During the coronavirus pandemic, pharmaceutical companies engaged in finding a vaccine have seen a substantial increase in investor interest. AstraZeneca, a leading European pharmaceutical company, has seen roughly a 15% increase since the March share price drop. Recently, good news on vaccine efficiency rates has widely featured in the media. Pfizer was the first pharmaceutical company to boast a 95% success rate, with Moderna following shortly after with similar statistics. This news has inflated investors’ confidence in these stocks and in the economy. Many predicted that there would be another market crash as soon as the coronavirus cases surged again. Despite the hindsight gained following the previous stock market crash, the bull market has continued to break through analyst expectations.

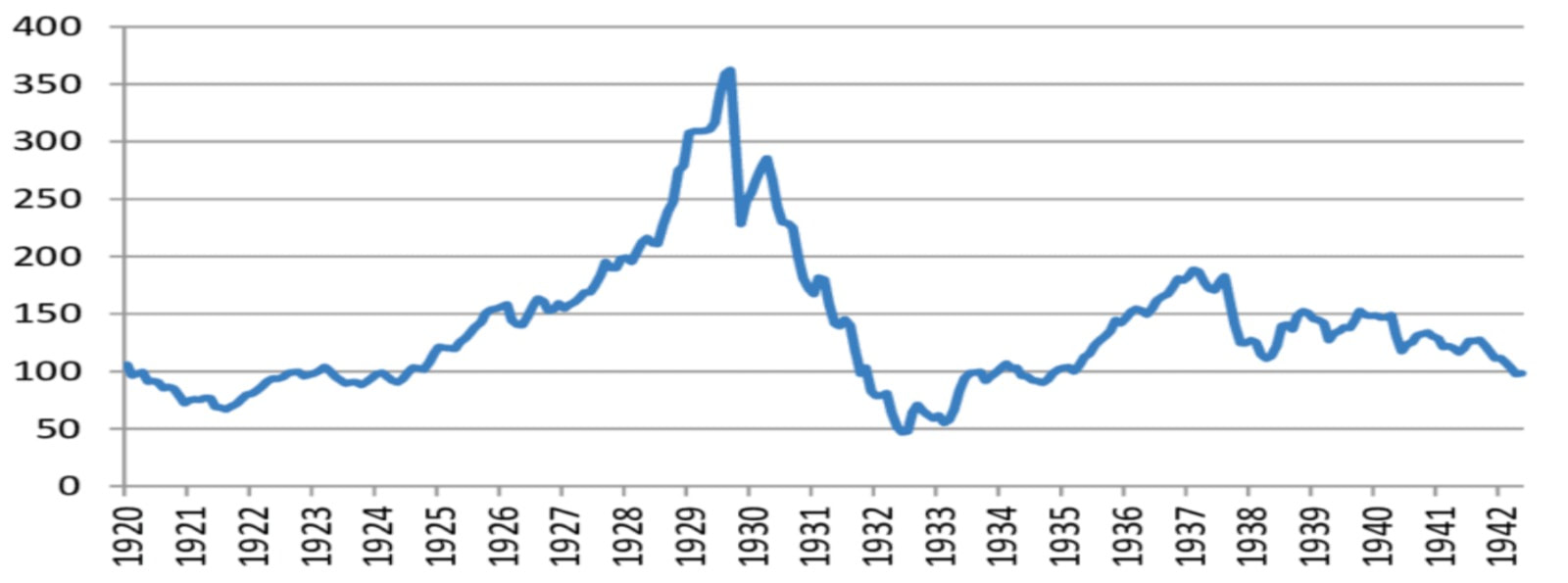

On November 25th, the Dow Jones Industrial Average hit its record high of 30,000 points. A similar spike in the DJIA was evidenced right before the Great Depression of the early 1930s. At the time, there was an aggressive bull market that was not rationally justified. As famous investor Benjamin Graham said, “all bull markets must end badly”. Like a bollinger band, the more stocks stick to the upper band, the more likely they will dive into the lower band. This was witnessed in the 1930s crash as the all time market highs were slingshotted into a recession which lasted for a decade.

On November 25th, the Dow Jones Industrial Average hit its record high of 30,000 points. A similar spike in the DJIA was evidenced right before the Great Depression of the early 1930s. At the time, there was an aggressive bull market that was not rationally justified. As famous investor Benjamin Graham said, “all bull markets must end badly”. Like a bollinger band, the more stocks stick to the upper band, the more likely they will dive into the lower band. This was witnessed in the 1930s crash as the all time market highs were slingshotted into a recession which lasted for a decade.

From an investor’s perspective, now would probably be an unwisely time to pump capital into the market. Most stocks are completely overvalued and a simple look at their P/E ratio and their intrinsic value would validate this. It is unclear for how long the bull market could still go on. Depending on fed stimulus checks or more positive vaccine news, it could potentially continue well into 2021. It might, therefore, be wise to invest in growth stocks that are likely to keep on performing better during their cyclical periods but with the security of a stop-loss to ensure minimal losses.

Filippo Lisanti

Filippo Lisanti