As the UK employs one of the most efficient vaccination schemes in the world and lockdown restrictions begin to ease, it is important to reflect upon one of the most re-shaped industries by COVID-19. The housing market, often seen as a top indicator for economic welfare since the 2008 financial crisis, has suffered immensely under government procedures to slow the spread of the virus, and has undergone a series of major consolidations as a result.

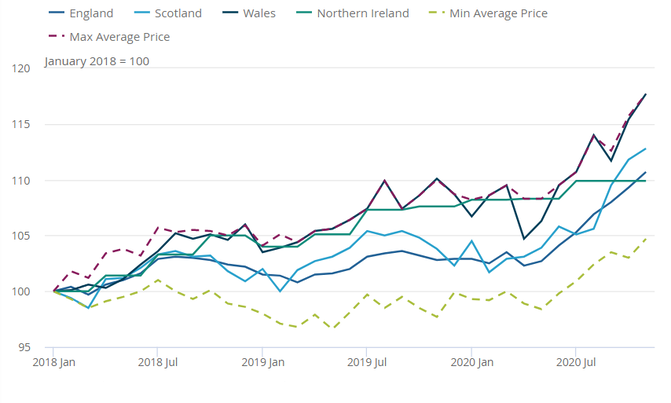

In March 2020, Prime Minister Boris Johnson joined a series of other world leaders in the establishment of a lockdown procedure. This resulted in a sharp decrease in transactions, prices and overall construction activities during the months of March and April. In fact, during the height of the first wave of lockdowns, the annual house price growth stood at only 0.7% in comparison to the 7.6% recorded in November 2020. Similar trends in annual house prices were also experienced by every nation within the UK, as demonstrated by the chart. Additionally, in comparison to 2019 figures, the transaction volume in April 2020 dropped by over 50%, a value that rippled across the fragmented residential homebuilder industry, deeply impacting revenues.

In March 2020, Prime Minister Boris Johnson joined a series of other world leaders in the establishment of a lockdown procedure. This resulted in a sharp decrease in transactions, prices and overall construction activities during the months of March and April. In fact, during the height of the first wave of lockdowns, the annual house price growth stood at only 0.7% in comparison to the 7.6% recorded in November 2020. Similar trends in annual house prices were also experienced by every nation within the UK, as demonstrated by the chart. Additionally, in comparison to 2019 figures, the transaction volume in April 2020 dropped by over 50%, a value that rippled across the fragmented residential homebuilder industry, deeply impacting revenues.

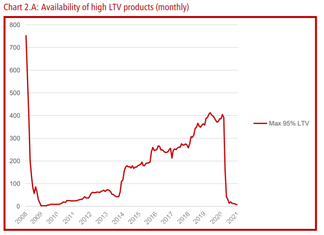

It is important to note, however, that this trend did not follow a restricted path amongst all types of housing, as flats in urban regions faced the sharpest declines due to a long-term shift in living preferences to more rural regions. A shortage in high LTV mortgage products, in addition to a sudden increase in consumption led to fewer people closing on new homes with high deposits, thus relying more on riskier loans or opting for other mortgage guarantee schemes. To combat the economic uncertainties that followed the first set of lockdowns and price fluctuations, the UK approved a new set of “tax holidays” to raise tax brackets, thus incentivizing first-time homeowners into purchasing homes located in target regions. This, along with a record-low base interest rate of only 0.1% established by the Bank of England, resulted in a 13-year high mortgage approval rate in December 2020, the month that historically has the lowest mortgage approval rates due to seasonal preferences.

Although it is impossible to predict when the mortgage industry will be back to pre-COVID levels without fiscal support, it is important to note that the number of mortgage approvals by October 2020 was already higher than seen in previous years, and that, despite the operational restrictions placed on homebuilders, most new projects were able to meet pre-established deadlines. It is also uncertain to which extent “work from home” schemes employed across the UK will remain an option to employees after lockdowns are lifted, as many surveys have indicated that between 10-17% of office workers prefer to permanently stay in their home-offices.

And how exactly did residential house builders adapt to both the initial shock and the long-term effects of COVID-19?

Due to the fragmented nature of this market, consolidations were bound to happen as firms aim to protect cash flow levels whilst also taking advantage of low interest rates to increase their land banks with new purchases. One of the most notable acquisitions that occurred right before the pandemic was that of Linden Homes (residential branch of GallifordTry) by Bovis Homes for £1.1 billion, which resulted in the newly formed and rebranded Vistry Group becoming a top five housebuilder, with the capacity to construct 12,000 homes annually and an impressive land bank. The cash and stock transaction earned GallifordTry shareholders 29.3% of the new entity, and left Vistry Group in a much better position to handle the effects of COVID-19.

Another interesting merger in the property development field was by Inc & Co Property Group, which acquired Prospect Business Centers, an office construction company for an undisclosed amount in March 2020. Due to the private nature of this transaction, not a lot of information is available to the public, but the CEO of Inc & Co actively promoted the strategic move by stating “we’ve entered a very trying time for businesses with the COVID-19 pandemic and we’re wanting to support as many businesses as possible to survive and thrive.” [1]

The effects of the pandemic also rippled throughout the entire construction and real estate development supply chains, as manufacturing and steel firms such as Severfield bought struggling steel manufacturers such as Yorkshire-based DAM Structures. Additionally, Breedon Group, a public construction materials company, acquired CEMEX’s UK assets in a £178 million all cash deal, in order to take advantage of several synergy benefits.

What lies ahead:

Whilst the UK has shown several indicators of economic recovery, it is impossible to determine when the “new normal” will be reached. Despite the government incentives placed to encourage first-time home owners, several obstacles remain before construction companies can demonstrate pre-COVID financials.

Ana Leticia Raposo

[1] https://pressreleases.responsesource.com/news/99377/inc-co-property-group-acquire-prospect-business-centres-to-support/

Want to keep up with our most recent articles? Subscribe to our weekly newsletter here.

And how exactly did residential house builders adapt to both the initial shock and the long-term effects of COVID-19?

Due to the fragmented nature of this market, consolidations were bound to happen as firms aim to protect cash flow levels whilst also taking advantage of low interest rates to increase their land banks with new purchases. One of the most notable acquisitions that occurred right before the pandemic was that of Linden Homes (residential branch of GallifordTry) by Bovis Homes for £1.1 billion, which resulted in the newly formed and rebranded Vistry Group becoming a top five housebuilder, with the capacity to construct 12,000 homes annually and an impressive land bank. The cash and stock transaction earned GallifordTry shareholders 29.3% of the new entity, and left Vistry Group in a much better position to handle the effects of COVID-19.

Another interesting merger in the property development field was by Inc & Co Property Group, which acquired Prospect Business Centers, an office construction company for an undisclosed amount in March 2020. Due to the private nature of this transaction, not a lot of information is available to the public, but the CEO of Inc & Co actively promoted the strategic move by stating “we’ve entered a very trying time for businesses with the COVID-19 pandemic and we’re wanting to support as many businesses as possible to survive and thrive.” [1]

The effects of the pandemic also rippled throughout the entire construction and real estate development supply chains, as manufacturing and steel firms such as Severfield bought struggling steel manufacturers such as Yorkshire-based DAM Structures. Additionally, Breedon Group, a public construction materials company, acquired CEMEX’s UK assets in a £178 million all cash deal, in order to take advantage of several synergy benefits.

What lies ahead:

Whilst the UK has shown several indicators of economic recovery, it is impossible to determine when the “new normal” will be reached. Despite the government incentives placed to encourage first-time home owners, several obstacles remain before construction companies can demonstrate pre-COVID financials.

Ana Leticia Raposo

[1] https://pressreleases.responsesource.com/news/99377/inc-co-property-group-acquire-prospect-business-centres-to-support/

Want to keep up with our most recent articles? Subscribe to our weekly newsletter here.