boris Johnson is trying to rise again his consensus with many affirmations on the state of the negotiation. In any case, the EU seems to have a stronger position than the British government and looking also at prior phases, all the clues let analysts think that Brussel will obtain a favourable accord. The No Deal scenario would represent a failure, with huge economic consequences on both sides.

Analysts

To conclude, even though there are good signs for cross border M&A activity, such as low interest rates, an increasing number of distressed companies in the need for capital infusions and relatively strong US dollar, a new scenario, with enhanced nationalist scrutiny, will affect cross border M&A deals. Making predictions on future trends is not an easy task: the first big question regards the length and seriousness of the Covid-19 second wave in Europe and UK. After the incredible March market crash, investors recovered in just a couple of months the heavy losses, but the recent restrictions put in place in many EU countries in these days are making fear rise again. These strong fluctuations in the market value of many listed companies and the difficulties in finding the right long-term valuation will for sure lead to an increase of stocks as a mean of payment in addiction to an increase of debt. In this context, stock payments are seen as a way to share the risk between the parties, which are reluctant using cash, even though many large companies increased their pile of cash during the years after the 2008 financial meltdown.

Considering the above-mentioned US-China tensions, the election of Joe Biden is an important event that can change US attitude toward Allies and international organizations. Probably, Donald Trump will exploit any legal procedure to try to reverse the election, but it is very unlikely that these actions will change the results. Biden considers China as a problem and from the beginning of his electoral campaign, he agreed with Trump on the necessity to stop Chinese expansion desires. It is difficult to say if the relationship between the two countries will improve or not, but the approach of Biden will be completely different from the one his predecessor. We expect more international collaboration and not unilateral actions.

A final threat is Brexit, and it seems that it will last long. The fears of a No Deal between EU and UK are higher than ever, and it is inevitable that even in the better scenario, UK companies will be affected by the end of the Free Trade Agreement. After many difficulties in managing the pandemic, Boris Johnson is trying to rise again his consensus with many affirmations on the state of the negotiation. In any case, the EU seems to have a stronger position than the British government and looking also at prior phases, all the clues let analysts think that Brussel will obtain a favourable accord. The No Deal scenario would represent a failure, with huge economic consequences on both sides.

Analysts

- Elena Donati

- Emanuele Virno Lamberti

- Leonardo Baldassarri