“We were No. 1, and we’re going to be No. 1 again with a larger lead” declared Nasdaq chief executive Bob Greifeld commenting last month decision of a $1.1 billion acquisition of International Securities Exchange (ISE), the Deutsche Börse Group-owned operator of three electronic options exchanges.

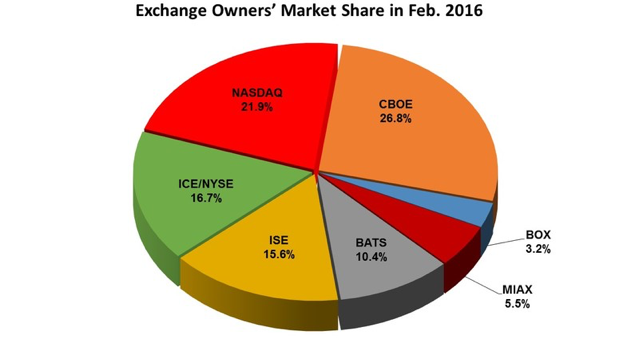

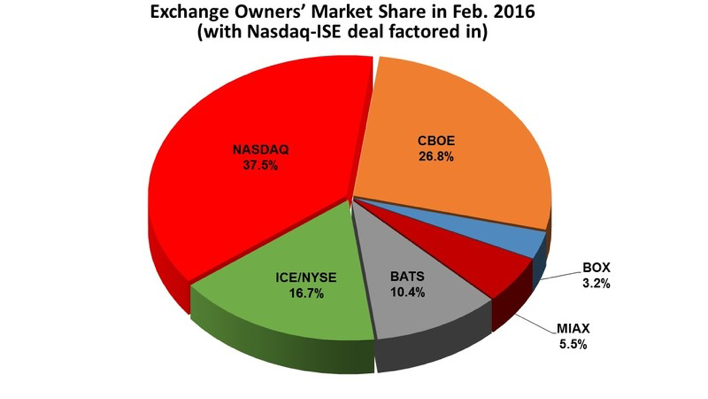

However, investors seemed not to appreciate the decision and as a matter of fact, Nasdaq stock lost 3.5% by the day following the announcement. A deal that gives Nasdaq almost 40% control of the US options market sounds like a news worth of celebration for fans of the most famous OTC market. Going deeper in the analysis, it will turn out to be a deal actually damaging those supporters’ interests.

Much to competitors’ chagrin, the deal undoubtedly strengthens Nasdaq position of leader in the market, as US-based company’s managers provide as main strategic explanation for the deal: bringing the options businesses together will mean more competitive pricing in the industry. Rivals are competing over a shrinking pie. Options volume in 2015 totaled 4.14bn contracts, a 2.9% decrease from 2014.

At first glance, this news would appear an answer to the prayers of those investors seeking a simpler market structure with fewer exchanges, thus hoping for far deeper liquidity. However, it is not such a fairy tale, as it appears to be. Tom Wittman, executive vice-president and global head of equities at Nasdaq, has already declared that they have no intention to decrease the number of exchanges because they deem traders prefer specialized exchanges tailored to their needs. On the other hand, he unveiled the new project of launching new products.

Another point in favor of the deal concerns Nasdaq doubled stake in Options Clearing Corporation, the world’s largest derivatives trader, reaching a noteworthy amount of 40%. Such a high stake would allegedly grant Nasdaq the power to set the rules and costs for clearing and settling trades through board representation. Regardless of this, it cannot be denied that they will cash in more fees.

Summing up, the decision seems to be the right one if seen from Nasdaq own perspective. Traders, the other facet of the market, are pretty damaged by such a mix of consolidation of the market without any improvement concerning fragmentation. Traders have been paying high fixed costs up to now for a market that is being squeezed in volume in the last couple of years. The largest part of those fixed costs derived from the fragmentation and the consequent fall in the ease and speed for executing trades.

To conclude, such a deal cannot do nothing but leaving traders in “the worst of all worlds” as Manoj Narang, founder of Mana Partners, a new US hedge fund, stated referring to the higher expected costs due to lower competition on a much more consolidated market, in exchange for the same degree of fragmentation as before.

However, investors seemed not to appreciate the decision and as a matter of fact, Nasdaq stock lost 3.5% by the day following the announcement. A deal that gives Nasdaq almost 40% control of the US options market sounds like a news worth of celebration for fans of the most famous OTC market. Going deeper in the analysis, it will turn out to be a deal actually damaging those supporters’ interests.

Much to competitors’ chagrin, the deal undoubtedly strengthens Nasdaq position of leader in the market, as US-based company’s managers provide as main strategic explanation for the deal: bringing the options businesses together will mean more competitive pricing in the industry. Rivals are competing over a shrinking pie. Options volume in 2015 totaled 4.14bn contracts, a 2.9% decrease from 2014.

At first glance, this news would appear an answer to the prayers of those investors seeking a simpler market structure with fewer exchanges, thus hoping for far deeper liquidity. However, it is not such a fairy tale, as it appears to be. Tom Wittman, executive vice-president and global head of equities at Nasdaq, has already declared that they have no intention to decrease the number of exchanges because they deem traders prefer specialized exchanges tailored to their needs. On the other hand, he unveiled the new project of launching new products.

Another point in favor of the deal concerns Nasdaq doubled stake in Options Clearing Corporation, the world’s largest derivatives trader, reaching a noteworthy amount of 40%. Such a high stake would allegedly grant Nasdaq the power to set the rules and costs for clearing and settling trades through board representation. Regardless of this, it cannot be denied that they will cash in more fees.

Summing up, the decision seems to be the right one if seen from Nasdaq own perspective. Traders, the other facet of the market, are pretty damaged by such a mix of consolidation of the market without any improvement concerning fragmentation. Traders have been paying high fixed costs up to now for a market that is being squeezed in volume in the last couple of years. The largest part of those fixed costs derived from the fragmentation and the consequent fall in the ease and speed for executing trades.

To conclude, such a deal cannot do nothing but leaving traders in “the worst of all worlds” as Manoj Narang, founder of Mana Partners, a new US hedge fund, stated referring to the higher expected costs due to lower competition on a much more consolidated market, in exchange for the same degree of fragmentation as before.

Davide Laporta