Since the presidential election, 2017 has been predicted to be a high-risk year for the U.S. economy, characterized by binary outcomes with conflicting results. The underlying reason is the uncertainty about the ability of policymakers to provide the strong economic stimulus promised last year by President Donald Trump, regarding trade and fiscal policy.

At the end of 2016, the expected GDP growth-rate for 2017 was increased to 2.3%, based on a switch from negative to positive manufacturing growth. Yet, manufacturing has limited importance in the U.S. equity market, so positive sentiment is the main driver of higher growth.

Moreover, the downtrend in productivity implies that rising wages reduce corporate profits.

U.S. productivity rose for two consecutive quarters to close 2016, but the underlying trend remains weak.

In addition, a stronger consumer sentiment means that consumer debt is rising: consequently, the U.S. trade deficit will hammer relatively more the economic growth. Again, according to Wells Fargo, sentiment is overestimating the economy’s real pace.

Merril Lynch analysed three scenarios to estimate the movements in the U.S. stock markets in 2017.

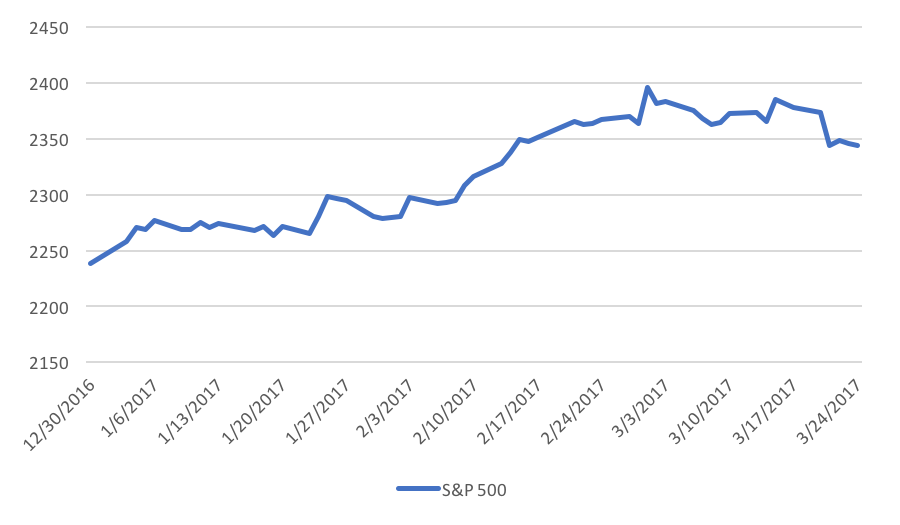

So far, the S&P 500 has already been trading higher than 2300 and it is also on an upward trend, which signals the investors’ euphoria.

At the end of 2016, the expected GDP growth-rate for 2017 was increased to 2.3%, based on a switch from negative to positive manufacturing growth. Yet, manufacturing has limited importance in the U.S. equity market, so positive sentiment is the main driver of higher growth.

Moreover, the downtrend in productivity implies that rising wages reduce corporate profits.

U.S. productivity rose for two consecutive quarters to close 2016, but the underlying trend remains weak.

In addition, a stronger consumer sentiment means that consumer debt is rising: consequently, the U.S. trade deficit will hammer relatively more the economic growth. Again, according to Wells Fargo, sentiment is overestimating the economy’s real pace.

Merril Lynch analysed three scenarios to estimate the movements in the U.S. stock markets in 2017.

- Base case: The S&P 500 year-end 2017 target is 2300.

- Bull case: Optimism is expected if fiscal stimulus and tax reform provide a boost to the economy. Target up to 2700.

- Bear case: Markets will be disappointed if policymakers lack the ability to deliver growth. Target down to 1600.

So far, the S&P 500 has already been trading higher than 2300 and it is also on an upward trend, which signals the investors’ euphoria.

Tax reform will be relevant to determine future market movements since the market is still not pricing the benefit from lower taxes.

Rising global inflation entailed a change in sectorial performances at the end of 2016: Financials soared, while investors lost appetite for low-volatility shares such as Utilities.

The sector recommendations provided by Bank of America (December 2016) were:

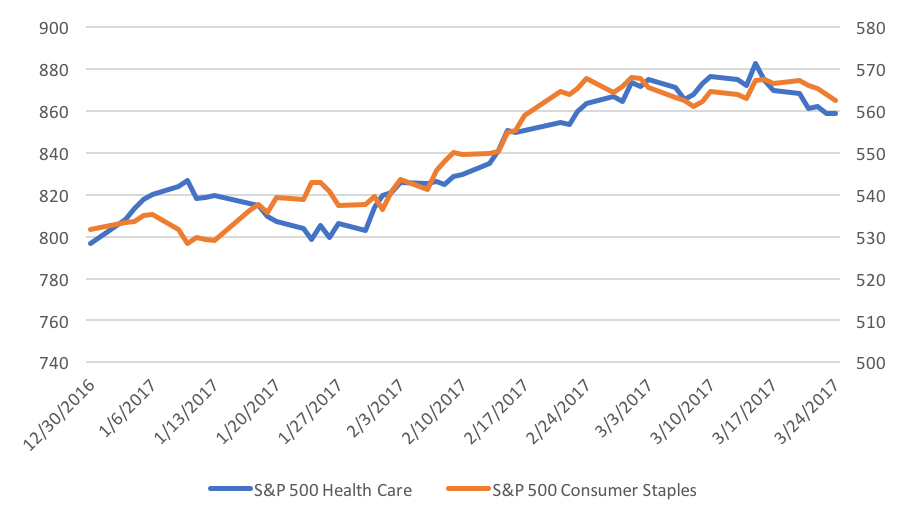

- In defensive sectors: overweight Health Care (stocks which are mostly inexpensive), underweight Consumer Staples (which trade at high multiples and are hurt by rising rates and strong dollar)

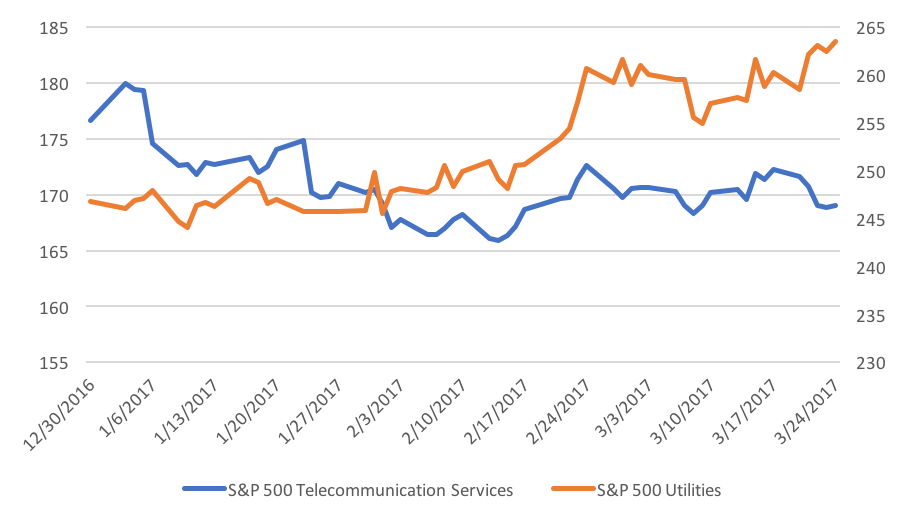

- Among bond proxies: overweight Telecom (which pay high dividends) and underweight Utilities (characterized by high P/E ratios and hurt by rising rates)

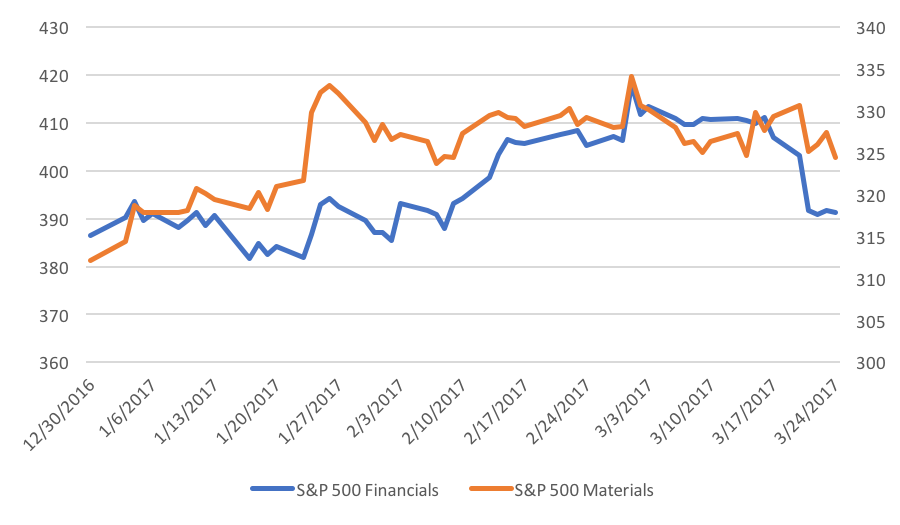

- As for Cyclicals: overweight Financials (which would benefit from higher interest rates, expected lower taxes and deregulation) and Consumer Discretionary (expected lower taxes and stimulus increase sales), while underweighting Materials (characterized by negative sales growth and hurt by rising rates and strong dollar; furthermore, Materials is also the most China-sensitive sector)

With reference to the Investment style, most banks agreed that large-caps should be preferred, while there were different opinions among investment managers about small-caps. In fact, the prices of these latter could suffer if economic growth disappoints investors and they decide to reduce the risk of their portfolios, because small-caps require higher levels of domestic growth to outperform the market. However, Wells Fargo recently increased their year-end small-cap equity target range.

Value stocks should be also be chosen because of expected economic growth.

We can easily see from the graphs that, so far, the investment recommendations provided by Merril Lynch have mostly failed to produce superior performances in different sectors of the S&P 500, including Consumer Staples, Telecom, Utilities and Financials. Clearly, this was caused by the uncertainty which has characterized the U.S. equity markets after the presidential election. Otherwise, the weak trends of some sectors, such as Financials, may suggest that the market had already priced most of the expected benefits of a future economic stimulus even before the beginning of 2017.

The consequences of President Trump’s pledges to increase infrastructure spending and lower taxes would be the following:

- Infrastructure-exposed stocks may benefit

- Lower taxes for individuals should stimulate consumer spending

- Corporate tax reform could raise companies’ EPS

Yet, the U.S. economy is facing some challenges: leverage is currently at very high levels. So, low-leveraged companies would benefit from proposals which eliminate the deductibility of interest payments and from rising interest rates.

Anyway, a lower tax rate would not help large and mid-sized companies if the deductibility of interest is eliminated, while smaller firms may benefit relatively more because of lower tax deductions.

Finally, the recent setback in Mr Trump’s health care reform may be detrimental to his fiscal and trade policy plans, which are far more relevant for the U.S. economy. If economic stimulus is not delivered, sentiment is likely to worsen and the U.S. stock market may suffer.

Gianluca Dimartino