Uber is a ride-hailing company that is set to go public in early May 2019 and will be traded in the New York Stock Exchange under the symbol “UBER”. The company offers many other services by which food-delivery, electric bikes and is developing self-driving cars. Uber is definitely on track for one of the biggest Tech IPOs and the largest since Chinese e-commerce giant Alibaba in 2014. The world’s largest ride-hailing company plans an initial public offering that values the firm between $80.5 billion and $91.5 billion.

Why the initial valuation of $100 Billion seemed to be an unattractive rating

It does look like the valuation is much less than the $120 billion expected last year by investment bankers, and closer to the $76 billion valuation it reached in a private fundraising round in 2018. The lower valuation reflects the poor stock performance of Lyft following its IPO last month. Actually, Lyft is a smaller rival of Uber and its shares ended trading at the end of April 20.5 % down from the IPO price. Moreover, Uber’s Take Rate has been in steady decline throughout 2018, along with a series of PR disasters that led to the #DeleteUber campaign and drove both riders and drivers to other minor platforms. Actually, many drivers are objecting to their pay and working conditions. The typical Uber driver earns about 8.55$ an hour before taxes. That is why Uber is choosing to have a conservative valuation.

However, Uber preserves the big advantage of being the largest player in many of the markets in which it does business, and this will likely seek to be emphasized to the future investors.

The terms of the agreement

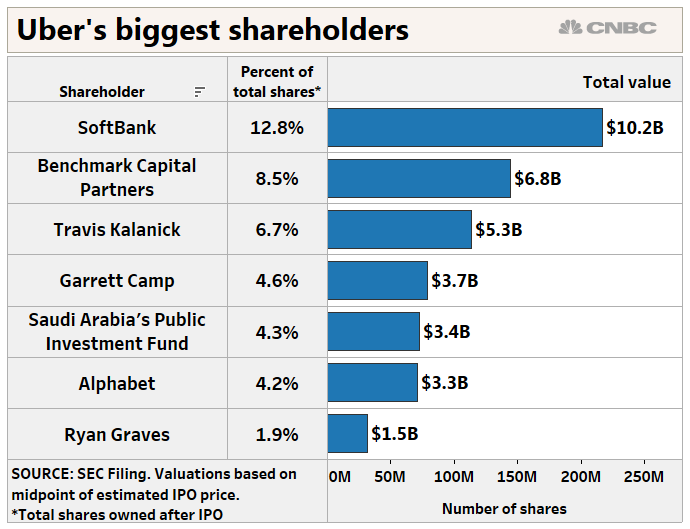

We are dealing with one of the most widely anticipated initial public offering in years, with a plan to pitch shares to investors initially at around $44-$50 each. If the IPO prices at the top end of its current range, Uber co-founders Travis Kalanick and Garrett Camp could jointly pocket $343 million considering that they plan to buy 6.86 million shares. About $500m worth of stock will be sold to PayPal in a private placement at the IPO price, as reported firstly by the Wall Street Journal. This investment provides also an expanded global commercial agreement between PayPal and Uber such as the development of Uber’s digital wallet. The Uber IPO is being led by Goldman Sachs & Co, Morgan Stanley and bank of America Merrill Lynch. Uber seeks to raise about $9 billion in cash in its initial public offering next month.

Why the initial valuation of $100 Billion seemed to be an unattractive rating

It does look like the valuation is much less than the $120 billion expected last year by investment bankers, and closer to the $76 billion valuation it reached in a private fundraising round in 2018. The lower valuation reflects the poor stock performance of Lyft following its IPO last month. Actually, Lyft is a smaller rival of Uber and its shares ended trading at the end of April 20.5 % down from the IPO price. Moreover, Uber’s Take Rate has been in steady decline throughout 2018, along with a series of PR disasters that led to the #DeleteUber campaign and drove both riders and drivers to other minor platforms. Actually, many drivers are objecting to their pay and working conditions. The typical Uber driver earns about 8.55$ an hour before taxes. That is why Uber is choosing to have a conservative valuation.

However, Uber preserves the big advantage of being the largest player in many of the markets in which it does business, and this will likely seek to be emphasized to the future investors.

The terms of the agreement

We are dealing with one of the most widely anticipated initial public offering in years, with a plan to pitch shares to investors initially at around $44-$50 each. If the IPO prices at the top end of its current range, Uber co-founders Travis Kalanick and Garrett Camp could jointly pocket $343 million considering that they plan to buy 6.86 million shares. About $500m worth of stock will be sold to PayPal in a private placement at the IPO price, as reported firstly by the Wall Street Journal. This investment provides also an expanded global commercial agreement between PayPal and Uber such as the development of Uber’s digital wallet. The Uber IPO is being led by Goldman Sachs & Co, Morgan Stanley and bank of America Merrill Lynch. Uber seeks to raise about $9 billion in cash in its initial public offering next month.