For decades, Hong Kong real estate market experienced a crescendo of seamless and thriving growth becoming the most expensive market globally in terms of affordability for medium income households, as shown in several studies (ex multis, in the Annual Demographia International Housing Affordability Study). However, a combination of an uncertain political turmoil, the pressure deriving from the US-China trade war and now the current outbreak of the Covid-19 are deeply threatening the sound development of Hong Kong’s property market, besides affecting stock indices and external trade relationships.

The actual impact of this real estate slump is clearly visible just looking at market data, but the potential shock is still to come. Indeed, according to Bloomberg Intelligence, the cumulative transaction value of commercial and retail properties experienced a considerable plunge of 12.9% in early 2020 amid lower transactions’ volumes and sizes. The downward trend is also noticeable in average rents, which dropped by 4% in January and in the vacancy rate of commercial properties, which reached the 7% threshold. These figures may not appear particularly alarming, especially due to the high market volatility of the last month. However, this negative sentiment, in tandem with a precarious growth in demand has the real power to generate a severe recession in Hong Kong’s economy in the upcoming months.

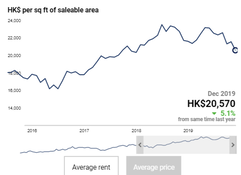

Indeed, there is a general consensus that markets (including the real estate one) are going to fully reflect Covid-19 with a sort of delay, as it happened last year for the political manifestations that started in March but were completely transposed in markets later in summer. (The principium of this downward trend can be seen in the figure below)

The natural risk of this uncertain environment is the potential downward spiral in property prices. In particular, commercial banks may show a bearish attitude in granting new loans and valuating properties, therefore inducing owners, especially the less liquid ones, to sell. This would push prices down even further in negative equity region, where the market price of the property becomes lower than the outstanding debt (mortgage loan) on the same property. As a matter of fact, this is already an ongoing phenomenon that can only be amplified, just considering that in December 2019, 128 mortgage loans (the number doubled from October) with a cumulative value of 764 mln HKD (approx. 98 mln USD) were valuated less than their mortgage amount.

That’s not all.