PE is the talk of the town around the globe, especially in the US. However, criticisms are rising following some high-profile failed transactions and bankruptcies that left employees without employment, and families without money. All while the investors brush it off and move on to the next investment. Political pressure is rising, especially with an upcoming election next year. Here is an overview.

Growing industry

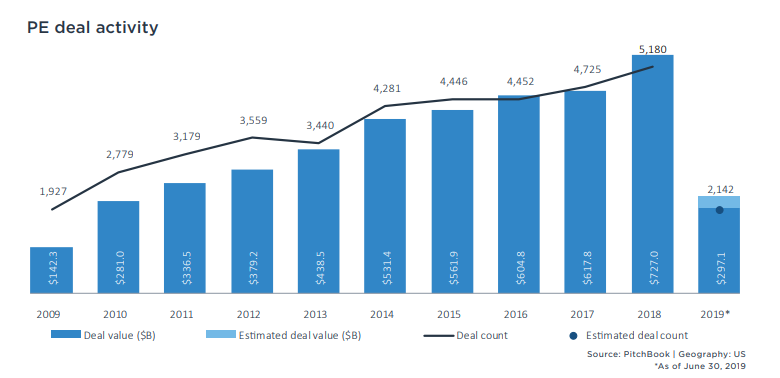

The global private equity industry has in the last three-four decades seen a growth that few industries can match. The net asset value in private equity has increased by a multiple of seven since 2002. This can be compared with global public equity, which has only grown at half the rate. Specifically, in the US the number of private equity-backed companies have doubled since 2006 and is now at approximately 8000.

Currently, yields around the world are low and the amount of capital available for deployment in private equity funds are at an all-time high, leading to high valuations forcing fund managers to be creative and sometimes extreme to be able to realize sufficient returns on capital.

Private equity has usually been a profitable investment for the investors. Researchers found that buyout funds, between 1990 and 2012, on average beat the S&P500 by approximately 20%. In recent years, PE has been hit with criticism from various directions, such as from star investor Warren Buffett. The critics claim, among else, that the private equity firms are misleading the public when disclosing their returns and that the numbers are overstated.

Another big part of the criticism is that private equity firms are gaining an unreasonable return, at the expense of the society, taxpayers and the buyout targets’ employees and retirees. The structure of a buyout transaction is built upon the premise of the PE investors using large amounts of debt and as little equity as possible to acquire the target company. The debt is not assumed by the PE investors, but by the target company itself, thus the investors have limited the downside at the expense of the existing stakeholders in the company. Proponents of these transactions claim that the “burden of debt” will force the company to become more efficient and that private equity firms ultimately run the firms better. However, the actions taken to optimize the organization often include vast layoffs of employees and selling off certain assets or business lines. This procedure is sometimes named “looting”.

Occasionally these transactions fail, and the bought-out companies’ debt-load becomes too heavy and they face distress or even bankruptcy. In those cases, employees are certainly affected, and sometimes the pensions of these companies are affected as well, increasing the disaster. A recent example of this happening is the bankruptcy and liquidation of the retail chain Toys ‘R Us. In September 2017, Toys ‘R Us filed for bankruptcy as it crumbled under a heavy debt-load following a buyout by private equity investors in 2006. They initiated a restructuring process but ultimately had to file for liquidation in 2018, laying off 30,000 employees without severance packages. Later it was brought into light that during the investment period, the investors had charged the company fees of $470 million.

Private equity has usually been a profitable investment for the investors. Researchers found that buyout funds, between 1990 and 2012, on average beat the S&P500 by approximately 20%. In recent years, PE has been hit with criticism from various directions, such as from star investor Warren Buffett. The critics claim, among else, that the private equity firms are misleading the public when disclosing their returns and that the numbers are overstated.

Another big part of the criticism is that private equity firms are gaining an unreasonable return, at the expense of the society, taxpayers and the buyout targets’ employees and retirees. The structure of a buyout transaction is built upon the premise of the PE investors using large amounts of debt and as little equity as possible to acquire the target company. The debt is not assumed by the PE investors, but by the target company itself, thus the investors have limited the downside at the expense of the existing stakeholders in the company. Proponents of these transactions claim that the “burden of debt” will force the company to become more efficient and that private equity firms ultimately run the firms better. However, the actions taken to optimize the organization often include vast layoffs of employees and selling off certain assets or business lines. This procedure is sometimes named “looting”.

Occasionally these transactions fail, and the bought-out companies’ debt-load becomes too heavy and they face distress or even bankruptcy. In those cases, employees are certainly affected, and sometimes the pensions of these companies are affected as well, increasing the disaster. A recent example of this happening is the bankruptcy and liquidation of the retail chain Toys ‘R Us. In September 2017, Toys ‘R Us filed for bankruptcy as it crumbled under a heavy debt-load following a buyout by private equity investors in 2006. They initiated a restructuring process but ultimately had to file for liquidation in 2018, laying off 30,000 employees without severance packages. Later it was brought into light that during the investment period, the investors had charged the company fees of $470 million.

Political pressure

These developments in the industry has not gone unnoticed in the political arena and depending on the outcome of the presidential election in almost exactly one year, the industry might be facing some serious headwinds. Both Elizabeth Warren and Bernie Sanders, US senators as well as Democratic presidential candidates have been delivering heavy criticism and proposed legislative changes affecting private equity firms and their practices.

In mid-2019 Warren published a draft legislation titled “Stop the Wall Street Looting Act”, containing her ideas to limit what she sees as predatory activities of private equity firms. The main point addressed in this bill is the driving incentive for the investors in transactions like these; since they have limited liability for the debt, there are incentives to take big fees and carried interest through dividend recapitalizations and so on. This feeds a risk-taking mindset where the losses are taken by the employees and society, as seen in the Toys ‘R Us debacle.

The Senator Warren’s proposed remedy for this, is essentially to remove the limited liability in these private equity investments, forcing the investors to take the portfolio companies’ debt onto their own balance sheets. In the event of a default, creditors could then recover their principal from the assets of the fund or the investors, allowing for recovery of funds taken out of the portfolio company in the forms of the aforementioned fees and dividends.

Warren’s bill received, as one would expect, a significant amount of backlash from the industry. Critics claim that this would make it “next to impossible for investors to invest in struggling businesses that need capital”, as a US trade organization commented.

Bernie Sanders, another Democratic presidential candidate, has been keeping a long-standing anti-Wall Street stance throughout his political career. He has criticized the PE industry multiple times, and most recently in conjunction with a high-profile closing of a private equity-owned hospital in Philadelphia. The private equity investor could not reach an agreement with the state or city and decided instead to close the hospital and sell the property to other investors, as the hospital was bleeding cash. The closure led to termination of employment for 2500 people and forces residents to find healthcare elsewhere.

Senator Sanders published his own draft of reforms he wants to see in corporate America. Although, it is spanning more areas than just private equity, there are some ideas that will inevitably affect private equity firms as well, such as corporate tax raises and required ownership of firms by employees.

These proposals are obviously dependent on their authors becoming president in the 2020 election, which few in the scene seem to believe is unlikely according to several surveys. Nevertheless, the critique regarding private equity practices will not go away easily, especially as the industry continues to develop and the presidential race continues.

In mid-2019 Warren published a draft legislation titled “Stop the Wall Street Looting Act”, containing her ideas to limit what she sees as predatory activities of private equity firms. The main point addressed in this bill is the driving incentive for the investors in transactions like these; since they have limited liability for the debt, there are incentives to take big fees and carried interest through dividend recapitalizations and so on. This feeds a risk-taking mindset where the losses are taken by the employees and society, as seen in the Toys ‘R Us debacle.

The Senator Warren’s proposed remedy for this, is essentially to remove the limited liability in these private equity investments, forcing the investors to take the portfolio companies’ debt onto their own balance sheets. In the event of a default, creditors could then recover their principal from the assets of the fund or the investors, allowing for recovery of funds taken out of the portfolio company in the forms of the aforementioned fees and dividends.

Warren’s bill received, as one would expect, a significant amount of backlash from the industry. Critics claim that this would make it “next to impossible for investors to invest in struggling businesses that need capital”, as a US trade organization commented.

Bernie Sanders, another Democratic presidential candidate, has been keeping a long-standing anti-Wall Street stance throughout his political career. He has criticized the PE industry multiple times, and most recently in conjunction with a high-profile closing of a private equity-owned hospital in Philadelphia. The private equity investor could not reach an agreement with the state or city and decided instead to close the hospital and sell the property to other investors, as the hospital was bleeding cash. The closure led to termination of employment for 2500 people and forces residents to find healthcare elsewhere.

Senator Sanders published his own draft of reforms he wants to see in corporate America. Although, it is spanning more areas than just private equity, there are some ideas that will inevitably affect private equity firms as well, such as corporate tax raises and required ownership of firms by employees.

These proposals are obviously dependent on their authors becoming president in the 2020 election, which few in the scene seem to believe is unlikely according to several surveys. Nevertheless, the critique regarding private equity practices will not go away easily, especially as the industry continues to develop and the presidential race continues.

Tobias Mattsson - 30/10/2019