With the sale of his 10% stake in Valeant Pharmaceuticals, the controversial Canadian drug-maker, hedge fund legend Bill Ackman, founder and CEO of Pershing Square Capital Management, suffered the worst loss of his career. According to Bloomberg estimates, Ackman lost about $4bn during the 2-year holding period. He initially bought his stake at an average cost of $190 and sold the stock at $11.

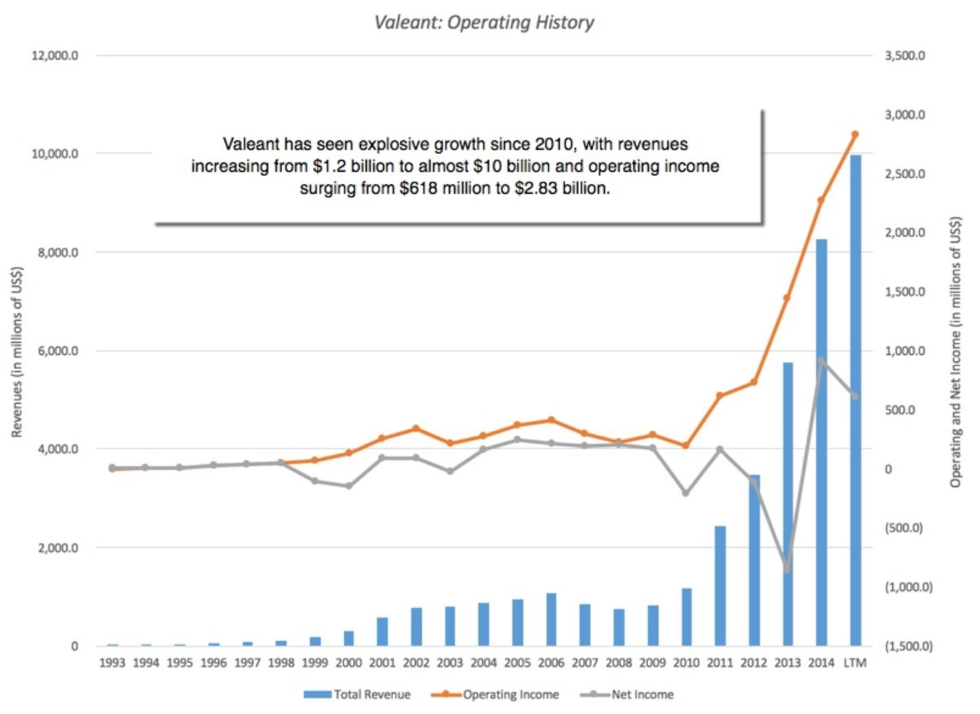

Valeant had a stellar rise, from a mid-cap drug-maker to a global pharmaceutical powerhouse, which took place after J. Michael Pearson became CEO of the company.

Pearson, a former director at McKinsey & Co. in the pharmaceutical advisory business, always criticized the pharmaceutical industry for their capital allocation, which he deemed inefficient. He was convinced drug companies spend too much on research & development (R&D), which is inherently risky and expensive. Therefore, when he took over Valeant in 2008, he implemented a strategy suiting his idea of how to run a pharmaceutical company: he acquired companies by the dozen during his tenure, mainly financed by debt, slashed the R&D departments of the acquired firms and often jacked up prices of acquired drugs. He implemented a highly performance oriented remuneration system at Valeant, with management compensation predominantly in stocks with a long vesting period. When the share price skyrocketed to more than $250, Pearson became a billionaire for a limited period of time.

Valeant had a stellar rise, from a mid-cap drug-maker to a global pharmaceutical powerhouse, which took place after J. Michael Pearson became CEO of the company.

Pearson, a former director at McKinsey & Co. in the pharmaceutical advisory business, always criticized the pharmaceutical industry for their capital allocation, which he deemed inefficient. He was convinced drug companies spend too much on research & development (R&D), which is inherently risky and expensive. Therefore, when he took over Valeant in 2008, he implemented a strategy suiting his idea of how to run a pharmaceutical company: he acquired companies by the dozen during his tenure, mainly financed by debt, slashed the R&D departments of the acquired firms and often jacked up prices of acquired drugs. He implemented a highly performance oriented remuneration system at Valeant, with management compensation predominantly in stocks with a long vesting period. When the share price skyrocketed to more than $250, Pearson became a billionaire for a limited period of time.

Source: Forbes

Pershing Square and Valeant first came into contact when the two teamed up in a controversial bid for Allergan. Today, an insider trading related to the Allergan bid is pending. Pershing Square acquired a stake in Allergan in April 2014. Pershing, allegedly knowing that Valeant would bid for Allergan, tried to use its stake to put pressure on the management to accept the offer. Allergan fiercely defended the hostile bid, calling Valeant a “house of cards” and eventually sold itself to Actavis.

After the bid for Allergan was over, Ackman made a handsome profit of about $2.2bn on Allergan shares, but he got to know Pearson and Valeant during their bid and was thrilled by the way they did business. He decided to invest more than $4bn in Valeant, and even called the company the new Berkshire Hathaway.

Pershing entered the Valeant bonanza late, enjoying a ride from about $190 to $262 per share, just to take the downhill ride all the way to $11. During the summer of 2015, the first cracks became visible. Investors became vary of Valeant’s business model of not developing drugs on their own, but rather buying competitors, slashing their R&D departments and increasing prices. The reason was increased scrutiny of US regulators and politicians towards drug pricing after a series of massive price hikes. Back then, democratic frontrunner Hillary Clinton tweeted that she will regulate “price gouging” of pharmaceutical companies and explicitly named Valeant as one of them. Moreover, Martin Shkreli became famous after jacking up the price of decade old drug he bought by several hundred percent overnight. Shkreli’s move caused public outrage and put drug pricing into the spotlight, stimulating political debate.

However, the major turning point for Valeant was the publication of a short thesis by short seller Andrew Left of Citron Research, which indicated Valeant was engaging in accounting fraud. Mr. Left, who compared Valeant to Enron, discovered that Valeant used Philidor Rx, a specialty pharmacy, to distribute drugs. On a conference call in October 2015, Valeant disclosed for the first time that it had used Philidor’s services, has an option to buy the business and had already incorporated its financials into its own results. Citron indicated that Philidor could be used to “stuff the channel” and artificially inflate revenues. In the days following the report, Valeant shares plunged more than 50%. Making matters worse, J. Michael Pearson waited several days to respond to Citron’s accusations in a comprehensive conference call, and Bill Ackman felt the need to give a conference call himself to defend the company.

After the bid for Allergan was over, Ackman made a handsome profit of about $2.2bn on Allergan shares, but he got to know Pearson and Valeant during their bid and was thrilled by the way they did business. He decided to invest more than $4bn in Valeant, and even called the company the new Berkshire Hathaway.

Pershing entered the Valeant bonanza late, enjoying a ride from about $190 to $262 per share, just to take the downhill ride all the way to $11. During the summer of 2015, the first cracks became visible. Investors became vary of Valeant’s business model of not developing drugs on their own, but rather buying competitors, slashing their R&D departments and increasing prices. The reason was increased scrutiny of US regulators and politicians towards drug pricing after a series of massive price hikes. Back then, democratic frontrunner Hillary Clinton tweeted that she will regulate “price gouging” of pharmaceutical companies and explicitly named Valeant as one of them. Moreover, Martin Shkreli became famous after jacking up the price of decade old drug he bought by several hundred percent overnight. Shkreli’s move caused public outrage and put drug pricing into the spotlight, stimulating political debate.

However, the major turning point for Valeant was the publication of a short thesis by short seller Andrew Left of Citron Research, which indicated Valeant was engaging in accounting fraud. Mr. Left, who compared Valeant to Enron, discovered that Valeant used Philidor Rx, a specialty pharmacy, to distribute drugs. On a conference call in October 2015, Valeant disclosed for the first time that it had used Philidor’s services, has an option to buy the business and had already incorporated its financials into its own results. Citron indicated that Philidor could be used to “stuff the channel” and artificially inflate revenues. In the days following the report, Valeant shares plunged more than 50%. Making matters worse, J. Michael Pearson waited several days to respond to Citron’s accusations in a comprehensive conference call, and Bill Ackman felt the need to give a conference call himself to defend the company.

Graph: Valeant's shares price

Source: Bloomberg

In March 2016, the stock dived again. The company missed the earnings estimations of analysts, dramatically adjusted its guidance and warned that it may not be able to publish the annual report on time, hence potentially breaking debt covenants and triggering technical default. With a debt load of prior acquisitions mounted to about $30bn and the business model of serial acquisition in question, investors kept fleeing the sinking ship. Bill Ackman kept his position, defended the company and increased his personal stakes by joining the board, firing J. Michael Pearson from the firm and hiring Joe Papa from Perrigo as new CEO. Until the end, Ackman signaled optimism and declared the stock dramatically undervalued. In March 2017 however, he decided that he had seen enough and sold out his entire stake in Valeant for around $11 per share, wiping out about $4bn of his investors’ money.

Even after losing this huge amount, seriously impairing his investment track-record, Bill Ackman doesn’t seem to change his investment strategy of concentrated bets. Last November, when the large losses in Valeant already were probable, Pershing Square announced the acquisition of a 9.9% stake in troubled fast food chain Chipotle Mexican Grill. Moreover, Ackman continues his fight against controversial supplemental nutrition company Herbalife, where he established a short position in excess of 1$bn.

J. Michael Pearson lost a large portion of his fortune. He even received a margin call from Goldman Sachs as he used his Valeant stock as a collateral for multimillion-dollar loans, among other things to donate to his alma mater. On 28 March, Pearson sued Valeant over 3 million shares that Valeant did not distribute to him, valued at $32.8mn.

Mathias Hoerl

Even after losing this huge amount, seriously impairing his investment track-record, Bill Ackman doesn’t seem to change his investment strategy of concentrated bets. Last November, when the large losses in Valeant already were probable, Pershing Square announced the acquisition of a 9.9% stake in troubled fast food chain Chipotle Mexican Grill. Moreover, Ackman continues his fight against controversial supplemental nutrition company Herbalife, where he established a short position in excess of 1$bn.

J. Michael Pearson lost a large portion of his fortune. He even received a margin call from Goldman Sachs as he used his Valeant stock as a collateral for multimillion-dollar loans, among other things to donate to his alma mater. On 28 March, Pearson sued Valeant over 3 million shares that Valeant did not distribute to him, valued at $32.8mn.

Mathias Hoerl