Founded in 1915, Naspers has evolved from a local into a multinational newspaper publisher, with a primary interest in e-commerce platforms and a private equity-style approach to investing. In the early 2000s, Naspers took on a stake in a Chinese start-up, Tencent, which then became a top player in the Chinese online services and tech markets. Naspers stake in Tencent is now considered one among the most successful venture investments of all time.

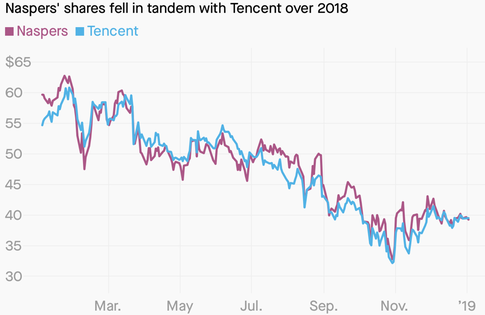

Currently, Naspers accounts for the 25% of the 150 largest stocks on the Johannesburg Stock Exchange (JSE). Namely, if it were in the US, Naspers would be listed among the twenty-five biggest companies of the Nasdaq. However, this is now a paradox for Naspers: since Naspers 31% share in Tencent amounts to approximately $134 billion, whereas Naspers itself is valued at $99 billion, its stake in Tencent is worth about $30 billion more than the whole firm’s total value. Despite the fact that there are roughly forty-two media and internet businesses in more than one hundred twenty countries owned by Naspers or where Naspers has a stake, the aforementioned discount stems from the fact that most remaining ventures held by Naspers do not generate significant cash flows. This has led Naspers’ shareholders to look for a way to release the “Tencent holding” and to narrow this 26% discount.

Currently, Naspers accounts for the 25% of the 150 largest stocks on the Johannesburg Stock Exchange (JSE). Namely, if it were in the US, Naspers would be listed among the twenty-five biggest companies of the Nasdaq. However, this is now a paradox for Naspers: since Naspers 31% share in Tencent amounts to approximately $134 billion, whereas Naspers itself is valued at $99 billion, its stake in Tencent is worth about $30 billion more than the whole firm’s total value. Despite the fact that there are roughly forty-two media and internet businesses in more than one hundred twenty countries owned by Naspers or where Naspers has a stake, the aforementioned discount stems from the fact that most remaining ventures held by Naspers do not generate significant cash flows. This has led Naspers’ shareholders to look for a way to release the “Tencent holding” and to narrow this 26% discount.

There is another issue that Naspers is facing: the company has become too big for the JSE, a quarter of which is indeed represented by the company. This size requires capital from foreign investors, some of whom is not keen to have exposure on South Africa’s currency and political risk. Moreover, on the domestic side, Naspers claimed that institutional investors have been forced to cut down their holdings in the company because its weighting is now around 25% of the JSE, in contrast with the single-stock limit exposure of many local investors.

In response to the two issues above, on March 25, Naspers announced its intention to transfer later this year its stake in Tencent, combined with some other rising holdings, to a new company. The “NewCo” will be a global consumer tech group, listed on Euronext Amsterdam and with a secondary listing on the Johannesburg Stock Exchange. This newly created entity would be the largest tech company by asset value in Europe. Immediately after the announcement, Naspers’ shares slightly went up by 0.5%, while Tencent’s ones fell down by 2.5%. The portion of Tencent’s stock owned by Naspers will be blocked even after the deal, since Naspers announced that it will retain 75% of the “Newco”.

Effectively, Naspers is asking markets for some trust in its ability to find the “next Tencent” with the resources coming from the sale of the “actual” one. However, in the current market situation, other investors are trying to do the same. Brian Bandsma, an emerging markets portfolio manager at Vontobel Quality Growth claimed: “There’s so much money in the private-equity space chasing tech all over the world, creating value becomes questionable”.

Most investors who strongly support Tencent are likely to prefer its shares to a stake in the new, complex structure, which implied a sort of lock-up agreement without a wind-up date. Hence, they are unlikely to buy these assets at a premium because they do not completely trust Naspers’ management. In addition, Naspers would ultimately remain the largest South African company listed on the Johannesburg Stock Exchange, even after this long list of spin-offs.

Simone Farina

In response to the two issues above, on March 25, Naspers announced its intention to transfer later this year its stake in Tencent, combined with some other rising holdings, to a new company. The “NewCo” will be a global consumer tech group, listed on Euronext Amsterdam and with a secondary listing on the Johannesburg Stock Exchange. This newly created entity would be the largest tech company by asset value in Europe. Immediately after the announcement, Naspers’ shares slightly went up by 0.5%, while Tencent’s ones fell down by 2.5%. The portion of Tencent’s stock owned by Naspers will be blocked even after the deal, since Naspers announced that it will retain 75% of the “Newco”.

Effectively, Naspers is asking markets for some trust in its ability to find the “next Tencent” with the resources coming from the sale of the “actual” one. However, in the current market situation, other investors are trying to do the same. Brian Bandsma, an emerging markets portfolio manager at Vontobel Quality Growth claimed: “There’s so much money in the private-equity space chasing tech all over the world, creating value becomes questionable”.

Most investors who strongly support Tencent are likely to prefer its shares to a stake in the new, complex structure, which implied a sort of lock-up agreement without a wind-up date. Hence, they are unlikely to buy these assets at a premium because they do not completely trust Naspers’ management. In addition, Naspers would ultimately remain the largest South African company listed on the Johannesburg Stock Exchange, even after this long list of spin-offs.

Simone Farina