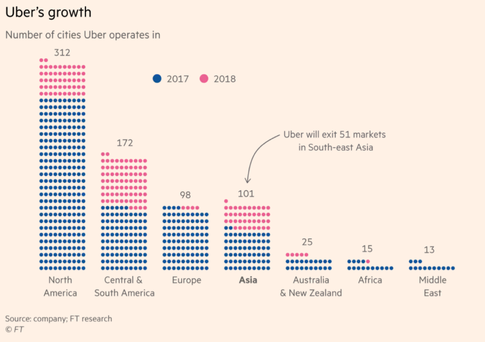

On March 26, 2018, Uber has announced that it is selling its Southeast Asian business to local rival Grab. Under the terms of the deal, the Singapore-based company Grab, which is already the region's dominant ride-hailing service, operating in more than 190 cities, will acquire all of Uber's operations in the region, which includes countries such as Indonesia, Malaysia, the Philippines, Singapore, Thailand and Vietnam, as well as its food delivery business UberEats. Uber, in return will get 27.5 per cent in the enlarged business, and its chief executive Dara Khosrowshahi will get a seat on the board of Grab. The deal has valued Uber’s stake at more than $2bn, leading to an implied valuation of the entire company at more than $7bn, as compared to the $6bn at which Grab was valued when it raised money last time in 2017.

Similarly, recent rumours revealed that Uber is in talks to merge its Indian operation with local ride-hailing rival Ola. The San Francisco-based company operates in about 30 Indian cities and has more than 35 percent share of the taxi market. Whereas, Ola, which operates in 110 cities, has more than a 45 percent share, according to Counterpoint Research. The problems in the Indian region are related to the expensive battle to dominate the market, which resulted in heavy cash burn mainly caused by competitive pricing and driver incentives, as also testified by Ola’s pre-tax loss of $355m on revenue of $116m for the financial year ending March 2016.

These operations are no news, in fact over the past two years, Uber has also ceded control of its Chinese and Russian businesses in mergers with local rivals Didi Chuxing and Yandex, in return for a 20 per cent and a 37 per cent stake, respectively.

Deals rationale

First of all, Uber aims to go public in 2019 and needs to stop its cash bleeding to justify a valuation of more than $50bn. The company has incurred in losses for more than $10bn since its foundation nine years ago. To overcome this issue, the recently appointed CEO Dara Khosrowshahi has repeatedly signalled his willingness to rationalise Uber's geographic presence to safeguard the company's financial sustainability. It is no surprise that under his control the company tightened its financial discipline also by means of disposal of the operating units in Asia, cutting adjusted losses to $741m in Q4 2017 from $1bn in the previous quarter.

In addition, the key player behind the recent consolidation in the ride-hailing industry and the above-mentioned deals is SoftBank. The Japanese investment group, which currently owns large stakes in the majority of the industry’s leader, was Grab’s biggest investor before the deal with Uber, and it is at the same time the largest investor of the San-Francisco based company, having poured $9.3bn in it last December. It is known that the strategic goal of the group is to have a more orderly market, with less competition and higher stability, after an era of costly expansion of the industry, that has seen the major players investing and burning a lot of cash, trying to become the leaders. More specifically, as declared by Rajeev Misra, head of Softbank’s Vision fund and member of Uber’s board, in an interview with the Financial Times, the group wants Uber to change its global strategy to focus on its "core" markets, particularly North America, Europe, and South America.

Success or failure for Uber?

To conclude, SoftBank's plan for Uber to reduce its geographic focus would require the company to sell its operations in key markets in which the company has invested a lot in the past years, such as India and South-east Asia. This would allow Uber to cut financial losses related to the high competition and improve its financials ahead of the expected IPO. However, refocusing on core markets like the US and Europe, is not a guarantee of success for Uber. In fact, in North America, Lyft, a company which is backed by Alphabet among the others, is gaining market share at the expense of Uber, while in Europe, the company faces a highly fragmented market and may have regulatory challenges on the horizon after the European Court of Justice ruled that it's subject to the same local regulations as taxi services throughout the EU.

Lorenzo Zanini

Similarly, recent rumours revealed that Uber is in talks to merge its Indian operation with local ride-hailing rival Ola. The San Francisco-based company operates in about 30 Indian cities and has more than 35 percent share of the taxi market. Whereas, Ola, which operates in 110 cities, has more than a 45 percent share, according to Counterpoint Research. The problems in the Indian region are related to the expensive battle to dominate the market, which resulted in heavy cash burn mainly caused by competitive pricing and driver incentives, as also testified by Ola’s pre-tax loss of $355m on revenue of $116m for the financial year ending March 2016.

These operations are no news, in fact over the past two years, Uber has also ceded control of its Chinese and Russian businesses in mergers with local rivals Didi Chuxing and Yandex, in return for a 20 per cent and a 37 per cent stake, respectively.

Deals rationale

First of all, Uber aims to go public in 2019 and needs to stop its cash bleeding to justify a valuation of more than $50bn. The company has incurred in losses for more than $10bn since its foundation nine years ago. To overcome this issue, the recently appointed CEO Dara Khosrowshahi has repeatedly signalled his willingness to rationalise Uber's geographic presence to safeguard the company's financial sustainability. It is no surprise that under his control the company tightened its financial discipline also by means of disposal of the operating units in Asia, cutting adjusted losses to $741m in Q4 2017 from $1bn in the previous quarter.

In addition, the key player behind the recent consolidation in the ride-hailing industry and the above-mentioned deals is SoftBank. The Japanese investment group, which currently owns large stakes in the majority of the industry’s leader, was Grab’s biggest investor before the deal with Uber, and it is at the same time the largest investor of the San-Francisco based company, having poured $9.3bn in it last December. It is known that the strategic goal of the group is to have a more orderly market, with less competition and higher stability, after an era of costly expansion of the industry, that has seen the major players investing and burning a lot of cash, trying to become the leaders. More specifically, as declared by Rajeev Misra, head of Softbank’s Vision fund and member of Uber’s board, in an interview with the Financial Times, the group wants Uber to change its global strategy to focus on its "core" markets, particularly North America, Europe, and South America.

Success or failure for Uber?

To conclude, SoftBank's plan for Uber to reduce its geographic focus would require the company to sell its operations in key markets in which the company has invested a lot in the past years, such as India and South-east Asia. This would allow Uber to cut financial losses related to the high competition and improve its financials ahead of the expected IPO. However, refocusing on core markets like the US and Europe, is not a guarantee of success for Uber. In fact, in North America, Lyft, a company which is backed by Alphabet among the others, is gaining market share at the expense of Uber, while in Europe, the company faces a highly fragmented market and may have regulatory challenges on the horizon after the European Court of Justice ruled that it's subject to the same local regulations as taxi services throughout the EU.

Lorenzo Zanini