Ready Player One, a sci-fi movie in which humanity uses a virtual reality software called OASIS to emulate life and escape the desolation of the real world has left many of its fans daydreaming. What they may ignore, however, is that this may be soon become reality: Improbable, a recently founded start-up, aims to create a virtual world as detailed, immersive and persistent as reality, where millions of people can live, interact and earn a living. The project is so outlandish and bizarre that, as its founder tells it, it will either end in a disastrous failure or an unmatched success. If that happens, it will be partly because the start-up drew the curiosity of a similarly improbable, wildly ambitious technology fund, which bet almost $500m in the project.

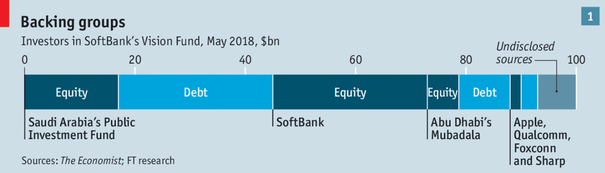

The recently born Vision Fund is the biggest venture capital fund in the world, managing a total wealth of $100bn. If you have no idea on how to size the monstrous number but still want a grasp, just consider that in 2016 all the venture capital funds in the world managed something around $60bn. The Vision Fund has been founded in 2016 from Masayoshi Son (founder of SoftBank, a Japanese telecoms and internet firm) who joined forces with Muhammad bin Salman, Saudi Arabia’s prince, who handed Masayoshi $45bn to diversify the economy of the state. That, summed to the $28bn put from SoftBank, created a gravity-like center who attracted other ‘smaller’ investors.

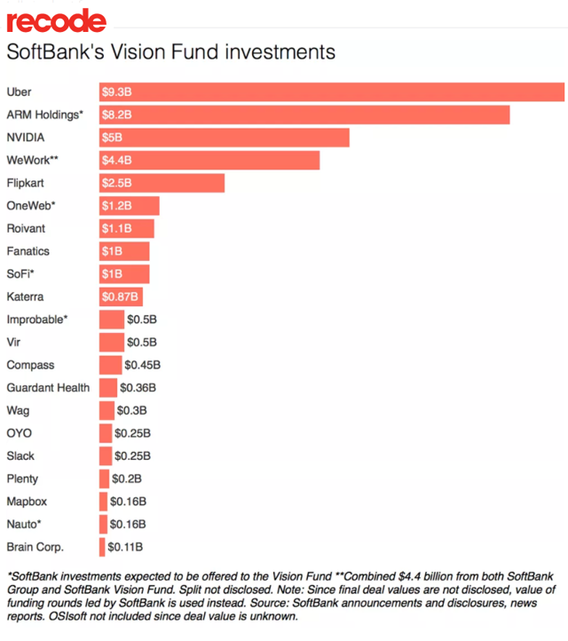

Son’s investment strategy does not fit in any conventional scheme and seems to work in reverse. Unlike many other VC funds, he does not wait for start-ups to come see him, but rather prefers scouts them down. In addition, when he shows up he usually offers much more money compared to the amounts initially asked by entrepreneurs: one of them recalls a meeting in which Son suddenly interrupted and told: “Stop, I have heard enough. How much do you want?” and ended up offering five times what the entrepreneur suggested. He concentrates his efforts in tech start-ups: into the fund’s portfolio you will find some of the most known firms in the industry, like Uber, ARM, Nvidia, WeWork and Flipkart, to name a few. His aim is to build a network, to which he refers as a “virtual Silicon Valley”, where he encourages them to collaborate to scale-up as soon as possible. “As the number of portfolio companies increases, the possibilities for synergies will be unlimited” says Mr. Son. “The Vision Fund is a platform where companies can stimulate and collaborate with each other”. But Mr. Son’s pitch did not convince everyone, and investors are skeptical. Many of them say that Son’s reckless investment strategy will end up in a disaster. Giving the debt leverage of the fund, this is likely to happen unless one of the start-ups does not perform extremely well: 40% of the fund’s resources is in the form of debt, which bears a 7% monthly coupon. The money is spent out almost as fast as it was taken in with more than $30bn already engaged (nearly as much as the entire American VC industry raised in 2017) leaving the fund heavily exposed. To these critiques, Son repeatedly cited the example of Alibaba, where he invested through SoftBank a mere $20m now worth $140bn. However, it is common knowledge that unicorns are hard to find.

Beside the financial results of this fund, what is most interesting is that Vision Fund is finally offering an alternative to those start-ups that do not want to be absorbed by other tech-giants, like Google, Facebook, Tencent and Baidu. This will boost competition in the sector, finally rebalancing the power of these tech giants who often offer the best checks to the brightest minds. For long the Silicon Valley has been accused to kill competition by acquiring all the new promising companies in the sector. Another fact may be even more impressive is that Son’s bets today are probably going to shape the world of tomorrow. The massive money pumping into frontier technologies will determine the fate of many start-ups: companies that receive hundreds of millions of dollars in one go are elevated far above their competitors. That gives a single person the kingmaking power of deciding where to head research or production, and hence the choices customers will have in the future. A proper verdict of Vision Fund will not be possible for years: fortune’s biggest wheel is spinning.

Riccardo Ronzani

Riccardo Ronzani