The rapid economic expansion of Vietnam, which has been labelled by some as “mini-China”, is attracting the interest of an increasing number of investors. The communist government has certainly played a significant role, pledging to pave the way for the establishment of a private economy and promoting the country’s integration into the global trading network and its establishment as a fertile ground for foreign manufacturing. Vietnam’s blossoming e-commerce market may prove to be the next battleground in a fierce competition between Japan, China and the US’ technological giants.

The current leader in the country’s e-commerce business is Lazada Group, that owns approximately 30 percent of market share. The company is a subsidiary of Alibaba, which recently doubled its investment in the former up to $4 billion, increasing even further its already consistent 83 percent stake thanks to this fresh capital infusion.

JD.com, another Chinese e-commerce company, acquired a 22 percent stake for an undisclosed amount (rumored to be around $50 million) in Tiki.vn, a Vietnamese start-up that, from a “garage business”, become a major player in the industry. In March, Amazon attended Vietnam Online Business Forum and pledged to provide services for the Vietnam E-Commerce Association.

This news induced speculations that the American technology titan would soon wage an offensive to enter the country.

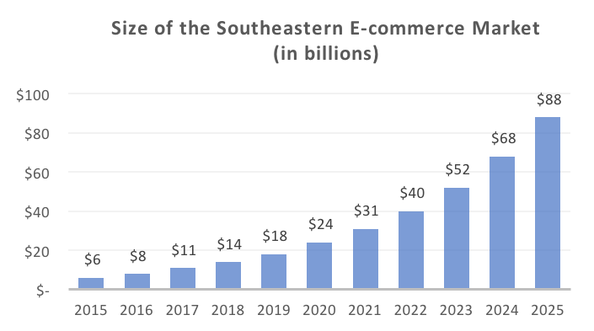

Vietnam’s e-commerce industry – despite being still young compared to the Chinese one –, thanks to the impact of factors such as the improvements in telecommunication, the proliferation of online payment services and the advantageous demographic conditions, is expected to experience astonishing growth rates in the next years.

According to the Vietnam E-Commerce Association, online sales spending expanded by 25 percent in 2017, a rate which is almost two and a half times higher than the one of retail sales. Moreover, according to the association’s forecasts, the market will maintain these remarkable magnitudes of growth up until 2020.

The current leader in the country’s e-commerce business is Lazada Group, that owns approximately 30 percent of market share. The company is a subsidiary of Alibaba, which recently doubled its investment in the former up to $4 billion, increasing even further its already consistent 83 percent stake thanks to this fresh capital infusion.

JD.com, another Chinese e-commerce company, acquired a 22 percent stake for an undisclosed amount (rumored to be around $50 million) in Tiki.vn, a Vietnamese start-up that, from a “garage business”, become a major player in the industry. In March, Amazon attended Vietnam Online Business Forum and pledged to provide services for the Vietnam E-Commerce Association.

This news induced speculations that the American technology titan would soon wage an offensive to enter the country.

Vietnam’s e-commerce industry – despite being still young compared to the Chinese one –, thanks to the impact of factors such as the improvements in telecommunication, the proliferation of online payment services and the advantageous demographic conditions, is expected to experience astonishing growth rates in the next years.

According to the Vietnam E-Commerce Association, online sales spending expanded by 25 percent in 2017, a rate which is almost two and a half times higher than the one of retail sales. Moreover, according to the association’s forecasts, the market will maintain these remarkable magnitudes of growth up until 2020.

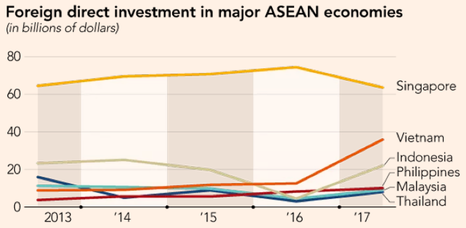

There are several dynamics that have represented a driving engine behind the dramatic advance of the e-commerce industry. Foremost is the rapid economic expansion which is predicted to continue in the near future. Bolstered by the state support of private business, favorable trade conditions, and the increased foreign direct investment, the export-driven economy of Vietnam enjoyed forecast-beating GDP increase of 6.8 percent in 2017. In addition, the economic growth attracts investors, whose confidence in the country converted into the substantial amount of FDI, which has more than doubled in a year and amounted to $36 billion. This sum largely dwarfs the corresponding numbers for Vietnam’s much larger neighbours.

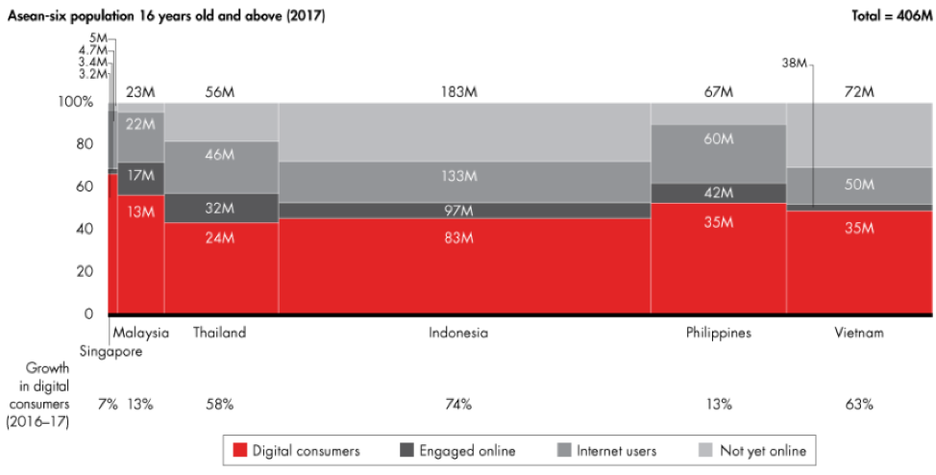

Another key driver of the e-commerce expansion is the proliferation of digital transactions and broadening of the consumer base that lay the ground for the industry. With a median age of just 30 years, and a dependency ratio – the fraction of working age population relative to the young and elderly one – of 42.5 percent, Vietnam has an extremely favorable demographic setting, making it eager for the development of online services. According to the report by Bain & Co, the proportion of Vietnamese population aged 16 and above that is engaged in online transactions has increased by more than a half from the previous year. This, according to National Payment Corporation of Vietnam, lead to an increase in the overall value of digital transactions by 75 percent. In addition, the average transaction value per user of digital commerce services, propelled by the expansion of the household income, increased by almost 20 percent.

In addition, Vietnamese youth demonstrate a high level of confident in the improvement of economic conditions in the near future, with more than 65% of the population between 18 and 35 expecting the economic climate of the country to improve soon. Almost half of the FTCR Vietnamese respondents claimed that they were expecting to commit more in discretionary spending. The buoyant expectation of Vietnamese is in stark contrast with the strengthening of somber economic sentiments in consumer outlooks in some of its neighbours, despite the consistent GDP growth in 2017. The continuous pessimism of Malaysian consumers, volatile confidence among Thai, and mild reductions in otherwise optimistic Indonesia and Philippines indices drove south the FTCR Economic Sentiment Index for Asean-4.

In conclusion, Vietnam presents a perfect environment for the development of the e-commerce market. The rapid economic development, increasing consumer spending, improvement of digital communication networks, young and committed population make it a valuable ground for giant technology firms, such as Amazon, Tencent, and Alibaba, to continue their expansion into Southeast Asia.

Sultan Massalov

In conclusion, Vietnam presents a perfect environment for the development of the e-commerce market. The rapid economic development, increasing consumer spending, improvement of digital communication networks, young and committed population make it a valuable ground for giant technology firms, such as Amazon, Tencent, and Alibaba, to continue their expansion into Southeast Asia.

Sultan Massalov