The US largest milk producer files for bankruptcy, following a nationwide and global change in the way humans consume and perceive milk. There are a number of reasons explaining this, ethical and environmental are two. This event makes you wonder which is the next company to fall following the same shift in consumer demand.

In 1996, the average American drank approximately 90 liters of milk, in 2018 that number had dropped to 54 liters. This is a decline of about 40% and the two major reasons for this are ethical, environmental and nutritional. Other contributing factors are changing consumer tastes and the recent rapid growth of competing alternatives such as non-dairy milks derived from oats, almond, and others.

Naturally, this change in market dynamic is affecting long-standing companies that produce milk and forces them to make radical changes or face financial pressure and potentially go bankrupt.

The US firm Dean Foods is the country’s largest dairy company. It has been around since 1925 and employs some 16,000 people, owns 58 brands and over 60 processing plants nationwide. With total revenues of $7.8 billion, and normal milk constituting 67% of the company’s sales in 2018, it was of course heavily affected by the shift in demand. This led the company to eventually file for Chapter 11 restructuring in early November 2019. Dean Foods had posted losses in five consecutive quarters leading up to the filing, and analysts’ estimates of the firm’s outlook were very dull.

Where to from here?

In their press release following the court filing, Dean Foods said that they were in serious talks about potentially selling their assets to the organization Dairy Farmers of America, DFA Inc. DFA is a marketing cooperative representing its owners, thousands of dairy farmers throughout America. In the case of the two parties coming to an agreement about the sale, the deal would still be subject to any competing bids for the business put forward during the length of the court proceedings.

To be able to keep operations going during this potentially drawn-out process, Dean Foods has also secured financing through a DIP financing package. DIP stands for debtor-in-possession and is a typical form of debt extended to companies that have filed for Chapter 11 bankruptcy. This debt is often placed at the highest level of seniority, making it senior to any pre-existing debt in the capital structure. In addition to fund continuing operations, Dean Foods will use the cash to fund to take care of unfunded obligations such as employee pensions and other benefits.

Structural change in the milk industry:

As mentioned above, the bankruptcy of Dean Foods shines a bright light on the changing dynamics in the milk and dairy industries. The following paragraph will present a few significant reasons as to why the demand for milk in general is decreasing and why a company like Dean Foods experienced such a steep decline in revenue.

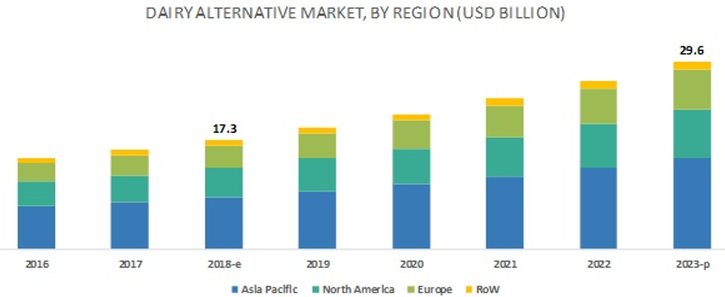

The market for non-dairy milks have experienced an incredible growth in the past few years, with the Swedish company Oatly (producing and selling oat milk) being one of the frontrunners. If you go back a few years, (less than ten is sufficient) the selection of non-dairy milks widely available in grocery stores or in coffee shops was very limited. The main product was soy milk. Fast-forward to present time, and pretty much every reasonably well-sorted grocery and almost every modern coffee shop offers a wide variety including milk from almond, soy, rice, coconut, and oats. In 2018, the market for dairy alternatives was approximately $17.3 billion, and is supposed to grow to close to $30 billion in 2023.

In 1996, the average American drank approximately 90 liters of milk, in 2018 that number had dropped to 54 liters. This is a decline of about 40% and the two major reasons for this are ethical, environmental and nutritional. Other contributing factors are changing consumer tastes and the recent rapid growth of competing alternatives such as non-dairy milks derived from oats, almond, and others.

Naturally, this change in market dynamic is affecting long-standing companies that produce milk and forces them to make radical changes or face financial pressure and potentially go bankrupt.

The US firm Dean Foods is the country’s largest dairy company. It has been around since 1925 and employs some 16,000 people, owns 58 brands and over 60 processing plants nationwide. With total revenues of $7.8 billion, and normal milk constituting 67% of the company’s sales in 2018, it was of course heavily affected by the shift in demand. This led the company to eventually file for Chapter 11 restructuring in early November 2019. Dean Foods had posted losses in five consecutive quarters leading up to the filing, and analysts’ estimates of the firm’s outlook were very dull.

Where to from here?

In their press release following the court filing, Dean Foods said that they were in serious talks about potentially selling their assets to the organization Dairy Farmers of America, DFA Inc. DFA is a marketing cooperative representing its owners, thousands of dairy farmers throughout America. In the case of the two parties coming to an agreement about the sale, the deal would still be subject to any competing bids for the business put forward during the length of the court proceedings.

To be able to keep operations going during this potentially drawn-out process, Dean Foods has also secured financing through a DIP financing package. DIP stands for debtor-in-possession and is a typical form of debt extended to companies that have filed for Chapter 11 bankruptcy. This debt is often placed at the highest level of seniority, making it senior to any pre-existing debt in the capital structure. In addition to fund continuing operations, Dean Foods will use the cash to fund to take care of unfunded obligations such as employee pensions and other benefits.

Structural change in the milk industry:

As mentioned above, the bankruptcy of Dean Foods shines a bright light on the changing dynamics in the milk and dairy industries. The following paragraph will present a few significant reasons as to why the demand for milk in general is decreasing and why a company like Dean Foods experienced such a steep decline in revenue.

The market for non-dairy milks have experienced an incredible growth in the past few years, with the Swedish company Oatly (producing and selling oat milk) being one of the frontrunners. If you go back a few years, (less than ten is sufficient) the selection of non-dairy milks widely available in grocery stores or in coffee shops was very limited. The main product was soy milk. Fast-forward to present time, and pretty much every reasonably well-sorted grocery and almost every modern coffee shop offers a wide variety including milk from almond, soy, rice, coconut, and oats. In 2018, the market for dairy alternatives was approximately $17.3 billion, and is supposed to grow to close to $30 billion in 2023.

Source: Marketsandmarkets (2019)

Another reason for the deterioration in revenues and profits for Dean Foods is that more and more competition is coming from private-label products, produced by retail chains and grocery stores themselves. Low prices on milk is a common way for stores to attract customers into their stores to profit of ancillary purchases, and thus it is beneficial for the stores to have their own label of milk where they have a higher flexibility on pricing. As a natural consequence, big brand milk producers get pushed out.

Finally, the general demand for milk in America is declining following growing ethical and nutritional concerns. Historically, milk has had a good reputation as a nutritious drink, especially for kids, that builds strong bones through its calcium content, among other benefits. These benefits have been put in question by recent research that instead points to milk raising risk of certain forms of cancer and heart disease through raising cholesterol levels. Furthermore, the topic of animal cruelty in conjunction with dairy production has also grown to be a significant deterrent of consuming milk and related products. The rise of the vegan diet has certainly benefitted from the increased availability of non-dairy substitutes.

Environmental concerns is the final reason worth mentioning. Animal agriculture, that is production of meat and dairy, is responsible for 60% of agriculture’s greenhouse gas emissions while only constituting 18% of total calories and 37% of protein consumed by humans.

These reasons together have managed to bring down one of the largest food companies in the US, and similar challenges are imposed on other food companies as well. The question is most likely when the next company goes belly-up, rather than if it will happen.

Finally, the general demand for milk in America is declining following growing ethical and nutritional concerns. Historically, milk has had a good reputation as a nutritious drink, especially for kids, that builds strong bones through its calcium content, among other benefits. These benefits have been put in question by recent research that instead points to milk raising risk of certain forms of cancer and heart disease through raising cholesterol levels. Furthermore, the topic of animal cruelty in conjunction with dairy production has also grown to be a significant deterrent of consuming milk and related products. The rise of the vegan diet has certainly benefitted from the increased availability of non-dairy substitutes.

Environmental concerns is the final reason worth mentioning. Animal agriculture, that is production of meat and dairy, is responsible for 60% of agriculture’s greenhouse gas emissions while only constituting 18% of total calories and 37% of protein consumed by humans.

These reasons together have managed to bring down one of the largest food companies in the US, and similar challenges are imposed on other food companies as well. The question is most likely when the next company goes belly-up, rather than if it will happen.

Tobias Mattsson - 29/12/2019