The UK nonprime (including subprime) credit market, an important source of financing for borrowers with a low credit score, is facing numerous threats. Vanquis, one of the few remaining companies that can provide nonprime loans, is suffering after an inflow of claims against it, calling into question the stability and investability of the market. The rise of unregulated lenders and alternative borrowing schemes, to the detriment of established nonprime lending institutions, has important implications for the well-being of already vulnerable borrowers.

Market Overview

In several important economies, including the US and the UK, the provision of loans to borrowers is done based on their credit score. Borrowers with low credit scores are alienated from accessing prime lending; the nonprime credit market represents a lifeline to such individuals. Nonprime lenders are specific financial institutions that take the risk of providing loans to individuals with average to low credit scores, counterbalancing the higher risk of default with higher interest rates. This market flourishes when banks (prime credit market players) require borrowers to have a high credit score to request a loan, as a significant portion of the population, including those working in precarious employment conditions, become marginalised when seeking liquidity.

In the UK, the nonprime lending market, which accounted for about 4% of the total consumer credit market in 2013, has shrunk to 0.3% last year, says not-for-profit Fair4AllFinance. This is concerning because the number of underserved customers in the UK is growing. In 2018, the estimation of customers who had non-standard credit histories was around 12 million, while in November 2023, this figure rose to around 17 million people, with an estimated shortage of credit supply of approximately £2 billion.

The main reason for this massive fall in nonprime lending despite the clear need is explained by the lack of institutions qualified to provide nonprime loans – a supply-side problem. Two of the last institutions that could provide this service, Vanquis and Amigo, have experienced a massive fall in their financial metrics and their stock prices in recent years. For instance, their stock price declined by 21% and 55% respectively from the beginning of the year.

Increased regulation, seen by many as necessary, has squeezed this sector. Providing the grounds for expensive claims against creditors, this sharp regulatory increase has left many creditors unable to continue operating in this market. For instance, in the high-cost, short-term credit subsector, prices were capped in 2015; between 2016 and 2021, the number of lenders decreased by 66% and the total number of quarterly loans by 90%, as reported by the FT.

Another very important aspect is the rise of professional claims management companies that have profited from this regulatory scrutiny and have started “targeting” the nonprime credit market. On one hand, they are representing borrowers that have been left unable to pay back the high interest on their loans. On the other hand, these professional claims companies are overwhelming nonprime creditors out of business. This trend raises significant doubts about the sustainability of this segment of the credit market and opens a multitude of questions about its future. The biggest fear is that low-income population, which is facing an increasingly detrimental cost of living, is forced to accept high-cost, or worse, unregulated options that could massively deteriorate their well-being.

For instance, a type of short-term financing called Buy Now, Pay Later (BNPL), which has not been adequately regulated yet, is becoming a noticeably popular option for consumers with a low credit score. BNPL loans to individuals who cannot access prime lending have increased by 53% since 2021, due to a shift in preferences of consumers, who prefer making use of this interest-free alternative rather than entering the nonprime credit market. As expected, this unregulated instrument is damaging its users' well-being. Almost one-quarter of UK Buy Now, Pay Later users have been charged late repayment fees, with users aged 18-34 hit hardest. Moreover, those people have experienced a deterioration of their credit score or were contacted by a debt collection agency. In this regard, the Treasury affirmed that there will be a proportionate regulation of BNPL services, ensuring borrower protection while leaving them the freedom to access these products.

The lack of instruments for low credit score borrowers also caused a growth in illegal moneylending. The providers of illegal loans are called money sharks. Fair4AllFinance has estimated that in June 2023 roughly 3 million people have borrowed from an unlicensed or unauthorised money lender in the last three years. The total amount of debt per borrower was around £3,000 on average, while repayment rates involved paying double the borrowed amount.

The UK credit market has certainly experienced a decline in choice for consumers that has been ignored for too long. Creating a healthy credit system should be a priority that requires a combined effort by both the UK government and regulators. A clear long-term strategy for the nonprime lending market is needed to restore confidence in consumers and avoid low-income borrowers getting hurt by unregulated credit sources.

In several important economies, including the US and the UK, the provision of loans to borrowers is done based on their credit score. Borrowers with low credit scores are alienated from accessing prime lending; the nonprime credit market represents a lifeline to such individuals. Nonprime lenders are specific financial institutions that take the risk of providing loans to individuals with average to low credit scores, counterbalancing the higher risk of default with higher interest rates. This market flourishes when banks (prime credit market players) require borrowers to have a high credit score to request a loan, as a significant portion of the population, including those working in precarious employment conditions, become marginalised when seeking liquidity.

In the UK, the nonprime lending market, which accounted for about 4% of the total consumer credit market in 2013, has shrunk to 0.3% last year, says not-for-profit Fair4AllFinance. This is concerning because the number of underserved customers in the UK is growing. In 2018, the estimation of customers who had non-standard credit histories was around 12 million, while in November 2023, this figure rose to around 17 million people, with an estimated shortage of credit supply of approximately £2 billion.

The main reason for this massive fall in nonprime lending despite the clear need is explained by the lack of institutions qualified to provide nonprime loans – a supply-side problem. Two of the last institutions that could provide this service, Vanquis and Amigo, have experienced a massive fall in their financial metrics and their stock prices in recent years. For instance, their stock price declined by 21% and 55% respectively from the beginning of the year.

Increased regulation, seen by many as necessary, has squeezed this sector. Providing the grounds for expensive claims against creditors, this sharp regulatory increase has left many creditors unable to continue operating in this market. For instance, in the high-cost, short-term credit subsector, prices were capped in 2015; between 2016 and 2021, the number of lenders decreased by 66% and the total number of quarterly loans by 90%, as reported by the FT.

Another very important aspect is the rise of professional claims management companies that have profited from this regulatory scrutiny and have started “targeting” the nonprime credit market. On one hand, they are representing borrowers that have been left unable to pay back the high interest on their loans. On the other hand, these professional claims companies are overwhelming nonprime creditors out of business. This trend raises significant doubts about the sustainability of this segment of the credit market and opens a multitude of questions about its future. The biggest fear is that low-income population, which is facing an increasingly detrimental cost of living, is forced to accept high-cost, or worse, unregulated options that could massively deteriorate their well-being.

For instance, a type of short-term financing called Buy Now, Pay Later (BNPL), which has not been adequately regulated yet, is becoming a noticeably popular option for consumers with a low credit score. BNPL loans to individuals who cannot access prime lending have increased by 53% since 2021, due to a shift in preferences of consumers, who prefer making use of this interest-free alternative rather than entering the nonprime credit market. As expected, this unregulated instrument is damaging its users' well-being. Almost one-quarter of UK Buy Now, Pay Later users have been charged late repayment fees, with users aged 18-34 hit hardest. Moreover, those people have experienced a deterioration of their credit score or were contacted by a debt collection agency. In this regard, the Treasury affirmed that there will be a proportionate regulation of BNPL services, ensuring borrower protection while leaving them the freedom to access these products.

The lack of instruments for low credit score borrowers also caused a growth in illegal moneylending. The providers of illegal loans are called money sharks. Fair4AllFinance has estimated that in June 2023 roughly 3 million people have borrowed from an unlicensed or unauthorised money lender in the last three years. The total amount of debt per borrower was around £3,000 on average, while repayment rates involved paying double the borrowed amount.

The UK credit market has certainly experienced a decline in choice for consumers that has been ignored for too long. Creating a healthy credit system should be a priority that requires a combined effort by both the UK government and regulators. A clear long-term strategy for the nonprime lending market is needed to restore confidence in consumers and avoid low-income borrowers getting hurt by unregulated credit sources.

Vanquis: a Case Study

Vanquis, one of the last few authorised actors in the UK nonprime lending market, has been facing significant difficulties recently, with broader implications for consumers’ access to nonprime loans. Vanquis Banking Group Plc engages in the business of supplying personal credit products to 1.7 million customers across the UK, supporting financial inclusion and social mobility. It operates through four segments: Vanquis Bank, Consumer Credit Division, Moneybarn and Central. The Vanquis Bank segment issues credit cards to people who are often declined by mainstream card providers. The Consumer Credit division segment offers home credit loans; online lending; and operates as loan guarantor. The Moneybarn segment includes non-standard vehicle finance.

Vanquis Banking Group was founded in 1880 and went public in 1962, marking the transition from a family business to a public company under the name of Provident Financial plc. In 2017, the Group underwent an ill-fated reorganisation in response to the new regulatory atmosphere in the sector, prompting a 90% stock price fall in the next 4 years. Furthermore, several regulatory initiatives have sensitised important branches of the business, such as relending (in the case of home credit). Claims compensation-related expenses increased from around £2.5 million in H2 2019 to £25 million in H2 2020. In 2023, the Group’s name was changed to Vanquis Banking Group, reflecting the Group’s new strategic position to focus on the mid-cost credit market and close its online and doorstep lending businesses, in line with the previously described trend following increasingly strict market regulation.

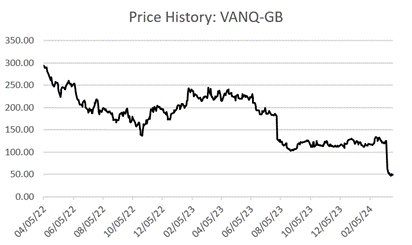

Vanquis has always been one of the main players in the UK nonprime credit market, with a capitalisation on 25 March 2024 amounted to £124.3 million; however, the firm’s KPIs have shown a concerning trend and a relatively flat revenue growth. The semi-annual net profit for June 2023 was a loss of £10.4 million and the diluted earnings per share stood around £0.08 in December 2023. The stock price as of 22 March 2024 is £49 and follows a declining trend. Considering the period between 24 March 2023 and 22 March 2024, the stock reached its highest point of £243.2 per share on 31 March 2023, and its lowest point of £43.15 per share on 18 March 2024. Overall, the Group witnessed a 78% decrease in its stock price throughout the year. More in depth, after a relatively stable period, the share price fell sharply from 11 March 2024 due to the Group’s announcement of an income and pretax profit in 2024 substantially below market expectations.

Vanquis, one of the last few authorised actors in the UK nonprime lending market, has been facing significant difficulties recently, with broader implications for consumers’ access to nonprime loans. Vanquis Banking Group Plc engages in the business of supplying personal credit products to 1.7 million customers across the UK, supporting financial inclusion and social mobility. It operates through four segments: Vanquis Bank, Consumer Credit Division, Moneybarn and Central. The Vanquis Bank segment issues credit cards to people who are often declined by mainstream card providers. The Consumer Credit division segment offers home credit loans; online lending; and operates as loan guarantor. The Moneybarn segment includes non-standard vehicle finance.

Vanquis Banking Group was founded in 1880 and went public in 1962, marking the transition from a family business to a public company under the name of Provident Financial plc. In 2017, the Group underwent an ill-fated reorganisation in response to the new regulatory atmosphere in the sector, prompting a 90% stock price fall in the next 4 years. Furthermore, several regulatory initiatives have sensitised important branches of the business, such as relending (in the case of home credit). Claims compensation-related expenses increased from around £2.5 million in H2 2019 to £25 million in H2 2020. In 2023, the Group’s name was changed to Vanquis Banking Group, reflecting the Group’s new strategic position to focus on the mid-cost credit market and close its online and doorstep lending businesses, in line with the previously described trend following increasingly strict market regulation.

Vanquis has always been one of the main players in the UK nonprime credit market, with a capitalisation on 25 March 2024 amounted to £124.3 million; however, the firm’s KPIs have shown a concerning trend and a relatively flat revenue growth. The semi-annual net profit for June 2023 was a loss of £10.4 million and the diluted earnings per share stood around £0.08 in December 2023. The stock price as of 22 March 2024 is £49 and follows a declining trend. Considering the period between 24 March 2023 and 22 March 2024, the stock reached its highest point of £243.2 per share on 31 March 2023, and its lowest point of £43.15 per share on 18 March 2024. Overall, the Group witnessed a 78% decrease in its stock price throughout the year. More in depth, after a relatively stable period, the share price fell sharply from 11 March 2024 due to the Group’s announcement of an income and pretax profit in 2024 substantially below market expectations.

Data: MarketScreener

The reason for these downward forecasts lies in the recent increase in claims across the business. According to the Group’s management, it has been experiencing “significant levels of third-party complaint submissions”, raising its administrative costs significantly and making it impossible to continue treating them as normal operating costs. The majority of complaints relate to Vanquis’s credit card business, which is the most important one and constitutes almost the entirety of its pre-tax profits after moving away from doorstep and online lending. Dealing with the high volume of these new claims, even if the majority are not upheld, increased its administration costs leading the income in 2024 to be ‘materially’ lower than the £583.3 million expected by analysts. The Group is exploring proactive legal measures to address this situation and continues to take significant steps to reset pricing, bringing its business model more in line with regulatory requirements. With the implementation of these changes, the Group expects to return to modest lending growth from the beginning of the second quarter.

The adjusted PBT for 2024 will be substantially lower than the market consensus, resulting in low single-digit adjusted ROTE. Despite the negative outlook due to the increase in claims and due to the recent low levels in earnings, the firm shows “acceptable” capital buffers, good funding access, and a well-established but narrow franchise in consumer and auto lending in the UK. Vanquis is confident of its well-established market position and aspires to establish “solid foundations” to transform the business. In 2025, the Group’s rectified ROTE is expected to remain in the low single digits, as it continues its repositioning and transformation. Following the full implementation of the new strategy, from 2026, the board will revisit the capital allocation policy and reset the level of dividend from which to maintain a progressive policy thereafter. The challenges facing by the UK nonprime and subprime credit market and the increasing need of controlled products may reward the board’s commitment to restoring a sustainable business in the next years.

The adjusted PBT for 2024 will be substantially lower than the market consensus, resulting in low single-digit adjusted ROTE. Despite the negative outlook due to the increase in claims and due to the recent low levels in earnings, the firm shows “acceptable” capital buffers, good funding access, and a well-established but narrow franchise in consumer and auto lending in the UK. Vanquis is confident of its well-established market position and aspires to establish “solid foundations” to transform the business. In 2025, the Group’s rectified ROTE is expected to remain in the low single digits, as it continues its repositioning and transformation. Following the full implementation of the new strategy, from 2026, the board will revisit the capital allocation policy and reset the level of dividend from which to maintain a progressive policy thereafter. The challenges facing by the UK nonprime and subprime credit market and the increasing need of controlled products may reward the board’s commitment to restoring a sustainable business in the next years.

Future Outlook

The global economic difficulties created by the pandemic and by the Russia-Ukraine conflict have put a serious strain on the global credit sector. In an ideal world, consumers would not have to indulge themselves in any form of high interest borrowing. We’ve already seen what that can lead to….2008…. What is even more concerning is that consumers are now becoming unsatisfied with nonprime lending services. As a result, they are looking to cheaper alternatives which have stormed the market as the global fintech scene continues since following its ‘reincarnation’ at the beginning of the pandemic. The UK, in this example, recently drowning in inflation and stunted growth levels like many other developed nations, possesses a nonprime credit market with a very uncertain future.

It is important to consider various factors such as interest rates, technology and regulation, that could impact the nonprime credit market. The inflation outlook is looking rather positive – 2024 inflation is expected to hit the 2.2% level (previously at 7.3% and 9.1% in 2023 and 2022 respectively). The Bank of England (BoE) is looking to lower interest rates from 5.25% to 4.5% by the end of 2024. Provided that this fall in interest rates is met with an increase in lender confidence (led by a general macroeconomic improvement), lending is likely to expand in the UK. This could lead to an expansion of supply in the nonprime credit market as institutions become more willing to lend to borrowers with lower credit scores as fundraising from deposits becomes easier. From the demand side of market, borrowers may look to re-enter the nonprime sector with interest rates being not as excessive as previously seen. Moreover, as inflation falls drastically, institutions are likely to be more certain about market conditions. This could lead to a stronger and safer financial environment in which banks and other lending institutions look to expand their prime and nonprime lending practices. Thus, with interest rates potentially falling and inflation lowering, the hope is that consumers exit unregulated payment services and head back to more traditional borrowing techniques.

It is also important to mention the possible transformation of lenders such as Vanquis as they are forced to “move up the credit spectrum” and halt their provision of certain services. A publication by the University of Salford (cited by the FT) suggests that community development financial institutions (CFDIs) can play a positive, substitutive role in alleviating local poverty and supporting individuals in need. Expanding affordable credit is a matter of great concern for the UK government, which has supported further research into this domain – but the development of these alternatives is not matching the real unravelling of the nonprime credit market. The likely outcome in this case is a move to unregulated alternatives, perpetuating the problem that the increased regulation of nonprime lenders set out to fix in the first place.

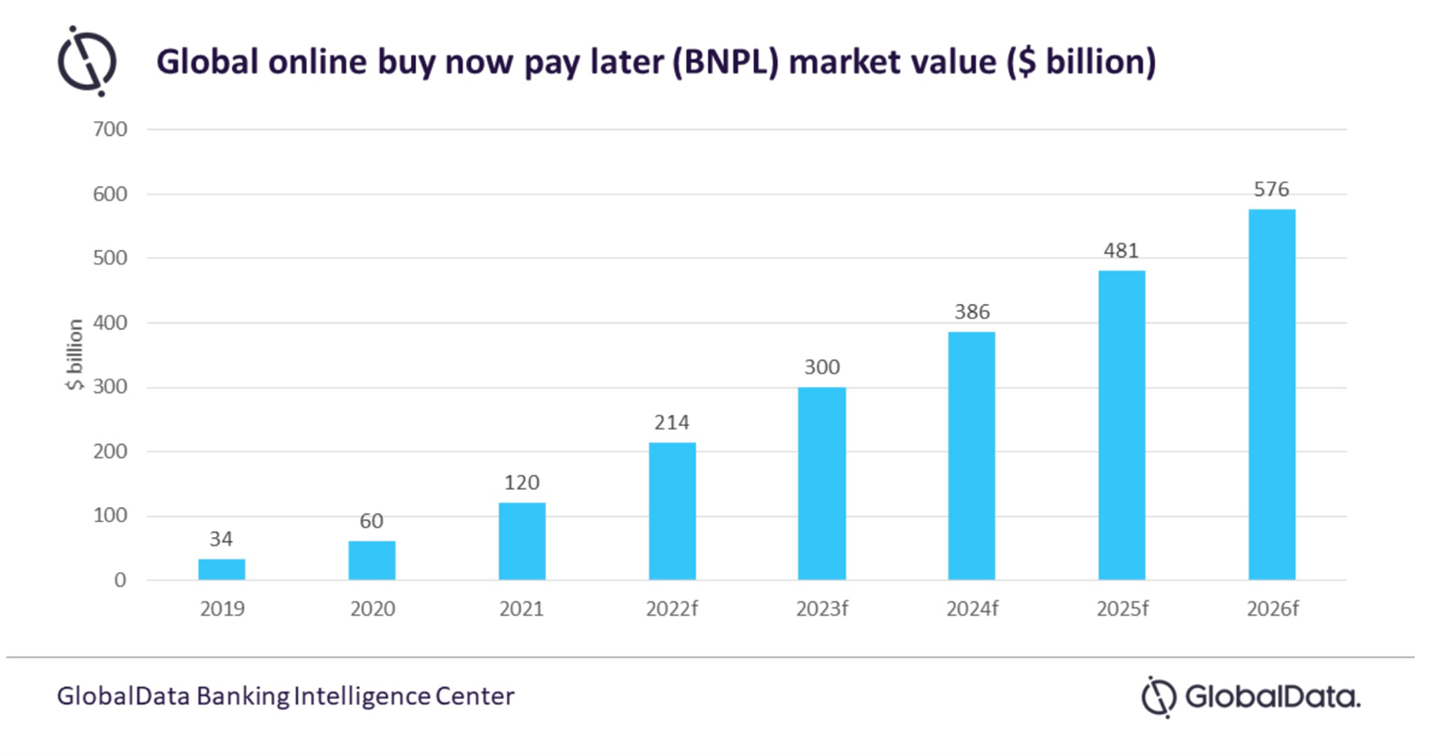

It is also important to consider how technological innovation may affect the nonprime market in the near future. BNPL payment services are looking to expand their operations with big names such as Klarna already serving over 18 million customers in the UK. As these fintech firms look to become more creative with their payment schemes, customers are enjoying the benefits of interest-free payments. In fact, the global buy now pay later market size is projected to grow from $37.19 billion in 2024 to $167.58 by 2032, exhibiting a CAGR (compound annual growth rate) of 20.7% during the given period. An example of this is how the US BNPL market is expected to rapidly expand in the next ten years as seen below:

The global economic difficulties created by the pandemic and by the Russia-Ukraine conflict have put a serious strain on the global credit sector. In an ideal world, consumers would not have to indulge themselves in any form of high interest borrowing. We’ve already seen what that can lead to….2008…. What is even more concerning is that consumers are now becoming unsatisfied with nonprime lending services. As a result, they are looking to cheaper alternatives which have stormed the market as the global fintech scene continues since following its ‘reincarnation’ at the beginning of the pandemic. The UK, in this example, recently drowning in inflation and stunted growth levels like many other developed nations, possesses a nonprime credit market with a very uncertain future.

It is important to consider various factors such as interest rates, technology and regulation, that could impact the nonprime credit market. The inflation outlook is looking rather positive – 2024 inflation is expected to hit the 2.2% level (previously at 7.3% and 9.1% in 2023 and 2022 respectively). The Bank of England (BoE) is looking to lower interest rates from 5.25% to 4.5% by the end of 2024. Provided that this fall in interest rates is met with an increase in lender confidence (led by a general macroeconomic improvement), lending is likely to expand in the UK. This could lead to an expansion of supply in the nonprime credit market as institutions become more willing to lend to borrowers with lower credit scores as fundraising from deposits becomes easier. From the demand side of market, borrowers may look to re-enter the nonprime sector with interest rates being not as excessive as previously seen. Moreover, as inflation falls drastically, institutions are likely to be more certain about market conditions. This could lead to a stronger and safer financial environment in which banks and other lending institutions look to expand their prime and nonprime lending practices. Thus, with interest rates potentially falling and inflation lowering, the hope is that consumers exit unregulated payment services and head back to more traditional borrowing techniques.

It is also important to mention the possible transformation of lenders such as Vanquis as they are forced to “move up the credit spectrum” and halt their provision of certain services. A publication by the University of Salford (cited by the FT) suggests that community development financial institutions (CFDIs) can play a positive, substitutive role in alleviating local poverty and supporting individuals in need. Expanding affordable credit is a matter of great concern for the UK government, which has supported further research into this domain – but the development of these alternatives is not matching the real unravelling of the nonprime credit market. The likely outcome in this case is a move to unregulated alternatives, perpetuating the problem that the increased regulation of nonprime lenders set out to fix in the first place.

It is also important to consider how technological innovation may affect the nonprime market in the near future. BNPL payment services are looking to expand their operations with big names such as Klarna already serving over 18 million customers in the UK. As these fintech firms look to become more creative with their payment schemes, customers are enjoying the benefits of interest-free payments. In fact, the global buy now pay later market size is projected to grow from $37.19 billion in 2024 to $167.58 by 2032, exhibiting a CAGR (compound annual growth rate) of 20.7% during the given period. An example of this is how the US BNPL market is expected to rapidly expand in the next ten years as seen below:

Source: GlobalData

What does this mean for the nonprime market? Potentially further contraction, but one should remember that some of these services are only provided to small payments (basic retail payments). For example, in the UK, PayPal Pay in 3 is limited to payments between £30 and £2000. Hence, the growth of Buy Now Pay Later and contraction of the nonprime market may not go so hand in hand in the future. Currently, the market for Buy Now Pay Later services is virtually unregulated. In 2022, the HM Treasury (HMT) published consultations on proposed legislation which included BNPL services under regulation. The institution suggested implementing creditworthiness assessments for transactions made using BNPL. The institution also stated that BNPL firms would need to carry out robust internal controls as well as other compliance mechanisms in order to mitigate operational risks and protect consumer interests. What is possible is that if the industry is to be regulated effectively and efficiently, it will not be able to operate and grow as freely as it has done in recent years.

Whilst regulation looms on BNPL services, the UK government could look to introduce schemes to help support nonprime lenders and borrowers and guide them away from potentially risky alternatives, broadening access to regulated credit markets. In fact, the Finance and Leasing Association (FLA) has suggested various schemes which the UK government could implement to help lending within the UK economy. Specifically, they have suggested the implementation of a Business Growth Guarantee Scheme. This scheme would substitute the Recovery Loan Scheme (a temporary measure implemented to support lenders and borrowers following the pandemic). It would also be permanent, however, providing firms with more certainty, hence permitting long-term planning with customers. The Association also wishes to create an Investor Guarantee Scheme (IGS). This scheme could be used to provide a liquidity solution in times of crisis to help small lenders. The Association has stated that the scheme would help “avoid a liquidity freeze in the future”.

All in all, the nonprime credit market finds itself in a very strenuous situation, with ambiguity concerning its future prospects. The growth of unregulated competitors has threatened consumer access to regulated credit, through cheaper alternatives.

Whilst regulation looms on BNPL services, the UK government could look to introduce schemes to help support nonprime lenders and borrowers and guide them away from potentially risky alternatives, broadening access to regulated credit markets. In fact, the Finance and Leasing Association (FLA) has suggested various schemes which the UK government could implement to help lending within the UK economy. Specifically, they have suggested the implementation of a Business Growth Guarantee Scheme. This scheme would substitute the Recovery Loan Scheme (a temporary measure implemented to support lenders and borrowers following the pandemic). It would also be permanent, however, providing firms with more certainty, hence permitting long-term planning with customers. The Association also wishes to create an Investor Guarantee Scheme (IGS). This scheme could be used to provide a liquidity solution in times of crisis to help small lenders. The Association has stated that the scheme would help “avoid a liquidity freeze in the future”.

All in all, the nonprime credit market finds itself in a very strenuous situation, with ambiguity concerning its future prospects. The growth of unregulated competitors has threatened consumer access to regulated credit, through cheaper alternatives.

Conclusion

All things considered, the nonprime credit market has been subject to significant transformation in the past decade, due to various internal and external factors alike. When looking at Vanquis, the existential nature of the threats to the nonprime credit market is clear. Debates regarding the fairness of the extensive measures of regulation it has been subjected to remain open. What is clear, however, is the need for stringent regulation on emerging competitors and the importance of ensuring access to liquidity to all those who most need it. This calls for further measures to restore confidence and support borrowers and lenders alike.

All things considered, the nonprime credit market has been subject to significant transformation in the past decade, due to various internal and external factors alike. When looking at Vanquis, the existential nature of the threats to the nonprime credit market is clear. Debates regarding the fairness of the extensive measures of regulation it has been subjected to remain open. What is clear, however, is the need for stringent regulation on emerging competitors and the importance of ensuring access to liquidity to all those who most need it. This calls for further measures to restore confidence and support borrowers and lenders alike.

By Chiara Roncoroni, Boaz Lister, Lorenzo Monteduro

SOURCES

- Financial Times

- FactSet

- HSBC

- Clear Score & EY report “Building a non-prime lending market that delivers for UK consumers”

- Fair4All Finance

- Vanquis Banking Group

- MarketScreener

- Reuters

- Investors’ Chronicle

- Cover Image – Interactive Investor