“U.S. banks notched a record quarterly profit, newly released data show, a result of the new tax law, rising interest rates and an improving economy”. This was the opening line of last year’s WSJ article after the release of major Wall Street banks’ first quarter reports. One year later, the economic situation has changed and we are assisting at the triumph of boring banking.

In May of last year, banks’ gains were attributed to two main drivers: Trump corporate tax cut and the increase in markets volatility. The effective tax rate reduction had – as effect – a general increase in net income. The increase in volatility due to trade tensions, plunging tech stocks and fears about inflation, boosted trading activity and particularly trading desk revenue. Namely, Morgan Stanley's trading revenue soared by 25%, Goldman Sachs’ by 31% and Bank of America by 38%. At JPMorgan, markets revenue overall rose 7%, helped by a 25% growth in stock trading. Citigroup registered a 3% increase in markets and securities services revenues driven by the 38% rise in equity markets.

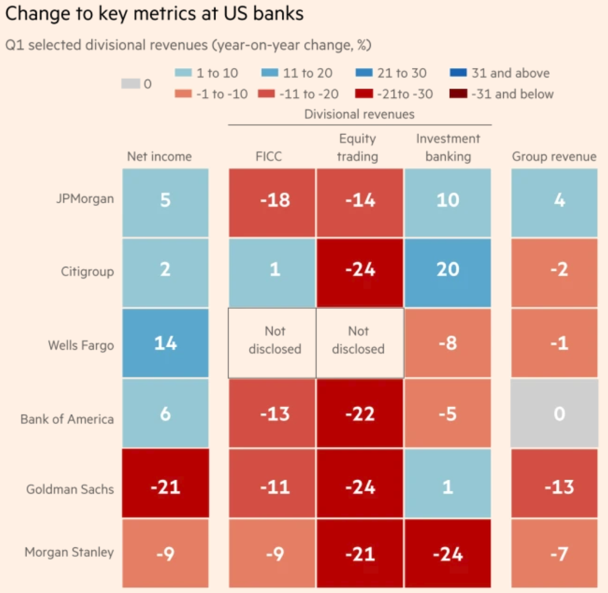

This year, first quarter reports depict a very different situation, especially in the sources of banks revenue, which can be used as a proxy in assessing the overall health of the U.S. economy. After a strong 2018, in fact, investors have been focusing on any signs of weakness. In particular, to attract the most attention are any indications of a slowing economy and the impact of a flattening yield curve.

In May of last year, banks’ gains were attributed to two main drivers: Trump corporate tax cut and the increase in markets volatility. The effective tax rate reduction had – as effect – a general increase in net income. The increase in volatility due to trade tensions, plunging tech stocks and fears about inflation, boosted trading activity and particularly trading desk revenue. Namely, Morgan Stanley's trading revenue soared by 25%, Goldman Sachs’ by 31% and Bank of America by 38%. At JPMorgan, markets revenue overall rose 7%, helped by a 25% growth in stock trading. Citigroup registered a 3% increase in markets and securities services revenues driven by the 38% rise in equity markets.

This year, first quarter reports depict a very different situation, especially in the sources of banks revenue, which can be used as a proxy in assessing the overall health of the U.S. economy. After a strong 2018, in fact, investors have been focusing on any signs of weakness. In particular, to attract the most attention are any indications of a slowing economy and the impact of a flattening yield curve.

The reporting season started with JPMorgan and Wells Fargo releases on Friday the 12th, Citigroup followed on Monday, Goldman Sachs and Bank of America on Tuesday and Morgan Stanley on Wednesday.

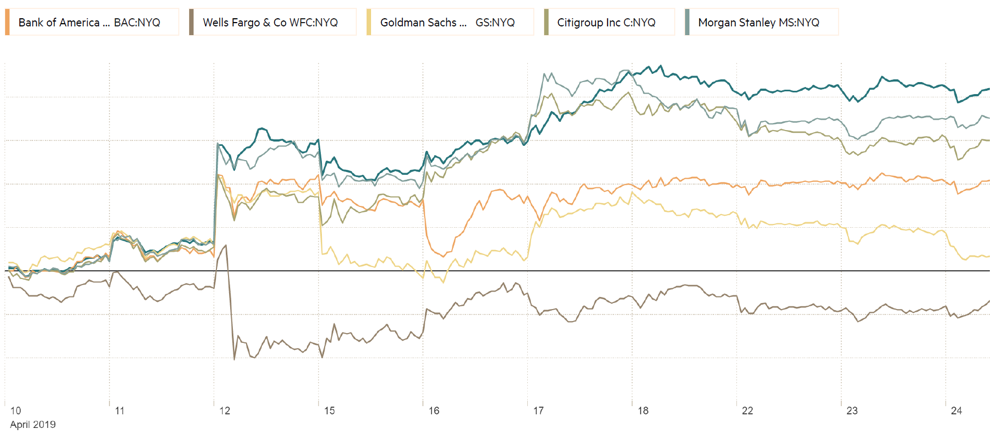

JPMorgan Chase (NYSE: JPM) kicked off the season with a stronger than expected first quarter, with the highest net income in U.S. banking history. The bank benefited from its diversified business model, which sees a dominant position in retail banking, investment banking, commercial banking, custody banking and asset & wealth management services. Despite the poor performance on the trading desks – markets revenue dropped 17% to $5.5 billion – the largest U.S. bank was able to beat analysts’ forecasts once again by achieving all-time high earnings per share of $2.65 compared to the consensus figure of $2.32. The single biggest driver was net interest income, that benefited from the 2018 four Fed interest rate increases. The tremendous results sparked an unambiguous market reaction and JPMorgan stock rose almost 5%, giving an upbeat outlook on the U.S. economy.

Wells Fargo (NYSE: WFC) first quarter was not as profitable, even if earnings per share were well above estimates, at $1.20 against $1.08. The bank reported revenue $21.6 billion, down from $21.9 billion of 2018. However, net interest income edged up 1% to $12.3 billion. Nonetheless, CFO John Shrewsberry expects net interest income to fall 2%–5% this year, because of a lower rate outlook, a flatter yield curve, tighter loan spreads and upward pressure on deposit pricing. Additionally, Wells Fargo, which is the largest U.S. mortgage lender, has dealt with a long series of scandals related to its culture and sales practices, particularly the fake-accounts scandal. This, together with an overall veil of uncertainty over the firm long-term strategy – the bank recently started a hunt for the new chief executive – contributed to increasing a dovish sentiment among investors. Wells Fargo stock dropped almost 3% after Q1 report was released.

Citigroup (NYSE: C) was the third large U.S. bank to release first quarter data. Results were characterized by a fall in revenue, due to a sharp decline in equity-trading, which dropped 24% reflecting “lower market volumes and client financing balances”. Despite this, earnings per share were higher than expected, at $1.87 against $1.80, boosted by large share buybacks – the bank has repurchased $4.06 billion in shares during the period. Additionally, to surprise was also the revenue from investment banking activities, which rose significantly with respect to last year and also in comparison the other major banks. Finally, net interest income showed a modest increase of 4%. After the mixed results, Citigroup shares, which are up roughly 30% year to date, fell slightly less than 1%.

Bank of America (NYSE: BAC) first quarter results showed record profits of $7.3 billion, representing a 6% increase. Earnings per share rose to $0.70, beating analysts’ predictions of $0.66. However, what is interesting about the data released by the bank is that even though it suffered large losses in investment banking and capital markets operations due to a challenging capital markets environment, it was able to endure thanks to the increase in retail banking revenue. This proves that business and consumer lending continue to be a source of strength, as reported last week by the Financial Times. In particular, “the key takeaway was net interest income expansion [in retail], driven by interest margin expansion and moderate loan growth,” said Jim Shanahan, a bank analyst at Edward Jones. Despite the positive results, Bank of America shares closed negative by less than 1%, this was due to the announcement, by the bank executives, that net interest income growth was fading because of declining interest rates and a slowing U.S. economy.

Goldman Sachs (NYSE: GS) earning results were the most disappointing among the six major U.S. banks, as revenue dropped 13% to $8.81 billion, below analyst’s estimate of $8.9 billion. This partially relates to the fact that Goldman is the most dependent on Wall Street activities, and that exposes the company to the decline in trading in the quarter. In fact, the bank suffered large losses in the markets division, particularly equity trading. On the other hand, revenue from investment banking activities was almost unchanged. These results partially explain investors solicitation for a keenly anticipated strategy review. To this regard, CEO David Solomon explained that the bank is “working to grow existing businesses, diversify its businesses with new products and services and improve efficiency”. In particular, the investment bank in taking a notable step in consumer finance with its joint venture with Apple over the new credit card. Goldman Sachs shares, which are already trading at discount with respect to peers, fell almost 4% after the earnings release.

Morgan Stanley (NYSE: MS) was the last, among U.S. largest banks, to release first quarter results and benefited from sufficiently lower expectations, also due to the lack of a retail division. The bank revenue and profit exceeded expectations, mainly because of positive results of the wealth management division, which held up better than rivals as well as the relatively good performance in bond trading, which was the best among peers. In particular, quarterly profits reached $2.4 billion, corresponding to $1.39 per share, well above the estimated $1.17. Despite this, the bank suffered an 8% loss in net income with respect to the previous year. Moreover, it is notable the 24% drop in investment banking revenue due to lower fees from M&A and underwriting activities. After the release, Morgan Stanley shares rose more than 1%.

JPMorgan Chase (NYSE: JPM) kicked off the season with a stronger than expected first quarter, with the highest net income in U.S. banking history. The bank benefited from its diversified business model, which sees a dominant position in retail banking, investment banking, commercial banking, custody banking and asset & wealth management services. Despite the poor performance on the trading desks – markets revenue dropped 17% to $5.5 billion – the largest U.S. bank was able to beat analysts’ forecasts once again by achieving all-time high earnings per share of $2.65 compared to the consensus figure of $2.32. The single biggest driver was net interest income, that benefited from the 2018 four Fed interest rate increases. The tremendous results sparked an unambiguous market reaction and JPMorgan stock rose almost 5%, giving an upbeat outlook on the U.S. economy.

Wells Fargo (NYSE: WFC) first quarter was not as profitable, even if earnings per share were well above estimates, at $1.20 against $1.08. The bank reported revenue $21.6 billion, down from $21.9 billion of 2018. However, net interest income edged up 1% to $12.3 billion. Nonetheless, CFO John Shrewsberry expects net interest income to fall 2%–5% this year, because of a lower rate outlook, a flatter yield curve, tighter loan spreads and upward pressure on deposit pricing. Additionally, Wells Fargo, which is the largest U.S. mortgage lender, has dealt with a long series of scandals related to its culture and sales practices, particularly the fake-accounts scandal. This, together with an overall veil of uncertainty over the firm long-term strategy – the bank recently started a hunt for the new chief executive – contributed to increasing a dovish sentiment among investors. Wells Fargo stock dropped almost 3% after Q1 report was released.

Citigroup (NYSE: C) was the third large U.S. bank to release first quarter data. Results were characterized by a fall in revenue, due to a sharp decline in equity-trading, which dropped 24% reflecting “lower market volumes and client financing balances”. Despite this, earnings per share were higher than expected, at $1.87 against $1.80, boosted by large share buybacks – the bank has repurchased $4.06 billion in shares during the period. Additionally, to surprise was also the revenue from investment banking activities, which rose significantly with respect to last year and also in comparison the other major banks. Finally, net interest income showed a modest increase of 4%. After the mixed results, Citigroup shares, which are up roughly 30% year to date, fell slightly less than 1%.

Bank of America (NYSE: BAC) first quarter results showed record profits of $7.3 billion, representing a 6% increase. Earnings per share rose to $0.70, beating analysts’ predictions of $0.66. However, what is interesting about the data released by the bank is that even though it suffered large losses in investment banking and capital markets operations due to a challenging capital markets environment, it was able to endure thanks to the increase in retail banking revenue. This proves that business and consumer lending continue to be a source of strength, as reported last week by the Financial Times. In particular, “the key takeaway was net interest income expansion [in retail], driven by interest margin expansion and moderate loan growth,” said Jim Shanahan, a bank analyst at Edward Jones. Despite the positive results, Bank of America shares closed negative by less than 1%, this was due to the announcement, by the bank executives, that net interest income growth was fading because of declining interest rates and a slowing U.S. economy.

Goldman Sachs (NYSE: GS) earning results were the most disappointing among the six major U.S. banks, as revenue dropped 13% to $8.81 billion, below analyst’s estimate of $8.9 billion. This partially relates to the fact that Goldman is the most dependent on Wall Street activities, and that exposes the company to the decline in trading in the quarter. In fact, the bank suffered large losses in the markets division, particularly equity trading. On the other hand, revenue from investment banking activities was almost unchanged. These results partially explain investors solicitation for a keenly anticipated strategy review. To this regard, CEO David Solomon explained that the bank is “working to grow existing businesses, diversify its businesses with new products and services and improve efficiency”. In particular, the investment bank in taking a notable step in consumer finance with its joint venture with Apple over the new credit card. Goldman Sachs shares, which are already trading at discount with respect to peers, fell almost 4% after the earnings release.

Morgan Stanley (NYSE: MS) was the last, among U.S. largest banks, to release first quarter results and benefited from sufficiently lower expectations, also due to the lack of a retail division. The bank revenue and profit exceeded expectations, mainly because of positive results of the wealth management division, which held up better than rivals as well as the relatively good performance in bond trading, which was the best among peers. In particular, quarterly profits reached $2.4 billion, corresponding to $1.39 per share, well above the estimated $1.17. Despite this, the bank suffered an 8% loss in net income with respect to the previous year. Moreover, it is notable the 24% drop in investment banking revenue due to lower fees from M&A and underwriting activities. After the release, Morgan Stanley shares rose more than 1%.

From the analysis of the first quarter reports, the main element that emerges is the ascendancy of retail banking with respect to investment banking and capital markets operations. Charles Peabody of Portales Partners highlighted this phenomenon: “Look at the banks’ different businesses – corporate and investment banking is not a source of growth, and asset management is not [either]. All the growth is coming from the retail banks”. In fact, while the other units generally showed poor performance, suffering losses or small growth, retail has been the one to push profits higher. At least for those banks that have a retail division.

The distinction between the banks with a strong retail unit and those that do not have it, namely Morgan Stanley and Goldman Sachs, which technically only has a tiny one, is reflected both in the overall performance and in the valuation of bank shares. In fact, these two banks are the worst performing among the six big U.S. banks, having fallen 11% and 21%, respectively. On the contrary, the four banks with branch networks saw an aggregate growth of net income of 9% in the first quarter. Additionally, JPMorgan and Bank of America, that have the strongest retail units, trade at higher premiums to tangible book value, showing investors appreciation for stable retail.

The reasons for the success of retail with respect to the other divisions are attributable, on one hand, to the challenging capital markets that characterized the first months of this year, on the other, to the Federal Reserve four rate increases that allowed banks to expand the interest rate margins, particularly by holding deposit rates low while increasing interest on loans. The bottom line effect is that “boring banking is exciting again”, as noted by the Financial Times journalist Robert Armstrong.

Despite the favourable momentum, investors are wondering how long this effect can last. The major concern is related to the Fed decision not to proceed with any other rate hikes, since this would translate in a flattening of the yield curve which reduces banks possibility to increase net interest income. Net interest income is the interest earned on debt securities, loans (including yield-related loan fees) and other interest earning assets minus the interest paid on deposits, short-term borrowings and long-term debt. The reason for this is that banks normally pay interest on short-term rates and lend at long-term ones, so as this spread reduces potential profits shrinks. This uncertainty has also prevented banks from growing core retail margins.

Finally, there are also upsides originating from the decision not to proceed with further rate rises, namely the decrease in funding costs and a possible increase in mortgage volumes. However, these two phenomena are unlikely to compensate for the loss in net interest income.

The ultimate question is, therefore, whether retail banking’s momentum will be sustainable for much longer, given the low-rate environment. For now, analysts are expecting a rapid slowdown in growth in later quarters of this year. To maintain this trend, in fact, according to Mr. Peabody of Portales “The economy has to get back to 3% GDP growth, which would change the whole trajectory of the yield curve”. Considering the just released U.S. GDP results, that show a still strong economy and a growth of 3.2%, all bets are off.

Alessandro Cinquegrani

The distinction between the banks with a strong retail unit and those that do not have it, namely Morgan Stanley and Goldman Sachs, which technically only has a tiny one, is reflected both in the overall performance and in the valuation of bank shares. In fact, these two banks are the worst performing among the six big U.S. banks, having fallen 11% and 21%, respectively. On the contrary, the four banks with branch networks saw an aggregate growth of net income of 9% in the first quarter. Additionally, JPMorgan and Bank of America, that have the strongest retail units, trade at higher premiums to tangible book value, showing investors appreciation for stable retail.

The reasons for the success of retail with respect to the other divisions are attributable, on one hand, to the challenging capital markets that characterized the first months of this year, on the other, to the Federal Reserve four rate increases that allowed banks to expand the interest rate margins, particularly by holding deposit rates low while increasing interest on loans. The bottom line effect is that “boring banking is exciting again”, as noted by the Financial Times journalist Robert Armstrong.

Despite the favourable momentum, investors are wondering how long this effect can last. The major concern is related to the Fed decision not to proceed with any other rate hikes, since this would translate in a flattening of the yield curve which reduces banks possibility to increase net interest income. Net interest income is the interest earned on debt securities, loans (including yield-related loan fees) and other interest earning assets minus the interest paid on deposits, short-term borrowings and long-term debt. The reason for this is that banks normally pay interest on short-term rates and lend at long-term ones, so as this spread reduces potential profits shrinks. This uncertainty has also prevented banks from growing core retail margins.

Finally, there are also upsides originating from the decision not to proceed with further rate rises, namely the decrease in funding costs and a possible increase in mortgage volumes. However, these two phenomena are unlikely to compensate for the loss in net interest income.

The ultimate question is, therefore, whether retail banking’s momentum will be sustainable for much longer, given the low-rate environment. For now, analysts are expecting a rapid slowdown in growth in later quarters of this year. To maintain this trend, in fact, according to Mr. Peabody of Portales “The economy has to get back to 3% GDP growth, which would change the whole trajectory of the yield curve”. Considering the just released U.S. GDP results, that show a still strong economy and a growth of 3.2%, all bets are off.

Alessandro Cinquegrani