In the cutthroat world of retail, financial decisions can make or break companies. But what happens when heavy leverage enters the picture? In this article, we dissect the impact of heavy leverage on a retail company's IPO and reveal the curious strategies of Private Equity giant, CVC Capital. Through a blend of Trading Comparable Analysis and financial statement scrutiny, we uncover the risks lurking from an investor's standpoint.

Company Overview:

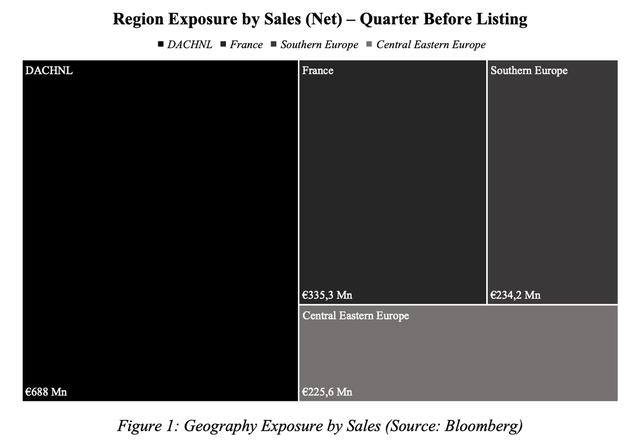

Douglas GmbH is a German-based multinational retail public company [XETR:DOU], operating in the beauty and cosmetic industry (FactSet industry ref. 3540 – Specialty stores). The chain has its roots in Hamburg, where Scottish soap manufacturer John Sharp Douglas, founded a soap factory in the city’s warehouse district in 1821. Currently, the company is one of the biggest market players in its sector, competing with major brands like Sephora and Ulta Beauty. Douglas GmbH operates mainly in EMEA and is geographically exposed - using sales as a proxy - as it follows:

Douglas GmbH is a German-based multinational retail public company [XETR:DOU], operating in the beauty and cosmetic industry (FactSet industry ref. 3540 – Specialty stores). The chain has its roots in Hamburg, where Scottish soap manufacturer John Sharp Douglas, founded a soap factory in the city’s warehouse district in 1821. Currently, the company is one of the biggest market players in its sector, competing with major brands like Sephora and Ulta Beauty. Douglas GmbH operates mainly in EMEA and is geographically exposed - using sales as a proxy - as it follows:

Strategy and Vertical Integration:

Douglas GmbH uses a multi-channel retail strategy, adapting to today’s customers’ needs, combining both physical and online stores, covering 22 omnichannel countries, where both types of stores are accessible to customers. The company’s supply chain is very integrated, with Douglas handling many processes from manufacturing to distribution. The firm currently has over 300,000 products, such as makeup, skincare, haircare items, perfumes and fragrances. Moreover, Douglas boasts one of Europe’s most successful loyalty schemes thanks to their beauty cards. Douglas inspires customers to live their own kind of beauty by offering an unparalleled assortment. The further development of the successful omnichannel positioning is at the heart of Douglas’ strategy, under which they are consistently expanding their Store experience and the strong e-commerce. The company has 55,000 SKUs from 750 brands (40+ exclusive brand partnerships) including 12,000 + SKUs on the marketplace. Sources products from all major national / international brands (400+ suppliers). Douglas’s best in class store portfolio is seen as a “Must-have” distribution platform for major brand suppliers. Regarding the contracts with suppliers the company is focused on long term selective distribution contracts (which run for up to 10 years); Annual international framework agreements with their top 16 suppliers and Annual local supply trading agreements. They have also negotiated Europe-wide framework trading agreements with several of their top suppliers. Douglas has a private labels business and sources their products from 50 different suppliers in Germany, France, Italy and Asia.

Seasonality & Working Capital Dynamics: Douglas’s most important sales period is the six-week period leading up to Christmas and over the New Year. According to the company other important sales periods are around Valentine’s Day, Easter and Mother’s Day. The uplift in sales around its most important trading periods is often followed by a period of price markdowns. Douglas incurs additional expenses in preparation for increased demand they typically expect leading up to, and around, the Christmas season and other peak selling periods and must carry a significant amount of inventory before such periods, also reflected in its liquidity (as deferred payments to suppliers are paid in cash in Q4 / Q1 of the financial year leading to cash outflows).

Financial Health:

In the first quarter of 2024, the company registered an 8.0% increase in adjusted net sales, with respect to Q1 2022/23, spiking from €1,440.6Mn to €1,555.5Mn. The delta is due to a 6.7% increase from sales in stores and a 10.7% increase from online sales. From Q1 2022/23 to Q1 2023/24, the income statement presented higher net operating expenses: the company itself justifies this due to higher wages (with higher bonus accruals), as well as marketing expenses and store expansions. As a result, the Q1 23/24 reported EBITDA was €318.4Mn, adjusted to €348.3Mn, while the adjusted EBITDA margin had an increase of 0.9%, with the latest value at 22.4%. The company also recorded a positive 10.6% net income delta, driven by a +12.6% change in adjusted EBITDA.

By looking at historical data from 2011 to 2024, the return on equity for the company fluctuated from 10.92 in 2011 to -17.03 the following year, it then remained steadily high at 39.29 and 24.24 in 2021 and 2022 respectively and ultimately falling to a -1.33 ROE for the past year. Moreover, Douglas displays financial difficulty in covering debt with operating cash flows. As of December 31st 2023, the company presented a great reduction in the leverage ratio, given by a decrease in total leverage and the increase in EBITDA as explained above. Since its acquisition by CVC in 2015, the business struggled to de-lever with underperforming and debt-financed acquisitions in Spain and Italy, increased competitive pressures in Germany (later solved) and management turnover, offset by growth in France & Eastern Europe and continued growth in their e- commerce platform. The group has negotiated a deferral of rental expenses to part mitigate falling store sales. Acceleration of growth within the e- commerce platform has a created “good company” within a “bad company” dynamic as revenues from e-commerce becomes a bigger proportion of the business and a key driver for future value.

The current ratio of the company is 1.07, below the usual range for a good ratio (between 1.5 and 3.0), meaning that the company presents liquidity problems, having difficulties to meet short-term obligations. This increases risk for the company and is unattractive to lenders and investors. To compare this with one of its competitors at present, Ulta Beauty has a current ratio of 1.71.

Takeover from Advent International and sale to CVC:

Background History: 2012 Advent International Takeover

In order to correctly perform and evaluate the effectiveness in the valuation of Douglas at the IPO, it is also important to analyze its changes in value over time starting from the takeover and the taking private of the company by Advent International in 2012. Advent International is one of the largest private equity firms in the world with currently $91Bn AUM, focusing on international buyouts, growth, and strategic restructuring.

Regarding Advent’s “relationship” with Douglas, the private equity firm decided to takeover Douglas in the end of 2012, with an offer of €1.5Bn at an offering price of €38 per share pledging approximately 79% of the stock, that was above the minimum threshold of 75% for the takeover to be successful. Moreover, this offer of €38 per share would represent a premium of 41.6% over the four- week volume weighted average price of Douglas shares of €26.83. Together with the shares tendered in the acceptance period totaling 79.84% and the 12.73% shareholding acquired from Lobelia Beteiligungs GmbH (the Kreke family), this makes up a total shareholding of 93.73%. In addition, Beauty Holding Three AG made share purchases outside the tender offer totaling a further 2.38% and has thus acquired 96.11% of all shares.

2015 - CVC Acquisition of Douglas

After a holding period of around 3 years by Advent International, their stake has then been sold to CVC Capital Partners Ltd in a deal valued €2.87Bn, where the transaction has been carried out via a holding company jointly-owned by CVC st 2015 for an EV of €2.87 billion (Implied valuation of EV / EBITDA of 9.2x) from Advent International. The founding Kreke family agreed to rollover their 15.7% equity stake into the existing transaction.

Rationale behind the 2024 IPO:

In March 2024, the Douglas Group started to prepare for its IPO, targeting an initial equity contribution of €1.1B. According to the deal, the two indirect shareholders (CVC Capital Partners and the Kreke family) would not sell their shares at the IPO. The rationale of the IPO lies in deleveraging the firm’s balance sheet and restructuring the debt position of the company. The deal also aimed at decreasing interest expenses to maximize financial flexibility and value creation. CVC’s managing partner Daniel Pindur stated that CVC would remain a major shareholder, as the PE firm sees “further growth potential” for Douglas, given also by positive market expectations towards the European premium beauty industry.

Citigroup Inc., Deutsche Bank AG, Goldman Sachs Group Inc., UniCredit SpA and UBS Group AG acted as bookrunners for the Douglas stock offering.

Our Valuation:

The aim of the IPO was to raise around €850Mn through the issuance of around 34Mn new common shares to outside investors. Meanwhile, existing investors inject €300Mn into the company, with the overall objective of raising in total €1.1Bn that will be used to reduce the current net debt to EBITDA of 4x to a more reasonable 2.7x.

Regarding the actual valuation, Douglas [XETR: DOU] was listed on the 21st of March 2024 with a price per share of €26, the lowest value on a proposed range of €26-€30 per share, reaching consequently a Market Cap of €2.8Bn with 107.7Mn shares outstanding. Furthermore, using the available data from FY2023, due to the absence of any financial report in FY2024, the Enterprise Value at listing is approximated to be €6.25Bn, therefore confirming the intention of CVC in valuing the company in a range of €5.5-€6.5Bn. With regards to the multiples, taking into account an expected EBITDA FY2024 of €800Mn, the company has been listed with a 7.8x EV/EBITDA FY2024 expected. To determine the appropriateness of this valuation and the results of the IPO, we have conducted a trading comparable analysis based off of public companies with similar characteristics.

Trading Comparable Analysis:

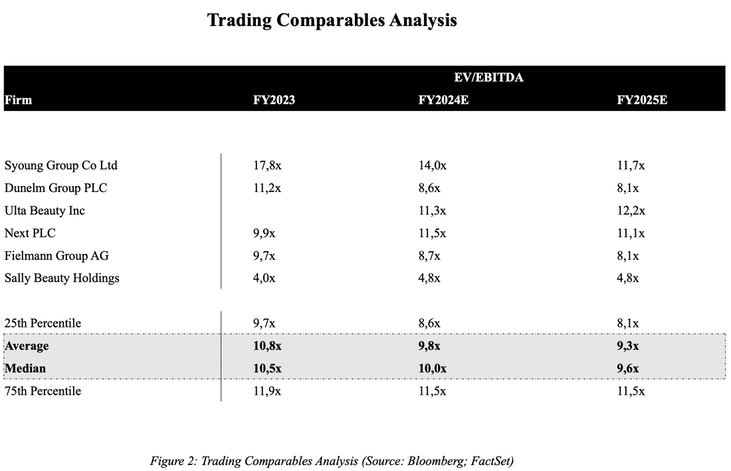

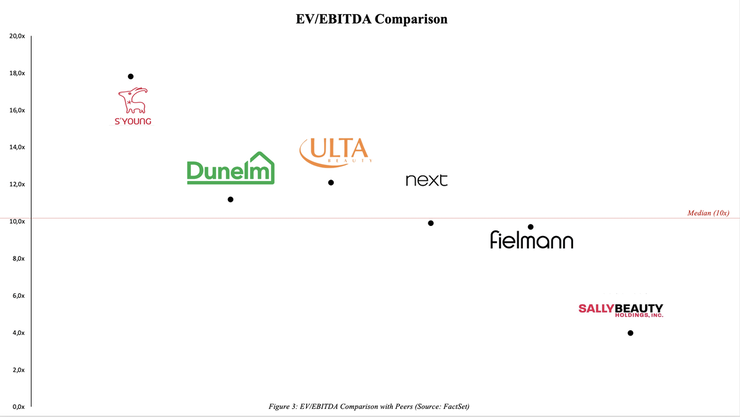

To appropriately determine the value of Douglas in the IPO, we have selected 6 different companies in the specialty retail sector ranging from the industry of perfumery and cosmetics to similar industries, due to the lack of listed companies similar to Douglas. Moreover, the public companies were chosen with a similar Operating Margin to Douglas’s one. More specifically, these companies are: Ulta Beauty Inc [NASDAQ: ULTA], Next PLC [LON: NXT], Fielmann Group AG [ETR: FIE], Syoung Group Co Ltd [SHE: 300740], Dunelm Group PLC [LON: DNLM], Sally Beauty Holdings [NYSE: SBH]. Other competitors like Sephora (owned by LVMH) and Marionnaud (owned by Hutchison Whampoa) are private / part of larger conglomerates hence are difficult to value.

Douglas GmbH uses a multi-channel retail strategy, adapting to today’s customers’ needs, combining both physical and online stores, covering 22 omnichannel countries, where both types of stores are accessible to customers. The company’s supply chain is very integrated, with Douglas handling many processes from manufacturing to distribution. The firm currently has over 300,000 products, such as makeup, skincare, haircare items, perfumes and fragrances. Moreover, Douglas boasts one of Europe’s most successful loyalty schemes thanks to their beauty cards. Douglas inspires customers to live their own kind of beauty by offering an unparalleled assortment. The further development of the successful omnichannel positioning is at the heart of Douglas’ strategy, under which they are consistently expanding their Store experience and the strong e-commerce. The company has 55,000 SKUs from 750 brands (40+ exclusive brand partnerships) including 12,000 + SKUs on the marketplace. Sources products from all major national / international brands (400+ suppliers). Douglas’s best in class store portfolio is seen as a “Must-have” distribution platform for major brand suppliers. Regarding the contracts with suppliers the company is focused on long term selective distribution contracts (which run for up to 10 years); Annual international framework agreements with their top 16 suppliers and Annual local supply trading agreements. They have also negotiated Europe-wide framework trading agreements with several of their top suppliers. Douglas has a private labels business and sources their products from 50 different suppliers in Germany, France, Italy and Asia.

Seasonality & Working Capital Dynamics: Douglas’s most important sales period is the six-week period leading up to Christmas and over the New Year. According to the company other important sales periods are around Valentine’s Day, Easter and Mother’s Day. The uplift in sales around its most important trading periods is often followed by a period of price markdowns. Douglas incurs additional expenses in preparation for increased demand they typically expect leading up to, and around, the Christmas season and other peak selling periods and must carry a significant amount of inventory before such periods, also reflected in its liquidity (as deferred payments to suppliers are paid in cash in Q4 / Q1 of the financial year leading to cash outflows).

Financial Health:

In the first quarter of 2024, the company registered an 8.0% increase in adjusted net sales, with respect to Q1 2022/23, spiking from €1,440.6Mn to €1,555.5Mn. The delta is due to a 6.7% increase from sales in stores and a 10.7% increase from online sales. From Q1 2022/23 to Q1 2023/24, the income statement presented higher net operating expenses: the company itself justifies this due to higher wages (with higher bonus accruals), as well as marketing expenses and store expansions. As a result, the Q1 23/24 reported EBITDA was €318.4Mn, adjusted to €348.3Mn, while the adjusted EBITDA margin had an increase of 0.9%, with the latest value at 22.4%. The company also recorded a positive 10.6% net income delta, driven by a +12.6% change in adjusted EBITDA.

By looking at historical data from 2011 to 2024, the return on equity for the company fluctuated from 10.92 in 2011 to -17.03 the following year, it then remained steadily high at 39.29 and 24.24 in 2021 and 2022 respectively and ultimately falling to a -1.33 ROE for the past year. Moreover, Douglas displays financial difficulty in covering debt with operating cash flows. As of December 31st 2023, the company presented a great reduction in the leverage ratio, given by a decrease in total leverage and the increase in EBITDA as explained above. Since its acquisition by CVC in 2015, the business struggled to de-lever with underperforming and debt-financed acquisitions in Spain and Italy, increased competitive pressures in Germany (later solved) and management turnover, offset by growth in France & Eastern Europe and continued growth in their e- commerce platform. The group has negotiated a deferral of rental expenses to part mitigate falling store sales. Acceleration of growth within the e- commerce platform has a created “good company” within a “bad company” dynamic as revenues from e-commerce becomes a bigger proportion of the business and a key driver for future value.

The current ratio of the company is 1.07, below the usual range for a good ratio (between 1.5 and 3.0), meaning that the company presents liquidity problems, having difficulties to meet short-term obligations. This increases risk for the company and is unattractive to lenders and investors. To compare this with one of its competitors at present, Ulta Beauty has a current ratio of 1.71.

Takeover from Advent International and sale to CVC:

Background History: 2012 Advent International Takeover

In order to correctly perform and evaluate the effectiveness in the valuation of Douglas at the IPO, it is also important to analyze its changes in value over time starting from the takeover and the taking private of the company by Advent International in 2012. Advent International is one of the largest private equity firms in the world with currently $91Bn AUM, focusing on international buyouts, growth, and strategic restructuring.

Regarding Advent’s “relationship” with Douglas, the private equity firm decided to takeover Douglas in the end of 2012, with an offer of €1.5Bn at an offering price of €38 per share pledging approximately 79% of the stock, that was above the minimum threshold of 75% for the takeover to be successful. Moreover, this offer of €38 per share would represent a premium of 41.6% over the four- week volume weighted average price of Douglas shares of €26.83. Together with the shares tendered in the acceptance period totaling 79.84% and the 12.73% shareholding acquired from Lobelia Beteiligungs GmbH (the Kreke family), this makes up a total shareholding of 93.73%. In addition, Beauty Holding Three AG made share purchases outside the tender offer totaling a further 2.38% and has thus acquired 96.11% of all shares.

2015 - CVC Acquisition of Douglas

After a holding period of around 3 years by Advent International, their stake has then been sold to CVC Capital Partners Ltd in a deal valued €2.87Bn, where the transaction has been carried out via a holding company jointly-owned by CVC st 2015 for an EV of €2.87 billion (Implied valuation of EV / EBITDA of 9.2x) from Advent International. The founding Kreke family agreed to rollover their 15.7% equity stake into the existing transaction.

Rationale behind the 2024 IPO:

In March 2024, the Douglas Group started to prepare for its IPO, targeting an initial equity contribution of €1.1B. According to the deal, the two indirect shareholders (CVC Capital Partners and the Kreke family) would not sell their shares at the IPO. The rationale of the IPO lies in deleveraging the firm’s balance sheet and restructuring the debt position of the company. The deal also aimed at decreasing interest expenses to maximize financial flexibility and value creation. CVC’s managing partner Daniel Pindur stated that CVC would remain a major shareholder, as the PE firm sees “further growth potential” for Douglas, given also by positive market expectations towards the European premium beauty industry.

Citigroup Inc., Deutsche Bank AG, Goldman Sachs Group Inc., UniCredit SpA and UBS Group AG acted as bookrunners for the Douglas stock offering.

Our Valuation:

The aim of the IPO was to raise around €850Mn through the issuance of around 34Mn new common shares to outside investors. Meanwhile, existing investors inject €300Mn into the company, with the overall objective of raising in total €1.1Bn that will be used to reduce the current net debt to EBITDA of 4x to a more reasonable 2.7x.

Regarding the actual valuation, Douglas [XETR: DOU] was listed on the 21st of March 2024 with a price per share of €26, the lowest value on a proposed range of €26-€30 per share, reaching consequently a Market Cap of €2.8Bn with 107.7Mn shares outstanding. Furthermore, using the available data from FY2023, due to the absence of any financial report in FY2024, the Enterprise Value at listing is approximated to be €6.25Bn, therefore confirming the intention of CVC in valuing the company in a range of €5.5-€6.5Bn. With regards to the multiples, taking into account an expected EBITDA FY2024 of €800Mn, the company has been listed with a 7.8x EV/EBITDA FY2024 expected. To determine the appropriateness of this valuation and the results of the IPO, we have conducted a trading comparable analysis based off of public companies with similar characteristics.

Trading Comparable Analysis:

To appropriately determine the value of Douglas in the IPO, we have selected 6 different companies in the specialty retail sector ranging from the industry of perfumery and cosmetics to similar industries, due to the lack of listed companies similar to Douglas. Moreover, the public companies were chosen with a similar Operating Margin to Douglas’s one. More specifically, these companies are: Ulta Beauty Inc [NASDAQ: ULTA], Next PLC [LON: NXT], Fielmann Group AG [ETR: FIE], Syoung Group Co Ltd [SHE: 300740], Dunelm Group PLC [LON: DNLM], Sally Beauty Holdings [NYSE: SBH]. Other competitors like Sephora (owned by LVMH) and Marionnaud (owned by Hutchison Whampoa) are private / part of larger conglomerates hence are difficult to value.

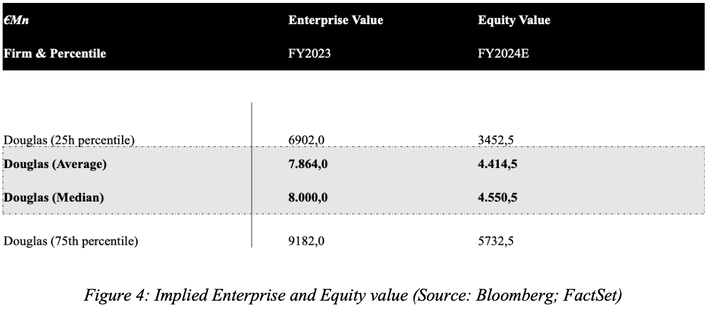

The analysis suggests that the average EV/EBITDA multiple for FY2024E is 9.8x, leading consequently to an implied Enterprise Value of €7.86Bn and an implied Equity Value of €4.41Bn. Similarly, the median EV/EBITDA multiple of FY2024E is 10.0x, causing then the implied Enterprise Value of Douglas to be €8bn and the implied Equity Value to be €4.55Bn. Therefore, given the previous results on the actual Enterprise Value and Equity Value of the IPO, it is evident that according to comparable analysis, the actual Enterprise value and Equity value resulted significantly lower than the implied one, with the actual EV/EBITDA also being around 2 round multiples below than the implied one. Therefore, we can say that the actual value of the firm was significantly lower than that suggested from the analysis, and the question is: Why is this the case?

Firstly, it is essential to consider that a reason which partially explains the lower actual valuation compared to the implied one, is the IPO discount. More specifically, IPOs comprise of a discount on the Market Cap of the firm reflected by a lower price, which in this case has reached the lowest level on the price range €26-€30, to attract a larger pool of investors and ensure that all the new issued shares are sold. Secondly, another reason which may justify the lower actual valuation compared to the one suggested through the comparative analysis, may be the high amount of debt that the company has compared to its peers, as the net debt to EBITDA of Douglas is estimated to be around 4.7x, while the average net debt to EBITDA ratio of the peers is 1.65x. Lastly, a third reason which may demonstrate the low valuation that Douglas received on its IPO is the slowdown that IPOs experienced in 2023, compared to previous years such as 2021, where the number of IPOs has been almost 5 times the one in 2023.

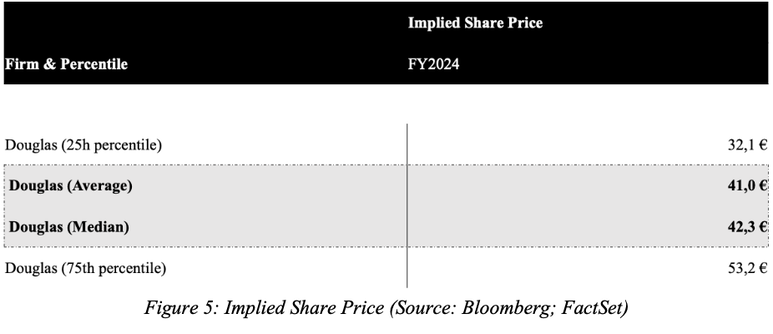

The effect of these possible explanations to a lower actual value of the firm compared to its implied value, may also be analysed more effectively by taking into consideration the implied share price given our valuation. For example, in the case of Douglas and using the implied equity value obtained in the previous analysis, the firm would be valued in a range between €32.10-€53.20. More specifically, using the median and average values, the price per share would be valued approximately €42.30 and €41 respectively. Therefore, if we consider the actual value per share of €26 at IPO and median implied share price of €42.30, it is possible to observe that the IPO discount in this case would be around 62.7%, which is an extremely high number compared to the average values. As a result, it is evident that at IPO Douglas has been undervalued and the reasons, among many others, may be the high amount of debt accumulated over time, or the difficulty in the development of an IPO of such deal size for a small-to- mid cap company that requires a large gross demand to ensure the sale of all stocks.

The effect of these possible explanations to a lower actual value of the firm compared to its implied value, may also be analysed more effectively by taking into consideration the implied share price given our valuation. For example, in the case of Douglas and using the implied equity value obtained in the previous analysis, the firm would be valued in a range between €32.10-€53.20. More specifically, using the median and average values, the price per share would be valued approximately €42.30 and €41 respectively. Therefore, if we consider the actual value per share of €26 at IPO and median implied share price of €42.30, it is possible to observe that the IPO discount in this case would be around 62.7%, which is an extremely high number compared to the average values. As a result, it is evident that at IPO Douglas has been undervalued and the reasons, among many others, may be the high amount of debt accumulated over time, or the difficulty in the development of an IPO of such deal size for a small-to- mid cap company that requires a large gross demand to ensure the sale of all stocks.

The “failed” IPO:

Even though Douglas has been valued at a large discount compared to the value proposed from the comparable analysis, and the price per share was set at the lowest level on the range proposed, the price continued to decrease causing Douglas’ IPO to be a “failure.” More specifically, the opening price per share on the market has been €25.50 and on the same day has decreased by 9%, reaching also €23.28 per share on early afternoon. Not only did the stock decrease on the same day, but on the 4th of April it reached the lowest price equivalent to €20.40 per share, representing a -25% change from the IPO price of €26, and currently stands at €20.40 per share. Consequently, Market Cap has now fallen to around €2.2Bn representing, a change of -17.20% compared to the initial Market Cap of €2.8Bn.

Nonetheless, even though rare, this sustained decrease in price from the IPO may have been caused because of “Douglas’ leverage, recent performance and high exposure to physical retail” as different investors stated. Given the previous results from the comparable valuation and the trend in share price from the IPO, we may possibly conclude that not always the usual practice for private equity firms to leverage acquired companies leads to profitable results. Indeed, private equity firms in many cases tend to highly leverage acquired companies to raise capital for investments and growth, while paying back the debt through the cash flow generated in subsequent years, and then exit at a certain multiple to generate high amounts of profit. However, the case of Douglas, may serve as an example to show that highly leveraged companies may produce a negative sentiment on the market and therefore lead to a decreasing price per share after the IPO.

Moreover, not only the high amount of leverage may directly disincentivize investment by the public due to its worsening financial position, but also indirectly by making it more difficult for a private equity firm such as CVC to exit the investment for a long period of time, causing the public to expect a large sale and excess supply in the near future. In this case CVC purchased its stake about 9 years ago and has held onto his asset for much more than its usual holding period of 3-5 years, and since an IPO makes an eventual exit much more achievable, then investors expect a greater supply of stock than demand soon, leading to a downward pressure on the price.

Even though Douglas has been valued at a large discount compared to the value proposed from the comparable analysis, and the price per share was set at the lowest level on the range proposed, the price continued to decrease causing Douglas’ IPO to be a “failure.” More specifically, the opening price per share on the market has been €25.50 and on the same day has decreased by 9%, reaching also €23.28 per share on early afternoon. Not only did the stock decrease on the same day, but on the 4th of April it reached the lowest price equivalent to €20.40 per share, representing a -25% change from the IPO price of €26, and currently stands at €20.40 per share. Consequently, Market Cap has now fallen to around €2.2Bn representing, a change of -17.20% compared to the initial Market Cap of €2.8Bn.

Nonetheless, even though rare, this sustained decrease in price from the IPO may have been caused because of “Douglas’ leverage, recent performance and high exposure to physical retail” as different investors stated. Given the previous results from the comparable valuation and the trend in share price from the IPO, we may possibly conclude that not always the usual practice for private equity firms to leverage acquired companies leads to profitable results. Indeed, private equity firms in many cases tend to highly leverage acquired companies to raise capital for investments and growth, while paying back the debt through the cash flow generated in subsequent years, and then exit at a certain multiple to generate high amounts of profit. However, the case of Douglas, may serve as an example to show that highly leveraged companies may produce a negative sentiment on the market and therefore lead to a decreasing price per share after the IPO.

Moreover, not only the high amount of leverage may directly disincentivize investment by the public due to its worsening financial position, but also indirectly by making it more difficult for a private equity firm such as CVC to exit the investment for a long period of time, causing the public to expect a large sale and excess supply in the near future. In this case CVC purchased its stake about 9 years ago and has held onto his asset for much more than its usual holding period of 3-5 years, and since an IPO makes an eventual exit much more achievable, then investors expect a greater supply of stock than demand soon, leading to a downward pressure on the price.

Looking to the future:

The year 2023 saw an increase in interest rates across major economies to tame inflation at highs not seen for many years, hence the "risk-off" attitude of investors towards IPOs, which led to subdued levels of activity in the European market. This year started with growing economic confidence and signs pointing to a potential reopening of markets, such as the stabilizing macroeconomic landscape, the growth in equity indices, and a buildup of demand from investors seeking opportunities to exit their investments through public offerings. Recent IPOs in the US, like Reddit [NASDAQ: RDDT] and Astera Labs [NASDAQGS:ALAB], performed well, especially amidst the excitement around artificial intelligence. Europe also witnessed notable successes, such as Galderma [GALD.SW]. However, not all new stocks fared as well, with the Douglas IPO being a notable example.

To better understand the market reaction to this public offering, different important factors must be considered. Smaller mid-cap firms like Douglas are facing greater challenges in going public, as investors tend to prefer larger, more attractive companies with consistent performance. Although some analysts are confident that the share price will eventually reflect the company’s stable margins and good growth rates, the beauty retailer entered the market after a prolonged period of challenges. Additionally, the company carries a significant amount of leverage, which may exceed the level that public investors tolerate.

Its net debt is roughly around 4.7x adjusted EBITDA. Douglas's debt increased significantly after its acquisition by CVC suggesting a potential anomaly in CVC's investment strategy. Douglas has showcased resilience and adaptability throughout its history, embarking on successful international expansion efforts since the 1980s and strategically navigating economic challenges. During the ownership phase by Advent International from 2012 to 2015, strategic acquisitions such as Nocibé in France and various perfumery chains in Spain and Italy played a pivotal role in diversifying its product portfolio and expanding its market reach. Moreover, Douglas capitalized on changing consumer behavior by embracing digital transformation early on with the launch of its online marketplace in 2000. The company’s continuous strategic realignments in the past, including store closures and a focus on online sales, underline its agility and commitment to optimization.

When looking at Douglas's future prospects, we see the options of either restructuring the company's operations and capital structure or focusing on recovery efforts to address its financial challenges. Recovery efforts could involve stabilizing operations and optimizing resources in order gradually reducing debt over time. For instance, considering Douglas's significant fixed assets (~ €3000Mn), we see an opportunity for the company to consider reducing its store presence and shifting more towards e-commerce (where it is already growing). We highlight that the primary challenge that Douglas needs to tackle pertains its ability to manage its leverage levels and implement a cohesive strategy for sustainable growth.

The year 2023 saw an increase in interest rates across major economies to tame inflation at highs not seen for many years, hence the "risk-off" attitude of investors towards IPOs, which led to subdued levels of activity in the European market. This year started with growing economic confidence and signs pointing to a potential reopening of markets, such as the stabilizing macroeconomic landscape, the growth in equity indices, and a buildup of demand from investors seeking opportunities to exit their investments through public offerings. Recent IPOs in the US, like Reddit [NASDAQ: RDDT] and Astera Labs [NASDAQGS:ALAB], performed well, especially amidst the excitement around artificial intelligence. Europe also witnessed notable successes, such as Galderma [GALD.SW]. However, not all new stocks fared as well, with the Douglas IPO being a notable example.

To better understand the market reaction to this public offering, different important factors must be considered. Smaller mid-cap firms like Douglas are facing greater challenges in going public, as investors tend to prefer larger, more attractive companies with consistent performance. Although some analysts are confident that the share price will eventually reflect the company’s stable margins and good growth rates, the beauty retailer entered the market after a prolonged period of challenges. Additionally, the company carries a significant amount of leverage, which may exceed the level that public investors tolerate.

Its net debt is roughly around 4.7x adjusted EBITDA. Douglas's debt increased significantly after its acquisition by CVC suggesting a potential anomaly in CVC's investment strategy. Douglas has showcased resilience and adaptability throughout its history, embarking on successful international expansion efforts since the 1980s and strategically navigating economic challenges. During the ownership phase by Advent International from 2012 to 2015, strategic acquisitions such as Nocibé in France and various perfumery chains in Spain and Italy played a pivotal role in diversifying its product portfolio and expanding its market reach. Moreover, Douglas capitalized on changing consumer behavior by embracing digital transformation early on with the launch of its online marketplace in 2000. The company’s continuous strategic realignments in the past, including store closures and a focus on online sales, underline its agility and commitment to optimization.

When looking at Douglas's future prospects, we see the options of either restructuring the company's operations and capital structure or focusing on recovery efforts to address its financial challenges. Recovery efforts could involve stabilizing operations and optimizing resources in order gradually reducing debt over time. For instance, considering Douglas's significant fixed assets (~ €3000Mn), we see an opportunity for the company to consider reducing its store presence and shifting more towards e-commerce (where it is already growing). We highlight that the primary challenge that Douglas needs to tackle pertains its ability to manage its leverage levels and implement a cohesive strategy for sustainable growth.

By: Alessandro Cera, Matilde Chiavenato, Federica Guirguis

Sources:

- Bloomberg Terminal

- FactSet

- Refinitiv - LSEG Data & Analytics

- Moody's Analytics

- Financial Times

- Reuters

- Douglas AG Investor statements