Sustainability will be a defining theme for financial markets in this decade and beyond. Awareness among our global community and investors is rapidly shifting, so much so that we are now on the brink of a new era of investing. It is recently been acknowledged by many financial and asset management firms that climate risk equals investment risk. We have seen and will continue to see a gradual but real transition to a low carbon economy, which will shift the way society functions and investing. This transition will produce winners and losers and in particular, we will see an impact on petroleum-based industries and there will be a risk of stranded assets. Firms will need to manage and direct their focus towards the E and the S and the G in ESG going forward, in order to evolve with the changing investment landscape and meet the expectations of their stakeholders who will hold them to higher standards for their behavior and purpose.

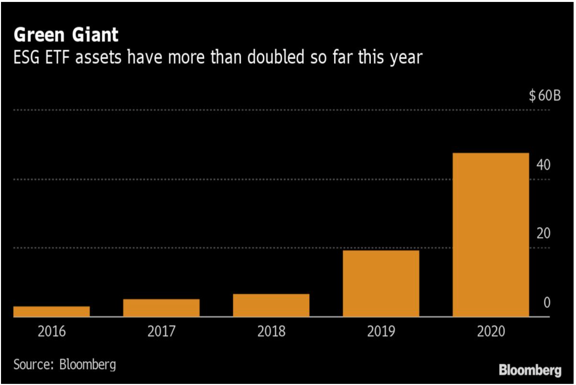

It is evident that markets are already pricing in this risk and we will only see this increase as time passes. Increasingly, investors will prefer to invest in companies with strong ESG scores. Many institutional investors are already beginning to shift from traditional investing to sustainable investing in their portfolios and this is reflected in the flows going into a sustainable investment, $22 billion which is roughly three times the 2019 total. As it relates to scoring, many ESG funds already exclude certain industries that score poorly on the MSCI ESG ratings such as weapons, petroleum, tobacco, thermal coal, etc. The current issue that investors have encountered with sustainable investing is that there is no universal scoring system and lack of agreement around standards and data. However, as the data becomes more consistent and agreed upon, this will be easier to evaluate and compare how companies score along these dimensions.

It is evident that markets are already pricing in this risk and we will only see this increase as time passes. Increasingly, investors will prefer to invest in companies with strong ESG scores. Many institutional investors are already beginning to shift from traditional investing to sustainable investing in their portfolios and this is reflected in the flows going into a sustainable investment, $22 billion which is roughly three times the 2019 total. As it relates to scoring, many ESG funds already exclude certain industries that score poorly on the MSCI ESG ratings such as weapons, petroleum, tobacco, thermal coal, etc. The current issue that investors have encountered with sustainable investing is that there is no universal scoring system and lack of agreement around standards and data. However, as the data becomes more consistent and agreed upon, this will be easier to evaluate and compare how companies score along these dimensions.

One of the main barriers historically to invest in ESG funds was a widespread belief that it required investors to sacrifice performance. This is changing. For example, two ESG funds, the iShares SUSA and ESGU outperformed their benchmark IVV, the core S&P 500 ETF, not only a year to date but over the past couple of years. With the possibility of a change of administration in the USA, that has publicly expressed its desire to make the United States more sustainable through regulation, policies, and incentives it is safe to assume that these funds will continue to outperform and gain more flows, leading to even better performance over time. On the other hand, the current administration does not share the same views on sustainability and the environment and as a result, will continue to support companies and funds with low ESG scores, thus hindering the possible growth of ESG funds. Therefore, it is evident that the results of the 2020 election will not only have a direct and important impact on the future of the United States but also how this new wave of investing will continue to evolve. Regardless of the type of investor you may be, we should all prepare for this transition to this new age of investing. It is here.

Nickolas Lockhart

Nickolas Lockhart