In this report, we will talk about the bond market and its role in the investment decisions of many. In particular, after a brief introduction on the structure and characteristics of fixed income securities, we will focus on the analysis of the Government bond market and the corporate bond one. In the former, we will focus mainly on the role of market expectations on the future monetary policies of the Federal Reserve and the European Central Bank. In the latter, we will briefly present how, notwithstanding the clear stress caused by the COVID-19 pandemic on the business of many firms, the spread between investment grade and non-investment grade bonds has remained fairly contained.

Fixed income securities: main characteristics

Bonds are debt instruments that allow public and private entities (governments as well as corporations) to raise funds. A bond is a contract that requires the borrower (the entity that issues the bond) to provide a certain amount (principal or nominal/face/par value of the bond) at the end of a certain period (called maturity) to the bondholder. Besides the face value, bonds can also give the right to receive recurrent payments, called coupons, represented by a certain rate of the face value (coupon rate), usually twice a year. It is important to mention two yields associated with bonds. The first is the running or current yield, which is simply the bond coupon rate divided by the clean price (hence, it does not consider the coupons that are maturing). The second, called yield to maturity (YTM), is the interest rate that makes the price today equal to the discounted value of the future cash flows (coupons and face value) and is a better measure of profitability. It is the yield that an investor will receive by buying the bond today and holding it until maturity while reinvesting all the coupons in the same bond. Bonds are first issued on the primary market, which means that lenders (usually financial institutions) underwrite a certain amount of debt directly from the issuer. Later, bonds are exchanged between different bondholders and institutions on secondary markets.

Taxation for bonds’ principal and coupon payments is usually at the state level on the income, and on capital gains if sold before maturity. For sovereign bonds, the tax rate is usually lower (in Italy, for instance, the standard 26% on financial income is reduced to 12,5% for sovereign bonds, while in the US is often 0%).

Bonds are usually less risky than equities. In fact, if held until maturity, they promise a fixed income and their only risk is the default of the issuer. But if the bond is not kept until maturity, fluctuations in the interest rate can alter the price of the bond. As the prevailing or average interest rates increase, new issuances on the primary market will pay more and therefore the price of old issuances on the secondary market will decline and vice versa. Therefore, there is an inverse relationship between the bond price and interest rates. Consistently, if the interest rate exceeds the coupon rate, then the price will drop below its face value and vice versa.

Fixed income securities: main characteristics

Bonds are debt instruments that allow public and private entities (governments as well as corporations) to raise funds. A bond is a contract that requires the borrower (the entity that issues the bond) to provide a certain amount (principal or nominal/face/par value of the bond) at the end of a certain period (called maturity) to the bondholder. Besides the face value, bonds can also give the right to receive recurrent payments, called coupons, represented by a certain rate of the face value (coupon rate), usually twice a year. It is important to mention two yields associated with bonds. The first is the running or current yield, which is simply the bond coupon rate divided by the clean price (hence, it does not consider the coupons that are maturing). The second, called yield to maturity (YTM), is the interest rate that makes the price today equal to the discounted value of the future cash flows (coupons and face value) and is a better measure of profitability. It is the yield that an investor will receive by buying the bond today and holding it until maturity while reinvesting all the coupons in the same bond. Bonds are first issued on the primary market, which means that lenders (usually financial institutions) underwrite a certain amount of debt directly from the issuer. Later, bonds are exchanged between different bondholders and institutions on secondary markets.

Taxation for bonds’ principal and coupon payments is usually at the state level on the income, and on capital gains if sold before maturity. For sovereign bonds, the tax rate is usually lower (in Italy, for instance, the standard 26% on financial income is reduced to 12,5% for sovereign bonds, while in the US is often 0%).

Bonds are usually less risky than equities. In fact, if held until maturity, they promise a fixed income and their only risk is the default of the issuer. But if the bond is not kept until maturity, fluctuations in the interest rate can alter the price of the bond. As the prevailing or average interest rates increase, new issuances on the primary market will pay more and therefore the price of old issuances on the secondary market will decline and vice versa. Therefore, there is an inverse relationship between the bond price and interest rates. Consistently, if the interest rate exceeds the coupon rate, then the price will drop below its face value and vice versa.

The predetermined and fixed nature of income flows associated with a bond allows investors to implement hedging strategies like immunization through duration-matching of the asset and liability side in order to avoid the risk of interest rate fluctuations. Duration is a measure of the time remaining until the initial price of the bond is repaid to the investor and is usually measured in years. It is different and always less or equal to the maturity as it considers also coupon payments. Therefore, a zero-coupon bond, a bond that pays no coupons, will always have its maturity equal to its duration. Duration is defined as the weighted average of the time necessary to receive the price back through the cash flows determined by the bond. Mathematically, in its modified form, it is the sensitivity of the bond price to changes in the interest rate or the first derivative of price with respect to the interest rate. Duration increases with maturity and decreases with the coupon rate, all other variables being equal. If both sides of the balance sheet have the same duration, a single movement in interest rate will have no effect on the value of the balance sheet and therefore on the solvency of the company. After every interest rate movement, though, the duration changes and the matching between asset and liability sides needs to be recalculated.

Bonds are therefore often used in combination with other asset classes by investors that require relatively safe instruments (like pension funds and insurance funds). Nevertheless, they do not give ownership rights and therefore a weaker influence on the company. Moreover, usually, there is a minimum size to invest in bonds that can go from as little as $1000 to hundreds of thousands of dollars for some bonds. Equities are usually more liquid as they are listed on exchanges, while most bonds are exchanged over-the-counter. Finally, if the bond is not indexed to inflation, the increase in the price level will reduce the real value of the bond’s cash flows.

The bond market: size and peculiarities

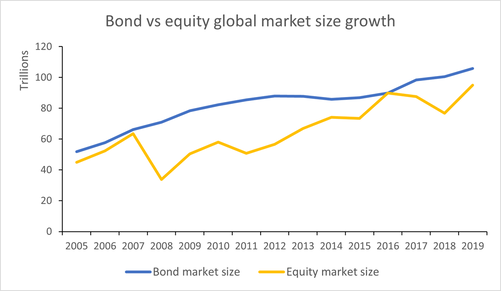

The global bond market is the biggest financial market in the world, estimated at around $106 trillion, bigger than the equity market, which stands at around $95 trillion. In its broader definition, it comprises all debt instruments including bonds (corporate and sovereign), loans, and asset-backed securities. About 70% of it is composed of sovereign, supranational, and agencies’ (SSA) debt, while the remaining is corporate debt.

Bonds are therefore often used in combination with other asset classes by investors that require relatively safe instruments (like pension funds and insurance funds). Nevertheless, they do not give ownership rights and therefore a weaker influence on the company. Moreover, usually, there is a minimum size to invest in bonds that can go from as little as $1000 to hundreds of thousands of dollars for some bonds. Equities are usually more liquid as they are listed on exchanges, while most bonds are exchanged over-the-counter. Finally, if the bond is not indexed to inflation, the increase in the price level will reduce the real value of the bond’s cash flows.

The bond market: size and peculiarities

The global bond market is the biggest financial market in the world, estimated at around $106 trillion, bigger than the equity market, which stands at around $95 trillion. In its broader definition, it comprises all debt instruments including bonds (corporate and sovereign), loans, and asset-backed securities. About 70% of it is composed of sovereign, supranational, and agencies’ (SSA) debt, while the remaining is corporate debt.

The main countries contributing to sovereign debt are the US, EU, and Japan, which together make 68% of the global SSA market. The size of the bond market has increased steadily in the last 10 years, fueled by low interest rates and loose monetary policy. The bond market has the important role of determining the cost of borrowing for companies and governments and the setting of interest rates. It is also a crucial part of the process of transmission of modern monetary policy by central banks, which often act by buying and selling sovereign bonds.

The primary market consists of firms and public institutions (central governments, municipalities, and other local or supranational institutions) issuing new bonds through either a private placement or a public offering. In the former case, bonds are not underwritten and sold directly to a single investor o group of investors, which are usually insurance companies, pension funds, or banks. With the latter, instead, the company or government works with a financial institution like an investment bank to offer its bonds to the market. It can happen through:

Secondary bond markets are the place where already issued debt securities are traded. Most of the trading happens between large institutions and broker-dealers in closed transactions (over the counter, OTC), while a minority of bonds is also traded in regulated exchanges. When the bond trades at a price equal to its face value it is said to trade “at par”; when the price is higher than face value is said to be trading “at premium” and when the price is instead lower, it trades “at discount”.

Quite intuitively, the higher the maturity the lower the price (and the higher the yield), since there is a higher default risk and a higher interest rate risk. As the time approached the maturity date, the price tends to the face value (which is the amount of money that will be paid at maturity).

The rating and riskiness of the issuer are crucial as it determines the probability for the bondholder to receive his or her money back. Large corporations and governments are rated by agencies like Moody’s and Standard&Poor’s, with the higher-level being AAA (for S&P) or Aaa (for Moody’s) and the threshold for investment-grade bonds being BBB- and Baa3 respectively. Under this level, instruments are called “junk bonds” and have higher yields but are riskier.

Some bonds have particular characteristics that determine their price. For example, a subordinated bond will have a lower price; a covered bond instead will give a lower yield as its risk is lower. In the case of callable bonds, as interest rates go down the issuer is more likely to redeem the bond, so that it can emit new debt at a lower interest rate. In this case, lower interest rates tend to reduce the price. General market conditions also influence bond prices: if the stock market is rising, investors will move out of fixed income instruments and invest more in stocks, and vice versa. Economically, an increase in investors’ preference for risk will drive them away from safer assets like bonds and towards equities.

Bonds can first be distinguished looking at the issuer: it can be public (a government or a municipality or other local or supranational entity) or private (usually a corporation). Bonds can then take different forms and names depending on their characteristics and goals. The main ones are zero-coupon bonds, fixed-rate bonds, floating rate bonds, convertible bonds, subordinated and covered bonds.

Other types of bonds are: green bonds, used to finance environmentally sustainable projects; war bonds, used to finance wars; perpetual bonds, which only pay a coupon indefinitely, and bonds in foreign currencies, most notably Eurodollars.

The primary market consists of firms and public institutions (central governments, municipalities, and other local or supranational institutions) issuing new bonds through either a private placement or a public offering. In the former case, bonds are not underwritten and sold directly to a single investor o group of investors, which are usually insurance companies, pension funds, or banks. With the latter, instead, the company or government works with a financial institution like an investment bank to offer its bonds to the market. It can happen through:

- Underwritten offerings. The whole issue is bought by the committed underwriter (the investment bank) which takes on itself the entire risk.

- Best effort offerings. The investment bank acts only as a broker and is committed only to its best effort to offer the bonds to the market, but not to buy them itself.

- Shelf registrations. In the US, a corporation could file an initial prospectus at the SEC and emit its bonds only later to the public without having to file another prospectus (but only a short statement), allowing for faster issuance when market conditions are more favorable.

- Auctions. This is the most common practice for government bonds since they are usually very liquid, and demand is high. It does not require an intermediary like an investment bank (and is therefore cheaper). The price and yield of the bonds are determined by the auction through the meeting of supply and demand.

Secondary bond markets are the place where already issued debt securities are traded. Most of the trading happens between large institutions and broker-dealers in closed transactions (over the counter, OTC), while a minority of bonds is also traded in regulated exchanges. When the bond trades at a price equal to its face value it is said to trade “at par”; when the price is higher than face value is said to be trading “at premium” and when the price is instead lower, it trades “at discount”.

Quite intuitively, the higher the maturity the lower the price (and the higher the yield), since there is a higher default risk and a higher interest rate risk. As the time approached the maturity date, the price tends to the face value (which is the amount of money that will be paid at maturity).

The rating and riskiness of the issuer are crucial as it determines the probability for the bondholder to receive his or her money back. Large corporations and governments are rated by agencies like Moody’s and Standard&Poor’s, with the higher-level being AAA (for S&P) or Aaa (for Moody’s) and the threshold for investment-grade bonds being BBB- and Baa3 respectively. Under this level, instruments are called “junk bonds” and have higher yields but are riskier.

Some bonds have particular characteristics that determine their price. For example, a subordinated bond will have a lower price; a covered bond instead will give a lower yield as its risk is lower. In the case of callable bonds, as interest rates go down the issuer is more likely to redeem the bond, so that it can emit new debt at a lower interest rate. In this case, lower interest rates tend to reduce the price. General market conditions also influence bond prices: if the stock market is rising, investors will move out of fixed income instruments and invest more in stocks, and vice versa. Economically, an increase in investors’ preference for risk will drive them away from safer assets like bonds and towards equities.

Bonds can first be distinguished looking at the issuer: it can be public (a government or a municipality or other local or supranational entity) or private (usually a corporation). Bonds can then take different forms and names depending on their characteristics and goals. The main ones are zero-coupon bonds, fixed-rate bonds, floating rate bonds, convertible bonds, subordinated and covered bonds.

Other types of bonds are: green bonds, used to finance environmentally sustainable projects; war bonds, used to finance wars; perpetual bonds, which only pay a coupon indefinitely, and bonds in foreign currencies, most notably Eurodollars.

Government bond market: the role of the monetary policy stance

Let us now focus on the government bond market and in particular the US and European ones. In order to understand this market segment, we need to focus on the monetary decisions of the FED and the European Central Bank in terms of the future level of interest rates. In turn, these latter depend on the future expectation of growth and inflation.

US Treasury Market

The Georgia runoff elections of January 5 led to a slim Democratic Party majority in the Senate and hence a unified government, at least regarding the legislative and executive branches. Nonetheless, thanks to potential congressional obstruction, there was not any additional stimulus package until March 11, when President Joe Biden signed a $1.9 trillion coronavirus relief package. This latter proposes to send direct payments of up to $1,400 to most American citizens and to extend the unemployment insurance to counterbalance the loss of consumer consumption due to the COVID-19 pandemic. The expectation of a strong government stimulus, together with the fast pace of the vaccinations, induced many economists to raise the forecasts for the 2021 US real GDP.

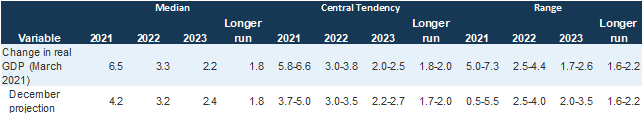

For example, we can look at FOMC economic projections in December 2020 and in March 2021 and compare the two.

Let us now focus on the government bond market and in particular the US and European ones. In order to understand this market segment, we need to focus on the monetary decisions of the FED and the European Central Bank in terms of the future level of interest rates. In turn, these latter depend on the future expectation of growth and inflation.

US Treasury Market

The Georgia runoff elections of January 5 led to a slim Democratic Party majority in the Senate and hence a unified government, at least regarding the legislative and executive branches. Nonetheless, thanks to potential congressional obstruction, there was not any additional stimulus package until March 11, when President Joe Biden signed a $1.9 trillion coronavirus relief package. This latter proposes to send direct payments of up to $1,400 to most American citizens and to extend the unemployment insurance to counterbalance the loss of consumer consumption due to the COVID-19 pandemic. The expectation of a strong government stimulus, together with the fast pace of the vaccinations, induced many economists to raise the forecasts for the 2021 US real GDP.

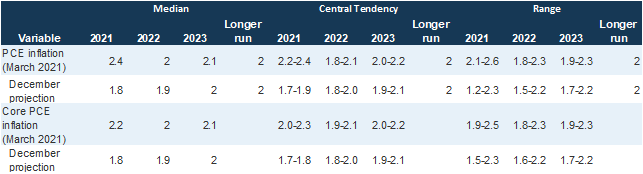

For example, we can look at FOMC economic projections in December 2020 and in March 2021 and compare the two.

Economic Projection from the 18 FOMC members - the seven members of the Board of Governors of the Federal Reserve System and the eleven presidents of the corresponding Federal Reserve Banks. Each participant's projections were based on information available at the time of the meeting, together with her or his assessment of monetary policy.

Source: FOMC meeting of March 16-17 2021

As we can see, members of the FOMC raised their real GDP growth in 2021 from a median of 4.2% to one of 6.5%.

With such strong expected growth, it is also important to consider another important macro indicator: inflation. Indeed, the progressive reopening of the economy, a weaker dollar, and an increase in commodity prices have all increased the inflation outlook in the US.

With such strong expected growth, it is also important to consider another important macro indicator: inflation. Indeed, the progressive reopening of the economy, a weaker dollar, and an increase in commodity prices have all increased the inflation outlook in the US.

Nonetheless, we have to remember that the FED does not have a proper inflation target like the ECB and its dual mandate is of maximum employment and stable prices, without a specific number. Therefore, it is likely that the monetary policy will remain accommodative in the near future as suggested by the FOMC meeting projections of March 2021 (a central tendency of 0.1-0.9% in 2023). Furthermore, Jerome Powell has repeatedly communicated to the market that he will allow for higher inflation, to compensate for the longer period of low inflation during the pandemic.

Therefore, it is likely that betting on higher yields will not be profitable, at least in the short run, even though it is likely that yields will reach a higher level in the medium term pushed by accommodative fiscal and monetary policy.

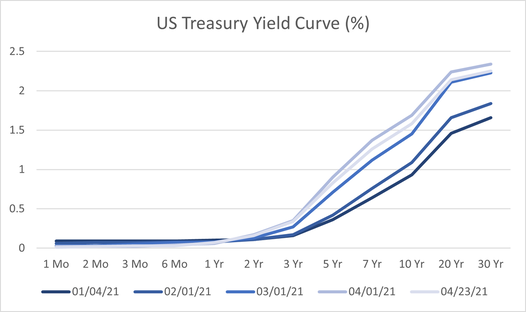

It is worth noting, however, by looking at the US yield curve that it seems like the market participants are expecting an earlier rate cut, disregarding the announcement of the FED. Therefore, it seems like the market is weighing more the risk of inflation. Indeed, yields climbed in the month of March pushed by the favorable economic outlook and the possible future inflation.

Therefore, it is likely that betting on higher yields will not be profitable, at least in the short run, even though it is likely that yields will reach a higher level in the medium term pushed by accommodative fiscal and monetary policy.

It is worth noting, however, by looking at the US yield curve that it seems like the market participants are expecting an earlier rate cut, disregarding the announcement of the FED. Therefore, it seems like the market is weighing more the risk of inflation. Indeed, yields climbed in the month of March pushed by the favorable economic outlook and the possible future inflation.

Eurozone Government Bond Market

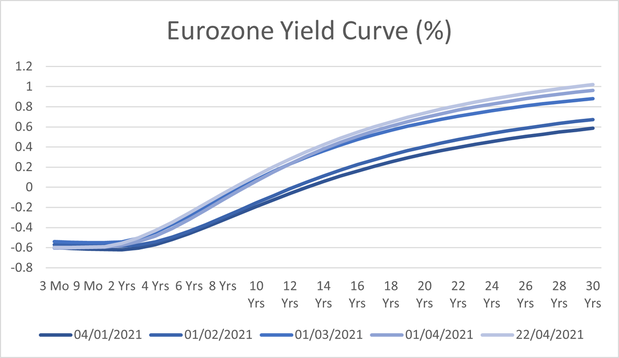

Let us focus now on the economic forecast of the Eurozone. In the April 22 press conference, Christine Lagarde acknowledged that, while the recovery in demand and the sizeable fiscal stimulus are helping to support the Euro area economy, the near-term economic outlook is still characterized by a high degree of uncertainty. Indeed, differently from the US, in Europe the vaccination campaigns only recently started to accelerate, solidifying the chance to a safe reopening in the summer. Because of that, the Governing Council decided to maintain its accommodative stance with the main refinancing operations rate left at 0.00%, and the marginal lending facility and the deposit facility rates at 0.25% and -0.50% respectively. In addition, the ECB will continue its net asset purchases under the pandemic emergency purchase program (PEPP) and will continue to provide liquidity through its Targeted Long-Term Refinancing Operation.

Indeed, contrary to what is happening in the US, the forecasted growth is still characterized by strong uncertainty and an overall lower level. Indeed, the ECB Survey of Professional Forecasters in the second quarter of 2021 shows a downward revision of the real GDP growth expectations in 2021 and upward in 2022. This is a result of the under-par start of the European vaccination campaign and the increase in COVID-19 cases in the first quarter of the year that leads to the implementation of additional restrictive policies in many EU Countries.

Let us focus now on the economic forecast of the Eurozone. In the April 22 press conference, Christine Lagarde acknowledged that, while the recovery in demand and the sizeable fiscal stimulus are helping to support the Euro area economy, the near-term economic outlook is still characterized by a high degree of uncertainty. Indeed, differently from the US, in Europe the vaccination campaigns only recently started to accelerate, solidifying the chance to a safe reopening in the summer. Because of that, the Governing Council decided to maintain its accommodative stance with the main refinancing operations rate left at 0.00%, and the marginal lending facility and the deposit facility rates at 0.25% and -0.50% respectively. In addition, the ECB will continue its net asset purchases under the pandemic emergency purchase program (PEPP) and will continue to provide liquidity through its Targeted Long-Term Refinancing Operation.

Indeed, contrary to what is happening in the US, the forecasted growth is still characterized by strong uncertainty and an overall lower level. Indeed, the ECB Survey of Professional Forecasters in the second quarter of 2021 shows a downward revision of the real GDP growth expectations in 2021 and upward in 2022. This is a result of the under-par start of the European vaccination campaign and the increase in COVID-19 cases in the first quarter of the year that leads to the implementation of additional restrictive policies in many EU Countries.

The SPF (Survey of Professional Forecasters) is conducted on a quarterly basis and gathers expectations for the rates of inflation, real GDP growth and unemployment in the euro area for several horizons. The participants in the survey are experts affiliated with financial or non-financial institutions based within the European Union.

Source: ECB Survey of Professional Forecasters Q2 2021

More positive is the outlook for inflation, which has experienced a strong upward revision for the year 2021, jumping from 0.9% in the SPF of January 2021 to 1.6% in the one of April. This revision is likely caused by the increase in commodity prices that we are experiencing in this first quarter of the year and the strong effect of the normalization of the German VAT. Indeed, German VAT rates were temporarily reduced from the standard rates to 16% and 5% and have turned back to standard levels (19% and 7% respectively) in January 2021.

Nonetheless, as we can see from the forecast, the expected inflation rate, even in the long horizon is lower but probably not close enough to justify a restriction of the monetary stance by the ECB in the near future, at least in terms of an increase in the interest rates.

This can be seen in the response of the yield curve, which highlights still expected negative rates in the short-medium term.

This can be seen in the response of the yield curve, which highlights still expected negative rates in the short-medium term.

Corporate Bonds - Decade high defaults amidst decade low spreads

Corporations can fund their capital structure with either debt or equity, commonly companies use debt for working capital as well as longer-term projects. When raising debt corporations can take out loans or issue bonds, and they mainly differ in that bonds are more easily tradable in the market.

Commonly, a corporation's creditworthiness is evaluated by investors who attempt to assess the likelihood that the corporation will default on its debt as well as the loss severity. This process, credit analysis, allows investors to find bonds that they believe are priced inefficiently by the market. In concert with this analysis, investors use credit ratings, an assessment of creditworthiness by rating agencies, to evaluate the likelihood of payback. Another proxy for risk stems from the spread between the corporate bond and the risk-free rate. The spread is variable and is often evaluated in terms of tranches as opposed to individual bonds, in order to evaluate the market’s required return.

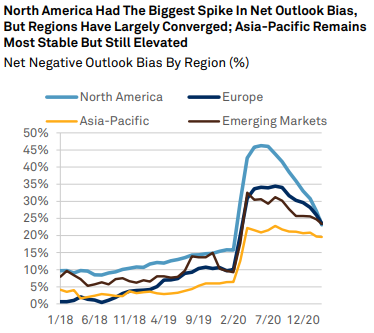

It is only natural that investment-grade bonds should provide a higher yield than the risk-free rate of equivalent maturity, further, non-investment grade bonds should trade at a higher yield yet. Nevertheless, the corporate bond spread is determined by the market, thus, it is cyclical. To the extent the market forecasts a positive economic outlook, credit spreads should narrow, and the opposite should also hold. Over the past 10 years, the high yield spread and the investment-grade spread hit their highs during the Covid 19 crash or the Euro crisis. As economies shut down, the likelihood of defaults rose, and some companies were obligated to take out debt at the very worst moment. Cyclical businesses and those with high financial or operating leverage were hit the hardest. Nevertheless, one year removed from the market panic, demand has increased as countries provide stimulus and vaccinations allow for the reopening. Thus, it is only natural that the market would forecast a more positive outlook. Rating agencies have now accordingly been bumping credit outlooks as can be seen in the chart below.

Corporations can fund their capital structure with either debt or equity, commonly companies use debt for working capital as well as longer-term projects. When raising debt corporations can take out loans or issue bonds, and they mainly differ in that bonds are more easily tradable in the market.

Commonly, a corporation's creditworthiness is evaluated by investors who attempt to assess the likelihood that the corporation will default on its debt as well as the loss severity. This process, credit analysis, allows investors to find bonds that they believe are priced inefficiently by the market. In concert with this analysis, investors use credit ratings, an assessment of creditworthiness by rating agencies, to evaluate the likelihood of payback. Another proxy for risk stems from the spread between the corporate bond and the risk-free rate. The spread is variable and is often evaluated in terms of tranches as opposed to individual bonds, in order to evaluate the market’s required return.

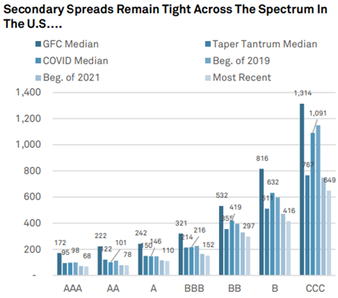

It is only natural that investment-grade bonds should provide a higher yield than the risk-free rate of equivalent maturity, further, non-investment grade bonds should trade at a higher yield yet. Nevertheless, the corporate bond spread is determined by the market, thus, it is cyclical. To the extent the market forecasts a positive economic outlook, credit spreads should narrow, and the opposite should also hold. Over the past 10 years, the high yield spread and the investment-grade spread hit their highs during the Covid 19 crash or the Euro crisis. As economies shut down, the likelihood of defaults rose, and some companies were obligated to take out debt at the very worst moment. Cyclical businesses and those with high financial or operating leverage were hit the hardest. Nevertheless, one year removed from the market panic, demand has increased as countries provide stimulus and vaccinations allow for the reopening. Thus, it is only natural that the market would forecast a more positive outlook. Rating agencies have now accordingly been bumping credit outlooks as can be seen in the chart below.

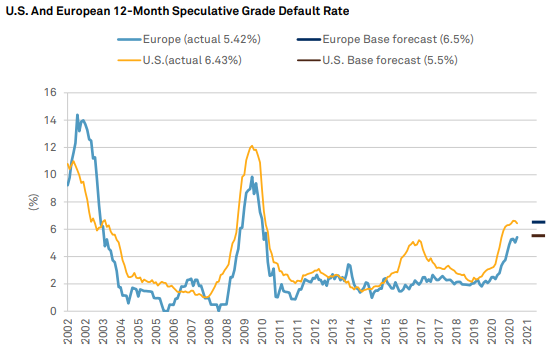

Despite the improved economic backdrop, there is still excessive leverage undertaken by the most distressed companies and it is hardly a stretch to say they are in a much worse position than they were 18 months ago. “Leverage in the most COVID-exposed industries increased in 2020, with debt to EBITDA increasing to 5.5x, from 4.5x a year earlier”, further it is estimated that earnings will continue to be depressed well into 2022 and even into 2023 for some companies. Furthermore, default rates are unlikely to come down in 2021 and should continue to be at historically elevated levels. It is also important to consider that we have the highest level of commercial debt ever, at 75% of global GDP.

It is hard to understand, from a fundamental perspective how credit spreads could be tighter than they were in 2019. Companies have worse credit ratios and weaker earnings and yet the market is pricing in an extremely positive outlook. Despite these spreads being seemingly too low, it must be considered that as central banks flooded the market with the liquidity, enabled easier borrowing. Further, at current interest rates, many institutional investors have been forced to move up the risk curve to achieve their projected returns. High yield bonds have become a way to earn significant yield as opportunities are scarce across the board, thus leading to a higher demand, which pushed down the yields.

In essence, it seems evident that the market expects that companies will be able to continuously roll over their debt, liquidity will be abundant, loose fiscal policy will continue, and the economy will recover. Despite a high likelihood that most of these events will take place, it still seems that the market may be overly optimistic given the worsened, though improving, credit ratios and poor earnings for high yield bonds. It may seem that the excessive optimism, however, comes not from an overly positive outlook of the future, but rather a lack of alternative ways for market participants to earn a required return and possibly an overabundance of excess liquidity in the system.

Bruno Badolato

Simone Boldrini

Carlo Geat

Want to keep up with our most recent articles? Subscribe to our weekly newsletter here.

Bruno Badolato

Simone Boldrini

Carlo Geat

Want to keep up with our most recent articles? Subscribe to our weekly newsletter here.