On Thursday, July 27, 2023, Kering announced it had entered into a binding agreement with Mayhoola to acquire 30% of the fashion brand Valentino’s shares in an all-cash deal for €1.7 billion. Furthermore, the agreement included an option for Kering to acquire 100% of Valentino by 2028. The article aims at providing an understanding of the key players involved and of the deal rationale and reaching a conclusion on whether Kering has overpaid or not its stake in Valentino through a relative valuation analysis

The Target: Valentino

Valentino is one of the most prestigious luxury Italian brands. Founded in 1960 by Valentino Garavani and his associate Giancarlo Giammetti, the luxury fashion house debuted internationally in 1962 in Florence, which at the time was the Italian capital of fashion. After years of success, it reached the big stages of the 1985 Milan Fashion Week and worked with celebrities such as Julia Roberts and Jacqueline Kennedy.

Around forty years of growth in popularity and expansion allowed Garavani and Giammetti to sell the company to an Italian conglomerate, the Holding di Partecipazioni Industriali (HdP), in 1998. At the time, HdP was led by Gianni Agnelli, the head of Fiat. The company was sold for approximately €270 million, and Valentino Garavani remained as the head designer for the brand.

However, after a disappointing four years and a failure to generate profit since its sale, HdP sold Valentino to Marzotto Apparel, an Italian textile group, for €240 million in 2002. Marzotto Apparel had the challenge of reinventing the brand which seemed outdated compared to its major competitors, Gucci and Louis Vuitton.

The spin-off was successful, and in 2007 the private equity group Permira acquired 29.6% of Valentino for €782.6 million, giving the fashion house a valuation of €2.6 billion. However, after the financial crisis of 2009, the company underwent significant debt restructuring.

In 2012, the Qatari royal family bought Valentino through its investment vehicle Mayhoola for Investments LLC for €700 million, for a 31.5x EBITDA multiple. The secretive fashion conglomerate Mayhoola paid a hefty premium for Valentino, as the average valuation at the time for a European luxury brand was around 10x EBITDA. This was part of Mayhoola’s strategic expansion into the international luxury world.

More than 10 years later, Mayhoola and the French-based multinational corporation Kering announced the Valentino deal, as well as publicly stated their plans to collaborate in the near future.

The Buyer: Kering Group

Description and History

Founded in 1921 as a timber trading company by François Pinault, the Kering Group has evolved into a global luxury conglomerate, including renowned Houses such as: Gucci, Yves Saint Laurent, Bottega Veneta, Balenciaga, Alexander McQueen, Brioni, Boucheron, Pomellato, DoDo, Qeelin, Ginori 1735, Kering Eyewear, Kering Beauté, Creed, and Valentino.

The evolution from a trading company to a Luxury Group was a process that started in 1999 with the acquisition of 42% of Gucci Group’s stake, after the previous listing in 1998.

From late 1990s the, back then, the Pinault Group sequentially acquired Yves Saint Laurent (1999), Boucheron (1999), Bottega Veneta (2001), Balenciaga (2001), Alexander McQueen (2001), Brioni (2012), Qeelin (2013), Pomellato (2013), Dodo (2013), and Creed (2023).

Officially, the Kering Group was established in 2013, adopting the tagline "Empowering Imagination" to underscore its commitment to global influence in terms of creativity, sustainability, and economic performance.

Strategy and Vertical Integration

Kering's multi-brand luxury model focuses on growth and expertise using a decentralized approach, promoting the growth of individual brands, and taking advantage of economies of scale, this made possible by sharing infrastructure and pooling together all Houses’ resources and strategic functions. In fact, each House maintains its distinctive identity and independence while fulfilling complementary roles within the overall structure.

To enhance the performance and market value of its Houses, Kering has recently committed to vertical integration. This involves securing the supply of raw materials, through the acquisition and establishment of new companies, and centralizing logistics.

With the creation of Kering Eyewear in 2015, the Group supports the supply chain of its Houses, providing high-quality materials and outstanding know-how. Furthermore, through target acquisitions, the Group reinforced its presence in the luxury goods value chain. Moreover, between 2019 and 2022, Kering inaugurated new distribution platforms in Trecate (Italy), Wayne (New Jersey), and Singapore, thereby improving its logistical infrastructure.

Kering Group’s recent M&A Activity

To strengthen its position in the luxury industry, from eyewear to perfumes and apparel, Kering has concluded three main acquisitions over the last months of 2023, involving the following companies: Usinage & Nouvelles Technologies, Creed and Valentino.

Kering Eyewear and UNT - June 2023

Over the past seven years, Kering Eyewear has strategically pursued a series of M&A transactions aimed at securing control of its supply chain. This initiative began in 2017 with the acquisition of Manufacture Kering Eyewear and continued in 2019 with the addition of Trenti Industria Occhiali. The project ended in June 2023 when the Group acquired 100% ownership of UNT. Founded in 1989 in Eastern France, Usinage & Nouvelles Technologies has earned a global reputation for manufacturing high-quality eyewear components.

Benefiting from these deals, Kering Eyewear has increased the level of quality and expertise in the industry, recording a double digit-growth in the sector by up more than 40% over 2022.

Kering Beauté and Creed - October 2023

The strategy of internalizing businesses has been extended and implemented also to the beauty sector. The House of Creed, a prestigious fragrance company founded by James Henry Creed in 1760, became part of Kering Beauté at the end of October 2023 through an all-cash transaction worth €3.5 billion.

This acquisition is part of the Group's efforts to establish an in-house beauty division serving its brand portfolio, including Bottega Veneta, Alexander McQueen, Balenciaga, Pomellato, and Queelin. However, Kering won’t be able to produce lines for Gucci and Yves Saint Laurent due to licenses lasting until 2028.

The idea is to develop cosmetics and perfumes lines exploiting Creed’s global distribution network and create enduring value for the Group. In the future, Kering aims to internalize all licenses, particularly the substantial $500 million per year Gucci’s one.

Kering and Valentino - End of 2023

Kering has announced the acquisition of a minority stake in Valentino, with the option to acquire full ownership of the company by 2028, thus becoming a significant shareholder with board representation.

The rationale of the deal traces back to the Gucci-driven group strategy. In fact, Gucci, that represents 52.1% of Kering’s revenue, has started to experience a slowdown in performance since 2018. Indeed, by acquiring Valentino, Kering has established a partnership with the Qatari investment fund Mayhoola that could lead to potential opportunities, investments, and synergies, countering the competition with LVMH. While it remains uncertain whether Kering will exploit its option, the partial acquisition is already seen as a great strategic move due to Valentino’s strong appeal to consumers.

In any case, Kering will have the opportunity to leverage Valentino's achievements and simultaneously strengthen its position as a luxury conglomerate, gaining synergies for the entire clothing sector.

Kering Group’s recent M&A Activity

To strengthen its position in the luxury industry, from eyewear to perfumes and apparel, Kering has concluded three main acquisitions over the last months of 2023, involving the following companies: Usinage & Nouvelles Technologies, Creed and Valentino.

Kering Eyewear and UNT - June 2023

Over the past seven years, Kering Eyewear has strategically pursued a series of M&A transactions aimed at securing control of its supply chain. This initiative began in 2017 with the acquisition of Manufacture Kering Eyewear and continued in 2019 with the addition of Trenti Industria Occhiali. The project ended in June 2023 when the Group acquired 100% ownership of UNT. Founded in 1989 in Eastern France, Usinage & Nouvelles Technologies has earned a global reputation for manufacturing high-quality eyewear components.

Benefiting from these deals, Kering Eyewear has increased the level of quality and expertise in the industry, recording a double digit-growth in the sector by up more than 40% over 2022.

Kering Beauté and Creed - October 2023

The strategy of internalizing businesses has been extended and implemented also to the beauty sector. The House of Creed, a prestigious fragrance company founded by James Henry Creed in 1760, became part of Kering Beauté at the end of October 2023 through an all-cash transaction worth €3.5 billion.

This acquisition is part of the Group's efforts to establish an in-house beauty division serving its brand portfolio, including Bottega Veneta, Alexander McQueen, Balenciaga, Pomellato, and Queelin. However, Kering won’t be able to produce lines for Gucci and Yves Saint Laurent due to licenses lasting until 2028.

The idea is to develop cosmetics and perfumes lines exploiting Creed’s global distribution network and create enduring value for the Group. In the future, Kering aims to internalize all licenses, particularly the substantial $500 million per year Gucci’s one.

Kering and Valentino - End of 2023

Kering has announced the acquisition of a minority stake in Valentino, with the option to acquire full ownership of the company by 2028, thus becoming a significant shareholder with board representation.

The rationale of the deal traces back to the Gucci-driven group strategy. In fact, Gucci, that represents 52.1% of Kering’s revenue, has started to experience a slowdown in performance since 2018. Indeed, by acquiring Valentino, Kering has established a partnership with the Qatari investment fund Mayhoola that could lead to potential opportunities, investments, and synergies, countering the competition with LVMH. While it remains uncertain whether Kering will exploit its option, the partial acquisition is already seen as a great strategic move due to Valentino’s strong appeal to consumers.

In any case, Kering will have the opportunity to leverage Valentino's achievements and simultaneously strengthen its position as a luxury conglomerate, gaining synergies for the entire clothing sector.

Our Valuation

As previously pointed out, the transaction scope encompasses a 30% stake in Valentino Fashion Group, with Kering retaining an option to acquire 100% of the company by 2028. The total cash consideration for the deal stands at €1.7bn, thereby valuing the equity of Valentino at approximately €5bn.

Kering acquired Valentino paying an EV/EBITDA multiple of 16.2x which, given an EBITDA of €350mn (reflecting an EBITDA Margin of 24.7%), places the luxury company’s EV at around €5.7bn. Concurrently, the EV/Sales multiple for the transaction was 4.0x. Nonetheless, we believe that employing a Sales multiple for evaluating a Luxury company like Valentino is not appropriate as it overlooks the high profitability of companies operating in the Luxury sector.

To investigate whether Kering overpaid or not Valentino, we have decided to carry out both precedent transactions and trading comparable analysis, by selecting a set of companies and deals in the Luxury Sector and calculating the appropriate metrics (Sources: Bloomberg, Oct. 3rd, 2023; Mergermarket).

Trading Comps Analysis

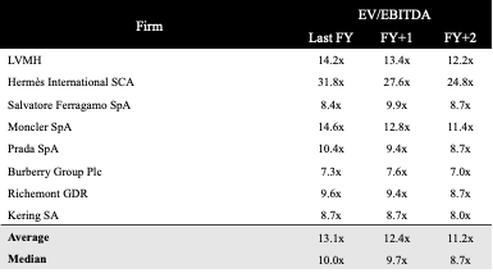

In order to better understand the valuation of Valentino, we have selected a set of 7 publicly listed comparable companies operating in the Luxury sector and all based in Europe. Furthermore, in the comparable selection, we have tried to pick companies with similar operating leverage and EBITDA margin as Valentino. Lastly, based on the size, the selected comparables can be divided into three main clusters: Luxury Conglomerates (Richemont, LVMH), Multi-Brand Luxury Companies (Moncler, Prada), and Single-Brand Luxury Companies (Hermès, Burberry, Salvatore Ferragamo).

Based on the latest annual financial statements of the comparable companies, as well as Bloomberg’s analysts’ consensus regarding the future growth prospects of these comparables, we have estimated both the Last and the 2-year forward EV/EBITDA multiples for the Luxury sector.

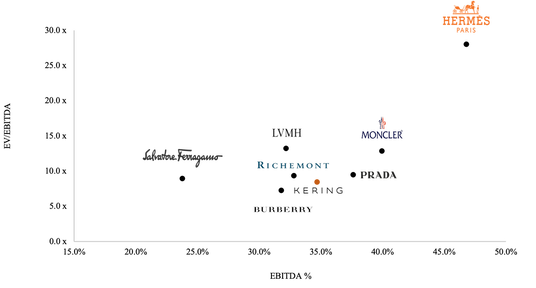

Our analysis suggests that the Average EV/EBITDA Multiple (Last) for the Luxury sector is 13.8x, suggesting an EV for Valentino of €4.8bn, approximately €770mn lower than the EV implied by the transaction (€5.7bn). Similarly, we have found out that the Median EV/EBITDA (Last) for the Luxury sector is 10.4x, thus leading to an even lower valuation of approximately €3.6bn for the EV. The significant difference between the Average and Median EV/EBITDA valuation stems from the presence of an outlier in our sample, namely Hermès. Indeed, Hermès has a valuation that is significantly higher than its peers in the Luxury sector. Upon further analysis, it is possible to see that the main driver of this higher valuation is Hermès outstanding profitability, showcasing an EBITDA Margin of 46.8% (as of FY22), more than 10 percentage points higher than the industry average. Indeed, by looking at the Figure 2 that compares the EV/EBITDA of Luxury Companies with their EBITDA Margin, we can see that the market significantly rewards the valuation of companies that showcase very high profitability.

Overall, we can say that the price paid by Kering for Valentino is significantly higher than what would be suggested by a trading comps analysis. Indeed, Kering is paying the Valentino stake 2.4 multiple rounds more than the average industry multiple, and 5.8 multiple rounds more than the industry’s median. Nonetheless, this analysis does not take into account two fundamental factors. In the first place, even if Kering is not acquiring a majority stake, it has secured a 4-year option to fully acquire Valentino, thus justifying a control premium in the purchase price. Additionally, we are not considering the potential synergies that Kering will be able to generate by integrating Valentino in its portfolio. To highlight, Kering’s EBITDA Margin stands at 36% (as of FY22), which is aligned to the industry average but is also significantly higher than Valentino’s EBITDA Margin (24.7%). This suggests that, by streamlining administrative functions, eliminating redundancies, and leveraging the greater bargaining power with suppliers, Kering can potentially elevate Valentino’s current EBITDA Margin to a value closer to the industry average, thus unlocking substantial value. Moreover, by exploiting Kering’s expansive commercial network, we believe that Valentino can potentially expand its global sales. Hence, when assessing the strategic implications for an industrial player like Kering, we believe that the premium paid is justified.

Figure 1: Current & Projected EV/EBITDA multiples in the industry (Source: Bloomberg)

Figure 2: Cross-comparison of EV/EBITDA and EBITDA margins (Source: Bloomberg)

Past Transactions Analysis

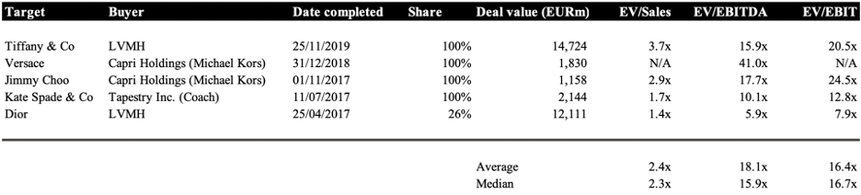

As trading multiples tend to be lower than transaction multiples due to the synergies involved for strategic buyers, it is appropriate to analyze precedent comparable transactions to see if Kering has overpaid for the company. Due to the trend of consolidation in the luxury apparel industry there have been multiple major transactions in the past decade with comparable sizes. The predominant strategic buyers in the industry have been three conglomerates, Kering, LVMH and Capri Holdings, the holding company of Michael Kors.

To accurately assess the rationale of Kering’s pricing of Valentino, we selected large transactions with strategic buyers, that also consider the synergies in their transaction size. Based on these selected transactions, the average EV/Sales multiple of transactions in the industry was 2.4x while the median was 2.3x. Based on this number, the Valentino transaction’s 4.0x multiple seems to be very high.

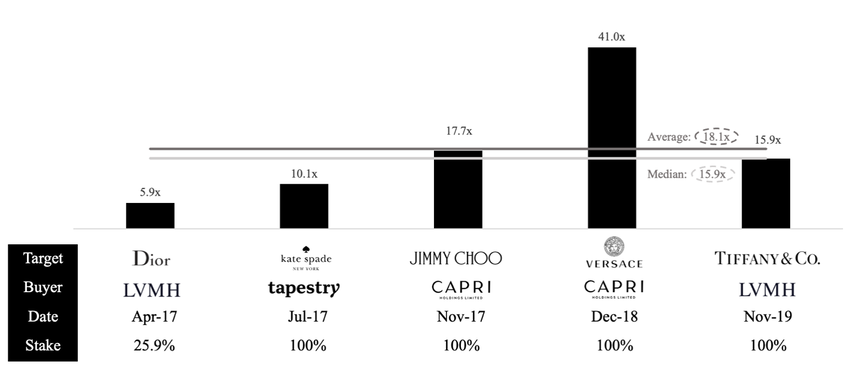

However, as previously mentioned, EV/EBITDA multiples paint a more accurate picture. The average EV/EBTIDA multiple for the same transactions was 18.1x while the median was 15.9x. The difference in the average and the median multiples is caused by Michael Kors’ acquisition of Versace, with an EBITDA multiple of 41.0x. The difference in EBITDA multiples compared to the average and the median for Kering’s acquisition are not as stark as for its sales multiples, but disregarding the outlier deal, with its EBITDA multiple of 16.2x, it is still above both the median and the average (12.4x without the Versace acquisition). This premium compared to the market may be explained by Kering’s retained option to purchase the rest of Valentino at a later date.

Past Transactions Analysis

As trading multiples tend to be lower than transaction multiples due to the synergies involved for strategic buyers, it is appropriate to analyze precedent comparable transactions to see if Kering has overpaid for the company. Due to the trend of consolidation in the luxury apparel industry there have been multiple major transactions in the past decade with comparable sizes. The predominant strategic buyers in the industry have been three conglomerates, Kering, LVMH and Capri Holdings, the holding company of Michael Kors.

To accurately assess the rationale of Kering’s pricing of Valentino, we selected large transactions with strategic buyers, that also consider the synergies in their transaction size. Based on these selected transactions, the average EV/Sales multiple of transactions in the industry was 2.4x while the median was 2.3x. Based on this number, the Valentino transaction’s 4.0x multiple seems to be very high.

However, as previously mentioned, EV/EBITDA multiples paint a more accurate picture. The average EV/EBTIDA multiple for the same transactions was 18.1x while the median was 15.9x. The difference in the average and the median multiples is caused by Michael Kors’ acquisition of Versace, with an EBITDA multiple of 41.0x. The difference in EBITDA multiples compared to the average and the median for Kering’s acquisition are not as stark as for its sales multiples, but disregarding the outlier deal, with its EBITDA multiple of 16.2x, it is still above both the median and the average (12.4x without the Versace acquisition). This premium compared to the market may be explained by Kering’s retained option to purchase the rest of Valentino at a later date.

Figure 3: Selected past transactions (Source: Mergermarket)

Figure 4: EV/EBITDA multiples of selected transactions (Source: Mergermarket)

Conclusion

Kering’s acquisition of a 30% stake in Valentino clearly shows the French conglomerate’s ambition of strengthening its position in the luxury sector. The results of both the public comps and past transactions valuations lead us to the conclusion that Kering paid a premium well above average for its share in Valentino, which however might be justified by the option to acquire the whole company by 2028 and the high potential for generation of synergies.

We will have to wait and see how Kering will operate the integration of Valentino and to which extent it will be able to exploit its value and prestige, in order to draw a final conclusion on the deal’s success.

Kering’s acquisition of a 30% stake in Valentino clearly shows the French conglomerate’s ambition of strengthening its position in the luxury sector. The results of both the public comps and past transactions valuations lead us to the conclusion that Kering paid a premium well above average for its share in Valentino, which however might be justified by the option to acquire the whole company by 2028 and the high potential for generation of synergies.

We will have to wait and see how Kering will operate the integration of Valentino and to which extent it will be able to exploit its value and prestige, in order to draw a final conclusion on the deal’s success.

By Francesco Pezzuto, Francesca Dini, Lucas Albin, Mate Mangoff

SOURCES

- Kering Press Release

- Financial Times

- Wall Street Journal

- Bloomberg

- Mergermarket

- Il Sole 24 Ore

- Reuters

- Just Style