Tod's Group, a renowned name in luxury fashion, is making headlines with its plan to leave the Milan Stock Exchange, thanks to a buyout led by L Catterton. This is the second (but likely successful) delisting attempt for Tod’s, and it is sparking discussions about LVMH's deeper intentions. Could this be a turning point in Tod’s ownership structure, steering the group towards LVMH’s expansive umbrella?

Overview

Recently Tod’s and its owner Diego Della Valle made headlines as the company is on the brink of being delisted from Piazza Affari, the Milan stock exchange. L Catterton, a private equity group backed by LVMH, is poised to acquire a 36% stake in the company, while the Della Valle family will retain the remaining 54%.

Tod’s group is a renowned Italian luxury fashion house specializing in footwear and apparel, under brands such as Tod’s, Roger Vivier, Hogan, and Fay. Although its roots trace back to the 1920s, it gained global recognition in the 1980s and 1990s, when prominent businessmen and European Royals began wearing its products, particularly shoes and bags.

The company has launched on the market proper fashion icons over the years, such as the Di Bag (named after one of its most notable wearers, Lady Diana), the Gommino shoe (a staple in Gianni Agnelli’s wardrobe), the Tab Sneaker, and the T Timeless Bag. The company went public in November 2000 with a valuation of 1.2 billion and in the recent years Tod’s has hinted several times at delisting due to Della Valle's belief that the company is undervalued. In the end, this move never materialized due to various complications, but the current scenario presents a potential opportunity. Maybe, it will finally be the right time.

L Catterton is an American multinational private equity group, which boasts a rich portfolio of companies including, among others, Jio Platforms, Peloton, Pinarello, and most notably, Birkenstock (which recently underwent an IPO). Established in 1989 as Catterton-Simons Partners in Connecticut, it merged with LVMH and Financière Agache (the holding company of the Arnault family) in 2016 to form L Catterton, aiming to combine private equity operations across North and South America with those of LVMH in Europe and Asia. LVMH and Groupe Arnault collectively hold 40% of L. Catterton. The privileged relationship between the two entities has brought Italian and international press to suggest that L Catterton is heavily influenced (if not entirely controlled) by LVMH in its decisions. This speculation is fueled by LVMH's 10% stake in Tod's and the amicable relationship between Arnault and Della Valle, who sought Arnault's assistance in the OPA (which he granted, indirectly, through L Catterton). It’s unclear if and how Arnault’s investments in Tod’s influenced L Catterton’s decisions. In response, L Catterton issued a statement asserting its complete independence from the French conglomerate.

Recently Tod’s and its owner Diego Della Valle made headlines as the company is on the brink of being delisted from Piazza Affari, the Milan stock exchange. L Catterton, a private equity group backed by LVMH, is poised to acquire a 36% stake in the company, while the Della Valle family will retain the remaining 54%.

Tod’s group is a renowned Italian luxury fashion house specializing in footwear and apparel, under brands such as Tod’s, Roger Vivier, Hogan, and Fay. Although its roots trace back to the 1920s, it gained global recognition in the 1980s and 1990s, when prominent businessmen and European Royals began wearing its products, particularly shoes and bags.

The company has launched on the market proper fashion icons over the years, such as the Di Bag (named after one of its most notable wearers, Lady Diana), the Gommino shoe (a staple in Gianni Agnelli’s wardrobe), the Tab Sneaker, and the T Timeless Bag. The company went public in November 2000 with a valuation of 1.2 billion and in the recent years Tod’s has hinted several times at delisting due to Della Valle's belief that the company is undervalued. In the end, this move never materialized due to various complications, but the current scenario presents a potential opportunity. Maybe, it will finally be the right time.

L Catterton is an American multinational private equity group, which boasts a rich portfolio of companies including, among others, Jio Platforms, Peloton, Pinarello, and most notably, Birkenstock (which recently underwent an IPO). Established in 1989 as Catterton-Simons Partners in Connecticut, it merged with LVMH and Financière Agache (the holding company of the Arnault family) in 2016 to form L Catterton, aiming to combine private equity operations across North and South America with those of LVMH in Europe and Asia. LVMH and Groupe Arnault collectively hold 40% of L. Catterton. The privileged relationship between the two entities has brought Italian and international press to suggest that L Catterton is heavily influenced (if not entirely controlled) by LVMH in its decisions. This speculation is fueled by LVMH's 10% stake in Tod's and the amicable relationship between Arnault and Della Valle, who sought Arnault's assistance in the OPA (which he granted, indirectly, through L Catterton). It’s unclear if and how Arnault’s investments in Tod’s influenced L Catterton’s decisions. In response, L Catterton issued a statement asserting its complete independence from the French conglomerate.

LVMH Previous Moves

During Spring 2021, LVMH increased its stake in Tod’s from 3.2% to 10%, by acquiring the shares from Diego Della Valle, the founder of Tod’s. This step was an important way to reinforce the long-standing relationship between the two families (Arnault and Della Valle), with Diego Della Valle being part of LVMH’s board since 2002. The acquisition proceeded with a 10% discount to Tod’s share price at 33.10 euros and Della Valle had a remaining 63.64% of Tod’s after the acquisition. At the time, Tod’s sales were tumbling as they struggled to grasp the impacts of COVID-19 lockdowns and their new strategy, whereas LVMH had seen increasing sales; hence, this was an opportunity for the French luxury group to help out the struggling Tod’s.

During Spring 2021, LVMH increased its stake in Tod’s from 3.2% to 10%, by acquiring the shares from Diego Della Valle, the founder of Tod’s. This step was an important way to reinforce the long-standing relationship between the two families (Arnault and Della Valle), with Diego Della Valle being part of LVMH’s board since 2002. The acquisition proceeded with a 10% discount to Tod’s share price at 33.10 euros and Della Valle had a remaining 63.64% of Tod’s after the acquisition. At the time, Tod’s sales were tumbling as they struggled to grasp the impacts of COVID-19 lockdowns and their new strategy, whereas LVMH had seen increasing sales; hence, this was an opportunity for the French luxury group to help out the struggling Tod’s.

Tod’s Previous Delisting Attempt

Already back in 2021, markets observing the struggling Italian luxury company raised speculations about a possible takeover, even by LVMH, or the idea of going private, which has become prevalent in the last years. By the end of 2022, there were plans to delist Tod’s to help the low-growth company revamp its brands’ waning popularity; however, the Della Valle family quickly abandoned the idea as the market viewed the operation as hostile. The founder and his brother did not reach the 90% benchmark support for the acquisition of the remaining part of the company or the merger with DeVa finance, Della Valle family’s holding company. One of the main reasons behind the failure was the low valuation of the company, which they offered to buy at 40 euros per share. Going to February 2024, Tod’s plans to delist again, but this time with the help of LVMH’s-backed private equity firm L. Catterton, which plans to acquire 36% of the company and Della Valle would remain with 54% ownership.

Already back in 2021, markets observing the struggling Italian luxury company raised speculations about a possible takeover, even by LVMH, or the idea of going private, which has become prevalent in the last years. By the end of 2022, there were plans to delist Tod’s to help the low-growth company revamp its brands’ waning popularity; however, the Della Valle family quickly abandoned the idea as the market viewed the operation as hostile. The founder and his brother did not reach the 90% benchmark support for the acquisition of the remaining part of the company or the merger with DeVa finance, Della Valle family’s holding company. One of the main reasons behind the failure was the low valuation of the company, which they offered to buy at 40 euros per share. Going to February 2024, Tod’s plans to delist again, but this time with the help of LVMH’s-backed private equity firm L. Catterton, which plans to acquire 36% of the company and Della Valle would remain with 54% ownership.

Strategic rationale of the deal

The official rationale behind the move towards delisting the company centers on facilitating operational agility and decision-making capabilities. Diego Della Valle also underscored the strategic importance of the deal for Tod’s in positioning itself for future challenges. However, L Catterton's connection to LVMH hints at deeper implications behind the deal. With deep-rooted personal connections spanning over two decades and collaborative engagements such as Della Valle's presence on LVMH’s board, the partnership between Tod’s and LVMH is anchored in mutual respect and strategic alignment. However, speculation looms over whether this partnership serves as a precursor to a potential acquisition by LVMH.

The deal, in fact, appears to straddle the line between a standard private equity investment and a strategic maneuver to pave the way for an eventual acquisition by LVMH. While the structured investment proposed by L Catterton appears to be aimed at driving Tod’s growth and operational efficiency, which is typical of private equity strategies, the collaboration may therefore serve multiple strategic purposes, including potentially passing Tod’s into the fold of LVMH’s luxury empire. The speculation is further fueled by LVMH’s recognition as an M&A machine in the luxury sector. With a reputation for shrewd deal-making and maximizing value for its shareholders, it's not unreasonable to question whether LVMH sees Tod’s as a lucrative opportunity to expand its luxury empire at a discounted rate.

Diego Della Valle Responding to all these speculations, Diego Della Valle stated he remains resolute in his commitment to retaining control over the company, emphasizing that selling directly to LVMH would have been a feasible option if that were the desired outcome.

Adding to the skepticism surrounding the deal, Tabor, a hedge fund holding a 1.1% stake in Tod’s ordinary shares, has raised concerns about the terms and pricing of the public tender offer. Tabor criticized the correctness of the terms and the offer price of 43 euros, suggesting that LVMH is gaining preferential, discounted access to Tod’s assets. This criticism aligns with the broader observation that LVMH may be positioning itself to acquire Tod’s at a lower cost than its true value, leveraging its existing relationship and influence within the luxury sector.

The official rationale behind the move towards delisting the company centers on facilitating operational agility and decision-making capabilities. Diego Della Valle also underscored the strategic importance of the deal for Tod’s in positioning itself for future challenges. However, L Catterton's connection to LVMH hints at deeper implications behind the deal. With deep-rooted personal connections spanning over two decades and collaborative engagements such as Della Valle's presence on LVMH’s board, the partnership between Tod’s and LVMH is anchored in mutual respect and strategic alignment. However, speculation looms over whether this partnership serves as a precursor to a potential acquisition by LVMH.

The deal, in fact, appears to straddle the line between a standard private equity investment and a strategic maneuver to pave the way for an eventual acquisition by LVMH. While the structured investment proposed by L Catterton appears to be aimed at driving Tod’s growth and operational efficiency, which is typical of private equity strategies, the collaboration may therefore serve multiple strategic purposes, including potentially passing Tod’s into the fold of LVMH’s luxury empire. The speculation is further fueled by LVMH’s recognition as an M&A machine in the luxury sector. With a reputation for shrewd deal-making and maximizing value for its shareholders, it's not unreasonable to question whether LVMH sees Tod’s as a lucrative opportunity to expand its luxury empire at a discounted rate.

Diego Della Valle Responding to all these speculations, Diego Della Valle stated he remains resolute in his commitment to retaining control over the company, emphasizing that selling directly to LVMH would have been a feasible option if that were the desired outcome.

Adding to the skepticism surrounding the deal, Tabor, a hedge fund holding a 1.1% stake in Tod’s ordinary shares, has raised concerns about the terms and pricing of the public tender offer. Tabor criticized the correctness of the terms and the offer price of 43 euros, suggesting that LVMH is gaining preferential, discounted access to Tod’s assets. This criticism aligns with the broader observation that LVMH may be positioning itself to acquire Tod’s at a lower cost than its true value, leveraging its existing relationship and influence within the luxury sector.

Deep dive on price considerations

To gain a better understanding of the situation, it's essential to revisit some key academic concepts. The acquisition premium is primarily composed of four components: undervaluation of the business, internal improvements, synergies, and private benefits of control.

The current tender offer involves the acquisition of a minority stake, meaning that no substantial control premium is paid to the target of the bid. In fact, based on the shareholder agreements, BidCo boasts strong protection mechanisms typical of a minority shareholder (co- sale, lock-up, provision for possible future IPO), while control will be retained by Della Valle. Consequently, L Catterton is facilitating the company's implementation of the turnaround program envisioned by the management in 2022, marking the first attempt at taking it private. L Catterton is therefore banking on operational improvements and possibly on the undervaluation of the company.

On the other hand, minorities could also be impacted if LVMH acquires Tod’s at a later date. In such a scenario, no synergies or private benefits of control would be shared with current shareholders. It is not surprising, therefore, that parties deny any plans in this regard. While the independence of L Catterton from LVMH and the shareholder agreements are compelling arguments, investors may still have reservations.

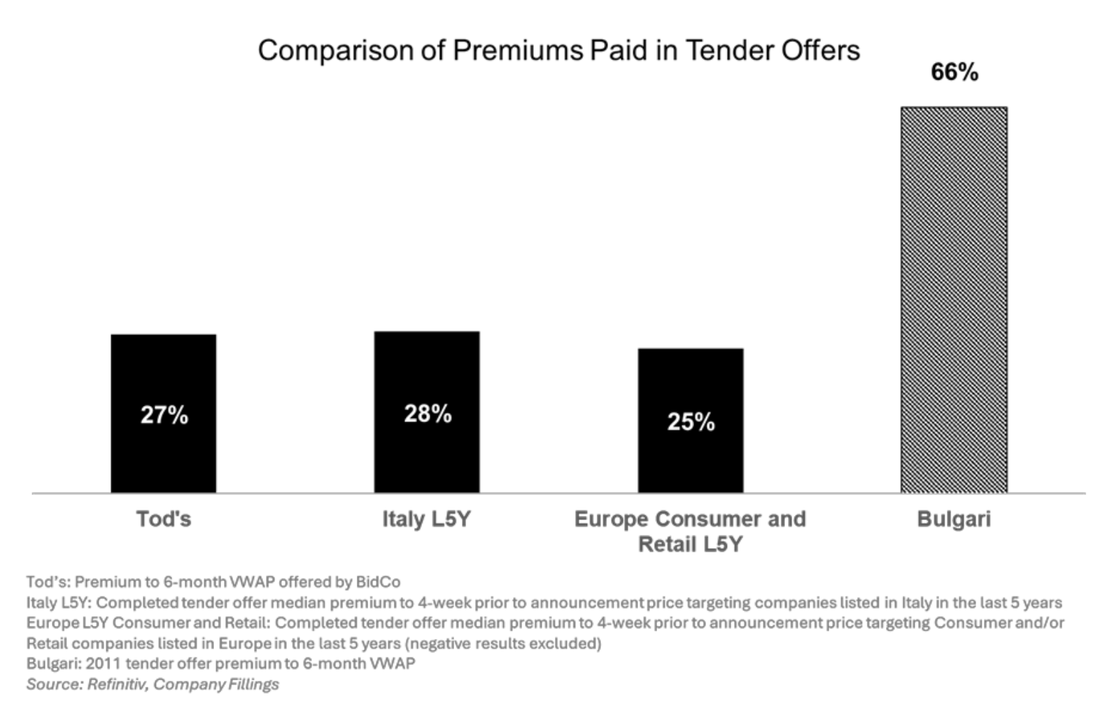

A more persuasive argument could be made by comparing past premiums paid in takeover offers with the 27.35% 6-month VWAP premium offered by L Catterton.

To gain a better understanding of the situation, it's essential to revisit some key academic concepts. The acquisition premium is primarily composed of four components: undervaluation of the business, internal improvements, synergies, and private benefits of control.

The current tender offer involves the acquisition of a minority stake, meaning that no substantial control premium is paid to the target of the bid. In fact, based on the shareholder agreements, BidCo boasts strong protection mechanisms typical of a minority shareholder (co- sale, lock-up, provision for possible future IPO), while control will be retained by Della Valle. Consequently, L Catterton is facilitating the company's implementation of the turnaround program envisioned by the management in 2022, marking the first attempt at taking it private. L Catterton is therefore banking on operational improvements and possibly on the undervaluation of the company.

On the other hand, minorities could also be impacted if LVMH acquires Tod’s at a later date. In such a scenario, no synergies or private benefits of control would be shared with current shareholders. It is not surprising, therefore, that parties deny any plans in this regard. While the independence of L Catterton from LVMH and the shareholder agreements are compelling arguments, investors may still have reservations.

A more persuasive argument could be made by comparing past premiums paid in takeover offers with the 27.35% 6-month VWAP premium offered by L Catterton.

The offer appears to align with tender offers targeting companies listed in Italy and Consumer & Retail companies listed on a European stock exchange over the last five years. Therefore, even if LVMH were to acquire a majority stake in Tod’s later on, the bidding price seems aligned with what a savvy investor might reasonably expect – private benefits of control and synergies are not factored in, but the offer is comparable to past transactions.

Investors who believe LVMH will acquire Tod’s might reference the 2011 merger with Bulgari, which offered minorities a higher premium. However, this deal should not serve as a benchmark for Tod’s shareholders due to significant structural differences (relative size, market positioning, deal structure, execution time), and the fact that the transaction occurred more than 10 years ago, making comparisons tenuous.

Tabor Asset Management highlighted the potential mispricing as the source of value in its letter, suggesting that minority shareholders might be adversely affected, raising questions about the fiduciary responsibility of the Board.

The argument raised by Tabor Asset Management is compelling and would make the analysis on premiums irrelevant. But it may be difficult to defend the point assuming a quasi-efficient market – investors are sure about the current price, while the valuation exercise remains open to discussion.

To conclude, since the IPO at €40 per share, Tod’s has underperformed relevant peers and the overall market, and –according to the management– the public eye has limited the company’s strategic abilities. In this context, subscription numbers (now close to 40% of the offer) suggest that the bid has been made at a fair price and offers a compelling exit for minorities. Moreover, a possible future investment from LVMH is uncertain not only in nature but also in timing – even if accounting for a possible higher premium due to shared control premium, a sure deal is preferable to a gamble.

Investors who believe LVMH will acquire Tod’s might reference the 2011 merger with Bulgari, which offered minorities a higher premium. However, this deal should not serve as a benchmark for Tod’s shareholders due to significant structural differences (relative size, market positioning, deal structure, execution time), and the fact that the transaction occurred more than 10 years ago, making comparisons tenuous.

Tabor Asset Management highlighted the potential mispricing as the source of value in its letter, suggesting that minority shareholders might be adversely affected, raising questions about the fiduciary responsibility of the Board.

The argument raised by Tabor Asset Management is compelling and would make the analysis on premiums irrelevant. But it may be difficult to defend the point assuming a quasi-efficient market – investors are sure about the current price, while the valuation exercise remains open to discussion.

To conclude, since the IPO at €40 per share, Tod’s has underperformed relevant peers and the overall market, and –according to the management– the public eye has limited the company’s strategic abilities. In this context, subscription numbers (now close to 40% of the offer) suggest that the bid has been made at a fair price and offers a compelling exit for minorities. Moreover, a possible future investment from LVMH is uncertain not only in nature but also in timing – even if accounting for a possible higher premium due to shared control premium, a sure deal is preferable to a gamble.

By Vittorio Granuzzo, Gauri Gupta, Lorenzo Pastorelli, Vasara Silininkaite

Sources

- Financial Times

- Tod’s

- Il Sole 24 Ore

- L Catterton

- Reuters

- Vogue Business

- La Conceria